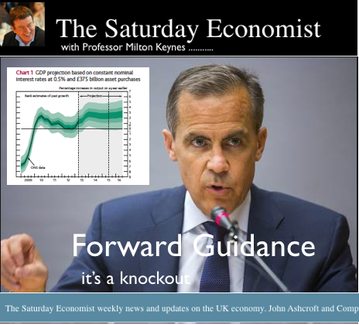

Economics news – the Governor speaks on forward guidance ... A relatively quiet week for UK economics news. Nationwide announced house prices increased by 3.5% over the past twelve months and the Bank of England reported the number of mortgage approvals for house purchases had increased to 60,624 compared to around 48,000 in July last year. That’s a 30% increase in activity over the year. Housing Boom? The Funding for Lending Scheme and the Help to Buy scheme are stimulating a recovery, already manifest over the last three years. Are we about to experience a housing boom? Well not just yet. Activity is still a long way off the top, half the level of January 2007 and still way down from the average 100,000 level experienced from 2000 to 2007. Even so, Treasury would be wise to re-examine the plans for Help to Buy phase 2. This the plan to support LTV ratios for all house purchase transactions (under £600,000). An election winner perhaps, but Chancellor Osborne should heed the words of Jack Kennedy senior. “Dear Jack, Don't buy a single vote more than is necessary. I'll be damned if I'm going to pay for a landslide.” Yes, the house market is on the move, no need to rock the foundations in the process. In Nottingham, Mark Carney made a key speech to business leaders reaffirming the foundations of forward guidance. The governor offered further reassurance base rates would be kept on hold until unemployment falls below 7%, probably 2016 at the earliest. An opportunity for businesses to invest and households to spend wisely in the interim. The Governor stressed the 2% CPI inflation target is still paramount beyond the medium term. At present, 2.4% CPI is a more realistic inflation target for the foreseeable future and probably the Governor’s tenure in office for that matter. Markets believe 2015 may see the first rise in base rates, the governor suggests, it’s a three year wait. We suspect more QE is off the agenda, now the old regime has moved aside. Interesting the Governor is decoupling base rates from long term gilt rates. The Governor keen to stress the MPC controls the short rate no matter what markets may think or do. Just as well, markets will push the gilt curve back into shape, offering a real yield over the ten year horizon and about time to. Good news for the banks and lending, the governor announced an easing of liquidity requirements once the 7% capital ratios have been achieved. Here is a central banker who talks to the banks. Moral dilemma confined to the tutorial room. A pragmatist not limited by theory and dogma. A man with whom we can all do business. The Governor skillfully avoided any comment on exchange rates “some will go up and some will go down” the actual remark. Those who thought the new regime would seek further currency weakness will be disappointed. What’s wrong with forward guidance. Not much. FG offers a commitment to securing growth at the expense of an inflation trade, off in the recovery phase. Policy makers are concerned about making a move (on rates) too soon in the cycle. Japan revisited and a lost decade in prospect, if monetary policy is tightened too quickly and escape velocity is not secured. The risk at the moment, still slightly to the downside, as world trade slows, despite the evidence of UK recovery. Is there a risk of runaway inflation? Not really. Despite domestic and international price pressures, the substantial output gap, relative to trend rate of growth, will ensure there will be no runaway inflation. Real wages will improve over the next few years but substantial escalation will be avoided. In any case, FG offers guidance with lots of small print. Rates may rise at any time within the guidelines. Borrowers beware. During the past week, the downward pressure on the BISTO kids continued with the currencies of Brazil, India, Indonesia, South Africa and Turkey coming under further strain. Brazil has won the plaudits for swift action which included a substantial $60 billion foreign currency intervention plus base rate increases of 200 basis points, to a current level of 9%. Growth may be the victim as down grades follow, lower inflation currently at 6% the prize, plus, some element of stability in the exchange rate, the bonus. In India, growth forecasts have been cut to 4.5%. Inflation at 10%, a large government deficit and a $250 billion external funding requirement do not augur well for the rupee as the world faces a run to the Dollar. International hot money flows estimated at 15% of global GDP are on the move, as the prospect of the “start of the beginning of tapering” in the USA pushes up yields on Treasuries and funds are repatriated towards the homeland. The depth of foreign currency reserves and the limits to foreign debt, the real key to weathering the storm. Brazil better placed than India to withstand the cyclical pressure, which inevitably leads to capital flight at the expense of domestic asset prices, bonds, equities and real estate. Capital controls, fixed exchange rates and interest rate policies, the “trilemma” for policy makers. Hot money, leverage and asset price hikes the price of international liquidity. Yes, long term rates are on the move as bond prices come under pressure. Pack the bags and forward the luggage, we are leaving Planet ZIRP. Gold bulls have marked the next direction for the old relic. Black gold, is also on the move. Oil prices came under pressure as the prospect of an escalation of the Syrian crisis pushed prices to $114 dollars per barrel. What happened to sterling? Sterling responded to the economics news, moving lower the dollar but up against the Euro. The pound closed at $1.5494 from $1.5569 and at €1.1719 from €1.1629 against the euro. The dollar moved up against the yen closing at ¥98.1 from ¥98.6 Oil Price Brent Crude closed up at $114 from $111. The average price in August last year was almost $115. We expect oil to average $112 in the current quarter. Markets, slipped - The Dow closed down at 14,810 from 15,010. The FTSE closed down at 6,413 from 6,492. A further chance for market makers to clean out the bear pit as Syrian uncertainty adds to the shift. A good time to average in? We still think the FTSE will clear 7000 within ten weeks. UK Ten year gilt yields closed up at 2.79 from 2.72, US Treasury yields closed at 2.79 from 2.82. Gold closed up at $1,394 from $1,397. The bulls have it or do they? That’s all for this week, If you enjoy the Saturday Economist, why not forward to a colleague of friend. Here's is the link to join the Mailing list for The Saturday Economist. John 10,000 now receive the Saturday Economist each week. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John Ashcroft - the Saturday Economist, Chief Economist at the Greater Manchester Chamber of Commerce, Economics Adviser to Duff & Phelps and Chief Executive of pro.manchester. The views expressed are personal and in no way reflect the policy statements of organisations with which we work. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.

0 Comments

Economics news – growth revised up in second quarter ... The second estimate of GDP for the second quarter was released on Friday. Growth was revised up by 0.1% providing a quarter on quarter gain of 0.7% and a 1.5% gain on the same quarter last year. Good news? ... of course. Consensus forecasts for the rest of the year are now around the 1.1% level with 1.8% in prospect for 2014. The revisions in the quarter attributed to smaller falls in output in manufacturing, construction and agriculture. Service sector growth overall was unchanged at 2.1% year on year. Service sector growth remained dominant accounting for 80% of total output in the economy. Manufacturing and construction (accounting for almost all of the remainder) fell by 0.5%. Real investment growth continued to fall but there was some good news on trade as export growth was up by almost 5% and import growth was flat in the quarter. Blip or flip? More of a blip, the trend in trade will not be sustainable for the year as a whole. Imports will increase as the economy grows. Exports will suffer as world trade slows. World Trade : according the the latest data from the CPB World Trade Monitor, world trade growth slowed to 2% in the first six months of the year. Although the latest data from the USA, China and Europe is more positive on output, UK export growth will be a challenge over the next six months. Our current forecast for world trade growth is just 3% but even this may be too optimistic. Particularly if we examine what is happening to the BISTO kids. Brazil, Indonesia, India, South Africa and Turkey are facing the challenge of currency weakness as capital flows are repatriated to the USA. The BRIC wall is under pressure as the beginning of the end of tapering in the USA, i.e. the end of QE, is putting real yield into US treasury investment once again. Dollars are returning to the homeland as Uncle Sam calls time on financial repression. Government Borrowing: In other UK news, the government borrowing figures were released on Wednesday. At first glance the figures for July Public Sector Borrowing were disappointing. Borrowing was £0.1 billion, this was £0.9 billion higher than last year when the government was in surplus. Not a huge amount - it’s only a £ billion after all - but it would appear the trend is heading in the wrong direction. A closer look at the figures reveals, receipts in the first four months of the year were 10% up on prior year driven by a steady increase in VAT receipts (up by 3%) and a significant increase in tax receipts, income, capital taxes and other taxes. Spending, on the other hand was up by just 4% in the year, interest payments and social security spending increased by less than 2%. In the current financial year, for the Chancellor, the news will get just better. On current trends we expect borrowing to fall to around £100 billion as spending plans are limited and an increase in growth, jobs, incomes and spending boosts receipts. The overall picture for the Treasury will look much better as the year progresses. What happened to sterling? Sterling responded to the economics news, moving lower. The pound closed at $1.5569 from $1.5633 and at €1.1629 from €1.1713 against the euro. The dollar moved up against the yen closing at ¥98.6 from ¥97.50 Oil Price Brent Crude closed up at $111.04 from $110.40. The average price in August last year was almost $115. We expect oil to average $112 in the current quarter. Markets, stabilised - The Dow closed at 15,010 from 15,081. The FTSE closed down at 6,492 from 6.499.99. A further chance for market makers to clean out the bear pit. A good time to average in. We still think the FTSE will clear 7000 within ten weeks. UK Ten year gilt yields closed unchanged at 2.72, US Treasury yields closed up at 2.82 from 2.83. Gold closed up at $1,397 from $1,377. The bulls may have it as prices edge higher. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. If you enjoy the Saturday Economist, please forward to a colleague of friend. Here's is the link to join the Mailing list for The Saturday Economist. John 10,000 now receive the Saturday Economist each week. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John Ashcroft is the Saturday Economist, Chief Economist at the Greater Manchester Chamber of Commerce, Economics Adviser to Duff & Phelps and Chief Executive of pro.manchester. The views expressed are personal and in no way reflect the policy statements of organisations with which we work. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Zombie companies : There is a belief that as economies recover, (as pressure on working capital increases for example) more business will be forced into liquidation. This is a myth. There is a belief the fact that UK business failures are lower (in the current recession cycle) , it is a portend of more failures to come. This is also a myth. The number of company liquidations increased in the second quarter 2013 to 3,978 from 3,601 in the first quarter and 4,064 in the second quarter last year. We anticipate the number of liquidations in the current year will be 15,600 down from just over 16,000 last year. Liquidations peak as the economy moves into recession. According to the larger scale business demographics data, the number of business “deaths” or de registrations surges in recession and the number of “births” or new registrations falls. The rate of growth of the total stock of businesses falls as the economy slows. We anticipate the total volume of business stock will increase to 2.4 million by 2014 - 2015. According to our research on the recession cycles : Business Failures are a coincident indicator - as the economy falters the rate of failure increases, as the economy recovers the rate of failure slows. In the 1980 cycle, as the economy recovered, the rate of business insolvency also increased, there was a positive correlation between growth and recovery. In the 1990 cycle, insolvencies were inversely coincident with economic growth, as the economy slowed, failures increased but as the economy recovered, the rate of insolvencies fell. In the 2008 cycle, insolvencies were inversely coincident with economic growth, as the economy slowed, failures increased but as the economy recovered in 2010 and 2011, the rate of insolvencies fell. As the economy recovers in 2013, the rate of business failures will fall and not increase as many analysts predict. The rate of business failure has been significant in the recession with the rate of business deaths increasing from an average 10% of total stock in the period 2000 - 2008 to 12% in 2009 and 13% in 2010. We estimate the rate of deaths in 2011 and 2012 to be 12%, significantly above trend rate The net rate of business formation fell by almost -3% in 2010 compared to a net growth rate of +1.8% in the period 2000 - 2008. For a copy of the full slide presentation : Download Zombie Companies Myth or Reality 2013 from the link below.

Economics news – for a further week, the good news keeps on coming ... falling inflation, a fall in unemployment plus a boost to retail sales in July ... Inflation figures were reported on Tuesday. The CPI inflation index fell to 2.8% in July from 2.9% in the prior month. By the end of the year we expect inflation to fall below the 2.5% threshold but the 2% target will be elusive for many months if not years ahead. In October the hefty tuition fees will fall out of the index providing a drop of 20 - 30 basis points. The 2% target will be a challenge - goods inflation averaged 2.4% and service sector inflation averaged 3.1%. Bad news for rail travelers, the rail fares will be indexed to RPI plus 1%. A 4.1% increase in fares is in prospect for 2014, placing additional pressure on retail prices and disposable incomes. The unemployment picture continues to improve, for those who can find work at least. The claimant count fell by 29,000, to a rate of 4.3% in July. The wider LFS data suggests a more modest fall in the three months to June. The rate of unemployment at 7.8% was unchanged, still way above the 7% threshold that may signal a change in monetary policy. Retail sales volumes increased by 3% in July as sunshine and consumer confidence provoked a spending rush, stimulated by sunny weather, a Murray win at Wimbledon and the Royal baby allegedly. Sunny weather boosted sales across a range of products including food, alcohol, clothing and outdoor items. By value retail sales increased by almost 5%. After a slow start to the year, the retail outlook has improved in the summer months. Will this continue? Why not! Employment is increasing and earnings are improving. A further 400,000 are in work compared to this time last year and earnings increased by 2% in the three months to June. We expect the retail rally to continue, though perhaps not at the 3% rate for the rest of the year. Housing - The big story continues to be the housing market. Prices are rising, mortgage activity is increasing, the help to buy scheme is providing a boost to first time buyers. New home build is set to increase by almost 30% this year. The housing market is on the move, time to lock up your fixed rates, as prices rise, the real cost of borrowing is zero, capital appreciation - the bonus. So what does this mean for the year? Our forecast is for growth of around 1.2% plus, rising to 2% in 2014. The economy has turned, the real risk - monetary policy is behind the curve. It is difficult to believe rates will be kept on hold until 2016, watch the US and add six months the best guide as always. Markets were equally sceptical, gilts and treasury yields are rising - gold is beginning to glitter again. What happened to sterling? Sterling responded to the economics news, moving higher. The pound closed at $1.5633, from $1.5505 against the dollar and at €1.1713 from €1.1617 against the euro. The dollar up against the yen closing at ¥97.5 from ¥96.24 Oil Price Brent Crude closed up at $110.40 from $108.22. The average price in August last year was almost $115. We expect oil to average $112 in the current quarter. Markets, were troubled - The Dow fell to 15,081 from 15,425. The FTSE closed down at 6.499.99 from 6,583. It’s a chance for market makers to clean out the bear pit. A good time to make a move. We still think the FTSE will clear 7000 within ten weeks. UK Ten year gilt yields closed at 2.72 from 2.45, US Treasury yields closed up at 2.83 from 2.58. Yields are moving higher, despite the wishes of central bankers. The name is Carney not Canute after all. Gold closed up at $1,377 from $1,315. Still waiting for the next big move but which way? Last week we said, the arguments are building for the bulls. It looks like they have made a decision. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Check out The Saturday Economist web site, and the new Chart of the Day Page. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. The Saturday Economist.com is mobile friendly, no need for a special app any more! Join the mailing list for The Saturday Economist or forward to a friend to let them share the fun! John John Ashcroft is the Saturday Economist, Chief Economist at the Greater Manchester Chamber of Commerce, Economics Adviser to Duff & Phelps and Chief Executive of pro.manchester. The views expressed are personal and in no way reflect the policy statements of organisations with which we work. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  In the service sector, manufacturing , construction and housing, the news is good news... The August Inflation Report was presented this month by Mark Carney, the new Governor of the Bank of England. The Bank is forecasting growth of almost 1.5% this year and 2.5% next. Inflation will remain above target but base rates may be kept on hold for a further three years. So much for forward guidance. The time may come when the central banker "will take away the punchbowl" but for the moment Carney is "putting his credit card behind the bar". Enjoy. Business activity in the service sector increased in July at fastest rate since late 2006 according to the latest survey data*. The headline Business Activity Index climbed to its highest reading since December 2006, posting 60.2 up from 56.9 in June. Above 50.0 readings have now been recorded for seven months in a row, with growth accelerating continuously throughout this period. *Markit/CIPS UK Services PMI® data. In the manufacturing sector, output was up by 2% in June compared to prior year after a disappointing first half. Capital goods, continue to drive recovery with strong growth of almost 4%. Consumer goods also rallied in June with output of consumer durables increasing by 2%. In construction, output in the second quarter was estimated to be 1.4% higher when compared with Q1 2013. Comparing Q2 2013 with the same period a year ago, construction output actually fell by 0.5%. We expect a further recovery in output into the second half with growth of 1% year on year, boosted by some housing activity. On trade, the deficit on trade in goods reduced to £24.9 billion in Q2 2013 from £26.5 billion in the first quarter. Exports of goods in the second quarter of 2013 reached £78.4 billion, the highest on record. Imports of goods also increased in Q2 2013 to £103.3 billion. Seasonally adjusted, the UK’s deficit on trade in goods and services was estimated to have been £1.5 billion in June, compared with a deficit of £2.6 billion in May. The deficit of £8.1 billion on goods, was offset by an estimated surplus of £6.5 billion on services. So what does this mean for the year ahead? We still expect the deficit trade in goods to increase to £105 billion in the year. Exports of goods will improve as world trade recovers but imports will increase to meet the improving demand in the domestic economy. The service sector will continue to drive recovery with a trend rate accelerating from 1.5% to 2% over the next six months. Manufacturing and construction output will improve in the second half but contribution to growth for the year will be muted following such a poor start. Our forecast for growth this year is around 1.2% with further growth in 2014 of around 2%. Slightly more bearish than the “Bank”. For the moment, the good news keeps on coming, a sustained recovery will require a growth in real household incomes. In the housing market, the Halifax reported prices increasing by almost 5% in July. There is little sign of a great change in the volume of activity for the moment, although the Council of Mortgage Lenders reported a strong recovery in buy to let activity. Lenders advanced 40,000 mortgages, worth £5.1 billion, to buy-to-let investors in the second quarter of 2013. Both the number of buy-to-let loans, and the value of lending, were the highest since the third quarter of 2008. The promise of low rates will push prices higher as the real cost of borrowing falls. Strong rental yields, low costs of borrowing and the prospects of capital appreciation present a heady cocktail for buy to let. More pressure on first time buyers, the real price of life on planet ZIRP. What happened to sterling? Sterling responded to forward guidance, moving higher. The pound closed at $1.5505 from $1.5284 against the dollar and €1.1617 from €1.1504 against the euro. The dollar slipped against the yen closing at ¥96.24 Oil Price Brent Crude closed largely unchanged at $108.22 from $108.95. The average price in August last year was almost $115. Not much pressure on price as we move into the Autumn. Markets, were up - The Dow fell to 15,425 from 15,658. The FTSE closed down slightly to 6,583 from 6,648. Markets trade softly into August. Still a good time to average in. The FTSE will clear 7000 within ten weeks. UK Ten year gilt yields closed at 2.45 from 2.42, US Treasury yields closed down at 2.58 from 2.60. Yields are set to move higher but the path will be slow, we remain parked on the runway of Planet ZIRP, the pilot has gone off the to pub. Gold closed down at $1,315 from $1,308. Still waiting for the next big move but which way? The arguments are building for the bulls. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Check out The Saturday Economist web site, and the new Chart of the Day Page. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. The Saturday Economist.com is mobile friendly, no need for a special app any more! Join the mailing list for The Saturday Economist or forward to a friend to let them share the fun! John John Ashcroft is the Saturday Economist, Chief Economist at the Greater Manchester Chamber of Commerce, Economics Adviser to Duff & Phelps and Chief Executive of pro.manchester. The views expressed are personal and in no way reflect the policy statements of organisations with which we work. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  7% unemployment and 2.5% the inflation the thresholds - rates may be on hold until 2016. The Bank of England released its quarterly inflation report, the first since Governor Mark Carney assumed the role of Governor. The report presents a more optimistic view of the UK’s growth prospects following a batch of recent good news on the economy. The MPC increased the GDP growth forecast for this year to around 1.5% increasing the 2014 forecast to around 2.5%. Consumer price inflation is likely to fall back to 2.0% but not for some time yet. It could be 2015 before inflation falls back to target and then some, 2.5% is the new threshold target for CPI inflation. Governor Carney introduced the first every version of "Forward Guidance" linking a change in monetary policy to the rate of unemployment. In particular, the MPC intends not to raise Bank Rate from the current level of 0.5% at least until the Labour Force Survey headline measure of the unemployment rate has fallen to a level of 7%. On current projections, this is unlikely to occur until 2016, inline with forward market forecasts on base rates. Is this an unconditional commitment? No. The Old Lady of Threadneedle Street will exercise the prerogative to change her mind subject to certain conditions. The guidance linking Bank Rate to the unemployment threshold would cease to hold if any of the following three ‘knockouts’ were breached: In the MPC’s view, CPI inflation 18 to 24 months ahead will be 0.5 percentage points or more above the 2% target. Medium-term inflation expectations no longer remain sufficiently well anchored and the Financial Policy Committee (FPC) judges that the stance of monetary policy poses a significant threat to financial stability. What does that mean? We can’t be sure. The intention is to suggest rates will be held until the recovery is well developed and “escape velocity” from recession has been achieved. The MPC would have us believe this is 2016. The risk is that inflation will remain above target as the recovery gains momentum and the MPC will be forced to raise rates before the suggested 2016 timeline. It is a knock out start by Mark Carney. The economy is recovering, rates will be held for the next twelve to eighteen months at least. Forward guidance has made a promising start. Let’s hope it does not provide too much mis direction. For now enjoy the recovery. Bank of England inflation report, August 2013 7th August 2013  Economics news – Base rates on hold, houses are moving, manufacturing and construction - building on the recovery. No surprise this week - base rates and QE were kept on hold following the meeting of the Monetary Policy Committee on Thursday. Guidelines on the Bank of England’s use of intermediate thresholds and forward guidance on monetary policy, will be released next week, along with the Inflation Report. It will be ground breaking, The Old Lady has a new cosmetic tool in the handbag. Fashion is in all things, including monetary policy. The Federal Reserve has adopted forward guidance using inflation and the rate of unemployment (6.5%) as guidelines for the timing of any rate increases. Latest US data on growth (1.4%) and jobs (162,000) in July, pushed the unemployment rate down to 7.4%. Any change in US rates is unlikely until late 2014 at the earliest. US growth is still below trend rate 2.4%. So what will the UK version of forward guidance look like? It won’t be pretty but it will be protracted. It could turn out to be more misdirection than guidance, if the MPC is behind the curve. Check out our Forward Guidance on Forward Guidance on The Saturday Economist web site this week. The pace of recovery could catch many by surprise. Manufacturing and construction are staging a strong recovery. Markit/CIPS UK PMI® data in July, suggests, growth of UK manufacturing production and new orders “surged” higher in the month. An increase in domestic demand is the main driver of growth. The key index jumped to 54.6 in the month, marginally above the average rate prior to recession. The construction index jumped to 57.0 in July from 51.0 in June. New orders and a “surge” in housing activity led to a pick up in orders and positive sentiment about the future. Ah yes, the confidence fairy drives a mail van, stacked with orders. So what is happening in the housing market? The Nationwide House Price Index suggested prices increased by nearly 4% compared to July last year. Prices are moving back to levels last seen in June 2008 and within 8% of the peak in late 2007. “The Homes for Heroes” campaign is helping to push prices higher. The level of transactions and new home building are beginning to respond. Our full report on the housing market will follow next month. Time to book the Pickfords van, the housing market is on the move. The Prime Minister has installed Jim Messina, Obama’s major foreign policy advisor, as campaign strategy adviser ahead of the next election. As part of the new team line up, George Osborne will deliver growth, jobs and debt reduction in time for the hustings. The most successful Chancellor in history? Perhaps. What happened to sterling? Sterling slipped this week closing at $1.5284 from $1.5384 against the dollar and down against the euro to 1.1504 from 1.1581. The Euro dollar closed unchanged at 1.3279 and against the Yen, the dollar closed at 98.9 from 98.2. Oil Price Brent Crude closed up at $108.95 from $107.2. The average price in July 2012 was $103 approximately, the average price in July was $108.5. Markets, were up - The Dow closed up 15,658 from 15,558. The FTSE closed at 6,648 from 6,554. Markets continue to rally. This is the time to average in, steadily into August. The FTSE may clear 7,000 within ten weeks. UK Ten year gilt yields closed at 2.42 from 2.34, US Treasury yields closed down at 2.60 from 2.56. Yields are set to move higher albeit against the wishes of the central banks. It really is time to pack up and leave Planet ZIRP. Gold closed down at $1, 308 from $1,325. The ancient relic will be cast aside as markets focus on equities and bonds. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Check out The Saturday Economist web site, and the new Chart of the Day Page. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. The Saturday Economist.com is mobile friendly, no need for a special app any more! Join the mailing list for The Saturday Economist or forward to a friend to let them share the fun! John The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  The Chancellor George Osborne has asked the Bank of England to produce a report on forward guidance in time for the August inflation report. Forward guidance is in fashion. It has been used by the US Federal Reserve since 2008, and more recently the European Central Bank has offered some guidance on monetary policy. As the new Governor of the Bank of England, Mark Carney is obligated to produce a report for the Chancellor of the Exchequer on forward guidance. Below I consider some of the issues and key challenges that will be faced in developing monetary policy on this basis. What is Forward Guidance? Forward guidance is the release of information about when and under what conditions the Bank of England may feel obliged to lift the level of base rates in the economy, as the period of Zero Interest Rates (Life on Planet ZIRP) comes to an end. The Bank of England has the responsibility to maintain price stability around the 2% level. But with inflation above target, the Bank has been more concerned about the recession, lost output, job losses, unemployment and the lack of growth in the economy, rather than trying to hit the elusive inflation target by increasing interest rates. Base rates have been at the “zero bound” or thereabouts at 0.5% (50 basis points), since March 2009, but with inflation above target and with the economy showing signs of recovery, the question becomes: when will rates rise and by how much? Forward Guidance and Intermediate thresholds Using intermediate thresholds, the Bank's MPC would inform the markets that base rate would be kept at the historically low 0.5% for a certain minimum period of time. Or, they could be held until certain conditions in the economy have been met - for example, a fall in the unemployment rate to a certain level. Ben Bernanke has suggested an unemployment rate of 6.5% could lead to an end of the end of an easy monetary policy in the USA. Below, we consider if the same target would work in the UK. What's the point of Forward Guidance? Central Banks believe that if consumers and businesses can be convinced that base rates will be on hold for some considerable period of time into the future, spending or investment plans will be brought forward to benefit from the lower rate. However, some commentators are not entirely convinced by this argument. With inflation above target and likely to remain so, businesses realise that as the economy recovers, interest rates will begin to rise sooner or later. If growth is faster, the sooner the rates will rise. If growth is slower, the rate rise will be delayed. The irony for business is the cost of capital is only a small part of the investment payback proposition. Demand is far more important. Rising demand will lead to a rise in rates but the payback will be better, despite the rise in the “cost of money”. The converse is also true. Lower demand may mean that rates will be on hold for longer. Capital may cost less but returns from limited growth are lower, therefore investment plans may be kept on hold, irrespective of the timing of an increase in rates. How does the Bank decide what conditions to set? At the moment we don’t really know what parameters will be chosen by Mark Carney as the new governor. It could be a promise not to raise rates for a period of time, or not to raise them until unemployment falls back below a certain level, perhaps 6.0%. Alternatively, rates could be on hold until the economy's output gap - a measure of the country's under utilised capacity - is eliminated by growth in the economy. The Output Gap The problem with the “output gap” measure, is that we have no way of knowing what the gap is. We cannot identify, measure or quantify, the output gap, let alone use this as a policy parameter. One option is to measure the output gap relative to the average rate of growth of the British Economy over the long term and estimate the output gap relative to trend. Using a long run average of 2.4%, the output gap at present is around 10%. Growth in the economy would have to be significantly above the long term average for a considerable period of time, before the gap closed completely. It would take seven years of growth at 4% to close the output gap! Can we really believe that with inflation above target and with growth at say 4.0%, we will wait seven years for base rates to rise? Of course not! The output gap would create great problems if used as an intermediate threshold. Forward Market Guidance In the May Inflation report, the Bank of England was happy to use forward guidance derived from the financial markets. Complex swap data suggested base rates would not begin to rise until 2016. Subsequently, following statements by the Federal Reserve, gilt yields started to rise and the UK OIS swap data implied UK base rates would begin to rise in 2015. The Bank of England was unhappy with this and gave clear indications that market perceptions were at odds with intentions. As the swap curve returned to the 2016 gradient, implying rates would not increase until 2016 - calm, amongst the MPC members at least, resumed. Historically, forward rates have provided little guidance as to the future direction of base rates. Nevertheless, used as a rough guide, the comments by the Bank of England have been effective in providing some steer. Using the OIS template, forward swap rates could be used as a benchmark for comment and direction - a sort of rough time line. Unemployment Rate Should the Bank of England use the unemployment rate as an intermediate threshold? In this scenario, base rates would increase only when the economy recovers and unemployment falls to a certain level. Assuming the unemployment level target is set to 6.5%, (the rate below which base rates may begin to rise), then we have to ask, what will drive the reduction in unemployment? The answer of course is growth. Using standard models of growth and job creation, assuming a trend rate of growth of say 2.5% from 2014 onwards, unemployment would hit a level of 6.5% in 2017. That’s one year beyond the current time frontier identified by the swap rate forecasts. A more modest recovery rate of 2% would see rates on hold until 2019 before the 6.5% unemployment target is met. But with inflation above target, base rates may have to rise long before this to combat inflation. Forward Guidance - is not an easy option Whatever guidance the Bank of England may provide in the short term, the Old Lady of Threadneedle Street will always have the legal right to change its mind later. Indeed, it is mandated to do so if inflation gets out of hand. Can Mark Carney come up with a sensible set of rules on forward guidance and make a careful selection of suitable intermediate thresholds? It will not be easy. In any case, what is the value of forward guidance if the Bank can change its mind in the future? Forward guidance can easily become misdirection. Mervyn King was always set against the use of forward guidance, on this particular matter he may well be proved right. We look forward to the deliberations of the New Governor in August. Originally published on the GM Chamber of Commerce Web site1st August 2013 |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

||||||

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed