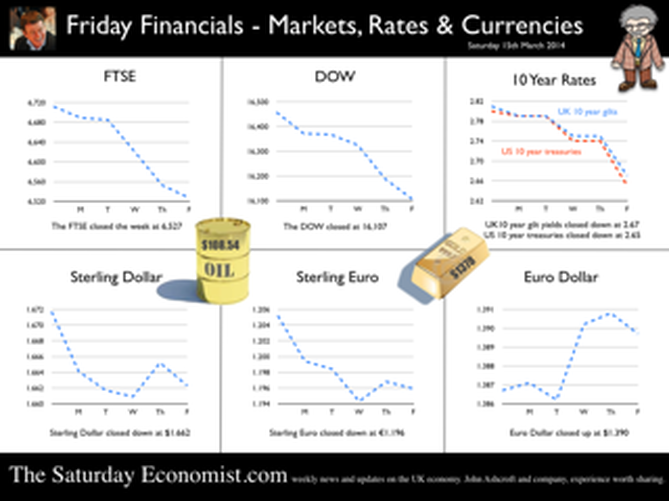

UK march of the makers … Good news for the march of the makers this week, - manufacturing output increased by 3.3% in January compared to disappointing growth of just 1.9% in the final quarter of 2013. Still some way to go to restore the sector to positive growth. Output remains some 9% below the peak registered in the first quarter of 2008. Output of Investment and capital goods increased by 3.8%, continuing the strong trend since the setback in 2008. We expect manufacturing output to increase by 2.9% for the year as whole and around 2.7% in the following year. Consumer goods output remained weak with further declines in the month. For some sectors of manufacturing, the march of the makers is more like a retreat from Moscow, than a move across the Rhineland. The makers will fail to make a real contribution to the rebalancing agenda. So what of net trade … The trade figures for January were released this week. After the December aberration, a month in which the ONS appears to have lost some £2 billion of imports, the total trade balance returned to normality. A deficit of £2.6 billion compared to £0.7 billion last month. There was a trade shortfall of £9.8 billion on goods, partly offset by an estimated surplus of £7.2 billion on services. For the year as a whole, we expect the trade deficit in goods to increase to £114 billion, offset by a trade in service surplus of £85 billion. The overall trade in goods and services shortfall will be £29 billion. At less than 2% of GDP, the deficit will not pose a threat to the outlook for sterling, assuming investment capital flows recover. The trade deficit will fail to make a real contribution to the rebalancing agenda. And what of Construction … Good news in construction. Output increased by 5.4% in January compared to the same month last year. New work increased by almost 6% in the month, as repair and maintenance budgets also increased by 4.5%. For the year as a whole we expect construction growth of around 6%, with strong growth in housing and commercial property expansion fuelling growth. Prospects for the year … The OECD suggests the UK economy will grow by over 3% in the first half of the year, in line with the strong expectations from the Bank of England “Nowcasting” model, news of which was also released this week. The NIESR GDP tracker for February suggests growth may have slowed to 2.6% in February after strong growth of 3.2% in the prior month. For the year as a whole most forecasters are moving to a 2.7% growth figure. Seems reasonable for now. The recovery appears secure and sustainable. Growth up, unemployment down, inflation down and borrowing heading in the right direction. Just the trade figures will continue to disappoint as we have long pointed out. Charlie Bean on the North East Scene … Charlie Bean was in the North East this week, delivering a speech to the Chamber of Commerce. Further reassurance the MPC will be doing its utmost to ensure that recovery is not nipped in the bud. “When the time does come for us to start raising Bank Rate, we should celebrate that as a welcome sign that the economy is finally well on the road back to normality”. Excellent. Much of the rest of the speech was devoted to investment, productivity and net trade. As the deputy governor points out, the United Kingdom has run a persistent trade deficit of the order of 2-3% of GDP since the beginning of the century. So much for “rebalancing”. On investment, productivity, depreciation and “on shoring”, the speech demonstrates the lack of fundamental understanding of the real economy amongst policy makers at a senior level. We had hoped for better from the new regime. Charlie represents the old guard due to retire in June this year. Of The Treasury Select Committee … The Governor and members of the MPC were in front of the Treasury Select Committee this week. The protocol still eludes the new man. Governor Carney actually winked at Chairman Tyrie at one stage. It is difficult to imagine Governor King, managing a nod let alone a wink. It appears the meetings of the MPC are minuted and recorded. Then for good measure the tapes are destroyed. Lack of good recording equipment formed part of the explanation by the old guard. The solution to invest in better equipment seemed a little too obvious for the Chairman and the new Governor. Expect a rethink! Wink Wink. So what happened to sterling? The pound closed at $1.662 from $1.672 and at 1.196 from 1.205 from against the Euro. The dollar closed at 1.390 from 1.387 against the euro and 101.31 from 103.3 against the Yen. Oil Price Brent Crude closed at $108.34 from $108.86. The average price in March last year was $108. Markets, moved down concerned about China and the Ukraine - The Dow closed at 16,107 from 16,458 and the FTSE closed at 6,527 from 6,712. UK Ten year gilt yields closed at 2.67 from 2.81and US Treasury yields closed at 2.65 from 2.80. Gold loves a crisis, closing up at $1,378 from $1,338. That’s all for this week. No Sunday Times and Croissants tomorrow. All records of the tennis results will be recorded then destroyed. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed