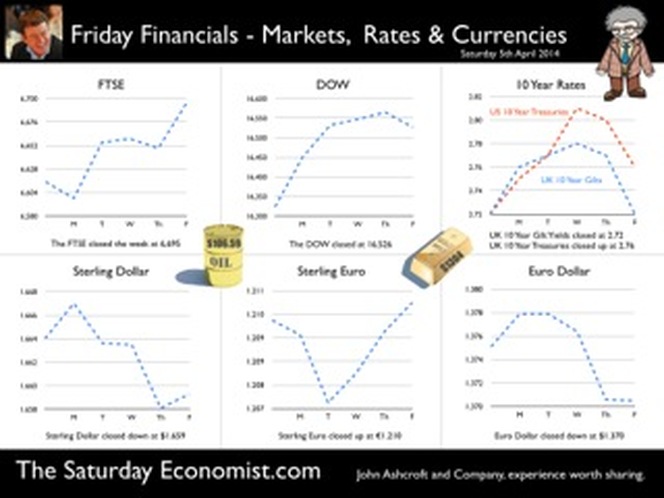

Car sales soar but so will the trade deficit … Good news of the recovery. Car registrations rose to 465,000 in March, an increase of 18% on last year. The new 2014 plates have been great for the car market. More new cars were registered last month, than at any time in the last ten years according to the Society of Motor Manufacturers and Traders. As Mike Hawes, SMMT Chief Executive explains. “Given the past six years of subdued economic performance across the UK, there is still a substantial margin of pent-up demand, contributing to a strong new and used car market.” Easy finance deals and advanced technologies make new cars cheaper to buy and to run. There has never been a better time to buy a new car. The pent up demand is to be unleashed. Bear in mind, we have over 31 million cars on the road in the UK, of which over one third are over nine years old. Let’s hope the owners don’t all appear in the showroom at once.That would create a traffic jam at the docks. The car market demonstrates clearly the problems with the march of the makers, the rebalancing agenda and the inability of sterling depreciation to remedy the trade balance. We expect car sales to increase to around 2.5 million units in 2014 returning to levels last seen in 2004 and 2005. Production is forecast to increase to 1.6 million units following the increase to 1.5 million last year. A further increase to 1.7 million units, then 1.8 million units is expected by 2016. Good news for manufacturing? Of course. But the majority of production is exported. Export sales may hit 1.3 million units in 2014, rising to 1.5 million by 2016. As a result, imports will have to increase to 2.2 million units in 2014, rising to 2.4 million units by 2016 to satisfy domestic demand. The trade deficit (unit sales) will increase to 0.8 or 0.9 million units. An increase to levels least seen pre recession. The recovery in the UK economy will exacerbate the trade deficit in cars just as it will in many other commodities. Relative rates of economic growth here and particularly in Europe primarily determine the demand for imports and exports. Demand is relatively inelastic with regard to price, particularly with exports. Manufacturers price to market or products form part of international syndication. Sterling has a minor role to play in determining the direction of trade in the international car market. Supply, is output constrained and cannot respond to domestic market growth. In fact 80% of car production is exported and 90% of domestic demand is satisfied by imports. We have warned previously, the UK cannot grow faster than trade partners in Europe or North America without a deterioration in the trade account. The car market is a simple arithmetic of the dilemma. Download the short report Car Market - Driving recovery or driving the deficit to access the underlying data. PMI Markit Surveys This is the week of the PMI Markit survey data with information on the March updates. The recovery continues in services, construction and manufacturing. The manufacturing upturn remains solid, service sector activity remains strong and construction firms report brightest outlook for business activity since January 2007. We have upgraded our forecast for UK growth this year to 2.9% based on the strength of the Manchester Index® and latest GM Chamber of Commerce QES survey data. House Prices, Nationwide reports house prices increasing by 9.5% across the UK, increasing by 18% in London. Prices remain slightly below the peak levels of 2007 except in the capital, were levels are now some 20% above peak. Should we worry about the boom in prices? Perhaps but not just yet. Activity levels are still subdued relative to the pre recession peaks but the recovery in prices will be of concern to policy makers as will the developing trade deficit. In our economics presentations we begin to touch on concerns about the recovery. Deflation is not one of them, house prices may be. The current account deficit certainly is. Especially if the trends in investment income from overseas are maintained. Then we shall see just what will happen to sterling. So what happened to sterling this week? The pound closed at $1.659 from $1.664 and at 1.21 unchanged against the Euro. The dollar closed at 1.370 from 1.375 against the euro and at 103.26 from 102.82against the Yen. Oil Price Brent Crude closed at $106.72 from $108.01. The average price in March last year was $108. Markets, the Dow closed up at 16,526 from 16,323 and the FTSE closed at 6,6956 from 6,615. UK Ten year gilt yields closed at 2.72 (2.72) and US Treasury yields closed at 2.76 from 2.72. Gold moved higher to $1,304 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed