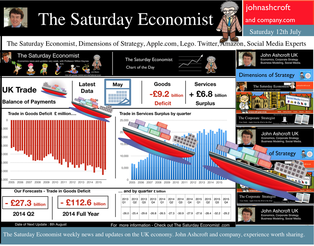

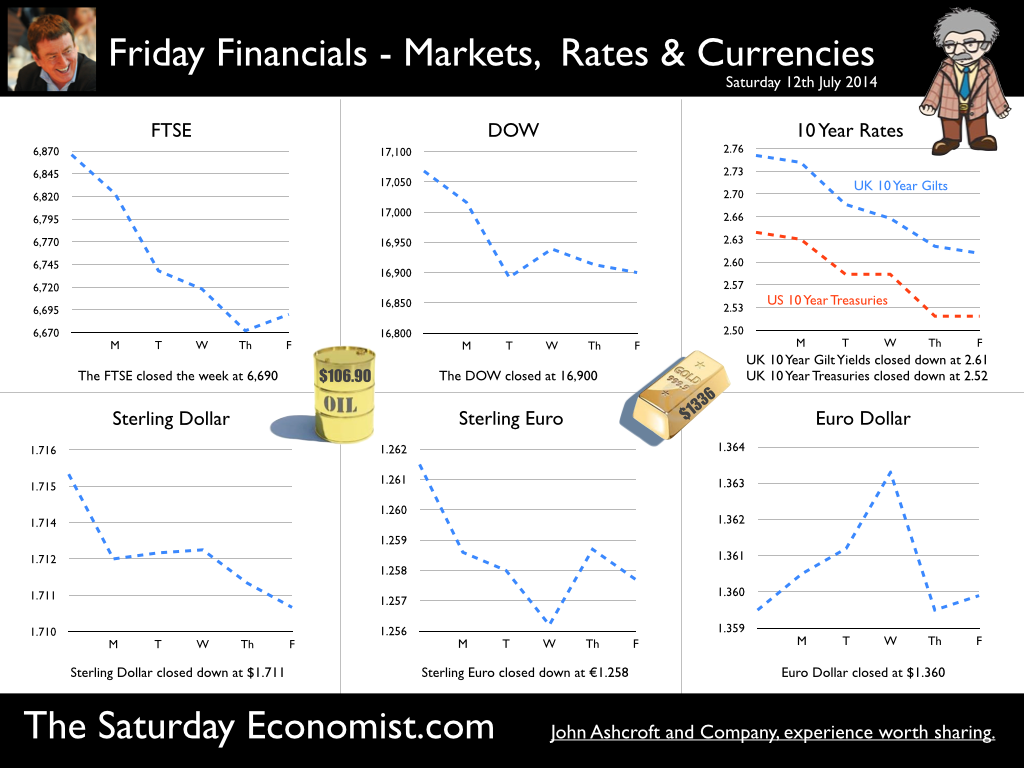

Is the recovery weakening ? A raft of economics news had the sub editors reaching for the panic button this week. “UK recovery hopes hit by new blow as trade deficit widens” The Evening Standard, yesterday. “Construction setback casts doubt on recovery”, The Times Business News, today. “Shock fall in output hits the pound”, the headline in The Times mid week. Should we be worried about the recovery? Not really! Recent Markit PMI™ survey data confirmed the strength of activity in services, manufacturing and construction into June. The NIESR GDP tracker suggests the UK economy grew at a rate of over 3% in the second quarter. Our own Manchester Index™, suggests growth may have weakened but only slightly, still around the 3% level. The preliminary estimate of GDP for Q2 is due out on the 25th July. Not long to wait for the next edition of the National Accounts. It’s like waiting for the next chapter in a Harry Potter novel. Can’t wait! Trade Deficit increased slightly … The trade deficit deteriorated slightly in May. The increasing trade deficit is a measure of the strength of the recovery not the weakness. For those who were expecting a recovery led by exports, re balancing trade, the data may come as something of a disappointment. For readers of The Saturday Economist it will come as no surprise. The trade in goods deficit increased to -£9.2 billion in May compared to -£8.8 billion in April. Our forecast for the quarter is a deficit of £27.3 billion and a full year deficit of £112.5 billion. The service sector surplus in the month was £6.8 billion unchanged from April. We expect a quarter surplus of £21 billion and a full year contribution of £81 billion. Overall the monthly deficit, goods and services was -£2.4 billion. We expect a full year deficit of - £31.6 billion. That’s approximately 2% of GDP. Disappointing, perhaps but no real surprise to readers of the Saturday Economist. The trade deficit is increasing, that’s a measure of the strength of the recovery as we have long pointed out. The service sector weakness, reflects the translation effect of a stronger pound rather than any price elasticity response. A strong recovery and a strong pound, the deficit will only deteriorate … Manufacturing output … Manufacturing output increased by 3.7% in May. The strong growth in investment (capital) goods continued (4.5%) as consumer durable output slowed to 2.7%. Our forecasts for the year remain unchanged, we anticipate growth of 4.2% for manufacturing output in 2014 and 3.9% in 2015. No change to our GDP forecasts for the year. Construction Figures … The construction figures for May were a little disappointing. After strong growth in the first quarter (6.8%), growth slowed to 3.4% in May. Our estimate of growth in the second quarter is lowered to 4% as a result. For the moment we make no change to our revisions for the full year. The monthly data is “dynamic” and subject to revision. Time to wait and see, if the revisions and seasonal adjustments yet to come, will change the outlook for the full year. Housing Market The latest data from Halifax HPI confirmed strong growth in the housing market continued. House prices were 8.8% higher in the three months to June compared to the same three months last year. Commenting, Stephen Noakes, Mortgages Director, said: "Housing demand continues to be supported by an economic recovery that is gathering pace, with employment levels growing and consumer confidence rising” The LSL Acadata price index for June was also released this week. The annual price rise was 9.6% with some evidence the volume of transactions is slowing. Opinion remains divided as to whether the new MMR are making an impact, or there is a shift in purchasers’ attitudes to market. Despite the new lending rules, we expect a significant increase in the volume of transactions this year, with the level of mortgage activity up 30% to date. Don’t miss our Housing Market update - due out next week. So what happened to sterling this week? Sterling closed down against the dollar at $1.711 from $1.715 and down against the Euro to 1.258 from (1.261). The Euro was unchanged against the dollar at 1.360. Oil Price Brent Crude closed down at $106.90 from $110.66. The average price in July last year was $102.92. Markets, closed down. The Dow closed below the 17,000 level at 16,900 from 17,068 and the FTSE was down at 6,690 from 6,866. The move to 7,000 too much for the moment. UK Ten year gilt yields were down at2.61 from 2.75and US Treasury yields closed at 2.52 from 2.64. Gold was up at $1,336 from $1,320. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed