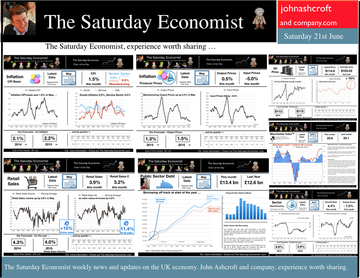

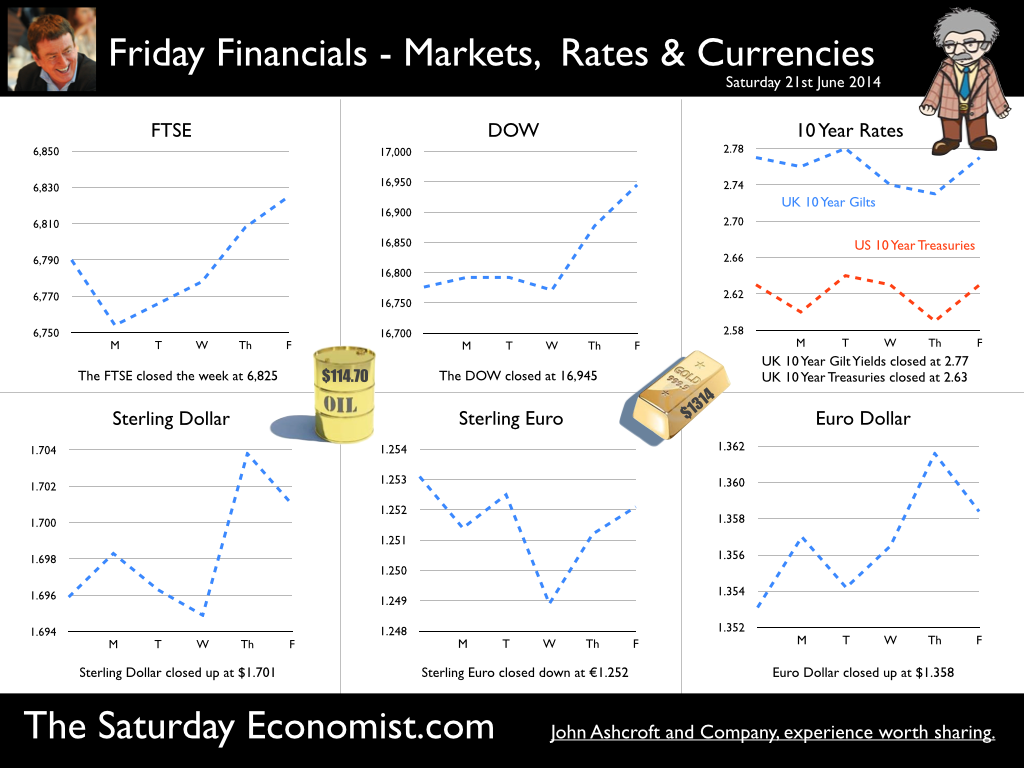

The Manchester Index™ confirms the UK recovery is on track with growth continuing around 3% into the second quarter of the year. The index fell slightly to 33.6 from 35.1, still much higher than pre recession levels. The preliminary results from the GM Chamber of Commerce QES data were available this week. The survey suggests strong growth in manufacturing continues, with slightly more moderate growth in the service sector. The results are in line with our forecasts for the full year - available in the June Economic Outlook. The full results and presentation on the influential Chamber of Commerce QES survey for Q2 will be available on the 4th July. Don’t miss that! Public Sector Finances off track … The strong performance in the economy is slightly at odds with the Public Sector Finances for May, released this week. The UK economy is expanding by just over 3% in the first half of the year. We would expect an improvement in borrowing given the strength of the recovery. Two months into the year and borrowing is off track compared to last year and to plan. In the first two months of the year, total borrowing was up at £24.2 billion compared to £23.2 billion prior year. Strong VAT revenues contributed to a 9% growth in total receipts but expenditure increased by almost 6%, despite a fall in interest payments. Last year’s borrowing figure has been revised to £107.0 billion for the financial year. Good news for the Chancellor but revenues will have to improve and expenditure will have to be contained, if this year’s OBR forecast is to be met. Strong Retail sales in May … Strong retail sales are contributing to the VAT receipts. In May retail sales volumes were up 3.9% compared to last year. This is down on April’s staggering 6.5% growth but we still expect growth of 4.6% in the current quarter and 4.3% for the year as a whole. Internet sales were up by 15%, now accounting for 11.4% of all activity. The online disruption continues. Sales values were up by just 3.2%, contributing to deflation and retail concerns in the High Street. Inflation slows in May … And so it was with the inflation figures. Inflation CPI basis slowed to 1.5% in May, down from 1.8% in April. Service sector inflation was 2.2% and goods inflation held at 0.9%. Falls in transport service costs, notably air fares, provided the largest contribution to the decrease in the rate. Other large downward effects came from food, drinks and clothing. The fall came as something of a surprise, we still expect inflation to track near target (2%) for the year as a whole. Producer Prices no pressure on inflation … No pressure on inflation is evident in the producer price information, released this week. Output prices in May increased by just 0.5% as input costs fell by 5%. Import prices of fuel, oil, food, metals, chemicals, parts, equipment and materials the real story. It is a story of weak international growth in GDP and trade, with slow growth in commodity prices, assisted by the strength of sterling, closing the week above the critical $1.70 level. Monetary Policy and Minutes of the MPC ... So why is Sterling so strong? Statements from Governor Carney that rates may rise “sooner than markets expect" are contrasting with the “Business as Usual” stance from the Federal Reserve. The Fed reduced the forecast GDP 2014 outlook for the US economy to just 2.2% from 3% earlier. Tapering is set to continue but guidelines suggest interest rates will not rise until the second quarter of next year. In the UK, we expect rates to rise in the final quarter of the year. Inflation and earnings suggest that strong growth of itself will not precipitate the rise. The Sterling genie is removing the $1.70 stopper. Who speaks for Sterling? We asked in March last year as the pound headed to the $1.50 level. Sterling look set to test $1.74 in the months ahead unless rate fears are calmed. So what happened to sterling this week? The pound closed up against the dollar pushing through resistance at the $1.70 level. Sterling closed up at $1.7010 from $1.696, steady against the Euro at 1.252 (1.253). The Euro strengthened against the dollar at 1.358 from 1.353. Oil Price Brent Crude closed up at $114.70 from $113.07 on Middle East concerns. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed up. The Dow closed down at 16,945 from 16,776 and the FTSE was also up at 6,825 from 6,790. UK Ten year gilt yields held at 2.77 and US Treasury yields closed at 2.63 from 2.77 on interest rate trends. Gold moved higher on geo political fears at $1,314 from $1,274. That’s all for this week. Visit the revamped web site. Download our Quarterly Forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. About the Manchester Index™ … The Greater Manchester economy correlates highly with trends in the national economy. The Manchester Index® is an early indicator of trends in both the Manchester and the UK economy. The index is derived from the GM Quarterly Economics Survey which forms part of the British Chambers of Commerce National Survey. Greater Manchester is the largest contributor to this important business survey. We poll 5000 businesses every quarter. As the principal national business survey and the first to be published in each quarter, the results are closely monitored by HM Treasury and the Bank of England Monetary Committee. The GM survey data has a high correlation with the national data. In other key indicators, the unemployment claimant count for example, has a high correlation (over 99%) with the national data set. Our business investment tracker utilises data from capacity and investment intentions to forecast investment in the UK economy. We lag capacity by four quarters and investment intentions by two quarters to model spending.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed