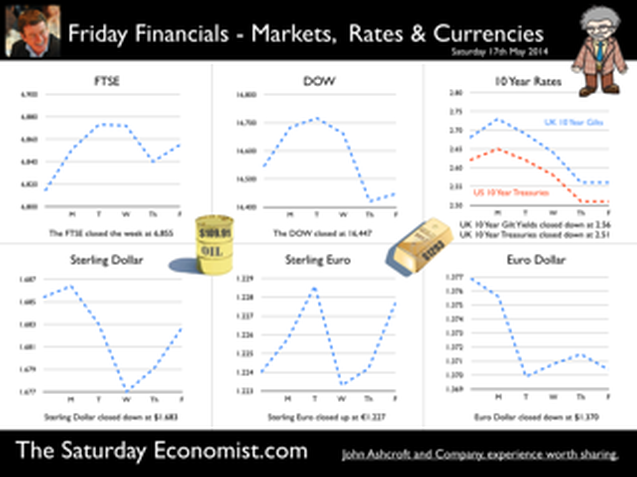

The Bank of England Inflation Report - May - So when will rates rise? Q2 2015 still the best bet. The final whistle not for some time yet! The Bank of England Inflation Report was released this week. It was all so predictable. The Governor’s opening remarks explained, “The overall outlook for GDP growth and inflation in this report is little changed from February. The UK economy continues to perform strongly. Having increased by more than 3% in the past year, output is now close to regaining the pre-crisis level. 700,000 more people are in work than a year ago and inflation is below, but close to, the 2% target. And so it proved. The strong labour market performance continued into April. The claimant count rate fell by 25,000, to a rate of 3.3%. The wider LFS data (to March) also reflected the improvement with a fall in the overall rate to 6.8%. On current trends the job centres really will be closing in 2017! The MPC expectations are for growth to increase by 3.2% in the second quarter and by 3.4% for the year as a whole, with continued expansion in household spending. Spending will be supported by an increase in real wages as inflation remains close to target and earnings increase moderately, with a gradual improvement in productivity. The MPC obsession with spare capacity continues. “While there is a range of views on the Committee, the best collective judgement is the margin of spare capacity is around 1% to 1.5% of GDP.” Charlie Bean is not entirely convinced about the “fuzzy concept” of spare capacity. “There is a real danger of spurious precision and the pretence of knowledge in this area” said the Deputy Governor. Quite so. That and many others perhaps! Does spare capacity impact on inflation prospects? Not so much. International inflationary pressures are key to current price trends and for the moment remain subdued. “The global picture is consistent with muted external inflationary pressures which, coupled with sterling’s appreciation, will moderate CPI inflation in the near term” said the Governor. Inflation has fallen sharply since the Autumn and the outlook for inflation in the medium term remains benign. A benign inflation outlook which will avoid undue pressure, in the short term, to increase rates, despite the strong growth figures and the buoyant housing market. So what of rates? The strength of the recovery has moved the economy “closer to the point at which interest rates will have to rise”, the official statement. So when will rates rise? In February, the MPC were happy to attach some credence to the market view that rates would begin to rise in the second quarter of next year. If anything the view in May is slightly more “dovish” or certainly more obtuse. “Our guidance is giving businesses and households confidence that we won’t take risks with price stability, financial stability, or the incipient expansion. It will promote the recovery in business investment, productivity and real wages, that a sustained expansion demands.” Rates are still unlikely to move until the second quarter of next year, the implication. As we explained last week, the MPC will be reluctant to move ahead of the Fed and the ECB. Forward guidance then lapsed into sporting analogy as the governor explained : “Securing the recovery is like making it through the qualifying rounds of the World Cup. That is an achievement but not the ultimate goal. The real tournament is just beginning and the prize is a strong, sustained and balanced expansion.” Yes the the Governor is laying out his team formation for the tournament ahead . “A flat back four with growth, inflation, unemployment and borrowing all heading in the right direction. Two strikers up front, household spending, with support to come from business investment. Some confusion in mid field from the housing market but no mention of exports and rebalancing. So expect the odd own goal from the trade performance, errant on the wing, as we move into the final stages of the competition. The Governor, for now, is not “taking away the punchbowl as the match gets going”. Far from it, you may continue to consume alcohol on the terraces, well into the final stages. Base rates are not expected to rise anytime soon. Q2 next year still the best bet. The final whistle will not be blown for some time yet.” So what happened to sterling this week? The pound closed broadly unchanged against the dollar at $1.683 from $1.685 and up against the Euro at 1.227 (1.224). The dollar closed at 1.370 from 1.375 against the euro and at 101.54 (101.18) against the Yen. Oil Price Brent Crude closed up at $109.91 from $108.16. The average price in May last year was $102.3. Markets, the Dow closed down at 16,447 from 16,544 but the FTSE closed up at 6,855 from 6,821. The markets are set to move, the push before the summer rush. UK Ten year gilt yields closed at 2.56 (2.68) and US Treasury yields closed at 2.51 from 2.62. Gold moved up slightly $1,293 from $1,287. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed