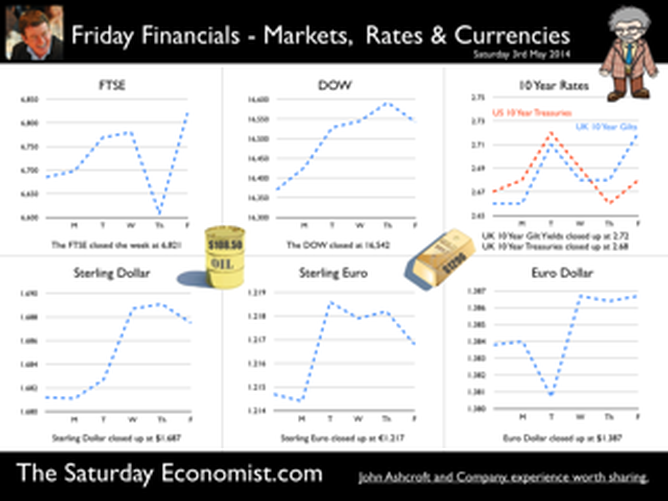

GDP Figures Q1 … UK growth in the first quarter of 2014 was an impressive 3.1% year on year with significant growth in construction, manufacturing and the service sector. [According to the preliminary estimate from the Office for National Statistics released this week.] Construction growth increased by 5.1% in the quarter and manufacturing output increased by 3.5%. Service sector output was up by 2.9% with continued strong growth in distribution, hotels, and leisure (4.9%). The business and financial services sector increased by 3.6%. The outturn is more or less in line with our estimates in the Quarterly Economics Outlook released in March. Following the latest data, we have lowered our forecasts for growth in the construction sector for the year as a whole and increased our estimate of growth in manufacturing. The overall GDP position remains unchanged. We still forecast GDP growth of 2.9% in 2014 and 2.8% in 2015. Growth continues into Q2 … The good news continued this week, with the latest Markit/CIPS PMI® survey data on manufacturing and construction. In April the UK manufacturing sector maintained a robust start to the year. At 57.3, the seasonally adjusted index rose to a five-month high and registered one of the best readings over the past three years. Construction output continued to increase in April, albeit at the slowest pace for six months. The index recording of 60.2 is down from the peaks at the turn of the year but still ahead of the long run average of 54.3. Residential construction was the best performing area of activity. The rate of expansion in April remained one of the fastest seen over the past ten years … just as well! House Prices - increase into double figures … House prices increased by over 10% according to the latest figures from Nationwide. Robert Gardner, Nationwide's Chief Economist said: “After several months of moderation, the pace of house price growth picked up in April. Annual house price growth reached double digits for the first time in four years, with the price of a typical home 10.9% higher than April 2013. Still much to be done in construction however, “The upturn in construction of new homes continues to lag far behind the upturn in demand, with the number of new homes being built in England still around 40% below pre crisis levels.” Sir Jon Cunliffe, Deputy Governor of the Bank of England, expressed some concerns about the housing market in a speech in London this week. “The question for the Financial Policy Committee, is whether the sustained momentum in the housing market will lead to unsustainable growth in household indebtedness, undermining the resilience of the financial system. The growing momentum in the housing market is now the brightest light on the dashboard of warning lights.” You have been warned! Growth in the USA ... In the USA, growth in the first quarter was up by 2.3% year on year (0.1% quarter on quarter). The relatively disappointing number was attributed to a severe winter and much bad, wet weather. The Federal reserve derived some consolation from the strength of the jobs numbers released this week. In April, the number of non farm payroll jobs increased by almost 290,000, the unemployment rate fell to 6.3% and revisions to the employment numbers over the past three months confirmed the strength of the US recovery. Jobs growth over the last three months has averaged almost 240,000. With evidence of a strong performance in employment and household spending, the Federal reserve announced a further reduction in tapering with a reduction in asset purchases to $45 billion per month. Tapering is on track to completion by the September / October this year. Interest rate rises will then ensue possibly within six months. With inflation below target, wages rising by just 1.9% and almost 10 million Americans unemployed, the FOMC will be in no rush to act. So what happened to sterling this week? The pound closed up against the dollar at $1.687 from $1.681 and up against the Euro slightly at 1.217 (1.215). The dollar closed at 1.387 from 1.382 against the euro and at 102.23 (102.15) against the Yen. Oil Price Brent Crude closed at $108.50 from $109.54. The average price in May last year was $102.3. Markets, the Dow closed up at 16,542 from 16,370 and the FTSE also closed up at 6,821 from 6,685. The markets are making the move, the push before the rush, may see the FTSE hit 7000 before the summer sell off! UK Ten year gilt yields closed at 2.72 (2.66) and US Treasury yields closed at 2.72 from 2.67. Gold moved down $1,296 from $1,301. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed