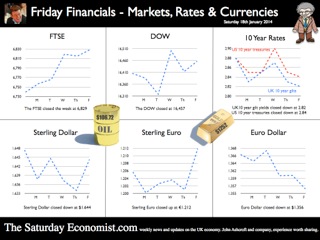

“If inflation is the genie, deflation is the ogre that must be fought decisively...” Christine Lagarde head of the IMF was speaking to the National Press Club in Washington this week. With inflation below central bank targets in Japan, USA and Europe, the IMF believe the rising risks of deflation could prove disastrous for the world recovery. Western leaders, haunted by fears of the American Great Depression and Japan’s Lost Decade, are fearful of premature monetary tightening which could threaten the nascent recovery. In folklore, a genie is a supernatural creature who does the bidding once summoned. This may not have been the intentioned meaning by the boss of the IMF but Mark Carney Governor of the Bank of England, could be forgiven the interpretation. This week, the inflation figures for December were released by the ONS. CPI inflation increased by just 2%. For the first time in over four years, the genie returned to target, as would an obedient creature, undertaking the bidding of the new Governor of the Bank of England. The genie is working hard to obey. It has taken some time to get the message into the bottle and the genie back on message! Mission accomplished? With such success, it would be churlish to point out that in the same month, RPI increased from 2.6% to 2.7%, goods inflation actually went up and service sector inflation closed the year at 2.4%. For the moment the wild ride of the last four years has come to a close. As Christine Lagarde stated, “Optimism is in the air, the deep freeze is behind us and the horizon is much brighter.” In further good news, UK manufacturing prices increased by just 1% in December and input costs actually fell by just over 1%. Import prices of metals, parts and equipment fell, reflecting higher sterling values and lower world prices. For the moment, the inflation outlook for 2014 appears benign. Deflation is the ogre ... So what of ogres and deflation. Ogres are monsters in legends and fairy tales that eat humans and are particularly cruel, brutish or hideous. In the UK fears of deflation are not evident. We still expect inflation to hover slightly above target through the year. The ogre of deflation will be banished within the Kingdom. Particularly with earnings on the rise and a Chancellor of the Exchequer, as the handsome prince, up for re election, pledging an increase in the minimum wage to £7 an hour over the next couple of years. Inflation has fallen to target much faster than we had envisaged. The good news - as earnings rise, the boost to real incomes will lead to a sustained level of growth in consumer expenditure and retail sales. Higher but not quite as high as the latest UK data might suggest perhaps! Retail Sales the nymph spirit ... This week, the ONS released the retail sales figures for December. Sales volumes increased by 5.3% and values increased by 6.1% compared to December last year. Despite the fears of the major retailers, the consumer hit the high street with great gusto in the run up to Christmas allegedly. Internet sales, increased by 11.8% and small stores, experienced higher growth with sales increasing by just over 8%. Can retail sales have been so strong in December? Contractions in volume sales amongst food stores and petrols stations adds to the confused picture in the month. According to the ONS, in the three months prior to December, retail sales volumes averaged just 2%. So much for saving for Christmas. The surge in activity in December appears rather high and slightly at odds to the anecdotal evidence from retailers themselves. The BRC, British Retail Consortium suggests sales increased by just 1.8% in December as footfall actually fell. The BDO high street tracker reported sales down in the pre Christmas week with a recovery to 3.5% growth in the final week of the year. Debenhams, M & S, Morrisons and Sainsburys struggled in the Christmas period. Argos, Dixons, Halfords, Primark, Lidl and Ocado amongst the winners in the multi channel race. The 5% growth in volumes reported by the ONS appears to be a high call. So much for lies, damned lies and seasonal adjustment. Shrek shacking up with the Sleeping Beauty ... Ogres returned to the High Street this week as Sports Direct revealed a near 5% stake in Debenhams. Imagine Shrek shacking up with Sleeping Beauty, shudders must have swept around the Debenhams board room. The subsequent put and call option by Sports Direct, just added more confusion to the retail horizon. So what happened to sterling? The pound closed at £1.6422 against the dollar and 1.2127 against the Euro. The dollar closing at 1.3538 against the euro and 104.23 against the Yen. Oil Price Brent Crude closed at $106.48. The average price in January last year was almost $113, so no real threat to inflation from crude oil prices Markets, moved higher. The Dow closed at 16,458 and the FTSE closed at 6,829. 7,000 on the FTSE a soft call for the near term. UK Ten year gilt yields closed at 2.84 and US Treasury yields closed at 2.82. Yields will test the 3% level as tapering accelerates into 2014. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research and our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed