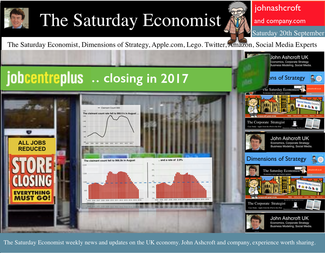

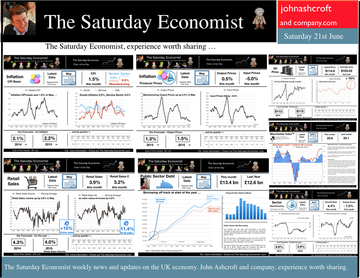

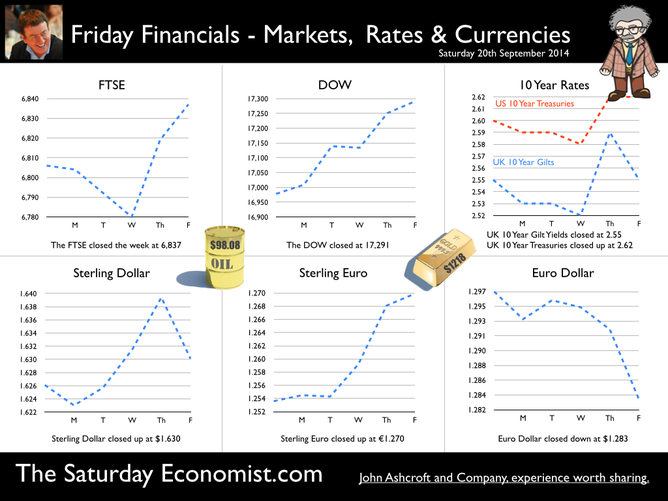

The prospect of a UK base rate rise before the end of the year receded this week with the release of latest data on inflation and earnings … Retail Prices … Retail price inflation CPI basis slowed to 1.5% in August from 1.6% prior month. Falls in the prices of motor fuels and food provided the largest downward contributions to the change in the rate. Markets expect CPI inflation to average 1.7% over the final quarter of the year, significantly below the MPC benchmark 2% target. Don’t worry about deflation too much, service sector inflation actually increased to a rate 2.7%, as goods inflation fell to 0.6%. Manufacturing Prices … Manufacturing output prices actually fell in August, down by -0.3% compared to a fall of -0.1% in July. Input costs, price of materials and fuels bought by UK manufacturers, fell -7.2% in the year to August, compared with a fall of -7.5% in the year to July. Crude oil costs were down by 14% as price of energy and import costs generally benefited from the weakness of world commodity and trade prices. The appreciation of Sterling helped, up by 8% against the dollar in the month. Home food material costs were down by -10%. Evidence that weak food prices at retail level are not really attributable to supermarket food wars after all. For the moment, inflation, or lack of it, is always and everywhere an international phenomenon. World trade prices are weak. Oil price Brent Crude is trading below $100 per barrel compared to $112 last year. Sterling closed at $1.63 this week up by just 3% compared to September last year. A warning perhaps, the currency contribution may be eroding and the dramatic fall in manufacturing costs may soon be reversed. Unemployment data … The number of people unemployed, claimant count basis fell below 1 million in August, the actual figure was 966,500 and a rate of 2.9%. Over the last six months over 200,000 have left the register. At this rate, job centres will be closing by the end of 2017, there will be no one looking for work. Despite the surging jobs market, pay data remains remarkably weak. Average earnings increased by 0.7% in July. Surprising given the rate of jobs growth. Some evidence of compression is more evident in manufacturing pay, up almost 2% and construction, up by 4%. Retail Sales ... Retail sales rallied in August as volumes increased by 3.9% year on year and values increased by 2.7%. Online sales volumes were up by 8.3% accounting for 11% of all retail transactions. Households are spending and will continue to do so. The August ©GfK Consumer Confidence Barometer confirms households are more optimistic, feel better off and believe it is a good time to spend. So what of base rates …? Janet Yellen, head of the Fed, gave additional guidance on the direction of US rates this week. “The Committee currently anticipates that economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run”. “A highly accommodative stance remains appropriate”. There was no real change in the police stance. Markets rallied and the Dow closed above 17,000. Analysts do not expect a rate rise in the USA before June next year. So what does this mean for UK rates? Weak growth in Europe, monetary accommodation in the US, low inflation and earnings data in the UK, will push the increase in UK base rates into 2015. Despite the schism on the committee, the MPC will be reluctant to move ahead of the Fed. No escape from Planet ZIRP just yet, we may regret the delayed take off in the years ahead. So what happened to sterling this week? Sterling rallied against the dollar to $1.630 from $1.626 and well up against the Euro at 1.270 from 1.254. The Euro was down against the dollar at 1.270 (1.297). Oil Price Brent Crude closed down at $98.08 from $97.62. The average price in September last year was $111.60. Markets, move up. The Dow closed at 17,291 from 16,978 and the FTSE closed down at 6,837 from 6,806. UK Ten year gilt yields moved 2.55 from 2.49 and US Treasury yields closed at 2.62 from 2.60. Gold drifted lower at $1,218 from $1,227. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here

0 Comments

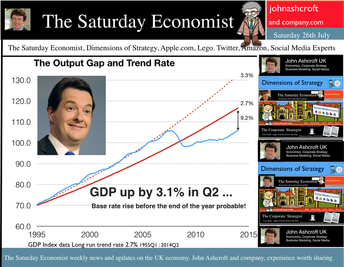

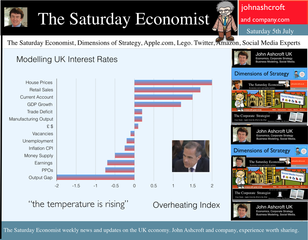

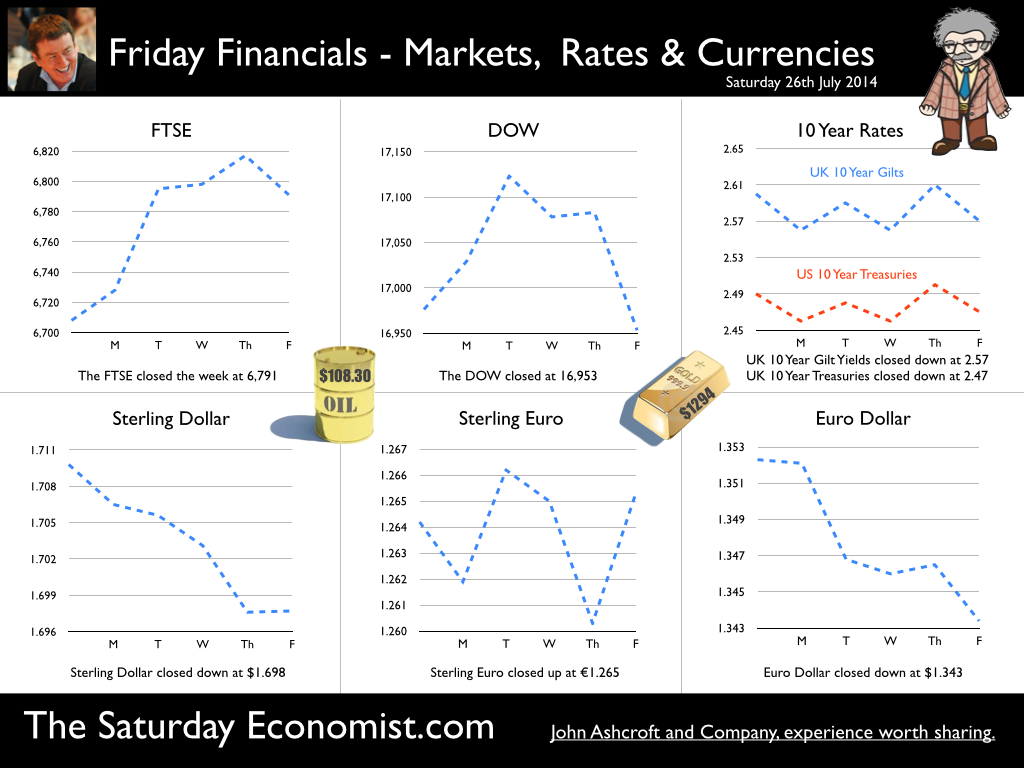

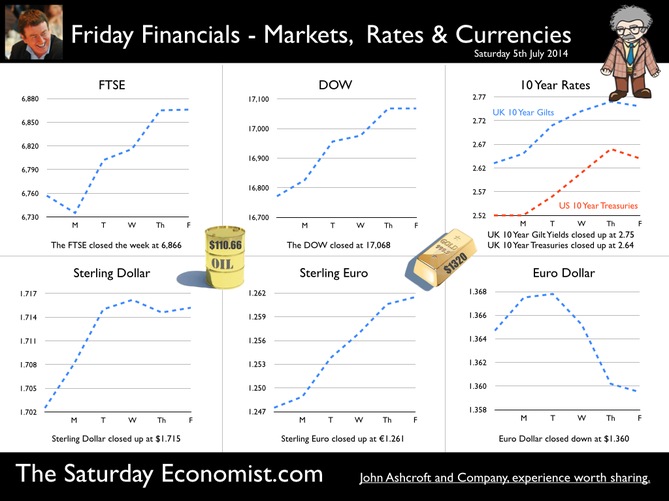

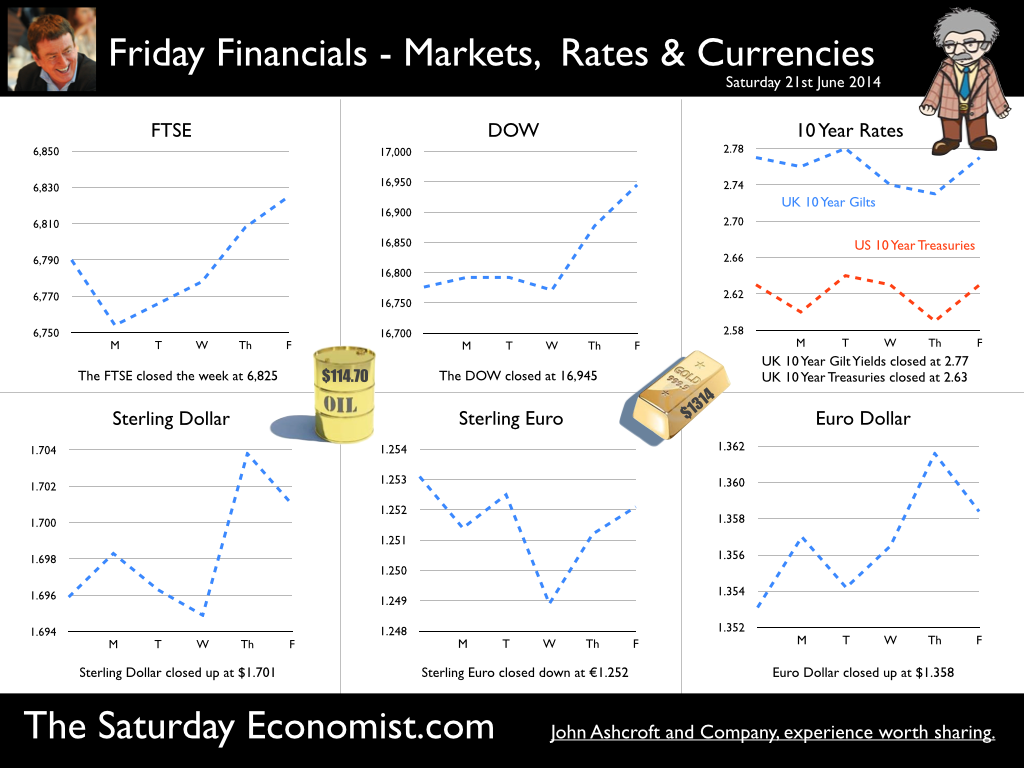

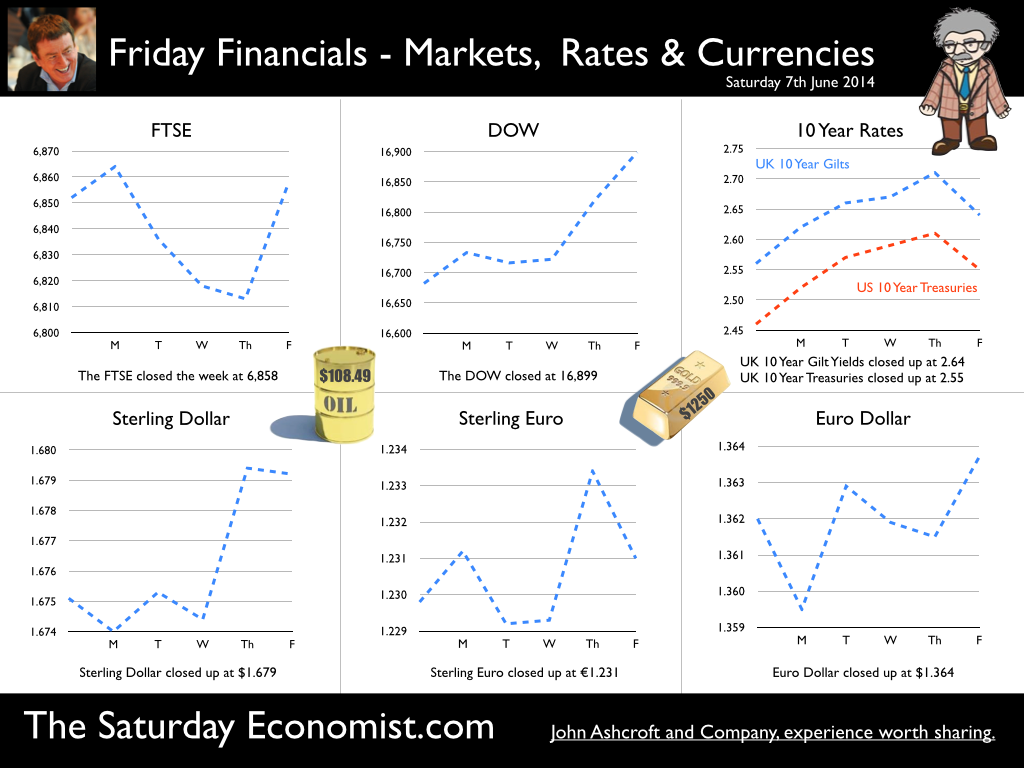

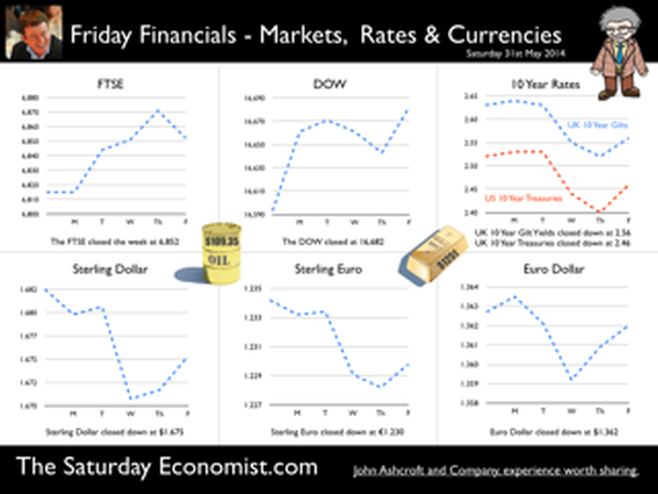

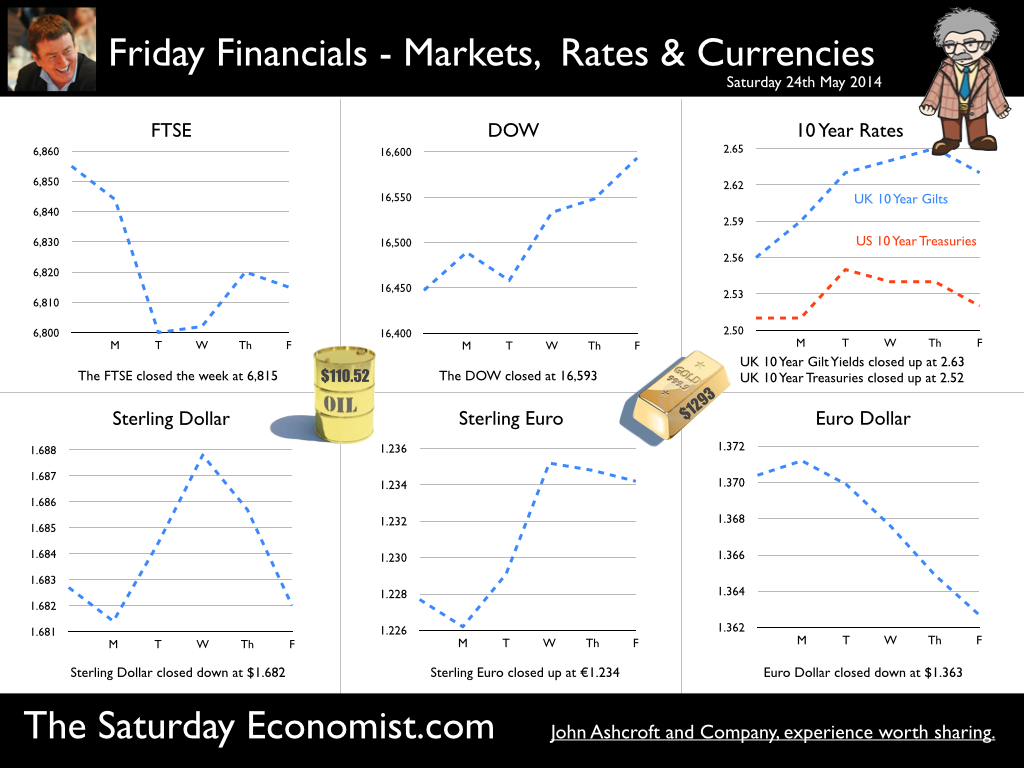

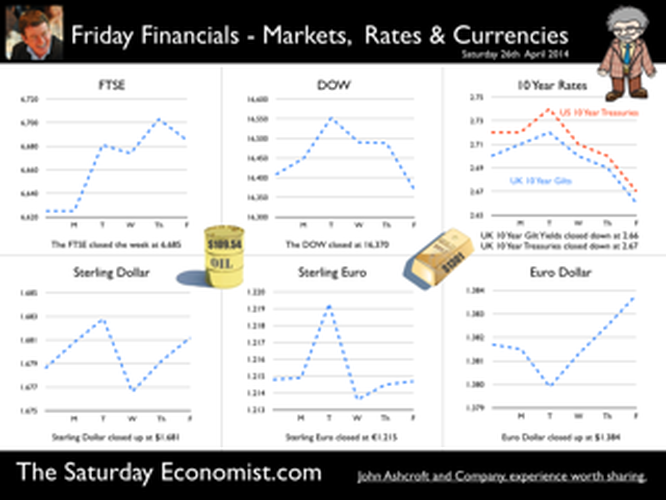

GDP up by 3.1% in Q2 ... a rate rise before the end of the year seems probable! The UK economy grew by 3.1% in the second quarter of the year according to the latest figures from the ONS. The economy is on track for growth of just over 3.0% this year and 2.8% next. The output gap closed to 9.2% based on our estimated long term trend growth rate of 2.7%. Service sector continued to support the expansion (up by 3.3%) with particularly good performances in the leisure sector (4.9%) and business services sector (4.2%). Manufacturing and construction also made strong contributions with growth of 3.2% and 4.2% respectively. This is the first estimate of growth based on partial information. The next update is due on the 16th August. The initial estimate may well be revised up (3.2%) based on revisions to the manufacturing data. This week the IMF revised their forecasts of the UK economy to 3.2% for 2014 and 2.7% next. The UK will be the fastest growing economy in the western world with deleterious implications for the trade balance. If the IMF forecasts are correct, UK growth will accelerate in the second half of the year to 3.4%. It‘s simple arithmetic not complex economics! If that is the case, The Saturday Economist™ Overheating Index™ will move higher, bringing the prospect of a rate rise before the end of the year into clear focus. Retail Sales … Retail sales volumes increased by 3.6% in June 2014 compared with June last year. This is lower than the average over the first six months of the year, a period within which the volume of sales averaged 4.1%. (March and April were particularly strong months for retail activity.) Retail sales growth averaged 3.9% in our benchmark period [200Q1 - 2008Q1]. The performance in June of 3.6% suggests MPC members will rest easy on the news, with no pressure on a rate rise evident in the data. The amount spent online increased by 13.4% year on year, accounting for 11.3% of all retail spending. The pressure on conventional retail is continuing to increase significantly. UK Government Borrowing : No fiscal fizzle, the deficit is increasing! Writing in the New York Times this week, Paul Krugman talked of the imaginary US budget and debt crisis. Despite all the fears of deficit doomsters, the US federal deficit will be just 2.8% of GDP this year, down from 9.8% in 2009. The economy is growing and the deficit is falling. It's a fiscal fizzle. “We don’t have a debt crisis, and we never did”, says Krugman. Excellent news for them over there! But is it so good over here? According to the figures released by the ONS this week, in the first three months of the year, total borrowing was higher than first quarter last year by some £3 billion. Total borrowing was £36.1 billion compared to £33.6 billion last year. Despite economic growth in the quarter of over 3%, the deficit is increasing rather than falling. The government is off track to hit the deficit target of £95.5 billion in 2014/15. The deficit to GDP ratio was 6.5% in 2013/14 set to fall to around 5.5% this year. On current trends this is not about to happen. Total debt of £1.3 trillion has risen to over 77% of GDP. Analysts are beginning to call for more cuts in spending to resolve the problem. Yet spending over the first three months of the year was up by less than 1% [ANLP basis] assisted by a fall in interest costs of almost 3%. The problem for the Chancellor - Exchequer revenues actually fell. Despite an increase in the VAT take of just over 4%, Income and CG taxes were down by 3.5%, which is bizarre in an economy growing by 3% in real terms and over 5% in nominal values. The US economy invariably demonstrates an ability to rebound, evaporating the internal deficit in the process in quite dramatic fashion. Fiscal drag, generates a fiscal fizzle, vaporising the deficit and improving the outlook for the Fed. In the UK, the process is more protracted. The current trend is troubling. No need to panic just yet. We still expect a significant rebound in the tax take through the year as the economy continues to grow at over 5% in nominal terms. The deficit was revised down last year to £105.8 billion. The target of £95.5 billion appears to be a stretch for the moment. No fiscal fizzle for the Chancellor more like a slow burn - the OBR targets could still be hit! So what of interest rates … At the last meeting of the MPC, the Committee agreed that no increase in base rates was warranted. For some members the decision had become “more balanced in the past few months compared to earlier in the year”. The latest figures on retail spending and GDP would suggest the decision remains finely balanced but the hawks will be flapping their wings. The Saturday Economist™ Overheating Index™, ticked higher this week as a result of the GDP data. The chances of a rate rise before the end of the year edged higher in line with the index. So what happened to sterling this week? Sterling closed down against the Dollar at $1.698 from $1.709 but up against the Euro to 1.265 from (1.263). The Euro moved down against the dollar at 1.343 from 1.352. Oil Price Brent Crude closed down at $108.30 from 108.40 from. The average price in July last year was $102.92. Markets, closed up. The Dow closed below the 17,000 level at 16,953 from 17,100 and the FTSE was up at 6,791 from 6,749. UK Ten year gilt yields were down at 2.57 from 2.60 and US Treasury yields closed at 2.47 from 2.49. Gold was down at $1,294 from $1,310. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  I made a trip to Liverpool this week. It was the Battle of the Economists, part of the International Festival of Business programme. Eight top economists were “in the ring” swapping punches. I “refereed” the morning event and hosted the Question Time session. It was a great event in the IFB calendar with lots of interesting perspectives on the world and UK economy. No blood spilled, nor egos bruised the outcome! To close the session, I asked the panel for views on when UK interest rates would begin to rise. Some argued for an immediate rate rise, most expected rates to rise in February next year and a few expected rates to rise in the November this year. As we said last week, “It is true there have been a lot of conflicting signals about when rates will rise! Following Mark Carney’s Mansion House speech, the odds in favour of a rate rise before the end of the year increased but then lengthened slightly, on the low inflation figures for May and the strength of sterling ”. “Don’t watch my lips - watch the data!” the new forward guidance from the Governor. This week, the data continued to suggest the rate rise would be sooner rather than later. House prices up almost 12% … House prices increased by almost 12% in the year to June according to Nationwide. In London prices increased by 26%. The price of a typical property in London, reached the £400,000 level with prices 30% above the 2007 highs. Should we be concerned? Of course but the rate of increase in house prices of itself, will not lead to an increase in interest rates necessarily. Sir Jon Cunliffe, Deputy Governor for Financial Stability at the Bank of England was in Liverpool this week. “The main risk we see arising from the housing market is the risk that house prices continue to grow strongly and faster than earnings. The concern is the increase in prices leads to higher and more concentrated household indebtedness.” The Bank is not worried about the rise in house prices per se. The FPC (Financial Policy Committee) is concerned about the risk to the banking sector from high household indebtedness exposed to the inevitable rate rise and potential collapse in asset prices. The introduction of measures on interest rate multiples and leverage, the confines of policy intervention for the moment. Car Sales up 10.6% year to date … The strength of the housing market demonstrates the strength of consumer confidence and spending. The economy is growing at 3% this year, retail sales were up by almost 4.5% in the first five months of the year, car sales were up by 6% in June and by 11% in the first six months. We are forecasting registrations will be over 2.4 million in 2014, higher than the pre recession levels recorded in 2007, placing additional pressure on the balance of payments in the process. Yet rates remain pegged at 0.5%! Does this continue to make sense? PMI Markit Purchasing Managers’ Index® Survey Data The influential PMI Markit surveys continue to demonstrate strong growth in the economy into June. In manufacturing, strong growth of output, new orders and jobs completed a robust second quarter. In construction, output growth continued at a four-month high and job creation continued at a record pace. In the service sector, the Business Activity Index, recorded 57.7 in June. The survey produced a record increase in employment with reports of higher wages pushing up operating costs. The Manchester Index™- nowcasting the UK economy The Manchester Index™, developed from the GM Chamber of Commerce Quarterly Economic Survey, slowed slightly from 35.1 in the first quarter to 33.6 in the second quarter, still well above pre recession levels. The data within the survey, confirms our projections for growth in the UK economy this year of 3%, moderating slightly to 2.8% in 2015. So when will rates rise ? The Saturday Economist Overheating Index revealed ... At the GM Chamber of Commerce Quarterly Economics Survey yesterday, we revealed the “overheating Index”. This is a summary of fourteen key indicators which form the basis of any decision to increase rates by the Monetary Policy Committee (MPC). The strength of consumer spending, reflected in house prices, retail sales and car sales would argue in favour of a rate rise earlier rather than later, as would the growth in the UK economy at 3% above trend rate. On the other hand, inflation, reflected in retail prices and manufacturing prices remain subdued. Despite the strength of the jobs market, earnings remain below trend levels. The decision, on when to increase rates, remains finely balanced for MPC members at this time. Our overheating index is broadly neutral but tipped slightly in favour of a rate rise now. By the final quarter of the year, assuming earnings and inflation rally from current levels, the decision will be much more clear cut. Based on data from the Overheating Index, we expect rates to rise before the end of the year. Clearly markets think so too ... So what happened to sterling this week? Sterling closed up again against the dollar at $1.715 from $1.702 and up against the Euro to 1.261 from (1.247). The Euro moved down against the dollar at 1.360 from 1.365. Oil Price Brent Crude closed down at $110.66 from $111.35. The average price in June last year was $102.92. Markets, US closed up on the strong jobs data. The Dow closed above the 17,000 level at 17,068 from 16,771 and the FTSE was also up at 6,866 from 6,757, the move above 7,000, too much for the moment. UK Ten year gilt yields were up at 2.75 from 2.63 and US Treasury yields closed at 2.64 from 2.63. Gold was up slightly at $1,320 from $1,316. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. The Manchester Index™ The influential Manchester Index™, is developed from the GM Chamber of Commerce Quarterly Economic Survey. It is a big survey which is comprehensive, authoritative and timely. Now we also have the Manchester Index™. The Manchester Index™ is an early indicator of trends in both the Manchester and the UK economy. Using the Manchester Index we are in a great position to “nowcast” the UK economy and get a pretty good steer on employment and investment in the process.  The Manchester Index™ confirms the UK recovery is on track with growth continuing around 3% into the second quarter of the year. The index fell slightly to 33.6 from 35.1, still much higher than pre recession levels. The preliminary results from the GM Chamber of Commerce QES data were available this week. The survey suggests strong growth in manufacturing continues, with slightly more moderate growth in the service sector. The results are in line with our forecasts for the full year - available in the June Economic Outlook. The full results and presentation on the influential Chamber of Commerce QES survey for Q2 will be available on the 4th July. Don’t miss that! Public Sector Finances off track … The strong performance in the economy is slightly at odds with the Public Sector Finances for May, released this week. The UK economy is expanding by just over 3% in the first half of the year. We would expect an improvement in borrowing given the strength of the recovery. Two months into the year and borrowing is off track compared to last year and to plan. In the first two months of the year, total borrowing was up at £24.2 billion compared to £23.2 billion prior year. Strong VAT revenues contributed to a 9% growth in total receipts but expenditure increased by almost 6%, despite a fall in interest payments. Last year’s borrowing figure has been revised to £107.0 billion for the financial year. Good news for the Chancellor but revenues will have to improve and expenditure will have to be contained, if this year’s OBR forecast is to be met. Strong Retail sales in May … Strong retail sales are contributing to the VAT receipts. In May retail sales volumes were up 3.9% compared to last year. This is down on April’s staggering 6.5% growth but we still expect growth of 4.6% in the current quarter and 4.3% for the year as a whole. Internet sales were up by 15%, now accounting for 11.4% of all activity. The online disruption continues. Sales values were up by just 3.2%, contributing to deflation and retail concerns in the High Street. Inflation slows in May … And so it was with the inflation figures. Inflation CPI basis slowed to 1.5% in May, down from 1.8% in April. Service sector inflation was 2.2% and goods inflation held at 0.9%. Falls in transport service costs, notably air fares, provided the largest contribution to the decrease in the rate. Other large downward effects came from food, drinks and clothing. The fall came as something of a surprise, we still expect inflation to track near target (2%) for the year as a whole. Producer Prices no pressure on inflation … No pressure on inflation is evident in the producer price information, released this week. Output prices in May increased by just 0.5% as input costs fell by 5%. Import prices of fuel, oil, food, metals, chemicals, parts, equipment and materials the real story. It is a story of weak international growth in GDP and trade, with slow growth in commodity prices, assisted by the strength of sterling, closing the week above the critical $1.70 level. Monetary Policy and Minutes of the MPC ... So why is Sterling so strong? Statements from Governor Carney that rates may rise “sooner than markets expect" are contrasting with the “Business as Usual” stance from the Federal Reserve. The Fed reduced the forecast GDP 2014 outlook for the US economy to just 2.2% from 3% earlier. Tapering is set to continue but guidelines suggest interest rates will not rise until the second quarter of next year. In the UK, we expect rates to rise in the final quarter of the year. Inflation and earnings suggest that strong growth of itself will not precipitate the rise. The Sterling genie is removing the $1.70 stopper. Who speaks for Sterling? We asked in March last year as the pound headed to the $1.50 level. Sterling look set to test $1.74 in the months ahead unless rate fears are calmed. So what happened to sterling this week? The pound closed up against the dollar pushing through resistance at the $1.70 level. Sterling closed up at $1.7010 from $1.696, steady against the Euro at 1.252 (1.253). The Euro strengthened against the dollar at 1.358 from 1.353. Oil Price Brent Crude closed up at $114.70 from $113.07 on Middle East concerns. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed up. The Dow closed down at 16,945 from 16,776 and the FTSE was also up at 6,825 from 6,790. UK Ten year gilt yields held at 2.77 and US Treasury yields closed at 2.63 from 2.77 on interest rate trends. Gold moved higher on geo political fears at $1,314 from $1,274. That’s all for this week. Visit the revamped web site. Download our Quarterly Forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. About the Manchester Index™ … The Greater Manchester economy correlates highly with trends in the national economy. The Manchester Index® is an early indicator of trends in both the Manchester and the UK economy. The index is derived from the GM Quarterly Economics Survey which forms part of the British Chambers of Commerce National Survey. Greater Manchester is the largest contributor to this important business survey. We poll 5000 businesses every quarter. As the principal national business survey and the first to be published in each quarter, the results are closely monitored by HM Treasury and the Bank of England Monetary Committee. The GM survey data has a high correlation with the national data. In other key indicators, the unemployment claimant count for example, has a high correlation (over 99%) with the national data set. Our business investment tracker utilises data from capacity and investment intentions to forecast investment in the UK economy. We lag capacity by four quarters and investment intentions by two quarters to model spending.  The MPC left rates on hold this week. We will have to wait a few weeks to find out if the vote was unanimous. For the moment the consensus view is likely to have held. But for how long will this be the case? Forward Guidance is already becoming confused by statements from Martin Weale and Charlie Bean. By the Autumn, the Bank may adopt Dr Doolittle’s pushmi.pullyu animal as a mascot. So thin - the margin of spare capacity - for consensus. The timing of rates is likely to become more polarised amongst MPC members. Who will make the first move? The “Wad is on Weale” to be the first to break ranks. UK data suggest rates may rise sooner … The UK data continues to suggest rates may have to rise sooner than forward guidance implies. Car sales in of May were up by almost 8% in the month and by 12% in the year to date. According to Nationwide, house prices increased by 11% in the twelve months to May. The Halifax House Price data suggested house prices increased by almost 9% over the same period. According to Stephen Noakes, Halifax Mortgages Director : “Housing demand is very strong and continues to be supported by a strengthening economic recovery. Consumer confidence is being boosted by a rapidly improving labour market and low interest rates”. Christine Lagarde and the IMF squad were in the UK this week. The IMF has warned that house prices pose the greatest threat to the UK recovery. It called on the Bank of England to enact policy measures "early and gradually" to avoid a housing bubble. The Fund's annual health check, suggested the UK economy has "rebounded strongly” confirming growth would "remain strong this year at 2.9%”. The IMF also suggested growth is becoming “more balanced” but … Trade deficit deteriorates … There was no evidence of rebalancing in the trade figures for April. The trade deficit in goods increased to £2.5 billion in the month as the deficit (trade in goods) increased to almost £10 billion. OK, someone forget to include all the oil data in the month, which may have under stated exports by £700 million but this is a minor detail. We expect the deficit (trade in goods) to be between £112 billion and £115 billion offset by a £50 billion service sector surplus this year. No rebalancing on the trade agenda, as we have long explained. Markit/CIPS UK PMI® Survey Data The Markit/CIPS UK PMI® survey data was also released this week. “The UK manufacturing upsurge continued”. The Manufacturing PMI index was 57.0 in May, down slightly from 57.3 in April. The survey noted strong growth in output and new orders. There was also a sharp rise in construction output. House building remained the strongest performing area of activity. The headline index was signaling growth for the thirteenth successive month at 60.0, compared to 60.8 prior month. The headline service sector index continued in positive territory at 58.6 compared to 58.7 last month. Service sector employment growth increased at the fastest rate in 17 years. Interest rate outlook … The strong growth in consumer spending, retail sales, car sales and the housing market continues. The outlook for output remains strong in construction, manufacturing and the service sector. We expect investment activity to increase this year. The unemployment rate will continue to fall, placing greater pressure on wage settlements, leading to an increase in earnings into the second half of the year. The trade deficit will continue to deteriorate albeit at a rate which is offset by the strength of the service sector surplus. Sterling will probably hold at current levels for the rest of the year. Inflation, will remain around target, such is the weakness of international energy and commodity prices for the near future. With such a strong outlook for the domestic economy, rates should probably be on the rise by the Autumn of this year. However the MPC will be reluctant to move ahead of the Fed and the ECB. USA and Europe ... In the USA, Friday’s strong jobs report confirmed the economy is improving following the slight setback in the first quarter. Non farm payroll increased by over 200,000 as the unemployment rate held at 6.3%. For the year as a whole, the Fed may downgrade the growth forecast to around 2.7% from 3% currently. For the moment, forward guidance suggests US rates may begin to rise in the second quarter of 2015 but the outlook may be shortened, if the job trends continue. In Europe, the ECB is heading in another direction. The growth forecast within the Eurozone is just 1% this year but officials are concerned about the prospect of deflation. The latest HICP figure confirmed prices increased by just 0.5% compared to 0.7% prior month. The ECB decided to lower the interest rate on the main refinancing operations of the Eurosystem by 10 basis points to 0.15% and the rate on the marginal lending facility by 35 basis points to 0.40%. The rate on the deposit facility was lowered by 10 basis points to -0.10%. To support bank lending to households and business, excluding loans for house purchase, the ECB will be conducting a series of targeted longer-term refinancing operations (TLTROs) valued at €400 billion over a four year period. The scheme follows the success of the UK Funding for Lending Scheme. So what of forward guidance … Domestic considerations suggest UK rates should be on the rise towards the end of the year. For the moment, forward guidance in the UK and the USA suggests rates will be held until the second quarter of 2015. This may change, if the trends in job growth continue here and in the USA. In Europe, forward guidance is more concerned with the prospects of deflation and a “lost decade”. An increase in rates is not on the “horizon” nor even in the appendix. So what happened to sterling this week? The pound closed up against the dollar at $1.679 from $1.675 and unchanged against the Euro at 1.231 (1.230). The dollar closed broadly unchanged at 1.364 from 1.362 against the euro and at 102.53 (101.80) against the Yen. Oil Price Brent Crude closed down at $108.48 from $109.35. The average price in June last year was $102.92. It is summer after all. Markets, the Dow closed up at 16,899 from 16,682 and the FTSE moved up to 6,858 from 6,852. UK Ten year gilt yields closed at 2.64 (2.56) and US Treasury yields closed at 2.55 from 2.46. Gold held at $1,250 from $1,251. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  It may have taken some time but households across Britain have finally come to terms the with strength of the recovery. According to GfK, the UK Consumer Confidence Barometer increased to levels last seen in the early part of 2005. Rejoice - we are having a recovery - would have been the Conservative mantra under Prime Minister Thatcher. Confidence in the economic situation of the country, increased to the highest level EVER, since records released in 2004. The propensity to spend is back to levels of 2006, even though the financial situation of households index is still below pre recession numbers. No surprise, perhaps, but with interest rates at such low levels, there is no real uptick in the intentions to save - for the moment at least. Interest Rates set to rise … Maybe households are waiting for the rates to rise. According to Markit®, nearly one in four households expect a rate rise within the next six months … almost half expect rates to rise within the next twelve months. Chris Williamson, Chief Economist at Markit® said, “the recent upbeat news-flow on the economy, strong economic growth in the first quarter, record employment growth and surging house prices, means an increasing number of people think it inevitable that policymakers will be forced into an earlier rate hike than previously envisaged.” Quite right! In fact almost ten per cent, think rates are set to rise within the next three months! So much for forward guidance from the Bank of England. Charlie Bean and Baby Steps … Charlie Bean, the outgoing (as in departing) deputy governor of the Bank of England has suggested “The argument for gradual rises suggests rates should start to go up sooner. The rise could start with “baby steps to avoid making mistakes”. “There’s a case for moving gradually because we won’t be quite certain about the impact of tightening the Bank rate, given everything that has happened to the economy.” The sentiment was also echoed by MPC member Martin Weale, this week. "We can wait a bit longer. How long that 'bit longer' will be I'm not sure.” Ah yes, the merits of forward guidance and a clear steer on monetary policy. Governor Carney will have to whip the MPC troops into line if we are to avoid complete confusion on the direction of rates. The Bank would still have us believe rates will rise in the second quarter of next year. UK rates should rise in the Autumn … In our Greater Manchester Chamber of Commerce Economic Quarterly Outlook, to be released next week, we begin to caution, UK rates should be on the rise in the Autumn, if the present trends in household spending, retail sales and the housing market continue. From an international perspective, the MPC will be reluctant to act ahead of the Fed and the ECB. In the first quarter, US GDP recorded growth of just 2% year on year, postponing, perhaps, the inevitable rate rise. In Europe, fears of deflation may force the ECB to act, to ease, rather than tighten, monetary conditions still further in the June meeting. Japan ends fears of deflation … In Japan, fears of deflation have been assuaged by Abenomics. The solution to fears of falling prices - increase the rate of sales tax and push up prices! Japanese inflation increased by over 3% in April, half of which is explained by the hike in taxes! Fears may later emerge about the slow down in growth, such is the Ground Hog day experience of the lost decade but for the moment, rejoice - the deflationary spiral has been broken in the East! Good News for growth in the UK … Good news for growth in the UK continued this week according to today’s Financial Times. Drugs and prostitution will add £10 billion to the UK economy. Yes, the news that prostitution and drugs will be included in the calculation of the National Accounts from September onwards, adding a new dimension to the “Service Sector” offer. The change will add almost £10 billion to the National Accounts. Hookers will contribute £5.3 billion to “output” (GDP(O)) and drug addicts will add £4.4 billion to the calculation of expenditure (GDP(E). According to ONS research, in 2009, 60,879 prostitutes serviced 25 clients per week at an average spend of £67.19. Don’t you just love economics! If only "tricks" paying 19p could be persuaded to spend more … that would be a recovery! So what happened to sterling this week? The pound closed down against the dollar at $1.675 from $1.682 and down against the Euro at 1.230 (1.234). The dollar closed broadly unchanged at 1.362 from 1.363 against the euro and at 101.80 (101.97) against the Yen. Oil Price Brent Crude closed down at $109.35 from $110.52. The average price in May last year was $102.30. Markets, the Dow closed up at 16,682 from 16,593 and the FTSE moved up to 6,852 from 6,815. The markets are set to move higher. UK Ten year gilt yields closed at 2.56 (2.63) and US Treasury yields closed at 2.46 from 2.52. Gold moved down to $1,251 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  It was one of those heavy weeks for economics releases. Inflation, retail sales, government borrowing plus the eagerly awaited second estimate of GDP. Add in ONS house price information and a heady cocktail of excited headlines was to be expected from the financial pages. Inflation data as expected … It began quietly enough with the inflation data. No surprises, CPI inflation edged up to 1.8% in April from 1.6% in the prior month. The large rise in service sector inflation to 2.8% from 2.3% was offset by a small decline in goods inflation, falling to 0.9% from 1.0%. The uptick was marginally reflected in producer prices, increasing to 0.6% from 0.5%. The more volatile input costs, fell at a slower rate -5.5%, from -6.3% prior month. Energy and oil prices, were again significant in the reduced input costs. Imported metals, chemicals, parts and equipment fell significantly assisted by the 10% appreciation of sterling against the dollar. For the year as a whole, we think inflation will hover close to the target for the best part of the year. The risk remains to the upside in the final quarter. A rise in international prices, and domestic demand, boosted by compression in the labour market is likely to push prices higher. No risk of deflation on the UK horizon, a real risk to the upside is developing. House Prices .. UK house prices increased, according to the ONS data, by 8% in the twelve months to March. “The house market may derail the recovery", the headline. “Carney believes that house prices are the biggest risk to the economy” the great caution. No matter, that house prices increased by over 9% in the prior month or that house prices outside London are increasing by just 4% on average. In the North West prices increased by just over 3%, in Scotland prices hardly increased at all. In London, house prices increased by 17%. Foreign cash buyers at the top end of the market may be confusing the overall trend. However, significant volume and price escalation in the mid tier market is also impacting on price averages. Governor Carney has made it clear interest rates will not rise to combat rising house prices. The remit to action lies with the Financial Policy Committee. Already, action has already been taken to modify the Funding for Lending Scheme away from mortgage lending. Discussions between the Bank and Treasury will continue to consider modifications to the “Help to Buy Scheme”. Implementation of the Mortgage Market Review will also curb lending into 2014. There is a structural problem in the housing market. Mark Carney, Governor of Threadneedle Street, points out that Canada has half the population of the UK but builds twice as many houses. No wonder there is a supply issue. But is the Bank of England prepared to help out? Not really. The Little Old Lady will not turn a sod, grab a hod nor build a single house this year. “We are not in the business of building houses” the Governor’s mantra. The Bank of England will not build a single house in this cycle but neither will it allow the housing market to derail the recovery, provoking a premature move in base rates. Retail Sales … Retail sales figures, on the other hand, suggest rates may have to rise much sooner than expected. Retail sales volumes increased by 6.8% in April compared to prior year. It was May 2004 when retail sales volumes increased at a similar rate. Base rates were 4.75% at the time rising to over 5% within eighteen months. Retail sales values increased by just over 6%. Online sales increased by 13%, accounting for 11% of total action. Consumer confidence is back to the pre recession levels, car sales are up by 8% this year and retail sales are soaring. From a UK perspective, rates should be on the move by the Autumn of this year. The MPC will be reluctant to move ahead of the Fed and the ECB. The international context suggests the rate rise may be delayed until the second quarter of 2015. Thereafter, for those who would argue the forward horizon has 2.5% cap, the retail sales figures and base rate history should provide a warning of surprises to come. GDP Second Estimate … No surprises in the second estimate of GDP release for Q1. No revisions. The UK economy grew by 3.1% boosted by an 8% surge in investment activity. Manufacturing and Construction increased by over 3% and 5% respectively. The economy is rebalancing … well a little bit! Our May Quarterly Economics Update on behalf of GM Chamber of Commerce is released next week. The outlook for the year remains broadly unchanged. We expect the UK economy to grow by around 3% this year and 2.8% in the following year. The surge in retail activity has been a surprise, as is the continued strength in employment. The outlook remains much the same. Growth up, inflation rising slightly, employment increasing and borrowing, despite the blip in April, set to fall. Just the trade figures will continue to disappoint as we have long pointed out. So what happened to sterling? The pound closed broadly unchanged against the dollar at $1.682 from $1.683 and up against the Euro at 1.234 (1.227). The dollar closed at 1.363 from 1.370 against the euro and at 101.97 (101.54) against the Yen. Oil Price Brent Crude closed up at $110.52 from $109.91. The average price in May last year was $102.3. Markets, the Dow closed up at 16,593 from 16,447 but the FTSE adjusted to 6,815 from 6,855. The markets are set to move, the push before the summer rush perhaps. UK Ten year gilt yields closed at 2.63 (2.56 and US Treasury yields closed at 2.52 from 2.51. Gold was unchanged at $1,293 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Next week the ONS will release the first estimate of GDP for Q1 2014. Expectations are for growth in the UK to be between 3% and 3.3% for the first three months of the year. The UK will be the fastest growing country in the developed world. A soggy start to the year may have damaged hopes in Washington to a claim on the title. Our own forecasts, realised last month, are at the bottom end of the range at just 3%. The Chancellor is creating a great platform in the run up to the election. Growth up, inflation down, employment up, borrowing down. Just the trade figures will continue to disappoint. The Osborne model for “austerity in recovery” may provide the textbook examples for the revisionist theory in the years to come. Four out of five rabbits ain’t so bad! The good news continued this week … Car Manufacturing According to the SMMT, car manufacturing picked up the pace in March as home and export markets improved significantly. UK car production rose 12% in the month to 142,158 units, bringing year to date growth to 2.9%. Good news for the UK’s volume manufacturers as European demand for cars strengthens. Not so good for the balance of payments. The growth in output will do little to offset the strength in domestic sales. New car registrations increased by 14% in the first three months of the year. Government Borrowing Better news on borrowing. Public sector borrowing totalled £107.7bn in the financial year. The out turn is £7.5bn lower than the £115.1bn borrowed in the prior year. Receipts were up by 4% with expenditure increasing by just 1%. The trend is heading in the right direction. The OBR expect borrowing to fall to £95 billion over the next twelve months and £75 billion in the following year. At the end of March 2014, public sector debt excluding temporary effects of financial interventions was £1,268.7 billion, equivalent to 75.8% of gross domestic product. Net debt has doubled since the end of the 2008/9 financial year. Retail Sales Even better news. Retail sales in March increased by 4.2% in volume and by 3.9% in value terms. Average prices of goods sold in March 2014 showed deflation of 0.5%. Fuel once again provided the greatest contribution to the fall in prices. The figures are consistent with the latest CPI data. But as we warned last week, oil prices Brent Crude Basis are now tracking ahead of last years levels for April and May. The deflationary shock may well be over. Domestic earnings are rising and world commodity prices are turning as the world and European recovery particularly, gathers momentum. Online sales were strong once again. The amount spent online increased by 7.1% in March 2014 compared with March last year. On line sales now account for almost 11% of total sales with a marked growth in food sales on line, increasing by almost 14%. Corporate Strategy Series Watch out for our Amazon case study coming soon. Over the Easter holidays, we released the second in our international corporate strategy series. The LEGO case study, follows on from the Apple Case Study originally developed for the Business School in Manchester. The third in the trilogy, Amazon will be released next month. Amazon is a great case study in how to grow (or how not to grow) an online business. Amazon with losses in 2000 of $1.4 billion on sales of $2.8 billion is probably the greatest example yet of a turnaround from burn rate to earn rate. How long can the Amazon model continue to grow? Is there much point in delivering salads in Seattle as part of the Amazon Fresh programme? Watch out for news of the release date.] So what happened to sterling this week? The pound closed up against the dollar at $1.681 from $1.679 and unchanged at 1.215 against the Euro. The dollar closed at 1.382 from 1.382 against the euro and at 102.15 (102.42) against the Yen. Oil Price Brent Crude closed at $109.54 from $109.76. The average price in April last year was $101.2. Markets, the Dow closed down slightly at 16,370 from 16,408 and the FTSE also closed up at 6,685 from 6,625. The markets will have to rally soon, if we are to sell in May and go away! UK Ten year gilt yields closed at 2.66 (2.70) and US Treasury yields closed at 2.67 from 2.72. Gold moved up to $1,301 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Inflation, deflation and retail sales … Inflation CPI basis fell to 1.7% in February from 1.9% at the start of the year. Good news for households as net earnings improve. Good news for the Bank of England as inflation hits the lowest level for almost five years. Interest rates are more likely to stay on hold into 2015. We never thought otherwise. Should we be worried about deflation? Not really. The fall was marked by a reduction in goods inflation. Service sector inflation, accounting for half the index, was unchanged at 2.4%. The other half, “goods stuff” slowed to 1.2% from 1.4%. Despite higher growth, lower unemployment and expansive monetary policy, inflation is drifting lower but it isn’t all one way. Fish and sewage prices increased by 6%, tobacco prices by 7%, utilities, gas and electricity up by over 6% and insurance costs up by 5%. If you plan to send a post card from your hospital bed to the kids in private school about a book you have just read. Don’t do it! Hospital services, postal services and book costs were up 6%. Education costs increased by over 10%. Stay healthy, watch TV and Skype the better solution. Strong growth in the UK suggests prices should be rising. So why the drop? The fall in inflation, particularly goods inflation is assisted by trends in world trade and prices, assisted by the appreciation of sterling. Manufacturing Prices … Sterling has appreciated by 10% over the year. World prices, oil and basic materials are relatively flat. In February, manufacturing input costs fell by 5.7% overall. Crude oil prices fell by 11% and imported metals and materials fell by 15% and 5% respectively. Imports of parts and equipment assisted the fall, down by 7%. Manufacturing output prices slowed to 0.5% from 0.9%. This will improve the retail inflation outlook over the short term. We haven't seen input costs fall like this since September 2009 as the UK and the world grappled with recession. So can it really last? World growth is increasing, world trade is growing, we still await the full recovery in Europe but it will come. Oil prices are becalmed, as the market tries to understand the implications of fracking in the USA. Commodity prices, particularly metals, copper, lead, zinc and iron ore are experiencing a market work out which reflects stock adjustment rather than supply and demand derterminants.. Sooner or later, commodity prices will turn, perhaps in the second half of the year. Fears of deflation are over played, as are the suggestions the inflation genie is back in the bottle in the UK. Retail Sales … UK domestic demand conditions are improving demonstrated by the strength of retail sales in the UK. Retail sales in February increased by 3.7%. Sales growth over the last three months has averaged 4.3%. Values in February increased by just 3.8%. On line sales increased by 12% in value accounting for almost 11% of all retail sales. Food sales increased by 14% with a 4% penetration. Clothing and footwear sales were up by 15% with an 11% share. National Accounts Data The latest revisions to UK gross domestic product (GDP) were released on Friday. GDP is estimated to have increased by 1.7% in 2013 revised down 0.1percentage points from the previously estimated 1.8% increase. Does this affect out outlook for the year? Not really. We have just released the GM Chamber of Commerce Quarterly Economic Outlook, in which we think growth will be around 2.9% this year. The forecast upgrade is as a result of the latest survey data and the strength of the Manchester Index®, a powerful indicator of trends in the UK economy. The late revisions will lower or forecasts for construction a little. Check out the full forecast on the GM Chamber Economics Web site. Manchester News Good news for Lynder Myers with a restructuring effected by Jepson Holt, Assure Law, EY and Duff & Phelps. Paul Smith from Duff & Phelps summed it up “the primary objective to find a solvent and consensual solution to a complex problem”. Excellent. So what happened to sterling? The pound closed at $1.664 from $1.649 and at 1.21 from 1.1956 against the Euro. The dollar closed at 1.375 from 1.3790 against the euro and 102.82 from 102.27 against the Yen. Oil Price Brent Crude closed at $108.01 from $107.37. The average price in March last year was $108. Markets, the Dow closed down at 16,323 from 16,410 and the FTSE closed at 6,615 from 6,557. UK Ten year gilt yields closed at 2.72 from 2.76 and US Treasury yields closed at 2.72 from 2.77. Gold loves a crisis, the crisis is over as the metal moved lower to $1,293 from $1,358. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Economics news – "The recovery is not yet secure" says the Chancellor ... The recovery is not yet secure and our economy is still too unbalanced. The Chancellor made use of a visit to Hong Kong this week to warn on the perils of the recovery. Just as well the Governor Mark Carney has stated the MPC will not take any risks with the rally. The Chancellor is concerned about the strength of the recovery. It is not yet secure, we are not making enough and we are not exporting enough, the continued claim. Hence in four weeks time George Osborne will deliver a budget that supports investment, manufacturing and exports. “A budget that ensures around the world, you can't help but see “Made in Britain”. A budget that lays the foundations for long term economic security". Excellent. Investment incentives and export support are both welcome. But we must ensure policy is founded on economic reality. We don’t need subsidies for the Spinning Jenny and a ban on homespun cotton from ancient empire. A strategy for investment and manufacturing, has to be grounded on firm foundations, fit for the 21st century. Christine Lagarde - the age of multilateralism As Christine Lagarde, pointed out in the Dimbleby lecture earlier this month, we live in the age of multilateralism. A world of integrated supply chains, where more than half of total manufactured imports and more than 70 percent of total service imports, are intermediate goods or services. “A typical manufacturing company today uses inputs from more than 35 different contractors across the world” according to the leader of the IMF. It is not so much as “Made in Britain” as assembled in Britain. It is not so much a question of exporting but “re-exporting”. Manufacturing exports are dependent on imports for raw materials, energy, processed goods, semi manufactures and finished components. The good news a strong currency will improve cost inputs, mitigating any re sale price effect. The bad news, any improvement in net trade in goods will be elusive. The Chancellor claimed “We cannot rely on consumers alone for our economic growth and we cannot put all our chips on the success of the City of London.” The fact is the recovery is driven by growth in the service sector, accounting for 80% of total output. Leisure, retail and financial services are leading the recovery, meeting the needs of an ambitious household sector accounting for two thirds of demand in the economy. We need a successful city of London, to generate the service sector surplus to offset the trade in goods deficit. As the Chancellor announced in Hong Kong, the UK is the first country in the G7 to agree an Renminbi swap line with the People’s Bank of China. London investors will have the confidence to expand their RMB activities. We may have in due course a RMB clearing bank in London. Chinese banks will be able to set up wholesale branches in the UK. This is all good news for the Banking, Financial and Professional services sector - essential for growth in the age of multilateralism. A policy dependent on the “March of the Makers” rebuilding the workshop of the world is neither balanced nor sustainable in the 21st Century. We shall see, just what the budget delivers next month. So what happened in the economy this week … A raft of economic data, confirming the recovery is on track for growth this year. Inflation, CPI basis, fell to 1.9% in January, pushed lower by a fall in goods inflation (1.4%) as service sector inflation remained steady at 2.4%. Unemployment fell, with a strong fall in the claimant count to 1.2 million, a rate of 3.6%. The wider LFS unemployment count, also fell in the month, albeit with a rate slightly up in the month to 7.2%. Earnings increased towards the end of the year. Retail sales were up in January by 4.3% in volume terms and 4.5% in value. The government borrowing figures for January at first sight, were a little disappointing with repayment in the month at £4.7 billion down from £6.3 billion last year. Tax receipts were significantly lower in the month, which is surprising given another 400,000 are in work with earnings are increasing. The figures will look better by the end of the financial year. We still think borrowing will be around £105 billion for the year as a whole. Heading in the right direction to eliminate the deficit in due course. So what does this all mean? The recovery may be unbalanced but probably is secure. Growth up, inflation down, employment up, borrowing down, just the trade figures will continue to disappoint, as we have long pointed out. So what happened to sterling? The pound closed down at $1.6640 from $1.6730 and at 1.210 from 1.222 against the Euro. The dollar closed at 1.3740 against the euro and 102.499 against the Yen. Oil Price Brent Crude closed at $109.67 from $108.56. The average price in February last year was almost $116. Markets, moved up - The Dow closed at 16,143 from 16,105 and the FTSE closed at 6,838 from 6,663. UK Ten year gilt yields closed at 2.79 from 2.80 and US Treasury yields closed at 2.75 from 2.74. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. John Join the mailing list for The Saturday Economist or why not forward to a colleague or friend? The list is growing as is our research and research team. Over ten thousand receive The Saturday Economist each and every week! © 2014 The Saturday Economist. John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed