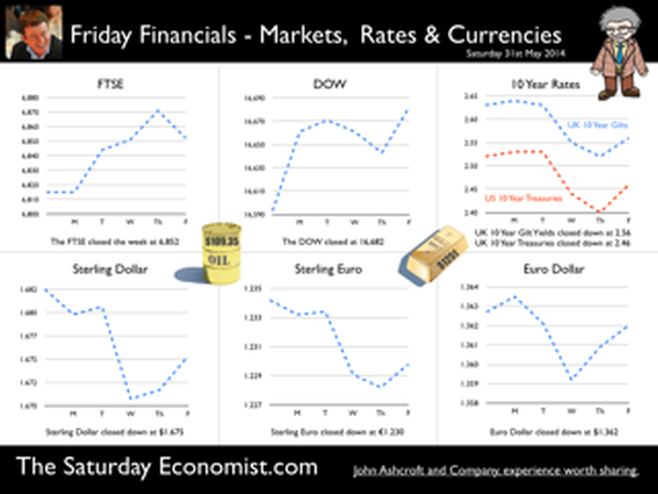

It may have taken some time but households across Britain have finally come to terms the with strength of the recovery. According to GfK, the UK Consumer Confidence Barometer increased to levels last seen in the early part of 2005. Rejoice - we are having a recovery - would have been the Conservative mantra under Prime Minister Thatcher. Confidence in the economic situation of the country, increased to the highest level EVER, since records released in 2004. The propensity to spend is back to levels of 2006, even though the financial situation of households index is still below pre recession numbers. No surprise, perhaps, but with interest rates at such low levels, there is no real uptick in the intentions to save - for the moment at least. Interest Rates set to rise … Maybe households are waiting for the rates to rise. According to Markit®, nearly one in four households expect a rate rise within the next six months … almost half expect rates to rise within the next twelve months. Chris Williamson, Chief Economist at Markit® said, “the recent upbeat news-flow on the economy, strong economic growth in the first quarter, record employment growth and surging house prices, means an increasing number of people think it inevitable that policymakers will be forced into an earlier rate hike than previously envisaged.” Quite right! In fact almost ten per cent, think rates are set to rise within the next three months! So much for forward guidance from the Bank of England. Charlie Bean and Baby Steps … Charlie Bean, the outgoing (as in departing) deputy governor of the Bank of England has suggested “The argument for gradual rises suggests rates should start to go up sooner. The rise could start with “baby steps to avoid making mistakes”. “There’s a case for moving gradually because we won’t be quite certain about the impact of tightening the Bank rate, given everything that has happened to the economy.” The sentiment was also echoed by MPC member Martin Weale, this week. "We can wait a bit longer. How long that 'bit longer' will be I'm not sure.” Ah yes, the merits of forward guidance and a clear steer on monetary policy. Governor Carney will have to whip the MPC troops into line if we are to avoid complete confusion on the direction of rates. The Bank would still have us believe rates will rise in the second quarter of next year. UK rates should rise in the Autumn … In our Greater Manchester Chamber of Commerce Economic Quarterly Outlook, to be released next week, we begin to caution, UK rates should be on the rise in the Autumn, if the present trends in household spending, retail sales and the housing market continue. From an international perspective, the MPC will be reluctant to act ahead of the Fed and the ECB. In the first quarter, US GDP recorded growth of just 2% year on year, postponing, perhaps, the inevitable rate rise. In Europe, fears of deflation may force the ECB to act, to ease, rather than tighten, monetary conditions still further in the June meeting. Japan ends fears of deflation … In Japan, fears of deflation have been assuaged by Abenomics. The solution to fears of falling prices - increase the rate of sales tax and push up prices! Japanese inflation increased by over 3% in April, half of which is explained by the hike in taxes! Fears may later emerge about the slow down in growth, such is the Ground Hog day experience of the lost decade but for the moment, rejoice - the deflationary spiral has been broken in the East! Good News for growth in the UK … Good news for growth in the UK continued this week according to today’s Financial Times. Drugs and prostitution will add £10 billion to the UK economy. Yes, the news that prostitution and drugs will be included in the calculation of the National Accounts from September onwards, adding a new dimension to the “Service Sector” offer. The change will add almost £10 billion to the National Accounts. Hookers will contribute £5.3 billion to “output” (GDP(O)) and drug addicts will add £4.4 billion to the calculation of expenditure (GDP(E). According to ONS research, in 2009, 60,879 prostitutes serviced 25 clients per week at an average spend of £67.19. Don’t you just love economics! If only "tricks" paying 19p could be persuaded to spend more … that would be a recovery! So what happened to sterling this week? The pound closed down against the dollar at $1.675 from $1.682 and down against the Euro at 1.230 (1.234). The dollar closed broadly unchanged at 1.362 from 1.363 against the euro and at 101.80 (101.97) against the Yen. Oil Price Brent Crude closed down at $109.35 from $110.52. The average price in May last year was $102.30. Markets, the Dow closed up at 16,682 from 16,593 and the FTSE moved up to 6,852 from 6,815. The markets are set to move higher. UK Ten year gilt yields closed at 2.56 (2.63) and US Treasury yields closed at 2.46 from 2.52. Gold moved down to $1,251 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed