UK Interest Rates on hold ... No surprise this week as the MPC voted to keep rates on hold and to maintain the asset purchase facility at £375 billion. The decision to increase rates may becoming more finely balanced for some but the news from around the world, will disturb the hawks and give succour to the doves. The rate rise may well be held over into the new year, despite the continued strong performance of the domestic economy. The minutes of the MPC meeting, due later this month, may provide some insight into the overall views of the individual committee members. ECB and Rates ... problems in the East In Europe, rates were kept on hold as Draghi continues to consider QE. Action is needed but the futile process of debt monetisation will do little to offset the economies beset by weak levels of domestic demand. Complaints against the need for labour reform and excessive regulation will largely miss the point. Italy is slipping back into recession with forecasts for the current year downgraded once again to growth of just 0.2%. France will struggle to hit the 1% growth target this year and German export performance is slowing as economies are transfixed by the crisis in Ukraine. Trade sanctions and threat of war are damaging exports from Euro land to Eastern Europe and to Russia. The Euro trading block is now imperilled by it’s very “raison d’être” at inception. Growth in the Euro economies is expected to be just 1% this year with no prospect of a rate rise on the horizon until late 2015 / 2016 at the earliest. Production and Manufacturing ... In the UK, manufacturing data was surprisingly weak in the latest data for June but Euroland is not to blame. Output increased in the month by just 1.9% after strong growth of 3.6% in the first quarter and 4% in April and May. In the second quarter overall growth was up by 3.2%. The underlying data from the Markit/CIPS Manufacturing PMI® suggests strong growth continued into June and July which suggests the latest ONS data may be something of an aberration. [We are adjusting our forecast for the year to growth in manufacturing of 3.4% based on the latest data. Expectations for UK GDP growth are unchanged at 3% following revisions to our service sector forecast.] The Car Market … The SMMT reported strong car sales in July, with new registrations up by 6% in the month and 10% in the year to date. Output increased by 3.5% over the year. The car market is on track to sell 2.45 million units this year. That’s actually higher than the levels achieved in 2007. Assuming output hits the 1.55 million mark, the deficit (trade in cars) will increase to almost 900,000 units. Car manufacturing is benefitting from the recovery in consumer confidence and household spending but the trade deficit will increase as a result of the strength of domestic demand and limitations to domestic capacity. The UK cannot enjoy a period as the strongest growth economy in the Western world without a significant deterioration in the trade balance. Deficit trade in goods and services … And so it continued to prove with the latest trade data. The deficit trade in goods increased slightly in the month of June to £9.5 billion offset by a £7 billion surplus in services. For the second quarter, the deficit was £27.4 billion (trade in goods) and just under £7 billion overall, goods and services. The service sector surplus was £20.5 billion. For the year as a whole, we expect the goods deficit to be £112.3 billion offset by an £80 billion plus serve sector surplus. No threat to the recovery but we still have concerns about the current account deterioration and the drop in overseas investment income. In the first six months of the year, exports of goods have fallen by almost 8% in value and imports have fallen by 4.6%. World trade growth has been subdued in the first six months of the year yet UK domestic demand increased by 3%. Sterling appreciation against the dollar has lead to a translation impact on the trade balance rather than an elasticity effect. Construction and housing ... The latest adjustment for construction data confirms the recovery continues driven by a huge increase in new housing. Total output increased by 5.3% in June, up by 4.8% in Q2 2014 compared to Q2 last year. The total value of new work in the month increased by 5.8% with the volume of new housing increasing by 18% compared to June last year. House Prices ... The increase in housing supply is doing little to assuage the demand for house moves and house prices. Halifax and Nationwide reported prices up by 10% in July. Our transaction model is simple. Activity is a function of house prices and the real cost of borrowing. With mortgages fixed at 4%, the double digit capital appreciation is irresistible to the basic mechanics of a free market. The real cost of borrowing is negative 6%. Demand for housing will continue to out strip supply, despite the regulatory adjustments to the mortgage market. So what happened to sterling this week? Sterling closed down against the dollar at $1.6774 from $1.682 and unchanged against the Euro at 1.252. The Euro was largely unchanged against the dollar at 1.341. Oil Price Brent Crude closed up slightly at $105.02 from 104.84. The average price in August last year was $111.28. Markets, closed mixed. The Dow closed up 61 points at 16,554 from 16,493 and the FTSE closed down 112 points at 6,567 from 6,679. UK Ten year gilt yields were down at 2.46 from 2.557and US Treasury yields closed at 2.42 from 2.49. Gold was up at $1,305 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

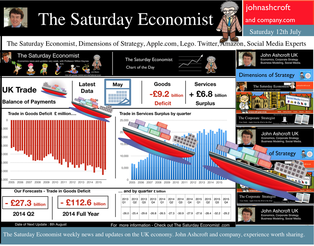

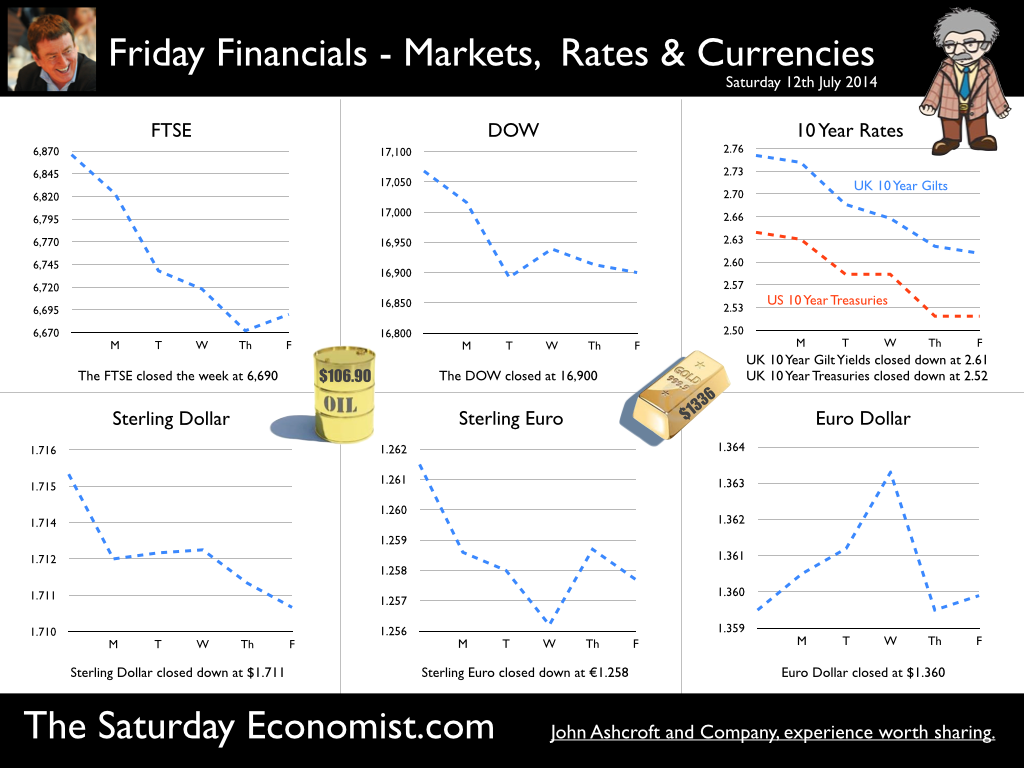

Is the recovery weakening ? A raft of economics news had the sub editors reaching for the panic button this week. “UK recovery hopes hit by new blow as trade deficit widens” The Evening Standard, yesterday. “Construction setback casts doubt on recovery”, The Times Business News, today. “Shock fall in output hits the pound”, the headline in The Times mid week. Should we be worried about the recovery? Not really! Recent Markit PMI™ survey data confirmed the strength of activity in services, manufacturing and construction into June. The NIESR GDP tracker suggests the UK economy grew at a rate of over 3% in the second quarter. Our own Manchester Index™, suggests growth may have weakened but only slightly, still around the 3% level. The preliminary estimate of GDP for Q2 is due out on the 25th July. Not long to wait for the next edition of the National Accounts. It’s like waiting for the next chapter in a Harry Potter novel. Can’t wait! Trade Deficit increased slightly … The trade deficit deteriorated slightly in May. The increasing trade deficit is a measure of the strength of the recovery not the weakness. For those who were expecting a recovery led by exports, re balancing trade, the data may come as something of a disappointment. For readers of The Saturday Economist it will come as no surprise. The trade in goods deficit increased to -£9.2 billion in May compared to -£8.8 billion in April. Our forecast for the quarter is a deficit of £27.3 billion and a full year deficit of £112.5 billion. The service sector surplus in the month was £6.8 billion unchanged from April. We expect a quarter surplus of £21 billion and a full year contribution of £81 billion. Overall the monthly deficit, goods and services was -£2.4 billion. We expect a full year deficit of - £31.6 billion. That’s approximately 2% of GDP. Disappointing, perhaps but no real surprise to readers of the Saturday Economist. The trade deficit is increasing, that’s a measure of the strength of the recovery as we have long pointed out. The service sector weakness, reflects the translation effect of a stronger pound rather than any price elasticity response. A strong recovery and a strong pound, the deficit will only deteriorate … Manufacturing output … Manufacturing output increased by 3.7% in May. The strong growth in investment (capital) goods continued (4.5%) as consumer durable output slowed to 2.7%. Our forecasts for the year remain unchanged, we anticipate growth of 4.2% for manufacturing output in 2014 and 3.9% in 2015. No change to our GDP forecasts for the year. Construction Figures … The construction figures for May were a little disappointing. After strong growth in the first quarter (6.8%), growth slowed to 3.4% in May. Our estimate of growth in the second quarter is lowered to 4% as a result. For the moment we make no change to our revisions for the full year. The monthly data is “dynamic” and subject to revision. Time to wait and see, if the revisions and seasonal adjustments yet to come, will change the outlook for the full year. Housing Market The latest data from Halifax HPI confirmed strong growth in the housing market continued. House prices were 8.8% higher in the three months to June compared to the same three months last year. Commenting, Stephen Noakes, Mortgages Director, said: "Housing demand continues to be supported by an economic recovery that is gathering pace, with employment levels growing and consumer confidence rising” The LSL Acadata price index for June was also released this week. The annual price rise was 9.6% with some evidence the volume of transactions is slowing. Opinion remains divided as to whether the new MMR are making an impact, or there is a shift in purchasers’ attitudes to market. Despite the new lending rules, we expect a significant increase in the volume of transactions this year, with the level of mortgage activity up 30% to date. Don’t miss our Housing Market update - due out next week. So what happened to sterling this week? Sterling closed down against the dollar at $1.711 from $1.715 and down against the Euro to 1.258 from (1.261). The Euro was unchanged against the dollar at 1.360. Oil Price Brent Crude closed down at $106.90 from $110.66. The average price in July last year was $102.92. Markets, closed down. The Dow closed below the 17,000 level at 16,900 from 17,068 and the FTSE was down at 6,690 from 6,866. The move to 7,000 too much for the moment. UK Ten year gilt yields were down at2.61 from 2.75and US Treasury yields closed at 2.52 from 2.64. Gold was up at $1,336 from $1,320. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed