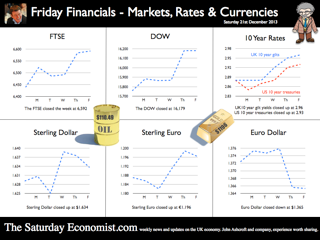

The good news for policy makers continued this week as inflation and unemployment continued to head in the right direction. The latest revisions to the National Accounts suggest the economy will grow by 2% this year. Inflation CPI ... falling Inflation CPI basis fell to 2.1% in November down from 2.2% in October. Manufacturing output prices increased by less than 1% in the month, unchanged from the prior period. Input costs for manufacturers actually fell by 1% as world commodity prices including metals and oil remained subdued. Overall the inflation outlook is benign with inflationary pressures diminishing. It will take some time for world demand to impact on price levels as long as the recovery in Europe remains protracted. We expect the international inflation outlook to look pretty soft over the next twelve months. Labour Costs ... set to rise On the other hand we expect a reversal in the trend in domestic labour costs by the end of next year. The claimant count fell by 37,000 in November to a level of 1.269 million, a rate of 3.8%. The overall number of claimants, over the past year, has fallen by 300,000 down from a rate of 4.6% in November 2012. 120,000 have found work over the past three months. At the current rate of jobs growth, the claimant count rate will fall to around 2.5%, within twelve to fifteen months. This is a pre recession rate, consistent with significant growth in rates of pay and remuneration. As it is, the rate of private sector earnings increased by almost 1.5% in October. The widely reported “whole economy rate” increased by just under 1% but the warning signs are there for policy makers - domestic inflationary pressures and labour costs will be back on the MPC agenda by the end of 2014. As unemployment falls ... The wider Labour Force Survey Data confirmed the unemployment level fell to 2.388 million in October and a rate of 7.4%. This is a fall of 120,000 over the past year as the overall number of people in employment increased by almost 500,000. The 7% hurdle rate outlined in Forward Guidance could be within reach within twelve months as the rate of economic growth accelerates into the final quarter of 2013 and into next. Interest rates are set to rise, probably after the 2015 election. Bank of England MPC Minutes ... The minutes of the Bank of England Monetary Policy Committee were released this week, explaining why base rates were not increased in the December meeting. The domestic recovery was robust with inflationary pressure diminishing it was said. The GDP figures had confirmed the rapid pick up in consumption growth. Strong contribution from stock building had been offset by a large drag from net trade. The overall divergence between domestic demand and net trade had been larger than expected. Any significant narrowing of the current account deficit in the near term seemed unlikely! Rebalancing ? Does this mean the MPC had got the message about the rebalancing agenda? Sadly not. The minutes went on to claim that a sustained recovery would require some rebalancing from domestic to external demand! Some hope, the UK is set for a classic consumption rally with domestic demand growth of significant proportions. Fears about the appreciation of sterling are misguided. Higher sterling will alleviate inflationary pressures and de facto improve margins and competitiveness of exports. For exporters, demand (not price) conditions are dominant. The sluggish recovery in Europe will be the real obstacle to export growth over the next twelve months. And what of Investment ... Better news for investment however. The minutes claimed that beyond the near term, it seemed likely that a pick up in business investment spending would be necessary, Business and Dwellings investment had been weaker than expected to date. Weaker than expected in the Bank of England model, perhaps. The good news is that, we expect a strong rally in investment spending in 2014 as capital expenditure projects are brought back to the board room on the back of stronger domestic demand. Just 20% of total investment is determined by plant and machinery and our models suggest the four year capital stock has fallen to £163 billion down from an average £183 billion in the three years prior to recession. That represents a fall of 12%. Our less aggressive ten year Capital Stock Model suggests the overall level of productive investment has fallen by just 2%. No threat to the output capacity of UK PLC. The shortfall will be addressed by additional investment over the next three years to restore capacity equilibrium. Investment in transport equipment is set to rally on the back of a a 10% increase in commercial vehicle sales this year. Intangibles “investment” is set to rise on the back of a healthier M & A and corporate finance market in 2014. Together transport equipment and intangible investments account for a further 20% of total investment. Why has investment been subdued ... ? Why has investment been subdued post recession? Well in general businesses will invest in response to rising demand not a fall in the cost of capital. More specifically, 60% of investment identified in the national accounts is linked to property, either dwellings or commercial real estate. No policy maker should be surprised by the lag in investment intentions in this sector. Significant price collapse has left almost half the banked commercial real estate under water on a conventional 65% LTV (loan to value) test. A significant recovery in prices is required to restore equilibrium in the commercial real estate sector. The recovery in property and real estate may be a little more protracted, than “other investment classes”. Nevertheless we expect strong investment growth in 2014 and 2015 with investment in “dwellings” staging a marked recovery. So what of the revisions to the National Accounts? The latest revisions to the National Accounts confirm the economy grew by 2% year on year in Q3. We now expect the economy to grow by 2% for the year as a whole and by 2.5% in 2014 rising to 2.7% in the following year. And what of tapering? The Fed announced the beginning of tapering with a reduction in the rate of asset purchases by $10 billion from January 2014. What is that all about? The Fed said, “The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.” Oh dear? The link between longer term rates and growth has never been fully explained as neither has the linkage between domestic asset price inflation and international deflationary pressures. Nevertheless, it is time to buckle up, we are leaving Planet ZIRP - This week, the US growth rate was revised up to 2% year on year in Q3, Fed rates will also be on the rise in 2015. What happened to sterling? The pound closed at £1.6351 from £1.6294. Against the Euro, Sterling closed at €1.1950 from €1.1856. The dollar moved up against the yen closing at ¥104. from ¥103.6 and closing at 1.3678 from 1.3740 against the Euro. Sterling is on a rally which has led to a break out above £1.60, but €1.20 still presents significant overhead resistance. Oil Price Brent Crude closed at $111.58 from $108.53. The average price in December last year was almost $110, so no real threat to inflation. Markets, US moved higher - The Dow closed at 16,275 from 15,755. The FTSE closed at 6,606 from 6,434. 7,000. UK Ten year gilt yields closed at 2.94 from 2.90 US Treasury yields closed at 2.89 from 2.87. Yields will test the 3% level as tapering accelerates. Gold closed at $1,207 from $1,239. That’s all for this week, and for this year. No Sunday Times and Croissants tomorrow or for the next few weeks. The professor and his team are away for a short break. Have a great Christmas of Holiday Break and have a Happy New Year. Join the mailing list for The Saturday Economist or forward to a friend John © 2013 The Saturday Economist, by John Ashcroft and Company, Dimensions of Strategy and The Apple Case Study. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed