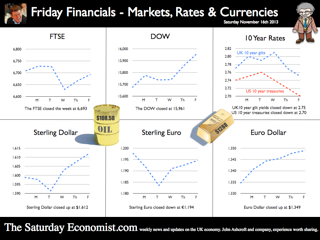

Economics news – you don’t have to be an optimist to see the glass is half full .. Yes it's the Inflation Report “You don’t have to be an optimist to see the glass is half full”, the opening remarks from Governor Carney’s Inflation Report presentation this week. The Governor went on to say, “the glass is half full and it will be filled”. A clear reference the recovery will be allowed to gain momentum before the Bank of England and the MPC will intervene “to take away the punch bowl” and begin the rise in base rates. The MPC are sticking with forward guidance. Rate rises will not even be considered until the level of unemployment hits 7% or even lower. [Subject to caveats on inflation expectations and market stability]. When will this be? In August the Bank assumed this would be in 2016 at the earliest. On Wednesday, the Governor admitted there was a 40% chance this could be by the end of 2014 with a 60% chance it would be by the end of 2015. Such has been the strength of the economics data over the last three months. Our own models assume the knock out unemployment rate will be hit by the third quarter of 2015. Thereafter rates may rise by around 50 basis points in short time. For the moment, the MPC are on a learning journey. The path of productivity, earnings, job creation and unemployment so unclear, we are all embarking on a “learning journey” suggested the governor. The £5m recently spent on the Bank of England model, of little value in the new world it would appear. Charlie Bean appeared most discomfited by the trip. Economics from Cambridge, a PhD from MIT and teaching at Stanford and LSE in the knowledge pack. One could be forgiven the reluctance to take the Mark Carney refresher course. But then why not? Having seriously failed to understand the impact of low rates on investment and depreciation on the trade balance, it is time to denounce the omniscient stance of the Oxbridge collective. Yes send them back to school. Martin Weale was indeed sent back to school this week. The MPC member was delivering a speech on the role of monetary policy and forward guidance to A-level students in London. “To cut a long story short, our job is to ensure that people buy coats when they need them”. Excellent. I am sure that cleared things up. Martin once worked in a shop apparently. Yes the black cloud gang disbanded, it’s back to school for all. Fill up your glasses, the punch bowl is on the table, the Carney Credit card is behind the bar. Inflation Good news for the Governor, inflation fell in October CPI to 2.2% from 2.7% in the prior month. Education hikes last year fell out of the index as we expected but the fall in transport costs pushed the index even lower. 2.4% CPI inflation was our call and still seems to be a reasonable target by the end of the year. Manufacturing prices suggest there is little cost pressure in the economy but retail energy prices are moving significantly higher. Retail Sales Retail sales figures in October were slightly disappointing, an increase of 1.8% in volume and 2.5% in value, slightly down on the averages in Q3. The demise of Barratts Shoes and Blockbuster a reminder, conditions remain tough on the high street as household real incomes remain under pressure. Internationally Janet Yellen, the new head at the Fed is still worried about the strength of the US recovery. Tapering may be postponed still later into the New Year. Growth in France and Japan in the third quarter a further warning the world recovery still requires accommodation. QE tapering US style is not the answer. Buying treasuries and Mortgage Backed Securities to support asset prices makes no sense. Blend a NASDAQ tracker fund into the purchase mix would follow the logic and demonstrate the folly. What happened to sterling? Sterling closed at £1.6113 from £1.6018. Against the Euro, Sterling closed at €1.1940 from €1.1982. The dollar moved up against the yen closing at ¥100.1 from ¥99.1 and closing at 1.3494 from 1.3368 against the Euro. Oil Price Brent Crude closed at $108.50 from $105.12. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, pushed higher - The Dow closed at 15,962 up from 15,762. The FTSE closed at 6,693 from 6,708. UK Ten year gilt yields closed at 2.75 from 2.77 US Treasury yields closed at 2.70 from 2.75. Yields will test the 3% level over the coming months. Gold closed at $1,288 from $1,284. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Friday Financials Feature with Monthly Markets updates coming soon. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed