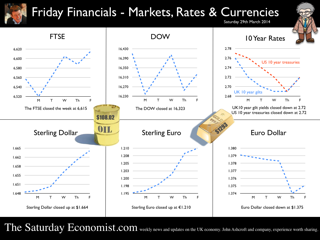

Inflation, deflation and retail sales … Inflation CPI basis fell to 1.7% in February from 1.9% at the start of the year. Good news for households as net earnings improve. Good news for the Bank of England as inflation hits the lowest level for almost five years. Interest rates are more likely to stay on hold into 2015. We never thought otherwise. Should we be worried about deflation? Not really. The fall was marked by a reduction in goods inflation. Service sector inflation, accounting for half the index, was unchanged at 2.4%. The other half, “goods stuff” slowed to 1.2% from 1.4%. Despite higher growth, lower unemployment and expansive monetary policy, inflation is drifting lower but it isn’t all one way. Fish and sewage prices increased by 6%, tobacco prices by 7%, utilities, gas and electricity up by over 6% and insurance costs up by 5%. If you plan to send a post card from your hospital bed to the kids in private school about a book you have just read. Don’t do it! Hospital services, postal services and book costs were up 6%. Education costs increased by over 10%. Stay healthy, watch TV and Skype the better solution. Strong growth in the UK suggests prices should be rising. So why the drop? The fall in inflation, particularly goods inflation is assisted by trends in world trade and prices, assisted by the appreciation of sterling. Manufacturing Prices … Sterling has appreciated by 10% over the year. World prices, oil and basic materials are relatively flat. In February, manufacturing input costs fell by 5.7% overall. Crude oil prices fell by 11% and imported metals and materials fell by 15% and 5% respectively. Imports of parts and equipment assisted the fall, down by 7%. Manufacturing output prices slowed to 0.5% from 0.9%. This will improve the retail inflation outlook over the short term. We haven't seen input costs fall like this since September 2009 as the UK and the world grappled with recession. So can it really last? World growth is increasing, world trade is growing, we still await the full recovery in Europe but it will come. Oil prices are becalmed, as the market tries to understand the implications of fracking in the USA. Commodity prices, particularly metals, copper, lead, zinc and iron ore are experiencing a market work out which reflects stock adjustment rather than supply and demand derterminants.. Sooner or later, commodity prices will turn, perhaps in the second half of the year. Fears of deflation are over played, as are the suggestions the inflation genie is back in the bottle in the UK. Retail Sales … UK domestic demand conditions are improving demonstrated by the strength of retail sales in the UK. Retail sales in February increased by 3.7%. Sales growth over the last three months has averaged 4.3%. Values in February increased by just 3.8%. On line sales increased by 12% in value accounting for almost 11% of all retail sales. Food sales increased by 14% with a 4% penetration. Clothing and footwear sales were up by 15% with an 11% share. National Accounts Data The latest revisions to UK gross domestic product (GDP) were released on Friday. GDP is estimated to have increased by 1.7% in 2013 revised down 0.1percentage points from the previously estimated 1.8% increase. Does this affect out outlook for the year? Not really. We have just released the GM Chamber of Commerce Quarterly Economic Outlook, in which we think growth will be around 2.9% this year. The forecast upgrade is as a result of the latest survey data and the strength of the Manchester Index®, a powerful indicator of trends in the UK economy. The late revisions will lower or forecasts for construction a little. Check out the full forecast on the GM Chamber Economics Web site. Manchester News Good news for Lynder Myers with a restructuring effected by Jepson Holt, Assure Law, EY and Duff & Phelps. Paul Smith from Duff & Phelps summed it up “the primary objective to find a solvent and consensual solution to a complex problem”. Excellent. So what happened to sterling? The pound closed at $1.664 from $1.649 and at 1.21 from 1.1956 against the Euro. The dollar closed at 1.375 from 1.3790 against the euro and 102.82 from 102.27 against the Yen. Oil Price Brent Crude closed at $108.01 from $107.37. The average price in March last year was $108. Markets, the Dow closed down at 16,323 from 16,410 and the FTSE closed at 6,615 from 6,557. UK Ten year gilt yields closed at 2.72 from 2.76 and US Treasury yields closed at 2.72 from 2.77. Gold loves a crisis, the crisis is over as the metal moved lower to $1,293 from $1,358. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed