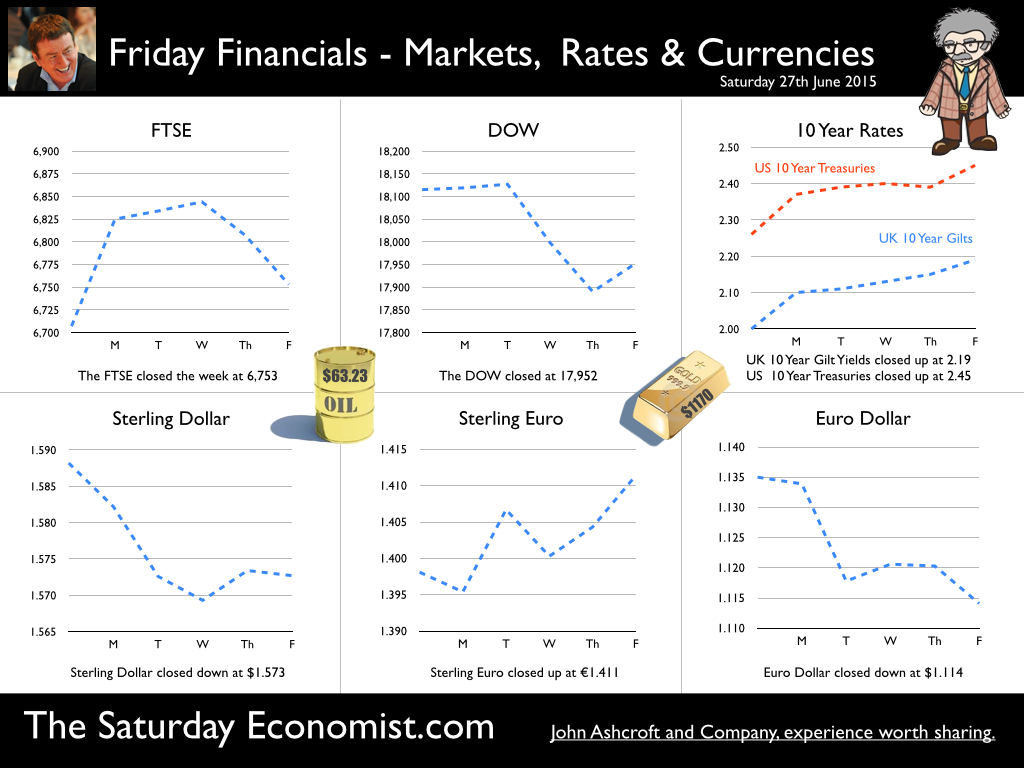

Greek negotiations - more a meeting of mimes … than a meeting of minds. It was a pretty good week for updates on the world economy. The US economy grew at a rate of 2.9% year on year in the first quarter. The Spanish economy grew at a healthy rate of 2.6%. The European economy is recovering. The PIGS are leaving the trough. The world economy will grow by 2.7% this year and over 3% next. World trade will increase by 3% this year and over 4% next. In the UK, we declared 2015 the year of the LILIES. With low inflation, low interest rates and an earnings surge, boosting the effects of more jobs and lower unemployment. This is the year “most of our people have never had it so good” said Harold MacMillan in 1957. “You will see a state of prosperity such as we have never had in my lifetime - nor indeed in the history of this country” he went on to say. Well at least since the great recession of 2008, we would add. But interest rates won’t stay low forever and inflation is set to rise by the end of the year … So when will rates rise? … In the US, September remains the favourite for the first rate rise with a further rate rise quite possible before the end of the year. MPC member Martin Weale suggested UK rates may have to rise earlier than expected, possibly as early as August. That seems all too hawkish. We expect a UK rate rise within three to six months of the first Fed move. The MPC won’t move ahead of the FED. So what’s going on in Greece … The European economy is in the early stages of recovery. This is really no time to leave the Greeks behind. Negotiations are becoming more a meeting of mimes than a meeting of minds. In ancient Greece, mimes were a simple farcical drama, including mimicry, dependent upon ludicrous actions and gestures for effect. So it continues to the present day with the Greek debt negotiations. The late call for a referendum by Prime Minister Alexis Tsipras is a measure of frustration in negotiations with the troika. The intransigent IMF is fond of draconian measures bordering on mediaeval economics. Punishment parallels with Captain Bligh. “The beatings will continue until morale improves:” the mantra. “I'm not advising cruelty or brutality with no purpose. My point is that cruelty with purpose is not cruelty - it's efficiency. A man will never disobey once he's watched his mate's backbone laid bare. He'll see the flesh jump, hear the whistle of the whip for the rest of his life.” So too it is hoped the anti austerity “Podemus” party in Spain will observe the flagellation of the radical-left Syriza party in Greece and take the whip in good measure. It really is time to end the farce, settle the issues and move on. We cannot leave the Greeks behind. Negotiations are stumbling over VAT hikes and pension cuts. The IMF rejected a Government proposal to increase corporation tax on the basis this would damage the economy. Yet pushed for higher VAT and Pension cuts. What nonsense. Strange to ignore the fact that pension cuts would damage, health , welfare and domestic demand. VAT hikes would put a sales tax on the tourist industry, especially the eradication of the 30% discount in the Greek Islands of Rhodes and Santorini. In negotiations with Governments, the numbers don’t always add up at onset. Do not question too closely the proposals of UK governments to reduce the deficit and eliminate debt over the lifetime of parliament. Nor should we forget the brilliant “magic asterisk” of the David Stockman era as budget director in the Reagan administration. “Cuts as yet to be identified” the small print on the magic asterisk included in the budget spreadsheets. Total Greek debt is just 3% of Eurozone GDP. It's an easy roll to move forward. Time for a few magic asterisks in the Greek Spreadsheets to move matters forward. There is no alternative … A Greek default with a return to the Drachma would lead depreciation of currency, onerous foreign debt obligations and high domestic inflation, Political instability with a threat to tourism a further risk. Higher import costs would mean the trade deficit would deteriorate with little or no improvement in tradeable goods exports. Banking instability would be exacerbated with capital controls imposed and bank withdrawals curtailed. It would take up to six months for an orderly currency transfer at best. Undecided who would pay for the printing presses to produce the new notes and what would happen to all those Euros stuffed into Greek mattresses already. And what of contagion? The geo political, currency and economic risks would be too much for a Eurozone for which Greek debt represents just 3% of GDP. Let us not forget too soon, the lessons of Lehman. Leave the IMF lobotomists out of the room, toss away the whip, a flick of the wrist and a few “Magic asterisks” would bring an end to the Drachma Drama. So what happened to Sterling this week? Sterling moved down against the Dollar to $1.573 from $1.588 but moved up against the Euro to €1.411 from €1.398. The Euro moved down against the Dollar to €1.114 from 1.135. Oil Price Brent Crude closed at $63.232 from $63.02. The average price in June last year was $111.80. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our forecast outlook. Markets, were troubled. The Dow closed down at 17,952 from 18115 but the FTSE closed up slightly at 6,753 from 6,707. Bonds moved lower as yields increased. UK Ten year gilt yields moved to 2.19 from 2.00 US Treasury yields moved to 2.45 from 2.26. Gold moved up to $1,1701 ($1,201). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

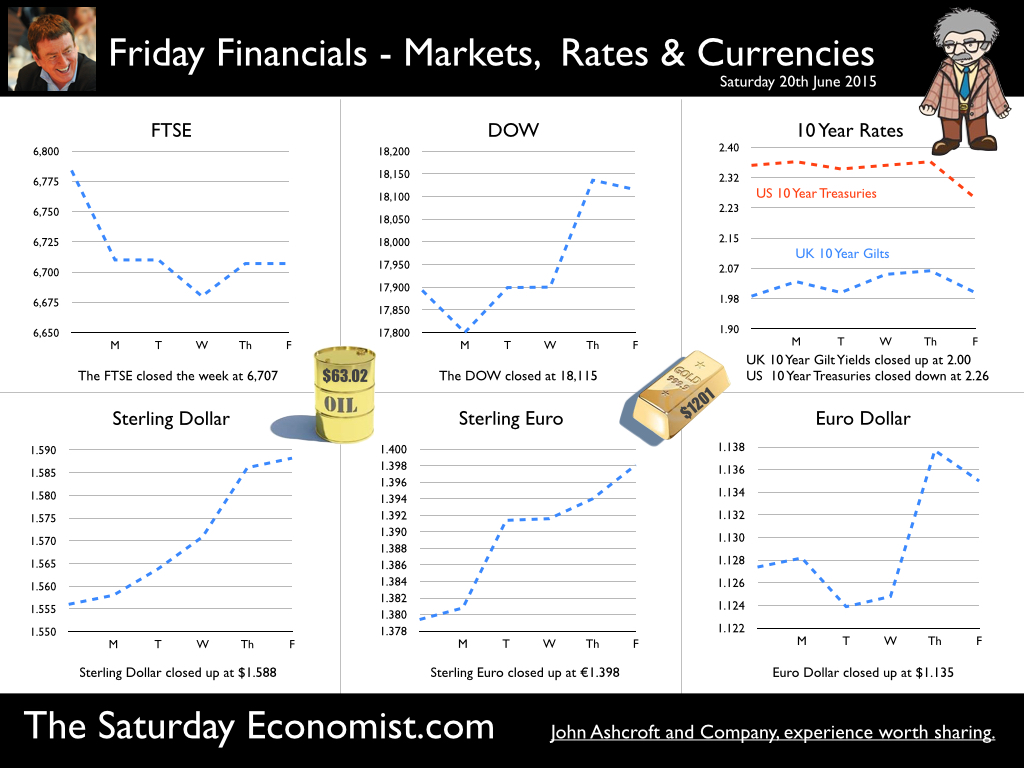

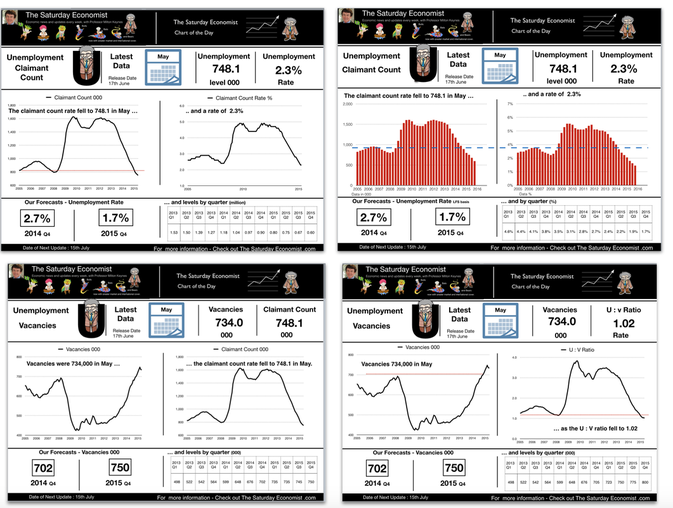

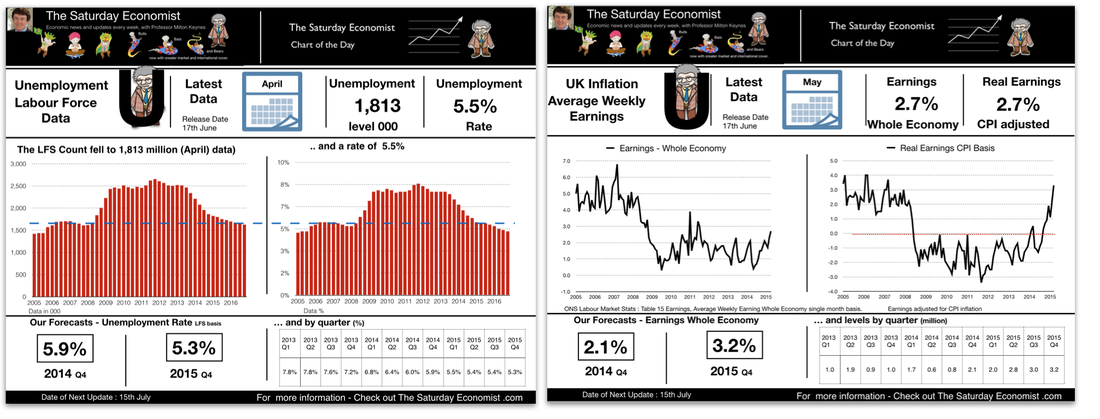

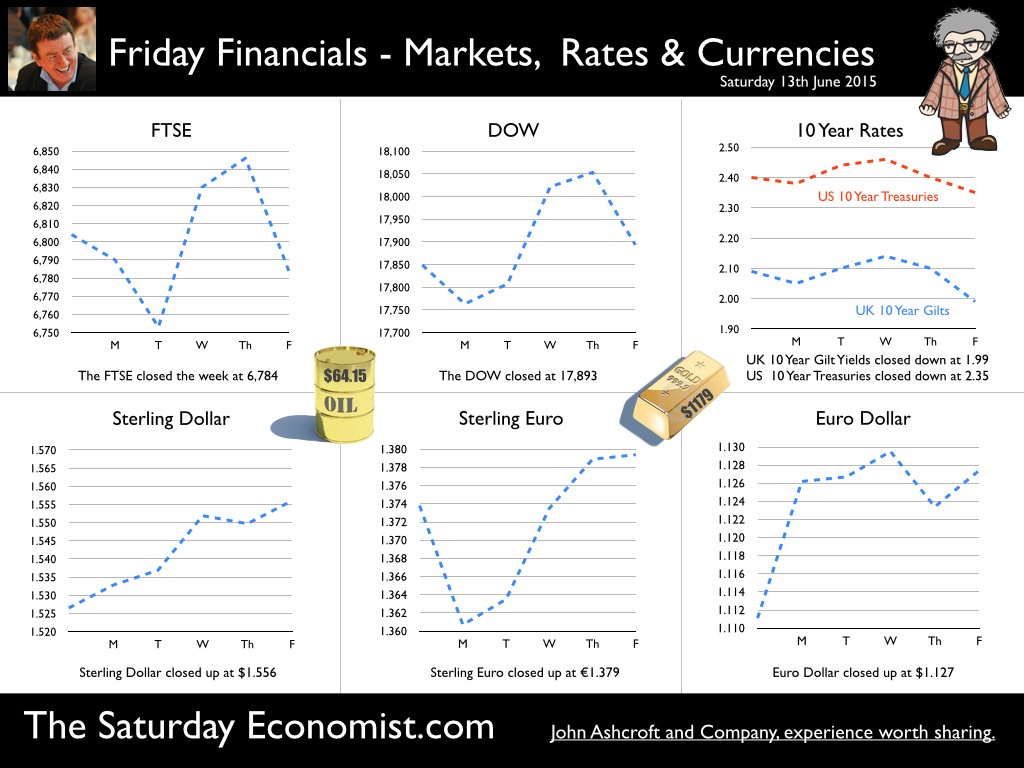

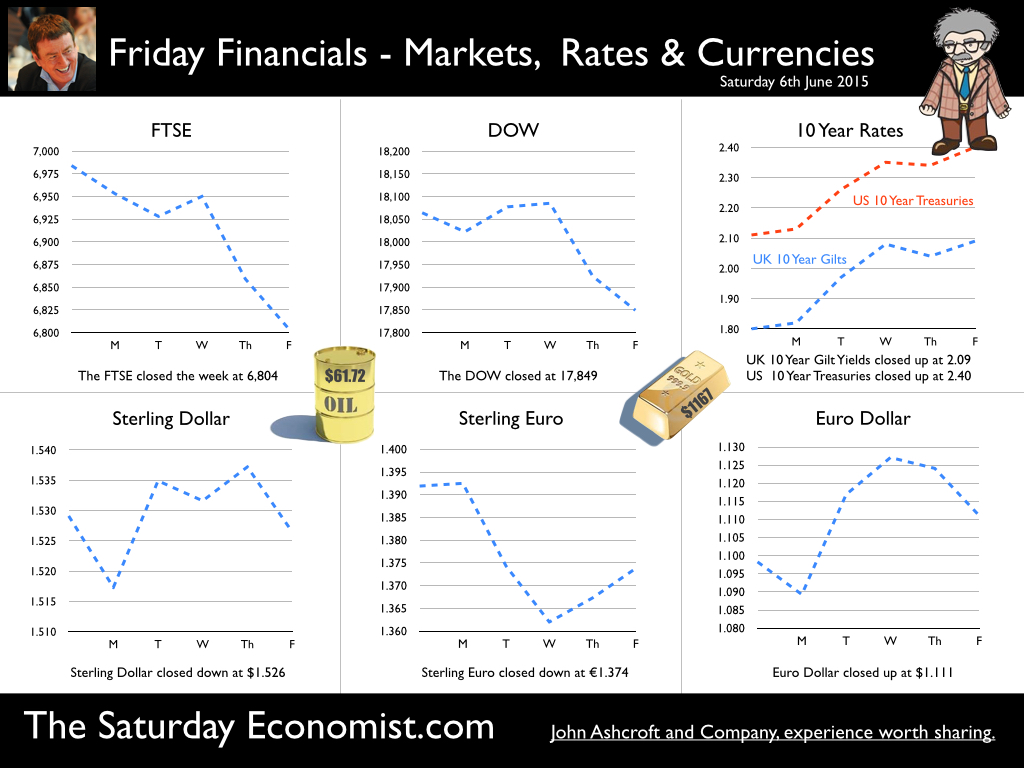

Year of the Lilies - Lilies don’t last long .. Breakfast TV this week with Steph McGovern talking about jobs and earnings. Asked about the feel good factor … this is the year of the LILIES, Low Inflation, Low Interest and Earnings Surge. For the consumer, the second half of 2015 may be the best period in this recovery cycle. “most of our people will never have it so good”. Real earnings are now over 2.5% adjusted for inflation. Between 2005 and 2007, real earnings averaged 2.5%. No wonder consumer confidence is high - unemployment is falling, wages are increasing, hence retail sales are booming. " Labour market overheating as earnings rise … It is time to realise the jobs market is signalling overheating in the economy, especially in a private service sector which is growing at 4%. The illusion of low inflation may disappear by the end of the year and into 2016. UK rates may have to rise sooner than the Bank of England would like to admit. Employment up by 424,000 in the year - self employment falls … There were 31.05 million people in work, 424,000 more than for a year earlier. The number of employees increased by 544,000. The number of self employed fell by almost 100,000. The thrill of entrepreneurship dwindles, as the lure of regular cash flow wins out! Private Service Sector jobs provide major gains … Private sector job gains were 483,000 as the public sector continues to shed jobs. Most of the job gains were in the service sector with accommodation, professional services and distribution, particular beneficiaries. Manufacturing employment increased by 76,000 (3%) compounding the UK productivity dilemma in the process. Unemployment rate 5.5% … There were 1.81 million unemployed people, 349,000 fewer than for a year earlier. The unemployment rates was 5.5%, down from 6.6% prior year. The number of people on the claimant count register fell by 16,000 in the month to 748,100 a rate of 2.3%. Over the year, 330,000 left the register, 50,000 over the last quarter. If the rate of job growth continues, Job centres will be closing in 2017. Vacancies increase … The number of vacancies in May increased to 734,000 compared to 652,000 a year earlier. Our UV ratio, the ratio of claimants to vacancies, fell to just 1.02. Earnings increase dramatically … Average earnings increased by 2.7% both including and excluding bonuses in the three months to May. Real earnings in the economy, adjusted for CPI inflation increased by over 2.6%. In the private sector, pay increased by 3.3%. Service sector pay increased by just under 3% with strong growth in business services (3%) and leisure (5%). (We define leisure as wholesale, retail, hotels, & restaurants). Manufacturing earnings moderated to 1.3% but construction earnings increased by over 5%. So what can we make of it all? … Employment is increasing, unemployment is falling. The labour market is tightening with recruitment difficulties increasing in the service sector and in construction. The latest earnings data confirms the strength of growth in the economy. We expect UK growth forecasts to be increased to almost 3% this year. On many measures the labour market has achieved levels beyond those experienced in 2007/8. Real earnings adjusted for inflation are at pre recession levels. The claimant count levels (sub 750k) are below the lows of 2008. At 2.3% the claimant count rate is below the 2008 low. Vacancies are higher than anything experienced in that year. The number of jobs in the economy has increased to 33.7 million from 32 million in 2008. The wider LFS data suggests the number of people unemployed in the economy fell to 1.8 million and a rate of 5.5%. In the two and a half years immediately prior to recession the unemployment rate averaged just 5.4%. So what of inflation … Inflation (CPI basis) rose by 0.1% in the year to May 2015, compared with a 0.1% fall last month. The largest upward pressure came from transport services, with the timing of Easter air fares, a likely factor in the movement. Service sector inflation increased to 2.3%. Goods deflation moderated slightly to -1.8%. Producer Prices … The output price index for manufactured goods fell by 1.6% in the year to May 2015. The overall price of materials and fuels bought by UK manufacturers fell 12.0% in the year to May 2015, down from a fall of 11.0% in the year to April 2015. Oil and food prices continue to dominate the low price outlook with imports of chemicals and metals assisting. So what does this mean for the rest of the year… We expect the low oil price impact to unwind by the end of the year, at a time of higher commodity prices world wide. In farming it is said the best cure for low prices is low prices and so it will prove with agriculture and food. Stronger growth, rising employment and recruitment difficulties will lead to wage increases compounding the inflation increases. We expect CPI inflation to increase to 1.2% by the end of the year and return to the 2% target (CPI basis) by the middle of 2016. So what of borrowing… on track to meet OBR target this year … The latest public sector finance figures were released by the ONS this week. Strong growth in income tax receipts reduced UK government borrowing in May to the lowest level in eight years. Public finances are benefiting from robust economic growth, stronger corporate profits, higher employment and a recovery in earnings Headline public borrowing fell to £10.1 billion in May from £12.4 billion a year earlier. For the first two months of the current financial year, public sector net borrowing was down by almost 25% compared to prior year. Income tax and national insurance receipts in May were the strongest for in four years. Total borrowing increased to £1.5 trillion (80% of GDP.) The Chancellor is exactly on track to meet the OBR target of £75.3 billion this year. With growth for the year set to be revised up, the out turn may be even better. Retail Sales Boom Continues … in the year of the Lilies! Retail sales in May 2015 increased by 4.6% compared with prior year. Food sales increased by 2.6%, textile, clothing and footwear stores increased by 4.2%, department store sales were up by 5.5% and household goods stores increased by over 12%. On line sales accounted for 12% of total values and increased by 7.4% on prior year. So what can we make of it all? For the consumer, the retail boom continues in the year of the Lilies. That’s Low Inflation, Low Interest Rates and an Earnings Surge. Last year sales volumes increased by 4.3% in the year. This year we expect a similar out turn for the year as a whole. For retailers, the thrill is muted. Higher levels of volume at lower revenue margins and internet sales reducing the take in store make life difficult for most retailers. So how long will it last? Lilies have an exotic look and a delicate nature but they are tender and must be treated with care. In the world of economics Lilies have a short life. The era of low inflation and low interest rates will draw to a close by the end of the year. Higher earnings will be offset by higher costs to come. Consumers may look back at the second half of 2015 and realise they never had it so good after all. So what of rates? Janet Yellen signaled this week, US rates are likely to rise at a gentle pace. The FOMC “Blue Dots” analysis suggest two modest US rate rises before the end of the year. The MPC minutes revealed “for two members the immediate policy decision remained finely balanced between voting to hold or raise rates.” The Fed will move, with September the favourite date. The MPC will follow, McCafferty and Weale are twitching. The UK rate move could be as early as November! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.588 from $1.556 and moved up against the Euro to €1.398 from €1.379. The Euro moved up against the Dollar to €1.135 from 1.127. Oil Price Brent Crude closed at $63.02 from $64.15. The average price in June last year was $111.80. The deflationary push continues. Our forecasts of $65 dollars Q2 look good, a $75 - $80 recovery by Q4 remains the base case. Markets, were mixed. The Dow closed up at 18,115 from 17,893 and the FTSE closed down at 6,707 from 6,784. Bond Prices were also mixed. UK Ten year gilt yields moved to 2.00 from 1.99 US Treasury yields moved to 2.26 from 2.35. Gold moved up to $1,201 ($1,179). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Labour market overheating as earnings rise .. “It is time to realise the jobs market is signalling overheating in the economy, especially in a private service sector which is growing at 4%. The illusion of low inflation may disappear by the end of the year and into 2016. UK rates may have to rise sooner than the Bank of England would like to admit.” Employment up by 424,000 in the year - self employment falls … There were 31.05 million people in work, 424,000 more than for a year earlier. The number of employees increased by 544,000. The number of self employed fell by almost 100,000. The thrill of entrepreneurship dwindles as the lure of regular cash flow wins out! Private Service Sector jobs provide major gains … Private sector job gains were 483,000 as the public sector continues to shed jobs. Most of the job gains were in the service sector with accommodation, professional services and distribution, particular beneficiaries. Manufacturing employment increased by 76,000 (3%) compounding the productivity dilemma in the process. (Manufacturing output increased by less than 2.5%.) Unemployment rate 5.5% … There were 1.81 million unemployed people, 349,000 fewer than for a year earlier. The unemployment rates was 5.5%, down from 6.6% prior year. Claimant count falls below 750,000 … The number of people on the claimant count register fell by 16,000 in the month to 748,100 a rate of 2.3%. Over the year, 330,000 left the register, 50,000 over the last quarter. Job centres will be closing in 2017, if the rate of job growth continues. Vacancies increase … The number of vacancies in May increased to 734,000 compared to 652,000 a year earlier. Our UV ratio, the ratio of claimants to vacancies, fell to just 1.02. Earnings increase dramatically … Average earnings increased by 2.7% both including and excluding bonuses in the three months to May. Real earnings in the economy, adjusted for CPI inflation increased by over 2.5%. In the private sector, pay increased by 3.3%. Public sector pay rises were subdued (0.3%). Service sector pay increased by just under 3% with strong growth in business services (3%) and leisure (5%). (We define leisure as wholesale, retail, hotels, & restaurants). Manufacturing earnings moderated to 1.3% but construction earnings increased by 5.3%. So what can we make of it all? … Employment is increasing, unemployment is falling. The labour market is tightening with recruitment difficulties increasing in the service sector and in construction. The latest earnings data confirms the strength of growth in the economy. We expect UK growth forecasts to be increased to almost 3% this year. On many measures the labour market has achieved measures beyond those experienced in 2007/8.. Real earnings adjusted for inflation are returning to pre recession levels. The claimant count levels (sub 750k) are below the highs of 2008. At 2.3% the claimant count rate is below the 2008 highs. Vacancies are higher than anything experienced in that year. The number of jobs in the economy has increased to 33.7 million from 32 million in 2008. The wider LFS data suggests the number of people unemployed in the economy fell to 1.8 million a rate of 5.5%. In the two and a half years immediately prior to recession the unemployment rate averaged just 5.4%. Summary It is time to realise the jobs market is signalling overheating in the economy, especially in a private service sector which is growing at 4%. The illusion of low inflation may disappear by the end of the year and into 2016. UK rates may have to rise sooner than the Bank of England would like to admit.  [The latest revision to construction data was released this week. Construction output increased by 4.4% in the first quarter of the year compared to a previous estimate of a slight fall year on year. I guess it’s an easy enough mistake to make. Bipolar disorder persists in the ONS with a SADD [Seasonally Adjusted Deficiency Disorder] contaminating the data. Construction growth increased by 9.5% in 2014 compared to 7.5% in prior publications. The changes in Q1 were largely to be expected. The previous numbers didn’t make sense. For some - the data revisions boost growth prospects. Our forecast for 2.8% GDP growth in 2015 remains the base case, with construction growth revised up slightly to 4.5% for the year as a whole. So what of Manufacturing … In business so to with entertainment and economics - if all the plates spinning well, it’s either the end of the act or an illusion. So it proved with the production data this week. Output in the mining and quarrying sector increased by 6.2% in April. Oil and gas extraction increased by almost 10%. There the excitement ends. Total production increased by 1.2% as manufacturing increased by just 0.2% Transport and chemicals were the highlight sectors up by 6% and 7% respectively. “Gloom around the loom” continued with textiles output down by 6% in the month and 8% in the first quarter. For the year as a whole manufacturing output is likely to increase by just over 2% compared to 3% in 2014. Ah yes the march of the makers - now moving at a funereal pace. So what of trade … The trade figures revealed a boost to exports in April. The UK deficit on trade in goods and services was estimated to have been £1.2 billion in April, compared with £3.1 billion in March. This reflects a deficit of £8.6 billion on goods, partially offset by an estimated surplus of £7.4 billion on services. Oil imports fell as chemical exports received a boost to trade. Exports to the US increased as imports from China and the EU fell. Should we get to excited about the April data? Not really! One months figures are volatile and subject to revision. When presented with information supporting an existing belief, the natural reaction is to accept new information without question. We call this "Confirmation Bias”. So too with trade data - the re balancing myth presents. [March last year looked even better.] The trend is our friend. We expect the trade in goods deficit to be £125 billion this year offset by a £90 billion trade in services surplus. Confirmation Bias? Yep - at least no one mentioned the J curve! So what of rates? Ian McCafferty [MPC] in an interview with Reuters this week, warned - the time for the Bank of England to start raising interest rates is getting closer. (Ian McCafferty voted for a rate rise late last year, suspending his call following the oil price collapse.) As the oil price effect unwinds and growth in the UK and world economy continues to pick up pace, the hawks will once again flap their wings in the MPC aviary. Capital markets are flapping on the prospects of the US rate rise. Emerging market funds have experienced strong outflows as investors realign dollar portfolios. Almost $10 billion left EM funds last week, 70% out of China according to the FT. The Russian Rouble dropped almost 10% against the dollar last month. Bond rates are rising as fixed income securities come under pressure. Robert Stheeman, the CEO of the DMO Debt Management Office warned Britain is at risk of government bond auction failure, the first since 2009. Increased financial market volatility to blame. Stheeman told Reuters in March that reduced liquidity and uncertainty about the outlook for U.S. monetary policy could lead to bigger price swings for British government bonds this year. US rates are expected to rise before the end of the year. September the favourite. The strong growth in the UK economy will continue. Once the Fed makes a move, the MPC will have to follow within a three to six months framework. McCafferty and Martin Weale will lead the call. Bond prices will fall as yields rise. So what happened to Sterling this week? Sterling moved up against the Dollar to $1.556 from $1.526 and moved up against the Euro to €1.379 from €1.364. The Euro moved up against the Dollar to €1.127 from 1.111. Oil Price Brent Crude closed at $64.15 from $61.72. The average price in June last year was $111.80. The deflationary push continues. Our forecasts of $65 dollars Q2 look good, a $75 - $80 recovery by Q4 remains the base case. Markets, moved nervously. The Dow closed up at 17,893 from 17,849 and the FTSE closed down at 6,784 from 6,804. Gilts moved down. UK Ten year gilt yields moved to 1.99 from 2.09 US Treasury yields moved to 2.35 from 2.40. Gold moved up to $1,179 ($1,197). That’s all for this week. Don’t miss The Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  IMF in US review - synchronized swimmer calls for synchronized rate rise The US economy was on the IMF agenda last week. “The Fed should defer any increase in policy rates until the first half of 2016” the plea from Christine Lagarde. The U.S economy had lost momentum in the first quarter, derailed by bad weather, a cut back in oil investment and a stronger dollar, or so it was said. The IMF expects US inflation to return to 2% target in 2017. The jobs market is returning to pre-crisis norms. The IMF forecast for growth in the US was cut to 2.5% in 2015, strange, following growth of 2.7% in the first quarter. The U.S. dollar has risen 13 percent in real terms over the past 12 months. The move a product of cyclical growth divergences, different trajectories for monetary policies and a portfolio shift toward U.S. dollar assets. Greater exchange rate and bond volatility would be more likely be minimized if the rest of the west had time to catch up with US monetary policy movements. The Fed should fore go an early rate rise, the call. It didn’t really make sense. It was more a plea from an ex synchronized swimmer making a call for a more synchronized rate rise across the world, to avoid greater bond and forex volatility. It was never likely to be taken seriously. US jobs data deafens IMF call… So it proved with the Bureau of Labour Release on Friday. Total non farm payroll employment increased by 280,000 in May, the unemployment rate was essentially unchanged at 5.5 percent. The data for the previous two months was up rated. Earnings are increasing. The major jobs gains are in the leisure service sector (yielding low productivity). Sounds familiar? Treasury bonds fell sharply as the robust jobs report supported expectations the Federal Reserve would raise interest rates later this year. The prospect of higher US borrowing costs left equity markets lower on both sides of the Atlantic. Bond markets fell as US yields increased to 2.4%. The IMF call, will fall on deaf ears. The Fed will take the early flight from Planet ZIRP. September remains the market favourite for a Fed rate rise. So what happened in the UK this week? Bank holds rates … The Monetary Policy Committee at its meeting on 3 June voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of purchased assets at £375 billion. The Bank of England now on Twitter! It’s just an RT Retweet from last month. House Price data … The Nationwide and Halifax released the latest data for May rises this week. Halifax house prices increased by 8.6% in the month compared to 8.5% in April. Commenting, Martin Ellis, Halifax housing economist, said: “The imbalance between supply and demand is likely to continue to push up house prices over the coming months”. At Nationwide, house price rises slowed to 4.6% in May compared to 5.2% in April. Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “The May data resumes the gradual downward trend in evidence since the summer of 2014. Over the longer term we would expect house price growth to converge with earnings growth, which has typically been around 4% per annum. However, much will depend on supply side developments. The rate of building activity has remained well below that required to keep up with population growth.” So what can we make of it all? At the Saturday Economist, we expect the increase in prices to continue to slow towards the end of the year averaging just over 5% by the final quarter. Averaging 4% by the final quarter of 2016. In other news … Latest Markit/CIPS UK PMI® Survey Data … Manufacturing … output increased on solid domestic demand. The UK Manufacturing PMI increased to 52.0 in May. Consumer goods sector remains main growth sector as job creation slows further. Construction … There was a slight rebound in construction output growth in May, helped by post-election bounce in new orders. The headline seasonally adjusted Markit/CIPS UK Construction Purchasing Managers’ Index® (PMI®) registered 55.9 in May, up from 54.2 in April. Services … expansion slows, but remains strong. The Business Activity Index signalled growth of services output for the twenty-ninth successive month in May, posting 56.5. So manufacturing output increases, construction orders rebound and the service sector continues the path of strong growth. Election uncertainty out of the way, on we go! Brexit next! So what of rates? Janet Yellen made it clear last week, the Fed will look through the soft data in the first quarter US rates will rise before the end of the year. September still the favourite. The strong growth in the UK economy will continue. Once the Fed makes a move, the MPC will surely follow within a three to six months framework. So what happened to Sterling this week? Sterling moved down slightly against the Dollar to $1.526 from $1.529 and moved down against the Euro to €1.364 from €1.392. The Euro moved up against the Dollar to €1.111 from 1.098. Oil Price Brent Crude closed at $61.72 from $65.64 on news of OPEC decision to maintain output. The average price in June last year was $111.80. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 remains the base case. Markets, moved down. The Dow closed down at 17,849 from 18,064 and the FTSE closed down at 6,804 from 6,984. Gilts moved up. UK Ten year gilt yields moved to 2.09 from 1.80 US Treasury yields moved to 2.40 from 2.11. Gold moved up to $1,197 ($1,189). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! Download the June Economic Outlook for the UK and World Economy released last week! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed