UK Interest Rates on hold ... No surprise this week as the MPC voted to keep rates on hold and to maintain the asset purchase facility at £375 billion. The decision to increase rates may becoming more finely balanced for some but the news from around the world, will disturb the hawks and give succour to the doves. The rate rise may well be held over into the new year, despite the continued strong performance of the domestic economy. The minutes of the MPC meeting, due later this month, may provide some insight into the overall views of the individual committee members. ECB and Rates ... problems in the East In Europe, rates were kept on hold as Draghi continues to consider QE. Action is needed but the futile process of debt monetisation will do little to offset the economies beset by weak levels of domestic demand. Complaints against the need for labour reform and excessive regulation will largely miss the point. Italy is slipping back into recession with forecasts for the current year downgraded once again to growth of just 0.2%. France will struggle to hit the 1% growth target this year and German export performance is slowing as economies are transfixed by the crisis in Ukraine. Trade sanctions and threat of war are damaging exports from Euro land to Eastern Europe and to Russia. The Euro trading block is now imperilled by it’s very “raison d’être” at inception. Growth in the Euro economies is expected to be just 1% this year with no prospect of a rate rise on the horizon until late 2015 / 2016 at the earliest. Production and Manufacturing ... In the UK, manufacturing data was surprisingly weak in the latest data for June but Euroland is not to blame. Output increased in the month by just 1.9% after strong growth of 3.6% in the first quarter and 4% in April and May. In the second quarter overall growth was up by 3.2%. The underlying data from the Markit/CIPS Manufacturing PMI® suggests strong growth continued into June and July which suggests the latest ONS data may be something of an aberration. [We are adjusting our forecast for the year to growth in manufacturing of 3.4% based on the latest data. Expectations for UK GDP growth are unchanged at 3% following revisions to our service sector forecast.] The Car Market … The SMMT reported strong car sales in July, with new registrations up by 6% in the month and 10% in the year to date. Output increased by 3.5% over the year. The car market is on track to sell 2.45 million units this year. That’s actually higher than the levels achieved in 2007. Assuming output hits the 1.55 million mark, the deficit (trade in cars) will increase to almost 900,000 units. Car manufacturing is benefitting from the recovery in consumer confidence and household spending but the trade deficit will increase as a result of the strength of domestic demand and limitations to domestic capacity. The UK cannot enjoy a period as the strongest growth economy in the Western world without a significant deterioration in the trade balance. Deficit trade in goods and services … And so it continued to prove with the latest trade data. The deficit trade in goods increased slightly in the month of June to £9.5 billion offset by a £7 billion surplus in services. For the second quarter, the deficit was £27.4 billion (trade in goods) and just under £7 billion overall, goods and services. The service sector surplus was £20.5 billion. For the year as a whole, we expect the goods deficit to be £112.3 billion offset by an £80 billion plus serve sector surplus. No threat to the recovery but we still have concerns about the current account deterioration and the drop in overseas investment income. In the first six months of the year, exports of goods have fallen by almost 8% in value and imports have fallen by 4.6%. World trade growth has been subdued in the first six months of the year yet UK domestic demand increased by 3%. Sterling appreciation against the dollar has lead to a translation impact on the trade balance rather than an elasticity effect. Construction and housing ... The latest adjustment for construction data confirms the recovery continues driven by a huge increase in new housing. Total output increased by 5.3% in June, up by 4.8% in Q2 2014 compared to Q2 last year. The total value of new work in the month increased by 5.8% with the volume of new housing increasing by 18% compared to June last year. House Prices ... The increase in housing supply is doing little to assuage the demand for house moves and house prices. Halifax and Nationwide reported prices up by 10% in July. Our transaction model is simple. Activity is a function of house prices and the real cost of borrowing. With mortgages fixed at 4%, the double digit capital appreciation is irresistible to the basic mechanics of a free market. The real cost of borrowing is negative 6%. Demand for housing will continue to out strip supply, despite the regulatory adjustments to the mortgage market. So what happened to sterling this week? Sterling closed down against the dollar at $1.6774 from $1.682 and unchanged against the Euro at 1.252. The Euro was largely unchanged against the dollar at 1.341. Oil Price Brent Crude closed up slightly at $105.02 from 104.84. The average price in August last year was $111.28. Markets, closed mixed. The Dow closed up 61 points at 16,554 from 16,493 and the FTSE closed down 112 points at 6,567 from 6,679. UK Ten year gilt yields were down at 2.46 from 2.557and US Treasury yields closed at 2.42 from 2.49. Gold was up at $1,305 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

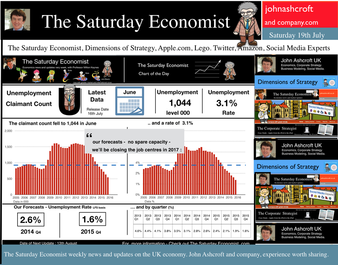

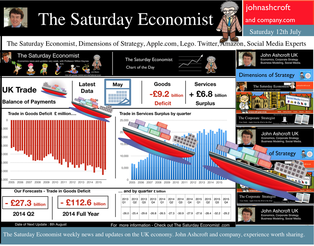

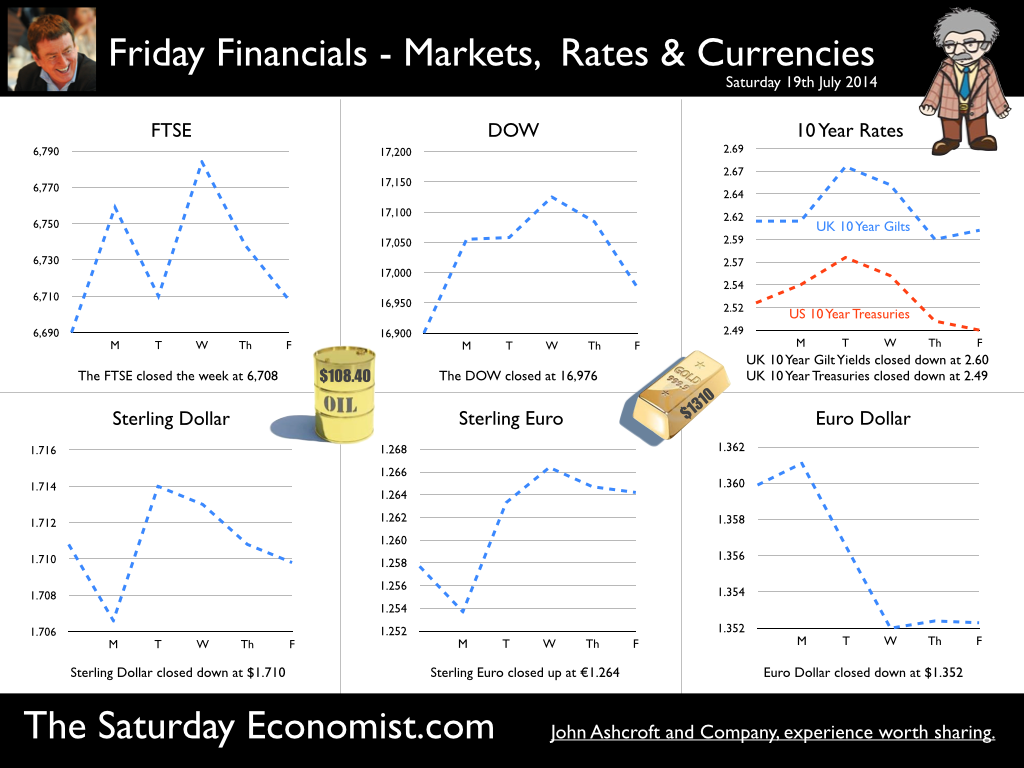

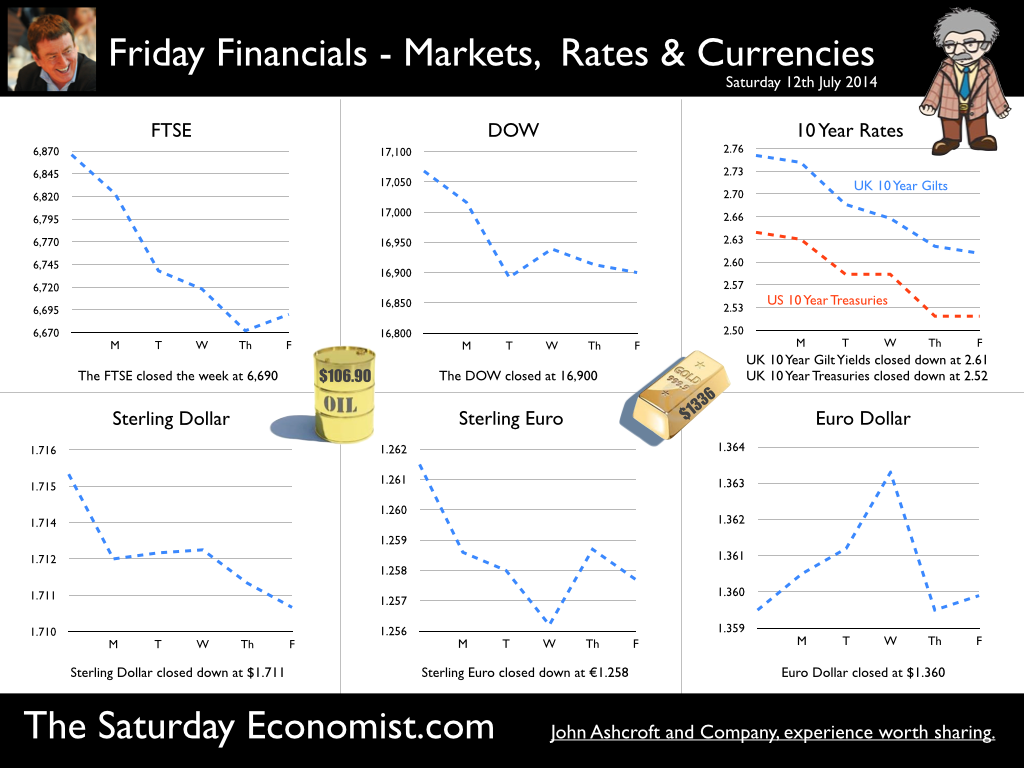

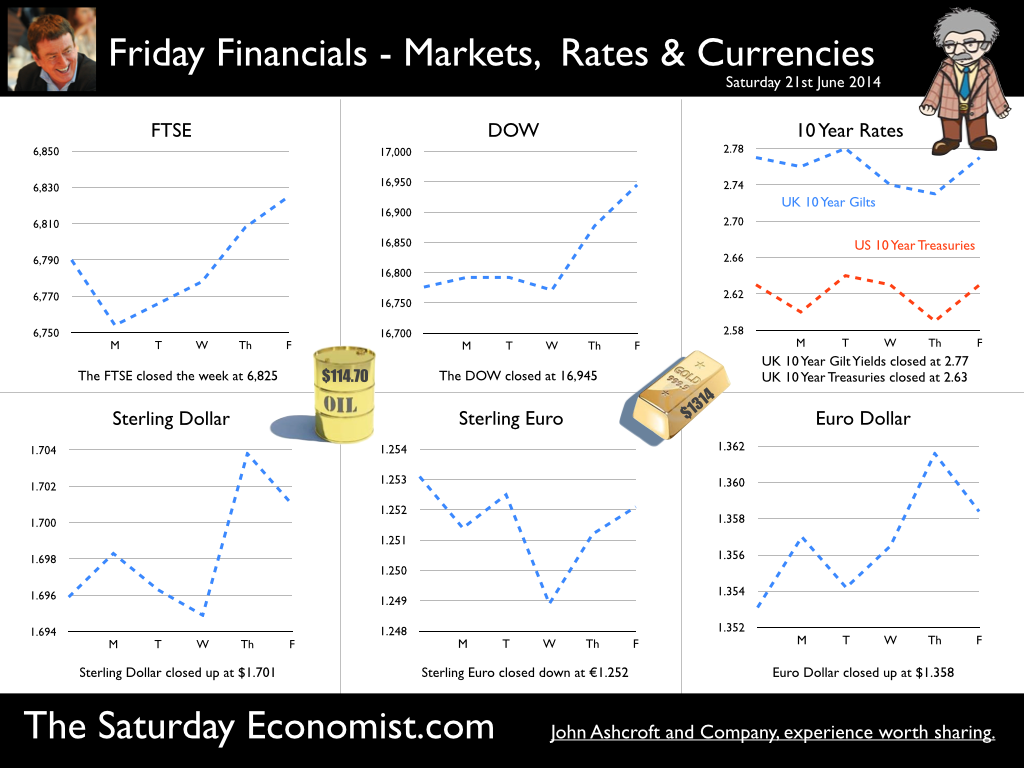

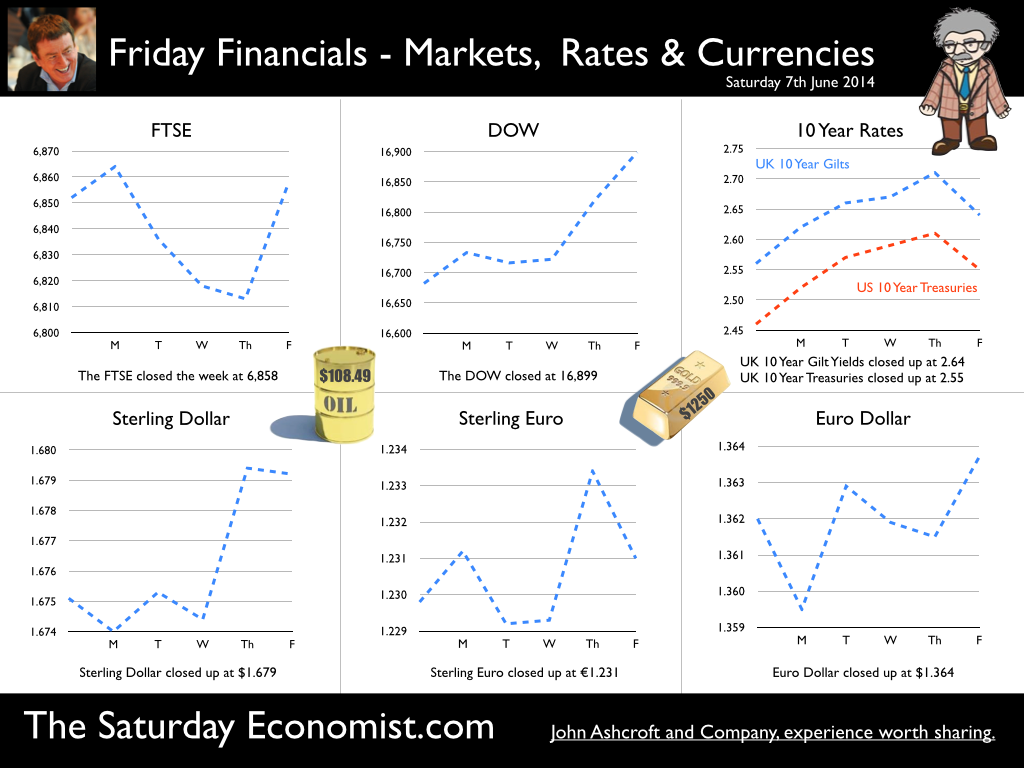

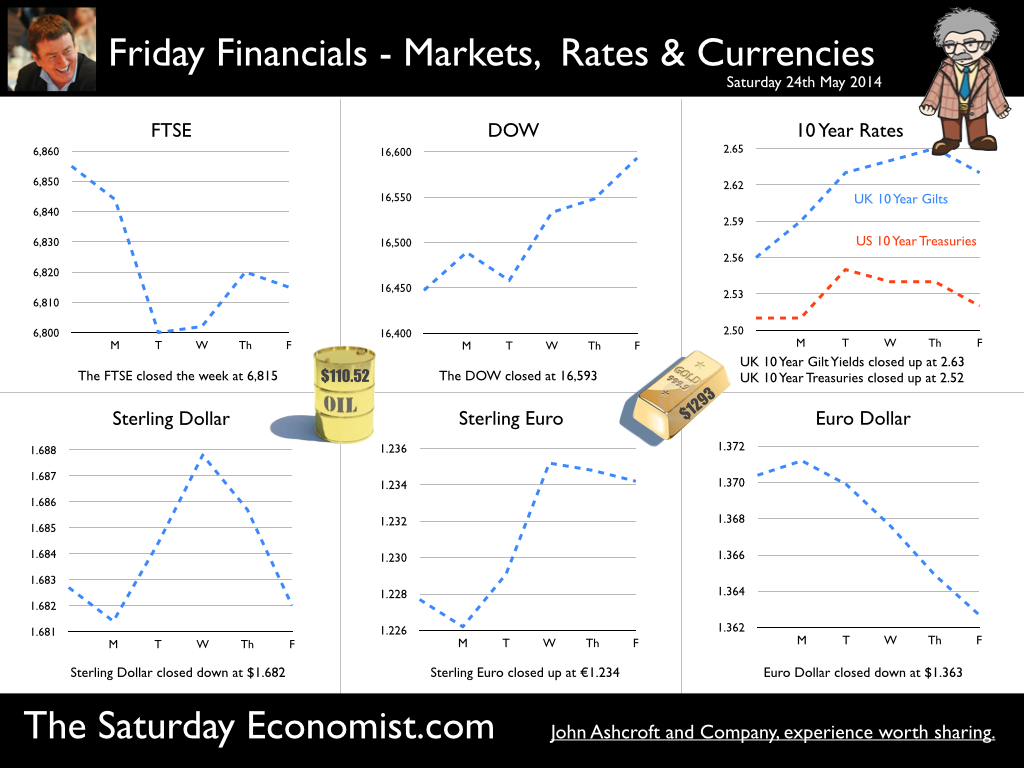

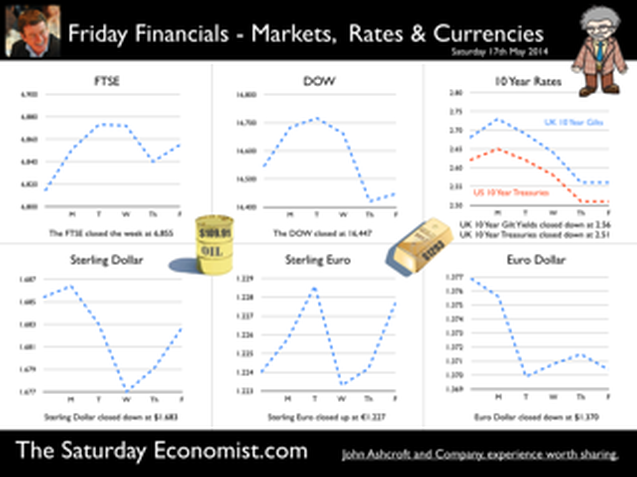

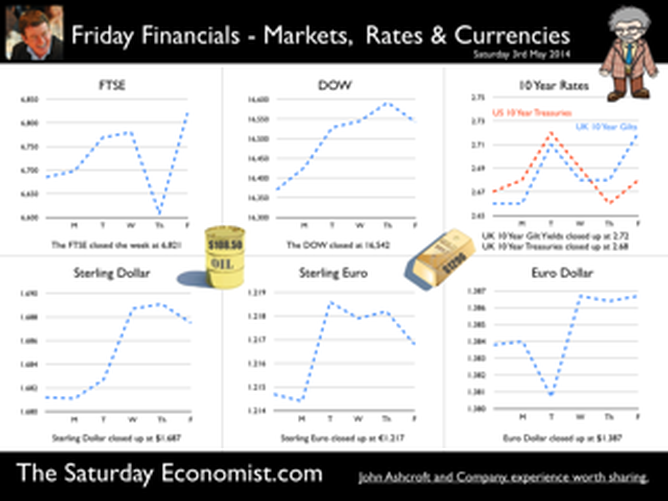

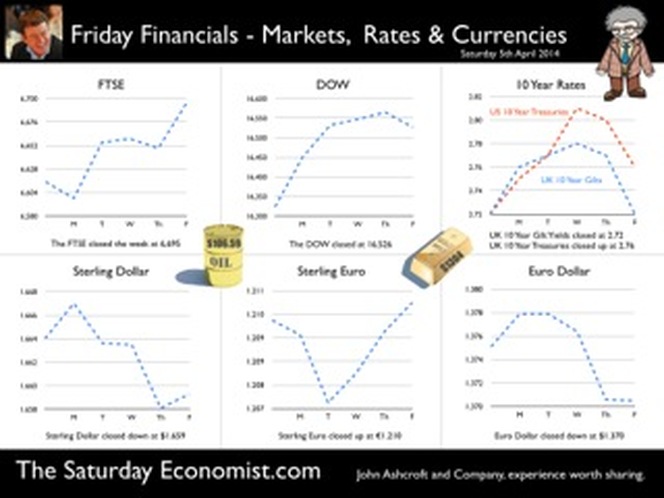

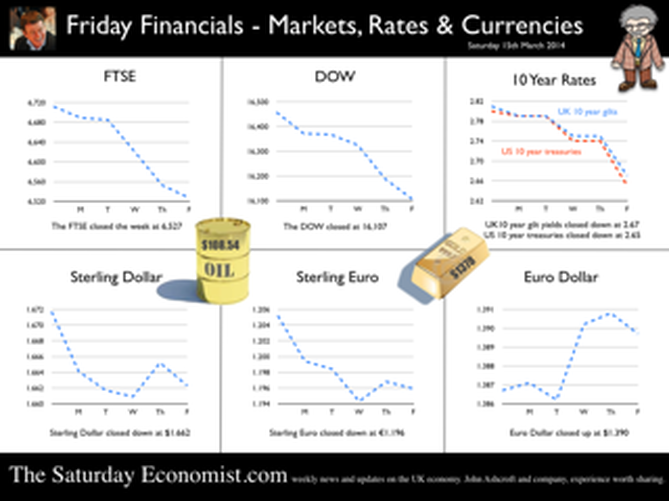

Of inflation and unemployment? Job centers will be closing in 2017 … This week the ONS released latest data on inflation and unemployment. The rate of employment growth is such, job centers will be closing in 2017, if current trends hold. Unemployment falls … Unemployment fell to 3.1% in June, (claimant count basis) and to 6.5% in the three months to May (LFS basis). The number of unemployed in June was 1.04 million. The rate of job creation has surprised not just our models but those of the Bank of England. Spare capacity will be eliminated within the next three months. Claimant count levels will be back at pre recession levels within six months and job centres will be closing by 2017 - no-one will be looking for work. Is this realistic? Probably not! Earnings remain at unrealistic levels if we accept the official data (sub 1%). The level of recorded earnings does not correlate with job levels. Neither does it sit well with evidence of household spending on car sales, retail sales and trends in the housing market. Our evidence on recruitment and skills shortages also infers that earnings should be on the increase. It is a strange world on Planet ZIRP! As for the so-called Productivity Paradox, do we really believe our businesses are taking on more and more people to do less and less work - of course not. The economy is in danger of overheating based on job trends. Productivity absorption will improve as output increases but this will not really ameliorate the inflation impact! So what of inflation in June? Inflation rises … Inflation CPI basis increased to 1.9% in June from 1.5% in May. Service sector inflation increased to 2.5% and goods inflation also increased to 0.9%. The largest contributions to rising prices came from clothing, food, drinks and transport. We expect inflation to hover above the 2% level for the rest of the year assuming sterling tracks $1.75. Manufacturing prices, increased by just 0.2% in the twelve months to June, slightly down from the prior month. Low world prices and higher sterling dollar values are easing the pressure on input costs. Metals, materials, parts and chemicals are all down in price, import cost basis. Housing Market … So what of the housing market this week? The Council of Mortgage Lenders released the latest gross lending figures for June. “The pace of lending slowed” according to the headlines. Commenting on market conditions in this month’s Market Commentary, CML chief economist Bob Pannell observes: "The macro-prudential interventions announced by the Financial Policy Committee in late June are finely calibrated and precautionary, but could nevertheless reinforce April’s Mortgage Market Review in tipping the UK towards a more conservative lending environment.” Yeah, thanks Bob. Lending was up by 20% in the first quarter, that’s an increase of almost 30% for the first six months of the year. Despite the interventions of the FPC we expect the volume of activity to increase by 25% this year and by a further 15% in 2015. Even then, activity will still be some 20% below pre recession levels. A great recovery but no real threat to the economic outlook over the medium term either. So what of interest rates … The Saturday Economist™ Overheating Index™, ticked higher this week as a result of the inflation and jobs update. Our overall growth outlook is unchanged but the chances of a rate rise before the end of the year ticked higher in line with the index. So what happened to sterling this week? Sterling closed down against the dollar at $1.709 from $1.711 but up against the Euro to 1.263 from (1.258). The Euro moved down against the dollar at 1.352 from 1.360. Oil Price Brent Crude closed up at $108.40 from 106.90 from. The average price in July last year was $102.92. Markets, closed up. The Dow closed above the 17,000 level at 17,100 from 16,900 and the FTSE was up at 6,749 from 6,690. UK Ten year gilt yields were down at 2.60 from 2.61 and US Treasury yields closed at 2.49 from 2.52. Gold was down at $1,310 from $1,336. That’s all for this week. Join the mailing list for The Saturday Economist™ or forward to a friend. John © 2014 The Saturday Economist™ by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Is the recovery weakening ? A raft of economics news had the sub editors reaching for the panic button this week. “UK recovery hopes hit by new blow as trade deficit widens” The Evening Standard, yesterday. “Construction setback casts doubt on recovery”, The Times Business News, today. “Shock fall in output hits the pound”, the headline in The Times mid week. Should we be worried about the recovery? Not really! Recent Markit PMI™ survey data confirmed the strength of activity in services, manufacturing and construction into June. The NIESR GDP tracker suggests the UK economy grew at a rate of over 3% in the second quarter. Our own Manchester Index™, suggests growth may have weakened but only slightly, still around the 3% level. The preliminary estimate of GDP for Q2 is due out on the 25th July. Not long to wait for the next edition of the National Accounts. It’s like waiting for the next chapter in a Harry Potter novel. Can’t wait! Trade Deficit increased slightly … The trade deficit deteriorated slightly in May. The increasing trade deficit is a measure of the strength of the recovery not the weakness. For those who were expecting a recovery led by exports, re balancing trade, the data may come as something of a disappointment. For readers of The Saturday Economist it will come as no surprise. The trade in goods deficit increased to -£9.2 billion in May compared to -£8.8 billion in April. Our forecast for the quarter is a deficit of £27.3 billion and a full year deficit of £112.5 billion. The service sector surplus in the month was £6.8 billion unchanged from April. We expect a quarter surplus of £21 billion and a full year contribution of £81 billion. Overall the monthly deficit, goods and services was -£2.4 billion. We expect a full year deficit of - £31.6 billion. That’s approximately 2% of GDP. Disappointing, perhaps but no real surprise to readers of the Saturday Economist. The trade deficit is increasing, that’s a measure of the strength of the recovery as we have long pointed out. The service sector weakness, reflects the translation effect of a stronger pound rather than any price elasticity response. A strong recovery and a strong pound, the deficit will only deteriorate … Manufacturing output … Manufacturing output increased by 3.7% in May. The strong growth in investment (capital) goods continued (4.5%) as consumer durable output slowed to 2.7%. Our forecasts for the year remain unchanged, we anticipate growth of 4.2% for manufacturing output in 2014 and 3.9% in 2015. No change to our GDP forecasts for the year. Construction Figures … The construction figures for May were a little disappointing. After strong growth in the first quarter (6.8%), growth slowed to 3.4% in May. Our estimate of growth in the second quarter is lowered to 4% as a result. For the moment we make no change to our revisions for the full year. The monthly data is “dynamic” and subject to revision. Time to wait and see, if the revisions and seasonal adjustments yet to come, will change the outlook for the full year. Housing Market The latest data from Halifax HPI confirmed strong growth in the housing market continued. House prices were 8.8% higher in the three months to June compared to the same three months last year. Commenting, Stephen Noakes, Mortgages Director, said: "Housing demand continues to be supported by an economic recovery that is gathering pace, with employment levels growing and consumer confidence rising” The LSL Acadata price index for June was also released this week. The annual price rise was 9.6% with some evidence the volume of transactions is slowing. Opinion remains divided as to whether the new MMR are making an impact, or there is a shift in purchasers’ attitudes to market. Despite the new lending rules, we expect a significant increase in the volume of transactions this year, with the level of mortgage activity up 30% to date. Don’t miss our Housing Market update - due out next week. So what happened to sterling this week? Sterling closed down against the dollar at $1.711 from $1.715 and down against the Euro to 1.258 from (1.261). The Euro was unchanged against the dollar at 1.360. Oil Price Brent Crude closed down at $106.90 from $110.66. The average price in July last year was $102.92. Markets, closed down. The Dow closed below the 17,000 level at 16,900 from 17,068 and the FTSE was down at 6,690 from 6,866. The move to 7,000 too much for the moment. UK Ten year gilt yields were down at2.61 from 2.75and US Treasury yields closed at 2.52 from 2.64. Gold was up at $1,336 from $1,320. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Manchester Index™ confirms the UK recovery is on track with growth continuing around 3% into the second quarter of the year. The index fell slightly to 33.6 from 35.1, still much higher than pre recession levels. The preliminary results from the GM Chamber of Commerce QES data were available this week. The survey suggests strong growth in manufacturing continues, with slightly more moderate growth in the service sector. The results are in line with our forecasts for the full year - available in the June Economic Outlook. The full results and presentation on the influential Chamber of Commerce QES survey for Q2 will be available on the 4th July. Don’t miss that! Public Sector Finances off track … The strong performance in the economy is slightly at odds with the Public Sector Finances for May, released this week. The UK economy is expanding by just over 3% in the first half of the year. We would expect an improvement in borrowing given the strength of the recovery. Two months into the year and borrowing is off track compared to last year and to plan. In the first two months of the year, total borrowing was up at £24.2 billion compared to £23.2 billion prior year. Strong VAT revenues contributed to a 9% growth in total receipts but expenditure increased by almost 6%, despite a fall in interest payments. Last year’s borrowing figure has been revised to £107.0 billion for the financial year. Good news for the Chancellor but revenues will have to improve and expenditure will have to be contained, if this year’s OBR forecast is to be met. Strong Retail sales in May … Strong retail sales are contributing to the VAT receipts. In May retail sales volumes were up 3.9% compared to last year. This is down on April’s staggering 6.5% growth but we still expect growth of 4.6% in the current quarter and 4.3% for the year as a whole. Internet sales were up by 15%, now accounting for 11.4% of all activity. The online disruption continues. Sales values were up by just 3.2%, contributing to deflation and retail concerns in the High Street. Inflation slows in May … And so it was with the inflation figures. Inflation CPI basis slowed to 1.5% in May, down from 1.8% in April. Service sector inflation was 2.2% and goods inflation held at 0.9%. Falls in transport service costs, notably air fares, provided the largest contribution to the decrease in the rate. Other large downward effects came from food, drinks and clothing. The fall came as something of a surprise, we still expect inflation to track near target (2%) for the year as a whole. Producer Prices no pressure on inflation … No pressure on inflation is evident in the producer price information, released this week. Output prices in May increased by just 0.5% as input costs fell by 5%. Import prices of fuel, oil, food, metals, chemicals, parts, equipment and materials the real story. It is a story of weak international growth in GDP and trade, with slow growth in commodity prices, assisted by the strength of sterling, closing the week above the critical $1.70 level. Monetary Policy and Minutes of the MPC ... So why is Sterling so strong? Statements from Governor Carney that rates may rise “sooner than markets expect" are contrasting with the “Business as Usual” stance from the Federal Reserve. The Fed reduced the forecast GDP 2014 outlook for the US economy to just 2.2% from 3% earlier. Tapering is set to continue but guidelines suggest interest rates will not rise until the second quarter of next year. In the UK, we expect rates to rise in the final quarter of the year. Inflation and earnings suggest that strong growth of itself will not precipitate the rise. The Sterling genie is removing the $1.70 stopper. Who speaks for Sterling? We asked in March last year as the pound headed to the $1.50 level. Sterling look set to test $1.74 in the months ahead unless rate fears are calmed. So what happened to sterling this week? The pound closed up against the dollar pushing through resistance at the $1.70 level. Sterling closed up at $1.7010 from $1.696, steady against the Euro at 1.252 (1.253). The Euro strengthened against the dollar at 1.358 from 1.353. Oil Price Brent Crude closed up at $114.70 from $113.07 on Middle East concerns. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed up. The Dow closed down at 16,945 from 16,776 and the FTSE was also up at 6,825 from 6,790. UK Ten year gilt yields held at 2.77 and US Treasury yields closed at 2.63 from 2.77 on interest rate trends. Gold moved higher on geo political fears at $1,314 from $1,274. That’s all for this week. Visit the revamped web site. Download our Quarterly Forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. About the Manchester Index™ … The Greater Manchester economy correlates highly with trends in the national economy. The Manchester Index® is an early indicator of trends in both the Manchester and the UK economy. The index is derived from the GM Quarterly Economics Survey which forms part of the British Chambers of Commerce National Survey. Greater Manchester is the largest contributor to this important business survey. We poll 5000 businesses every quarter. As the principal national business survey and the first to be published in each quarter, the results are closely monitored by HM Treasury and the Bank of England Monetary Committee. The GM survey data has a high correlation with the national data. In other key indicators, the unemployment claimant count for example, has a high correlation (over 99%) with the national data set. Our business investment tracker utilises data from capacity and investment intentions to forecast investment in the UK economy. We lag capacity by four quarters and investment intentions by two quarters to model spending.  The MPC left rates on hold this week. We will have to wait a few weeks to find out if the vote was unanimous. For the moment the consensus view is likely to have held. But for how long will this be the case? Forward Guidance is already becoming confused by statements from Martin Weale and Charlie Bean. By the Autumn, the Bank may adopt Dr Doolittle’s pushmi.pullyu animal as a mascot. So thin - the margin of spare capacity - for consensus. The timing of rates is likely to become more polarised amongst MPC members. Who will make the first move? The “Wad is on Weale” to be the first to break ranks. UK data suggest rates may rise sooner … The UK data continues to suggest rates may have to rise sooner than forward guidance implies. Car sales in of May were up by almost 8% in the month and by 12% in the year to date. According to Nationwide, house prices increased by 11% in the twelve months to May. The Halifax House Price data suggested house prices increased by almost 9% over the same period. According to Stephen Noakes, Halifax Mortgages Director : “Housing demand is very strong and continues to be supported by a strengthening economic recovery. Consumer confidence is being boosted by a rapidly improving labour market and low interest rates”. Christine Lagarde and the IMF squad were in the UK this week. The IMF has warned that house prices pose the greatest threat to the UK recovery. It called on the Bank of England to enact policy measures "early and gradually" to avoid a housing bubble. The Fund's annual health check, suggested the UK economy has "rebounded strongly” confirming growth would "remain strong this year at 2.9%”. The IMF also suggested growth is becoming “more balanced” but … Trade deficit deteriorates … There was no evidence of rebalancing in the trade figures for April. The trade deficit in goods increased to £2.5 billion in the month as the deficit (trade in goods) increased to almost £10 billion. OK, someone forget to include all the oil data in the month, which may have under stated exports by £700 million but this is a minor detail. We expect the deficit (trade in goods) to be between £112 billion and £115 billion offset by a £50 billion service sector surplus this year. No rebalancing on the trade agenda, as we have long explained. Markit/CIPS UK PMI® Survey Data The Markit/CIPS UK PMI® survey data was also released this week. “The UK manufacturing upsurge continued”. The Manufacturing PMI index was 57.0 in May, down slightly from 57.3 in April. The survey noted strong growth in output and new orders. There was also a sharp rise in construction output. House building remained the strongest performing area of activity. The headline index was signaling growth for the thirteenth successive month at 60.0, compared to 60.8 prior month. The headline service sector index continued in positive territory at 58.6 compared to 58.7 last month. Service sector employment growth increased at the fastest rate in 17 years. Interest rate outlook … The strong growth in consumer spending, retail sales, car sales and the housing market continues. The outlook for output remains strong in construction, manufacturing and the service sector. We expect investment activity to increase this year. The unemployment rate will continue to fall, placing greater pressure on wage settlements, leading to an increase in earnings into the second half of the year. The trade deficit will continue to deteriorate albeit at a rate which is offset by the strength of the service sector surplus. Sterling will probably hold at current levels for the rest of the year. Inflation, will remain around target, such is the weakness of international energy and commodity prices for the near future. With such a strong outlook for the domestic economy, rates should probably be on the rise by the Autumn of this year. However the MPC will be reluctant to move ahead of the Fed and the ECB. USA and Europe ... In the USA, Friday’s strong jobs report confirmed the economy is improving following the slight setback in the first quarter. Non farm payroll increased by over 200,000 as the unemployment rate held at 6.3%. For the year as a whole, the Fed may downgrade the growth forecast to around 2.7% from 3% currently. For the moment, forward guidance suggests US rates may begin to rise in the second quarter of 2015 but the outlook may be shortened, if the job trends continue. In Europe, the ECB is heading in another direction. The growth forecast within the Eurozone is just 1% this year but officials are concerned about the prospect of deflation. The latest HICP figure confirmed prices increased by just 0.5% compared to 0.7% prior month. The ECB decided to lower the interest rate on the main refinancing operations of the Eurosystem by 10 basis points to 0.15% and the rate on the marginal lending facility by 35 basis points to 0.40%. The rate on the deposit facility was lowered by 10 basis points to -0.10%. To support bank lending to households and business, excluding loans for house purchase, the ECB will be conducting a series of targeted longer-term refinancing operations (TLTROs) valued at €400 billion over a four year period. The scheme follows the success of the UK Funding for Lending Scheme. So what of forward guidance … Domestic considerations suggest UK rates should be on the rise towards the end of the year. For the moment, forward guidance in the UK and the USA suggests rates will be held until the second quarter of 2015. This may change, if the trends in job growth continue here and in the USA. In Europe, forward guidance is more concerned with the prospects of deflation and a “lost decade”. An increase in rates is not on the “horizon” nor even in the appendix. So what happened to sterling this week? The pound closed up against the dollar at $1.679 from $1.675 and unchanged against the Euro at 1.231 (1.230). The dollar closed broadly unchanged at 1.364 from 1.362 against the euro and at 102.53 (101.80) against the Yen. Oil Price Brent Crude closed down at $108.48 from $109.35. The average price in June last year was $102.92. It is summer after all. Markets, the Dow closed up at 16,899 from 16,682 and the FTSE moved up to 6,858 from 6,852. UK Ten year gilt yields closed at 2.64 (2.56) and US Treasury yields closed at 2.55 from 2.46. Gold held at $1,250 from $1,251. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  It was one of those heavy weeks for economics releases. Inflation, retail sales, government borrowing plus the eagerly awaited second estimate of GDP. Add in ONS house price information and a heady cocktail of excited headlines was to be expected from the financial pages. Inflation data as expected … It began quietly enough with the inflation data. No surprises, CPI inflation edged up to 1.8% in April from 1.6% in the prior month. The large rise in service sector inflation to 2.8% from 2.3% was offset by a small decline in goods inflation, falling to 0.9% from 1.0%. The uptick was marginally reflected in producer prices, increasing to 0.6% from 0.5%. The more volatile input costs, fell at a slower rate -5.5%, from -6.3% prior month. Energy and oil prices, were again significant in the reduced input costs. Imported metals, chemicals, parts and equipment fell significantly assisted by the 10% appreciation of sterling against the dollar. For the year as a whole, we think inflation will hover close to the target for the best part of the year. The risk remains to the upside in the final quarter. A rise in international prices, and domestic demand, boosted by compression in the labour market is likely to push prices higher. No risk of deflation on the UK horizon, a real risk to the upside is developing. House Prices .. UK house prices increased, according to the ONS data, by 8% in the twelve months to March. “The house market may derail the recovery", the headline. “Carney believes that house prices are the biggest risk to the economy” the great caution. No matter, that house prices increased by over 9% in the prior month or that house prices outside London are increasing by just 4% on average. In the North West prices increased by just over 3%, in Scotland prices hardly increased at all. In London, house prices increased by 17%. Foreign cash buyers at the top end of the market may be confusing the overall trend. However, significant volume and price escalation in the mid tier market is also impacting on price averages. Governor Carney has made it clear interest rates will not rise to combat rising house prices. The remit to action lies with the Financial Policy Committee. Already, action has already been taken to modify the Funding for Lending Scheme away from mortgage lending. Discussions between the Bank and Treasury will continue to consider modifications to the “Help to Buy Scheme”. Implementation of the Mortgage Market Review will also curb lending into 2014. There is a structural problem in the housing market. Mark Carney, Governor of Threadneedle Street, points out that Canada has half the population of the UK but builds twice as many houses. No wonder there is a supply issue. But is the Bank of England prepared to help out? Not really. The Little Old Lady will not turn a sod, grab a hod nor build a single house this year. “We are not in the business of building houses” the Governor’s mantra. The Bank of England will not build a single house in this cycle but neither will it allow the housing market to derail the recovery, provoking a premature move in base rates. Retail Sales … Retail sales figures, on the other hand, suggest rates may have to rise much sooner than expected. Retail sales volumes increased by 6.8% in April compared to prior year. It was May 2004 when retail sales volumes increased at a similar rate. Base rates were 4.75% at the time rising to over 5% within eighteen months. Retail sales values increased by just over 6%. Online sales increased by 13%, accounting for 11% of total action. Consumer confidence is back to the pre recession levels, car sales are up by 8% this year and retail sales are soaring. From a UK perspective, rates should be on the move by the Autumn of this year. The MPC will be reluctant to move ahead of the Fed and the ECB. The international context suggests the rate rise may be delayed until the second quarter of 2015. Thereafter, for those who would argue the forward horizon has 2.5% cap, the retail sales figures and base rate history should provide a warning of surprises to come. GDP Second Estimate … No surprises in the second estimate of GDP release for Q1. No revisions. The UK economy grew by 3.1% boosted by an 8% surge in investment activity. Manufacturing and Construction increased by over 3% and 5% respectively. The economy is rebalancing … well a little bit! Our May Quarterly Economics Update on behalf of GM Chamber of Commerce is released next week. The outlook for the year remains broadly unchanged. We expect the UK economy to grow by around 3% this year and 2.8% in the following year. The surge in retail activity has been a surprise, as is the continued strength in employment. The outlook remains much the same. Growth up, inflation rising slightly, employment increasing and borrowing, despite the blip in April, set to fall. Just the trade figures will continue to disappoint as we have long pointed out. So what happened to sterling? The pound closed broadly unchanged against the dollar at $1.682 from $1.683 and up against the Euro at 1.234 (1.227). The dollar closed at 1.363 from 1.370 against the euro and at 101.97 (101.54) against the Yen. Oil Price Brent Crude closed up at $110.52 from $109.91. The average price in May last year was $102.3. Markets, the Dow closed up at 16,593 from 16,447 but the FTSE adjusted to 6,815 from 6,855. The markets are set to move, the push before the summer rush perhaps. UK Ten year gilt yields closed at 2.63 (2.56 and US Treasury yields closed at 2.52 from 2.51. Gold was unchanged at $1,293 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Bank of England Inflation Report - May - So when will rates rise? Q2 2015 still the best bet. The final whistle not for some time yet! The Bank of England Inflation Report was released this week. It was all so predictable. The Governor’s opening remarks explained, “The overall outlook for GDP growth and inflation in this report is little changed from February. The UK economy continues to perform strongly. Having increased by more than 3% in the past year, output is now close to regaining the pre-crisis level. 700,000 more people are in work than a year ago and inflation is below, but close to, the 2% target. And so it proved. The strong labour market performance continued into April. The claimant count rate fell by 25,000, to a rate of 3.3%. The wider LFS data (to March) also reflected the improvement with a fall in the overall rate to 6.8%. On current trends the job centres really will be closing in 2017! The MPC expectations are for growth to increase by 3.2% in the second quarter and by 3.4% for the year as a whole, with continued expansion in household spending. Spending will be supported by an increase in real wages as inflation remains close to target and earnings increase moderately, with a gradual improvement in productivity. The MPC obsession with spare capacity continues. “While there is a range of views on the Committee, the best collective judgement is the margin of spare capacity is around 1% to 1.5% of GDP.” Charlie Bean is not entirely convinced about the “fuzzy concept” of spare capacity. “There is a real danger of spurious precision and the pretence of knowledge in this area” said the Deputy Governor. Quite so. That and many others perhaps! Does spare capacity impact on inflation prospects? Not so much. International inflationary pressures are key to current price trends and for the moment remain subdued. “The global picture is consistent with muted external inflationary pressures which, coupled with sterling’s appreciation, will moderate CPI inflation in the near term” said the Governor. Inflation has fallen sharply since the Autumn and the outlook for inflation in the medium term remains benign. A benign inflation outlook which will avoid undue pressure, in the short term, to increase rates, despite the strong growth figures and the buoyant housing market. So what of rates? The strength of the recovery has moved the economy “closer to the point at which interest rates will have to rise”, the official statement. So when will rates rise? In February, the MPC were happy to attach some credence to the market view that rates would begin to rise in the second quarter of next year. If anything the view in May is slightly more “dovish” or certainly more obtuse. “Our guidance is giving businesses and households confidence that we won’t take risks with price stability, financial stability, or the incipient expansion. It will promote the recovery in business investment, productivity and real wages, that a sustained expansion demands.” Rates are still unlikely to move until the second quarter of next year, the implication. As we explained last week, the MPC will be reluctant to move ahead of the Fed and the ECB. Forward guidance then lapsed into sporting analogy as the governor explained : “Securing the recovery is like making it through the qualifying rounds of the World Cup. That is an achievement but not the ultimate goal. The real tournament is just beginning and the prize is a strong, sustained and balanced expansion.” Yes the the Governor is laying out his team formation for the tournament ahead . “A flat back four with growth, inflation, unemployment and borrowing all heading in the right direction. Two strikers up front, household spending, with support to come from business investment. Some confusion in mid field from the housing market but no mention of exports and rebalancing. So expect the odd own goal from the trade performance, errant on the wing, as we move into the final stages of the competition. The Governor, for now, is not “taking away the punchbowl as the match gets going”. Far from it, you may continue to consume alcohol on the terraces, well into the final stages. Base rates are not expected to rise anytime soon. Q2 next year still the best bet. The final whistle will not be blown for some time yet.” So what happened to sterling this week? The pound closed broadly unchanged against the dollar at $1.683 from $1.685 and up against the Euro at 1.227 (1.224). The dollar closed at 1.370 from 1.375 against the euro and at 101.54 (101.18) against the Yen. Oil Price Brent Crude closed up at $109.91 from $108.16. The average price in May last year was $102.3. Markets, the Dow closed down at 16,447 from 16,544 but the FTSE closed up at 6,855 from 6,821. The markets are set to move, the push before the summer rush. UK Ten year gilt yields closed at 2.56 (2.68) and US Treasury yields closed at 2.51 from 2.62. Gold moved up slightly $1,293 from $1,287. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  GDP Figures Q1 … UK growth in the first quarter of 2014 was an impressive 3.1% year on year with significant growth in construction, manufacturing and the service sector. [According to the preliminary estimate from the Office for National Statistics released this week.] Construction growth increased by 5.1% in the quarter and manufacturing output increased by 3.5%. Service sector output was up by 2.9% with continued strong growth in distribution, hotels, and leisure (4.9%). The business and financial services sector increased by 3.6%. The outturn is more or less in line with our estimates in the Quarterly Economics Outlook released in March. Following the latest data, we have lowered our forecasts for growth in the construction sector for the year as a whole and increased our estimate of growth in manufacturing. The overall GDP position remains unchanged. We still forecast GDP growth of 2.9% in 2014 and 2.8% in 2015. Growth continues into Q2 … The good news continued this week, with the latest Markit/CIPS PMI® survey data on manufacturing and construction. In April the UK manufacturing sector maintained a robust start to the year. At 57.3, the seasonally adjusted index rose to a five-month high and registered one of the best readings over the past three years. Construction output continued to increase in April, albeit at the slowest pace for six months. The index recording of 60.2 is down from the peaks at the turn of the year but still ahead of the long run average of 54.3. Residential construction was the best performing area of activity. The rate of expansion in April remained one of the fastest seen over the past ten years … just as well! House Prices - increase into double figures … House prices increased by over 10% according to the latest figures from Nationwide. Robert Gardner, Nationwide's Chief Economist said: “After several months of moderation, the pace of house price growth picked up in April. Annual house price growth reached double digits for the first time in four years, with the price of a typical home 10.9% higher than April 2013. Still much to be done in construction however, “The upturn in construction of new homes continues to lag far behind the upturn in demand, with the number of new homes being built in England still around 40% below pre crisis levels.” Sir Jon Cunliffe, Deputy Governor of the Bank of England, expressed some concerns about the housing market in a speech in London this week. “The question for the Financial Policy Committee, is whether the sustained momentum in the housing market will lead to unsustainable growth in household indebtedness, undermining the resilience of the financial system. The growing momentum in the housing market is now the brightest light on the dashboard of warning lights.” You have been warned! Growth in the USA ... In the USA, growth in the first quarter was up by 2.3% year on year (0.1% quarter on quarter). The relatively disappointing number was attributed to a severe winter and much bad, wet weather. The Federal reserve derived some consolation from the strength of the jobs numbers released this week. In April, the number of non farm payroll jobs increased by almost 290,000, the unemployment rate fell to 6.3% and revisions to the employment numbers over the past three months confirmed the strength of the US recovery. Jobs growth over the last three months has averaged almost 240,000. With evidence of a strong performance in employment and household spending, the Federal reserve announced a further reduction in tapering with a reduction in asset purchases to $45 billion per month. Tapering is on track to completion by the September / October this year. Interest rate rises will then ensue possibly within six months. With inflation below target, wages rising by just 1.9% and almost 10 million Americans unemployed, the FOMC will be in no rush to act. So what happened to sterling this week? The pound closed up against the dollar at $1.687 from $1.681 and up against the Euro slightly at 1.217 (1.215). The dollar closed at 1.387 from 1.382 against the euro and at 102.23 (102.15) against the Yen. Oil Price Brent Crude closed at $108.50 from $109.54. The average price in May last year was $102.3. Markets, the Dow closed up at 16,542 from 16,370 and the FTSE also closed up at 6,821 from 6,685. The markets are making the move, the push before the rush, may see the FTSE hit 7000 before the summer sell off! UK Ten year gilt yields closed at 2.72 (2.66) and US Treasury yields closed at 2.72 from 2.67. Gold moved down $1,296 from $1,301. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Car sales soar but so will the trade deficit … Good news of the recovery. Car registrations rose to 465,000 in March, an increase of 18% on last year. The new 2014 plates have been great for the car market. More new cars were registered last month, than at any time in the last ten years according to the Society of Motor Manufacturers and Traders. As Mike Hawes, SMMT Chief Executive explains. “Given the past six years of subdued economic performance across the UK, there is still a substantial margin of pent-up demand, contributing to a strong new and used car market.” Easy finance deals and advanced technologies make new cars cheaper to buy and to run. There has never been a better time to buy a new car. The pent up demand is to be unleashed. Bear in mind, we have over 31 million cars on the road in the UK, of which over one third are over nine years old. Let’s hope the owners don’t all appear in the showroom at once.That would create a traffic jam at the docks. The car market demonstrates clearly the problems with the march of the makers, the rebalancing agenda and the inability of sterling depreciation to remedy the trade balance. We expect car sales to increase to around 2.5 million units in 2014 returning to levels last seen in 2004 and 2005. Production is forecast to increase to 1.6 million units following the increase to 1.5 million last year. A further increase to 1.7 million units, then 1.8 million units is expected by 2016. Good news for manufacturing? Of course. But the majority of production is exported. Export sales may hit 1.3 million units in 2014, rising to 1.5 million by 2016. As a result, imports will have to increase to 2.2 million units in 2014, rising to 2.4 million units by 2016 to satisfy domestic demand. The trade deficit (unit sales) will increase to 0.8 or 0.9 million units. An increase to levels least seen pre recession. The recovery in the UK economy will exacerbate the trade deficit in cars just as it will in many other commodities. Relative rates of economic growth here and particularly in Europe primarily determine the demand for imports and exports. Demand is relatively inelastic with regard to price, particularly with exports. Manufacturers price to market or products form part of international syndication. Sterling has a minor role to play in determining the direction of trade in the international car market. Supply, is output constrained and cannot respond to domestic market growth. In fact 80% of car production is exported and 90% of domestic demand is satisfied by imports. We have warned previously, the UK cannot grow faster than trade partners in Europe or North America without a deterioration in the trade account. The car market is a simple arithmetic of the dilemma. Download the short report Car Market - Driving recovery or driving the deficit to access the underlying data. PMI Markit Surveys This is the week of the PMI Markit survey data with information on the March updates. The recovery continues in services, construction and manufacturing. The manufacturing upturn remains solid, service sector activity remains strong and construction firms report brightest outlook for business activity since January 2007. We have upgraded our forecast for UK growth this year to 2.9% based on the strength of the Manchester Index® and latest GM Chamber of Commerce QES survey data. House Prices, Nationwide reports house prices increasing by 9.5% across the UK, increasing by 18% in London. Prices remain slightly below the peak levels of 2007 except in the capital, were levels are now some 20% above peak. Should we worry about the boom in prices? Perhaps but not just yet. Activity levels are still subdued relative to the pre recession peaks but the recovery in prices will be of concern to policy makers as will the developing trade deficit. In our economics presentations we begin to touch on concerns about the recovery. Deflation is not one of them, house prices may be. The current account deficit certainly is. Especially if the trends in investment income from overseas are maintained. Then we shall see just what will happen to sterling. So what happened to sterling this week? The pound closed at $1.659 from $1.664 and at 1.21 unchanged against the Euro. The dollar closed at 1.370 from 1.375 against the euro and at 103.26 from 102.82against the Yen. Oil Price Brent Crude closed at $106.72 from $108.01. The average price in March last year was $108. Markets, the Dow closed up at 16,526 from 16,323 and the FTSE closed at 6,6956 from 6,615. UK Ten year gilt yields closed at 2.72 (2.72) and US Treasury yields closed at 2.76 from 2.72. Gold moved higher to $1,304 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  UK march of the makers … Good news for the march of the makers this week, - manufacturing output increased by 3.3% in January compared to disappointing growth of just 1.9% in the final quarter of 2013. Still some way to go to restore the sector to positive growth. Output remains some 9% below the peak registered in the first quarter of 2008. Output of Investment and capital goods increased by 3.8%, continuing the strong trend since the setback in 2008. We expect manufacturing output to increase by 2.9% for the year as whole and around 2.7% in the following year. Consumer goods output remained weak with further declines in the month. For some sectors of manufacturing, the march of the makers is more like a retreat from Moscow, than a move across the Rhineland. The makers will fail to make a real contribution to the rebalancing agenda. So what of net trade … The trade figures for January were released this week. After the December aberration, a month in which the ONS appears to have lost some £2 billion of imports, the total trade balance returned to normality. A deficit of £2.6 billion compared to £0.7 billion last month. There was a trade shortfall of £9.8 billion on goods, partly offset by an estimated surplus of £7.2 billion on services. For the year as a whole, we expect the trade deficit in goods to increase to £114 billion, offset by a trade in service surplus of £85 billion. The overall trade in goods and services shortfall will be £29 billion. At less than 2% of GDP, the deficit will not pose a threat to the outlook for sterling, assuming investment capital flows recover. The trade deficit will fail to make a real contribution to the rebalancing agenda. And what of Construction … Good news in construction. Output increased by 5.4% in January compared to the same month last year. New work increased by almost 6% in the month, as repair and maintenance budgets also increased by 4.5%. For the year as a whole we expect construction growth of around 6%, with strong growth in housing and commercial property expansion fuelling growth. Prospects for the year … The OECD suggests the UK economy will grow by over 3% in the first half of the year, in line with the strong expectations from the Bank of England “Nowcasting” model, news of which was also released this week. The NIESR GDP tracker for February suggests growth may have slowed to 2.6% in February after strong growth of 3.2% in the prior month. For the year as a whole most forecasters are moving to a 2.7% growth figure. Seems reasonable for now. The recovery appears secure and sustainable. Growth up, unemployment down, inflation down and borrowing heading in the right direction. Just the trade figures will continue to disappoint as we have long pointed out. Charlie Bean on the North East Scene … Charlie Bean was in the North East this week, delivering a speech to the Chamber of Commerce. Further reassurance the MPC will be doing its utmost to ensure that recovery is not nipped in the bud. “When the time does come for us to start raising Bank Rate, we should celebrate that as a welcome sign that the economy is finally well on the road back to normality”. Excellent. Much of the rest of the speech was devoted to investment, productivity and net trade. As the deputy governor points out, the United Kingdom has run a persistent trade deficit of the order of 2-3% of GDP since the beginning of the century. So much for “rebalancing”. On investment, productivity, depreciation and “on shoring”, the speech demonstrates the lack of fundamental understanding of the real economy amongst policy makers at a senior level. We had hoped for better from the new regime. Charlie represents the old guard due to retire in June this year. Of The Treasury Select Committee … The Governor and members of the MPC were in front of the Treasury Select Committee this week. The protocol still eludes the new man. Governor Carney actually winked at Chairman Tyrie at one stage. It is difficult to imagine Governor King, managing a nod let alone a wink. It appears the meetings of the MPC are minuted and recorded. Then for good measure the tapes are destroyed. Lack of good recording equipment formed part of the explanation by the old guard. The solution to invest in better equipment seemed a little too obvious for the Chairman and the new Governor. Expect a rethink! Wink Wink. So what happened to sterling? The pound closed at $1.662 from $1.672 and at 1.196 from 1.205 from against the Euro. The dollar closed at 1.390 from 1.387 against the euro and 101.31 from 103.3 against the Yen. Oil Price Brent Crude closed at $108.34 from $108.86. The average price in March last year was $108. Markets, moved down concerned about China and the Ukraine - The Dow closed at 16,107 from 16,458 and the FTSE closed at 6,527 from 6,712. UK Ten year gilt yields closed at 2.67 from 2.81and US Treasury yields closed at 2.65 from 2.80. Gold loves a crisis, closing up at $1,378 from $1,338. That’s all for this week. No Sunday Times and Croissants tomorrow. All records of the tennis results will be recorded then destroyed. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed