|

Borrowing Falls ...

Latest figures confirm borrowing will be much lower than expected at the start of the year. In March, the OBR were forecasting borrowing of £234 billion in the current financial year. The strong bounce back in the economy suggests public finances are in much better state than expected. Revenues have been boosted by the growth in tax receipts. Expenditure has fallen as the return to work continues. Borrowing in May was estimated to be £24.3 billion, that's down by almost £20 billion compared to May last year. Revenues improved for most categories including fuel duties and VAT receipts. Spending was down compared to prior year. No surprise really, almost 9 million were furloughed at the start of the financial year. We expect this to have fallen to 2.5 million in the second quarter this year. Total borrowing could fall below £200 billion in the current financial year and below £100 billion next. The level of debt will rise to average £2.4 trillion over the next two years falling to 90% of GDP by the end of 2024. The UK will experience strong growth as the economy returns to trend rate. We expect growth of over 7% this year and over 5% next. Over the three year period, nominal growth will be over 25%. The economy is set to expand by over £500 billion within the three year period providing a big stimulus to revenues, shrinking the debt to GDP ratio. Our June Forecast Update is available to view on line and download. This is not a forecast of a boom. Just a return to trend rate of growth following the shock to output last year. We even include a chart on productivity! Bank Holds Rates ... The Bank of England Monetary Policy Committee voted this week to keep rates on hold and to maintain the existing target of UK government bond purchases at £875 billion. The bank continues to hang on to the £20 billion of corporate bonds picked up in the Brexit drama five years ago. The logic of the bond acquisition elusive, the language of the government bond purchases now excludes "QE". Monetary financing of the fiscal deficit is in play. 70% of the debt issued by the DMO last year was picked up by the Central Bank, as the buyer of last resort. It is not until the end of next year, the volume of new debt will fall within the capacity of the private sector. The Bank may have to extend the level of spend to fill the one trillion pound bank note for the Chancellor. The Bank may suggest the asset purchase programme will be concluded this year but the Old Lady stands ready to "increase the pace of purchases to ensure the effective transmission of monetary policy". Don't expect a rise in interest rates or gilt rates anytime soon. The MPC expects inflation CPI basis to rise to over 3% in the near term, before returning towards the 2% target by the end of the year. Andy Haldane, the departing Chief Economist, (he's off to the RSA) warned this week, “There’s a rising risk that 3% won’t be the peak and we could see greater persistence and a higher level,” he told Money Week magazine. “Next year could see price pressures building, not abating.” Now that would be a problem. The real fear is a lock in of wage inflation as prices rise. Coaching staff to return to work is proving to be more of a challenge than expected. Earnings increased by over 5.5% in the three months to April. In the service sector the increase was over 8% in May alone. Recruitment difficulties are increasing, Vacancies are rising to pre lock down levels. EU nationals are reluctant to return. In the UK some 3 million, including over 900,000 in the accommodation and food sector, were on furlough at the end of April. Time to get back to work says the Chancellor. Worrying also, oil prices continue to rise. We expected oil price to trade within a $65 to $70 dollar band over the summer months. Commodity prices including copper are topping out. Brent crude closed at $76 dollars this week. The calls for $100 dollar barrels improbable but alarming ... Oil is key chart in our "Inflation Chart Book" ... watch this space ... That's all for this week, we will be back with more next week. Want to be sure? Join the Club, become a Premium Subscriber, don't miss out. John For the more detailed forecasts for the economy, inflation and our Monday Morning Markets financial review, it really is time to sign up to The Saturday Economist Club, become a Premium Subscriber. Help us to maintain the high levels of research and analysis. Become A Premium Subscriber Get Access to All The Data

0 Comments

Markets Fret About Rising Rates ...

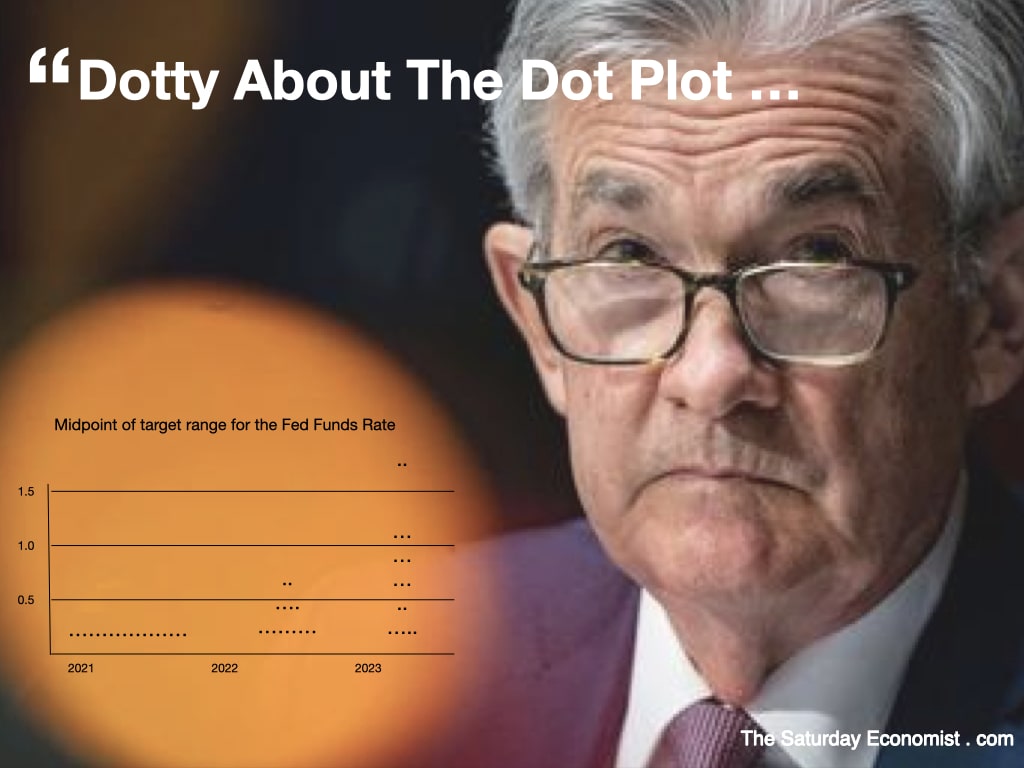

The Dow closed down, the dollar moved up. Ten year bond yields moved higher by just three basis points. Not much of a taper tantrum, more of a milk shake than an earthquake. The Fed announced the policy decision mid week, effectively to do nothing. It wasn't really making any changes. There would be no increase in base rates. The asset purchase program would continue at an eye watering $120 billion dollars per month. No real concerns about inflation. It remains always and everywhere a transitory phenomenon. The long run targets of 2% inflation and a return to maximum employment remain in place. The committee expects to "maintain an accommodative stance until these outcomes are achieved." The Dow tumbled over 1,000 points. The S&P closed 2% down. The overvalued Nasdaq moved higher yet. The Dollar moved up against Sterling and the Euro. The mood is moving back in favour of the dollar. Sterling closed at $1.38, the push on $1.42 a move too far. It was all about the Dot Plot. So what's a dot plot? Members of the FOMC mark, with a dot on a chart, expected base rate changes into the future. It's like pin the tail on the donkey but with financial futures, all eyes open. Policy makers signaled they expect to raise interest rates by late 2023, sooner than they had previously anticipated. Sentiment took a further hit on Friday after Federal Reserve Bank of St. Louis leader James Bullard said he expects the first rate increase even sooner, in late 2022. Bullard doesn't actually have a vote. Fed Chairman Jerome Powell affirmed, “rate increases are really not the focus of the committee” right now. “The real near-term discussion that we will begin, is about the path of asset purchases and when the central bank would be able to pull back on that". Has the mood changed in the Fed? “It’s the end of peak dovishness,” said Bleakley Global Advisors chief investment officer Peter Boockvar. “It’s not going hawkish. It’s just we’re past peak dovishness. Ah yes peak dovishness, a new phrase for the monetary policy handbook on Planet ZIRP. The Fed increased forecasts for US growth to 7% in 2021 and 3.3% in 2022. The reversion to trend at 1.8% is expected from 2024 onward. PCE inflation is expected to hit 3.5% this year slowing to 2.1% next. Unemployment is expected to slow to 4.5% this year and 3.8% next. Fed officials discussed an eventual reduction, or tapering, of the central bank’s bond-buying program. The timing of such a move remains uncertain. Central bank largesse may have to continue (in the US and the UK), until the burden of borrowing falls within the capacity of the private sector. Stocks and bonds fell after the Fed statements. The change in tone and new forecasts were “a wake-up call for the market” said Phil Orlando, chief equity-market strategist at Federated Hermes Inc. It may well have been a wake up call. By the end of the week, the markets had pressed the snooze button. It was time time to push the NASDAQ higher. Inflation is always and everywhere a transitory phenomenon after all ... CBI Forecasts Growth of 8.2% ... Just when we thought our 7.5% call may be a bit over the top, the CBI upped the stakes with forecasts of 8.2% growth in 2021 and 6.1% next. The CBI expects a much lower peak in the unemployment rate at 5.5% in Q3 in the third quarter as a result. Household spending is to be the linchpin of the recovery, driving just over a quarter of GDP growth in 2021, and 70% of growth in 2022. Actual retail sales slipped in May, food sales were down as shoppers went to the pub. The drop of 1.4% in the month contrasts with a near 25% growth year on year. Online sales slipped to 29% as a proportion of all retail activity. It was a big week for UK economics. The Labor stats reported a fall in unemployment to 4.7%. Earnings increased by over 8%, with a 14% jump in construction pay. The number of vacancies increased to 758,000 in May. Recruitment difficulties are increasing. The pre lock down level will soon be within reach. Businesses are calling for a relaxation of rules on immigration. EU workers are reluctant to return. The onset of the wage inflation spiral is the worry for policy makers. Inflation CPI basis hit 2.1% in May. We expect a rise to over 3% within months. Manufacturing prices increased by almost 5% as input costs moved to 11%. The manufacturing hike is in large part about oil prices. We had expected prices to fall from the $70 dollar level. The push on to $73 dollars this week is concerning. The threat of inflation and a wage spiral suggests rates may have too rise sooner than expected according to some. Bank of America, Merrill Lynch and Credit Suisse have brought forward forecasts of the first rate hike to May next year ... Really? This is life on Planet ZIRP ... don't get dotty about that dot plot ... That's all for this week, we will be back with more next week, stay safe ... The economy is hotting up ...

Official data from the Office For National Statistics this week revealed "the economy is hotting up". UK GDP is estimated to have grown by 2.3% in April, as government restrictions continued to ease. Compared to prior year, the economy grew by 28%. Construction activity was up by 80%. Manufacturing output increased by 40%. Service sector activity increased by 30%. The increase in the service sector was driven by a surge in retail expansion with strong growth in education, accommodation and food. Construction activity slowed slightly in the month. Developments in the service sector were faster than we had expected. The service sector expanded by 3.4% compared to March. The return to work continues. At the end of April, 3.4 million were on furlough compared to 4.7 million at the start of the year. We now expect this number to fall to around 2 million through the second quarter. Data from the ONS suggests the number may have fallen to 1.8 million at the end of May. For the year as a whole, we now expect growth of 7.5% this year and over 5% next. Thereafter, growth is expected to return to an underlying trend rate of 2% extending to 2025. Want to know more? We will be expanding on our five year forecasts at the Saturday Economist Live Session later this month. Want to know even more? Become a Premium Subscriber, you will have access to the TSE library and our detailed forecast updates. You can now sign up with a monthly subscription, it's that easy. US Inflation on the rise ... In the U.S. inflation spooks shuddered as CPI inflation hit 5% in May. The Fed shrugged. Markets moved on. Ten year bond yields fell eleven basis points to 1.46. Nasdaq moved higher, the S&P moved sideways, the Dow closed lower but not by much. Gold prices eased by $15 dollars. Oil prices moved up, one dollar. Inflation remains, as far as the Fed is concerned, "always and everywhere, a transitory phenomenon". It was all about "Oil Wells and Car Wheels". The oil price comparison with the 2020 slump to blame. Gasoline and Fuel oil prices were up by over 50% in the month. Transportation costs were up by 11%. Second hand car prices were up by 30%. Buyers are scrambling to buy depleted show room stocks. Production of new cars is hampered by supply shortages in a world of "Chips with Everything". The Fed is relaxed about inflation. Officials indicated they expect interest rates to remain close to zero until 2024. Fed forecasts for growth have been increased to 6.5% this year, thanks to the fiscal stimulus and the success of the vaccine roll out. No thoughts of tapering for the moment. Bond purchases will continue until the central government deficit slows. Expect the same in the UK. Rates on hold. The Trillion Pound bank note on offer to the Treasury until the central government deficit falls to around £100 billion. That could happen in fiscal 2022/23. Until then we remain trapped on Planet ZIRP with central bankers as buyers of last resort. Good News For Bitcoin ... Good news for "hodlers" of Bitcoin. El Salvador has become the first country in the world to accept Bitcoin as legal currency. President Nayib Bukele at the Bitcoin party in Miami this week said "The decision will help to push humanity in the right direction". El Salvador is in negotiations with the IMF to secure a $1 billion dollar loan. That's about 28,000 bitcoin at closing prices. A positive decision from the IMF on the loan, would be a bigger push for Central American humanity, he might have added .... That's all for this week, we will be back with more next week, stay safe ... see you on the 25th ... John Become a Premium Subscriber, Join The Saturday Economist Club, you will get access to our detailed research and publications in the Saturday Economist Club Library. It's time to get serious about The Saturday Economist Club ... Now you can join with a monthly subscription ... Click to learn more ... Construction growing through the roof ...

Great headlines from the Times this week. "The economy is growing at an eye popping rate". "Construction growth is going through the roof". "Manufacturing leads strong performance", "Red hot economy lifts markets, ". It didn't help when Nationwide reported house prices rising by 10.9% in April. Then the SMMT reported car sales increasing to 157,000 in the month from just 20,000 last year. Amazing what can happen once the showrooms reopen. Interesting, Diesel car share fell below 10%. Hybrid sales accounted for over 40% of all registrations. Not too difficult to imagine what will happen as greater supply comes on stream. Ford's claim that 40% of total global sales will be electric by 2030 appears a tad conservative. Back to the headlines. This is the week of the IHS Markit / CIPS UK PMI® data series. Hang on to your hats and cling to your eyeballs. Manufacturing surged to a record high in May, as new work intakes increased at a record rate. In construction, new orders increased at the fastest rate since the survey began in April 1997. In the service sector output growth increased at the fastest rate since May 1997. The manufacturing index hit 65.6, the construction index hit 64.2, the service sector index hit 62.9. Bear in mind anything over 50 reflects growth in the sector and in the economy more generally, then it is understandable, why eye balls are popping. The economy is roaring back to life. In the manufacturing sector, export orders increased at a survey record pace. Businesses reported stronger demand from the EU, the US and China. No surprise really, world trade increased by almost 10% in the first quarter of the year. Growth is expected to continue at a similar rate for the rest of the year. The strong and swift upswing in activity, is leading to capacity limitations, delivery delays, supply shortages and rising prices. The good news business optimism is rising with over 70% of manufacturers forecasting higher levels of production, in twelve months time. Businesses are recruiting. Difficulties are reported, especially in the hospitality sector. Really? The latest furlough data from HMRC reports numbers down to 3.4 million at the end of April of which almost one million were in accommodation and food. The sooner they, and the 1,700 furloughed in the energy sector, get back to work, the better. In the US, President Biden is suggesting labour support schemes should be ended in September. Rishi Sunak may well be of the same opinion ... Money For Nothing ... GiIts for Free. The next episode of The Saturday Economist Live will be on the 25th June. We are spreading our multi media reach. We now have over 4000 hits on our Podcast channel, over 1000 views in the Saturday Economist Club Library. We regularly get over 1000 views on our weekly LinkedIn Channel. Premium Subscribers numbers are increasing at a "Record Rate" ... We are working on a special feature "Digital Acceleration and the Smart Enterprise". This is an update on our work on Digital Disruption featuring in our Gazprom Moscow visit in at the end of 2019. We will talking about this at TSEL session later this month. The final drafts will be available to Premium Subscribers and members of the Saturday Economist Club. In our regular sessions we have talked much about Monetary Policy. QE is dead. "Money For Nothing" Gilts for free. The Bank of England is engaging in monetary financing of the fiscal deficit. Someone had to. According to the latest data from the Debt Management Office, total government liabilities increased by £450 billion in 2020. Foreign investors picked up less than 20% of the issue. Domestic insurance companies and pension funds bought into just 6% of the Treasury burden. The Bank of England picked up 70% of the gilts on offer. The "lender of last resort" became the "buyer of last resort". Nobody likes a "Gilt Strike". The Old Lady of Threadneedle Street now has 32% of total government debt in the handbag. The Trillion Pound Bank note handed to the Chancellor may yet not be enough ... now that IS eye popping ... That's all for this week, we will be back with more next week, stay safe ... John PS Become a Premium Subscriber, Join The Saturday Economist Club, you will get access to our detailed research and the publications in the Saturday Economist Cub Library, updated weekly and monthly. Click here to learn more ... It's time to get serious about The Saturday Economist Club ... |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed