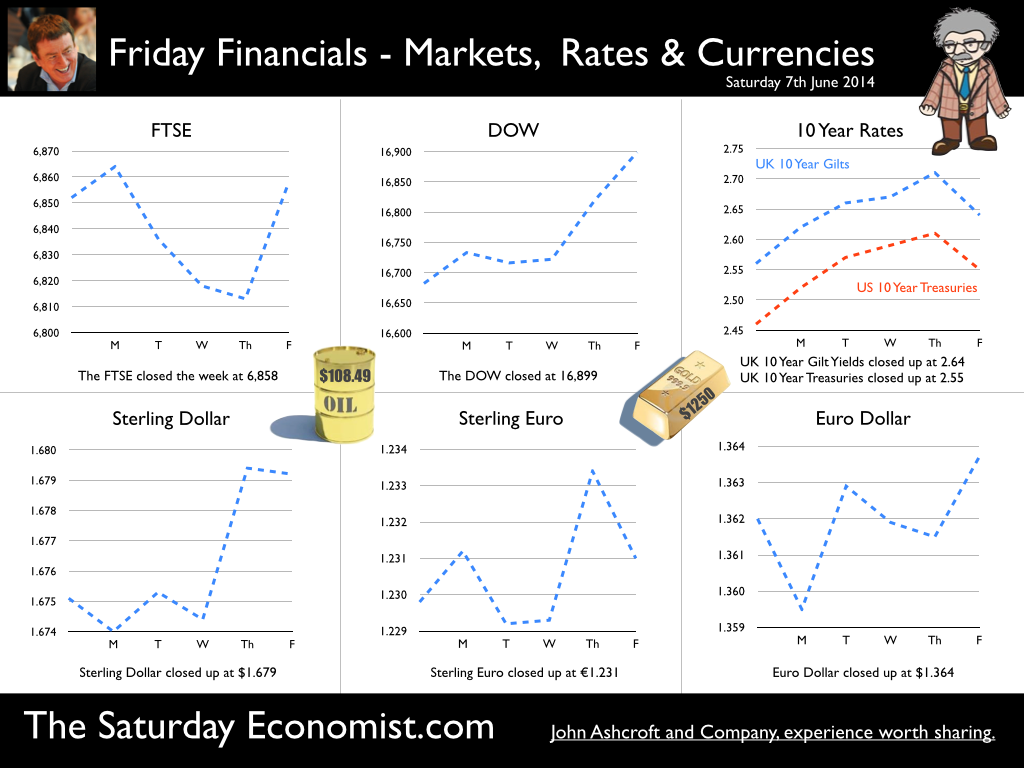

The MPC left rates on hold this week. We will have to wait a few weeks to find out if the vote was unanimous. For the moment the consensus view is likely to have held. But for how long will this be the case? Forward Guidance is already becoming confused by statements from Martin Weale and Charlie Bean. By the Autumn, the Bank may adopt Dr Doolittle’s pushmi.pullyu animal as a mascot. So thin - the margin of spare capacity - for consensus. The timing of rates is likely to become more polarised amongst MPC members. Who will make the first move? The “Wad is on Weale” to be the first to break ranks. UK data suggest rates may rise sooner … The UK data continues to suggest rates may have to rise sooner than forward guidance implies. Car sales in of May were up by almost 8% in the month and by 12% in the year to date. According to Nationwide, house prices increased by 11% in the twelve months to May. The Halifax House Price data suggested house prices increased by almost 9% over the same period. According to Stephen Noakes, Halifax Mortgages Director : “Housing demand is very strong and continues to be supported by a strengthening economic recovery. Consumer confidence is being boosted by a rapidly improving labour market and low interest rates”. Christine Lagarde and the IMF squad were in the UK this week. The IMF has warned that house prices pose the greatest threat to the UK recovery. It called on the Bank of England to enact policy measures "early and gradually" to avoid a housing bubble. The Fund's annual health check, suggested the UK economy has "rebounded strongly” confirming growth would "remain strong this year at 2.9%”. The IMF also suggested growth is becoming “more balanced” but … Trade deficit deteriorates … There was no evidence of rebalancing in the trade figures for April. The trade deficit in goods increased to £2.5 billion in the month as the deficit (trade in goods) increased to almost £10 billion. OK, someone forget to include all the oil data in the month, which may have under stated exports by £700 million but this is a minor detail. We expect the deficit (trade in goods) to be between £112 billion and £115 billion offset by a £50 billion service sector surplus this year. No rebalancing on the trade agenda, as we have long explained. Markit/CIPS UK PMI® Survey Data The Markit/CIPS UK PMI® survey data was also released this week. “The UK manufacturing upsurge continued”. The Manufacturing PMI index was 57.0 in May, down slightly from 57.3 in April. The survey noted strong growth in output and new orders. There was also a sharp rise in construction output. House building remained the strongest performing area of activity. The headline index was signaling growth for the thirteenth successive month at 60.0, compared to 60.8 prior month. The headline service sector index continued in positive territory at 58.6 compared to 58.7 last month. Service sector employment growth increased at the fastest rate in 17 years. Interest rate outlook … The strong growth in consumer spending, retail sales, car sales and the housing market continues. The outlook for output remains strong in construction, manufacturing and the service sector. We expect investment activity to increase this year. The unemployment rate will continue to fall, placing greater pressure on wage settlements, leading to an increase in earnings into the second half of the year. The trade deficit will continue to deteriorate albeit at a rate which is offset by the strength of the service sector surplus. Sterling will probably hold at current levels for the rest of the year. Inflation, will remain around target, such is the weakness of international energy and commodity prices for the near future. With such a strong outlook for the domestic economy, rates should probably be on the rise by the Autumn of this year. However the MPC will be reluctant to move ahead of the Fed and the ECB. USA and Europe ... In the USA, Friday’s strong jobs report confirmed the economy is improving following the slight setback in the first quarter. Non farm payroll increased by over 200,000 as the unemployment rate held at 6.3%. For the year as a whole, the Fed may downgrade the growth forecast to around 2.7% from 3% currently. For the moment, forward guidance suggests US rates may begin to rise in the second quarter of 2015 but the outlook may be shortened, if the job trends continue. In Europe, the ECB is heading in another direction. The growth forecast within the Eurozone is just 1% this year but officials are concerned about the prospect of deflation. The latest HICP figure confirmed prices increased by just 0.5% compared to 0.7% prior month. The ECB decided to lower the interest rate on the main refinancing operations of the Eurosystem by 10 basis points to 0.15% and the rate on the marginal lending facility by 35 basis points to 0.40%. The rate on the deposit facility was lowered by 10 basis points to -0.10%. To support bank lending to households and business, excluding loans for house purchase, the ECB will be conducting a series of targeted longer-term refinancing operations (TLTROs) valued at €400 billion over a four year period. The scheme follows the success of the UK Funding for Lending Scheme. So what of forward guidance … Domestic considerations suggest UK rates should be on the rise towards the end of the year. For the moment, forward guidance in the UK and the USA suggests rates will be held until the second quarter of 2015. This may change, if the trends in job growth continue here and in the USA. In Europe, forward guidance is more concerned with the prospects of deflation and a “lost decade”. An increase in rates is not on the “horizon” nor even in the appendix. So what happened to sterling this week? The pound closed up against the dollar at $1.679 from $1.675 and unchanged against the Euro at 1.231 (1.230). The dollar closed broadly unchanged at 1.364 from 1.362 against the euro and at 102.53 (101.80) against the Yen. Oil Price Brent Crude closed down at $108.48 from $109.35. The average price in June last year was $102.92. It is summer after all. Markets, the Dow closed up at 16,899 from 16,682 and the FTSE moved up to 6,858 from 6,852. UK Ten year gilt yields closed at 2.64 (2.56) and US Treasury yields closed at 2.55 from 2.46. Gold held at $1,250 from $1,251. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed