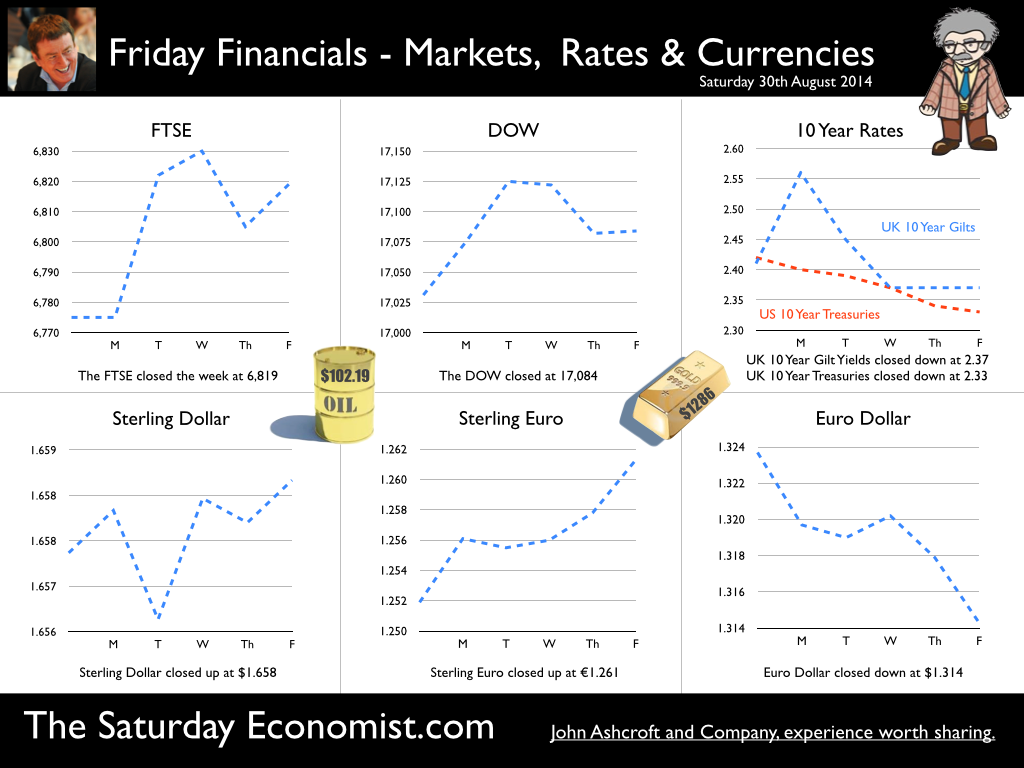

Give a man a fish and you feed him for a day Teach a man to fish - and you feed him for a lifetime! Yep - The old proverbs are great at summation but sometimes over looking the broader implications of the proposition. For the fisherman, thrusting a rod into hands is not enough. We have to preserve fish stocks, avoid pollution and ensure the piscators have a boat to reach the offshore shoals. A bit of international regulation helps, to guarantee the floating fish factories don’t suck away the livelihood of the locals. Yes, you can teach a man to fish but you leave him with nothing more than a stick in his hands and a soft line dangling into empty waters, unless broader policy issues are addressed. The great enemy of the truth is … What has this got to do with economics you may ask? We have to ensure the first principles of any proposition are covered in depth. JFK would say, “The great enemy of truth is very often not the lie - deliberate, contrived and dishonest but the myth - persistent, persuasive and unrealistic.” I feel the same way about QE, as I do about fishing. Allegedly stimulating growth and inflation, QE is a process in which central bankers buy debt from the debt management office underwritten by Treasury. In the UK HMT can then claim back the yield coupon eliminating the cost of debt issuance. It’s “money for nothing, gilts for free” a form of Dire Straits economics, which does little or nothing for growth or inflation. It is a combination of debt monetisation and financial repression. Ten year gilt yields at 2.3% are symptoms of the malaise, a combination of an over long stay on planet ZIRP with a toxic dose of QE, from time to time, in a misguided attempt to sustain life. QE is not the answer for Europe … In the UK, QE, intellectually discredited, came to an abrupt end in 2012. The Fed will terminate the US experiment in October this year. In Japan the nonsense persists. Kuroda, the Governor of the Bank of Japan continues with a QE programme worth $1.4tn (£923bn) despite the damage to the international gilt curve. This is the economy which introduced a sales tax in April, to stimulate inflation, ignoring the impact on demand and output. The impact on revenues muted in the process. In Europe, the torpor of the Euro economy continues, with news of rising employment and falling inflation. The Economist leads with “That Sinking Feeling Again” but what can Draghi do? Interest rates at the floor, Draghi can do no more, than talk down the Euro with a hint of QE to come. Why hold back? The ECB well understand, if there is nothing more powerful than idea whose time has come, there can be nothing more impotent or futile as an idea, for which the time has been and gone. So it is with QE, in part the problem of deflation lies elsewhere …. No Carnival in Brazil … In South America the bad news continues, a technical default in Argentina, major challenges in Venezuela and a down grade of growth forecasts in Brazil to just over 1% this year. An awful lot of coffee but no pick me up in Brazil as the world cup damaged output. Let them eat cacao but not watch football, the lesson from history. The latest data on world trade suggest that growth increased by 3.2% in the second quarter compared to 2.7% in Q1. The US recovery is assisting the process with news of a US GDP revision in the second quarter to growth of 2.5% compared to the earlier estimate of 2.4%. The world is recovering … So what of world prices? Deflation may be the spectre that haunts Europe but world price trends are partly to blame. World trade prices increased by just 0.4% in the second quarter after a fall of 1% in Q1. Oil, energy and commodity prices remain subdued. No rising prices as yet, so rates may be on hold for a bit longer … So what of base rates … Flip flops are becoming the footwear of choice for central bankers. Mark Carney, the unreliable boyfriend, started the fad, closely followed by Janet Yellen, fishing for answers in Wyoming last week. The consensus is for UK rates to rise by 25 basis points in February, as a rate rise before the end of the year is ruled out. So what happened to sterling this week? Sterling closed unchanged against the dollar at $1.658 from $1.657 but up against the Euro at 1.261 from 1.252. The Euro was down against the dollar at 1.314 (1.324). Oil Price Brent Crude closed down at $102.19 from 102.32. The average price in August last year was $111.28. Markets, rallied on the fishing report from Wyoming. The Dow closed up at 17,084 from 17,031 and the FTSE closed up at 6,819 from 6,775. UK Ten year gilt yields slipped to 2.37 from 2.41 and US Treasury yields closed at 2.33 from 2.34. Gold was slightly tarnished at $1,286 from 1,302. That’s all for this week. Join the mailing list for The Saturday Economist or please forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here *|MC:SHARE|*

0 Comments

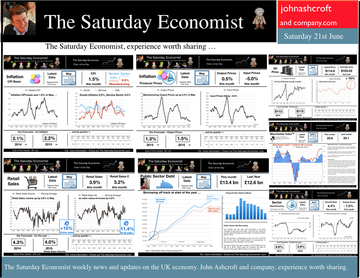

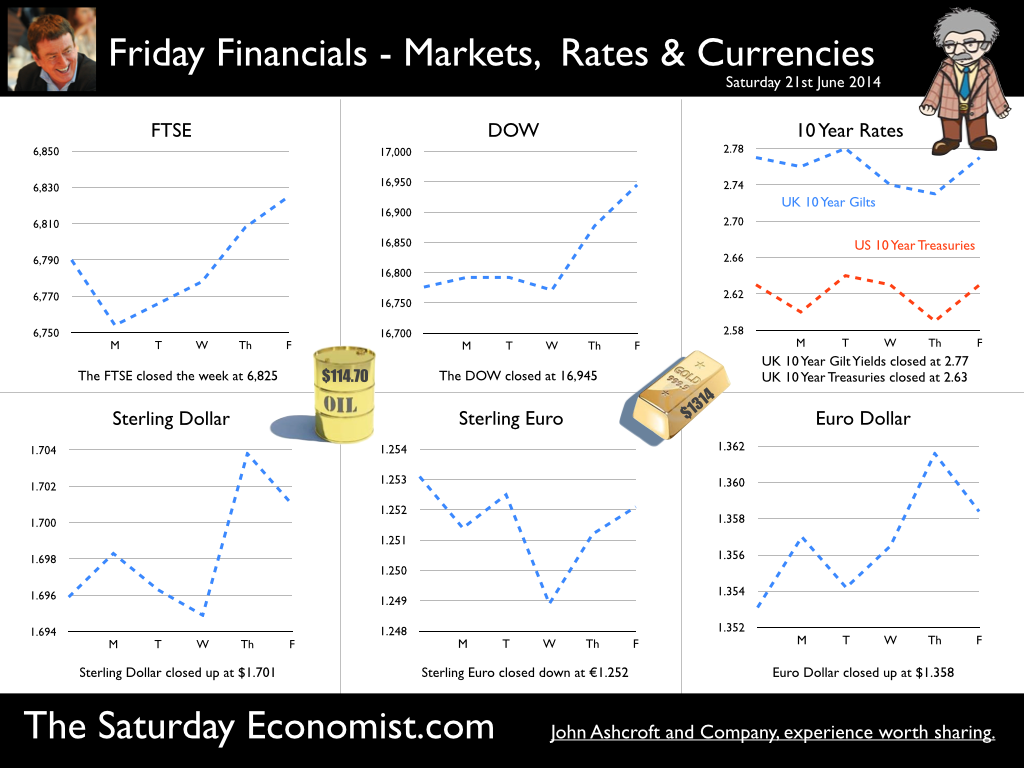

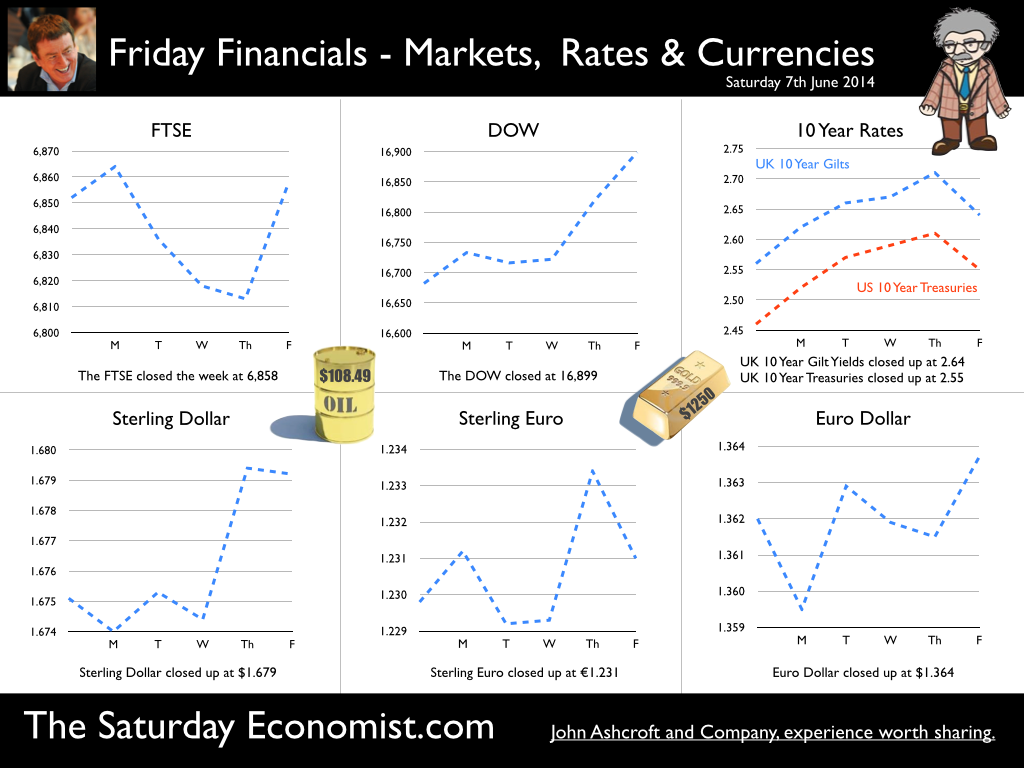

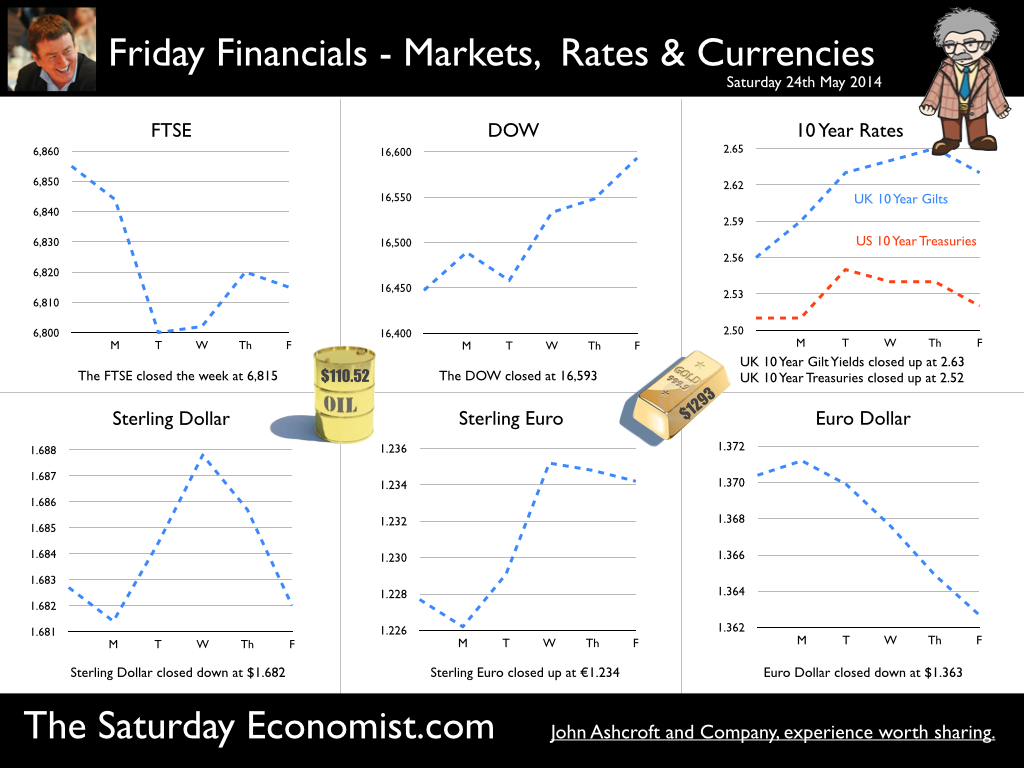

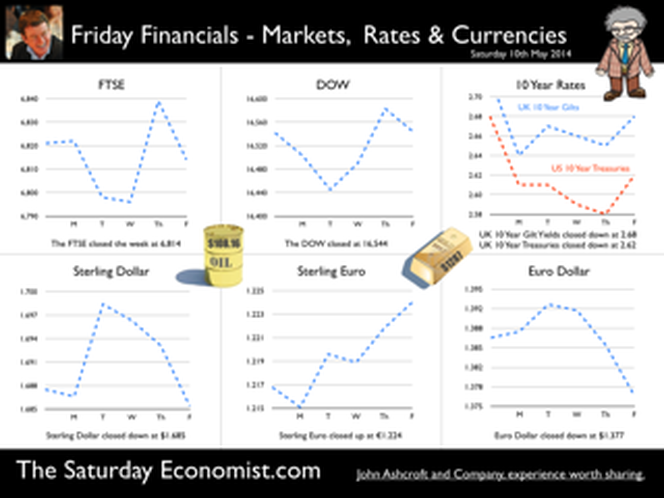

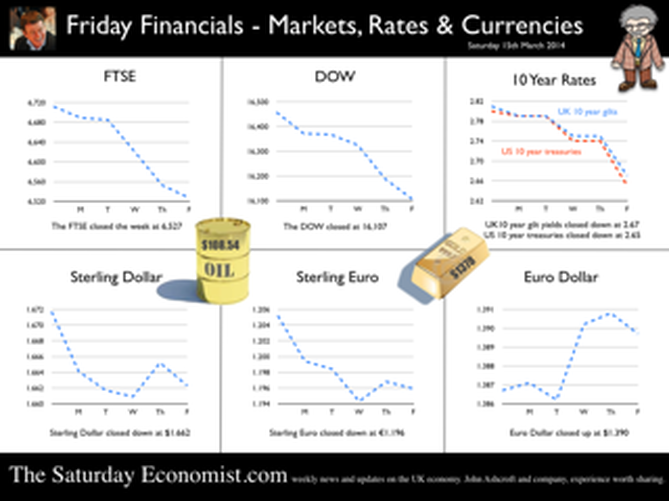

UK Interest Rates on hold ... No surprise this week as the MPC voted to keep rates on hold and to maintain the asset purchase facility at £375 billion. The decision to increase rates may becoming more finely balanced for some but the news from around the world, will disturb the hawks and give succour to the doves. The rate rise may well be held over into the new year, despite the continued strong performance of the domestic economy. The minutes of the MPC meeting, due later this month, may provide some insight into the overall views of the individual committee members. ECB and Rates ... problems in the East In Europe, rates were kept on hold as Draghi continues to consider QE. Action is needed but the futile process of debt monetisation will do little to offset the economies beset by weak levels of domestic demand. Complaints against the need for labour reform and excessive regulation will largely miss the point. Italy is slipping back into recession with forecasts for the current year downgraded once again to growth of just 0.2%. France will struggle to hit the 1% growth target this year and German export performance is slowing as economies are transfixed by the crisis in Ukraine. Trade sanctions and threat of war are damaging exports from Euro land to Eastern Europe and to Russia. The Euro trading block is now imperilled by it’s very “raison d’être” at inception. Growth in the Euro economies is expected to be just 1% this year with no prospect of a rate rise on the horizon until late 2015 / 2016 at the earliest. Production and Manufacturing ... In the UK, manufacturing data was surprisingly weak in the latest data for June but Euroland is not to blame. Output increased in the month by just 1.9% after strong growth of 3.6% in the first quarter and 4% in April and May. In the second quarter overall growth was up by 3.2%. The underlying data from the Markit/CIPS Manufacturing PMI® suggests strong growth continued into June and July which suggests the latest ONS data may be something of an aberration. [We are adjusting our forecast for the year to growth in manufacturing of 3.4% based on the latest data. Expectations for UK GDP growth are unchanged at 3% following revisions to our service sector forecast.] The Car Market … The SMMT reported strong car sales in July, with new registrations up by 6% in the month and 10% in the year to date. Output increased by 3.5% over the year. The car market is on track to sell 2.45 million units this year. That’s actually higher than the levels achieved in 2007. Assuming output hits the 1.55 million mark, the deficit (trade in cars) will increase to almost 900,000 units. Car manufacturing is benefitting from the recovery in consumer confidence and household spending but the trade deficit will increase as a result of the strength of domestic demand and limitations to domestic capacity. The UK cannot enjoy a period as the strongest growth economy in the Western world without a significant deterioration in the trade balance. Deficit trade in goods and services … And so it continued to prove with the latest trade data. The deficit trade in goods increased slightly in the month of June to £9.5 billion offset by a £7 billion surplus in services. For the second quarter, the deficit was £27.4 billion (trade in goods) and just under £7 billion overall, goods and services. The service sector surplus was £20.5 billion. For the year as a whole, we expect the goods deficit to be £112.3 billion offset by an £80 billion plus serve sector surplus. No threat to the recovery but we still have concerns about the current account deterioration and the drop in overseas investment income. In the first six months of the year, exports of goods have fallen by almost 8% in value and imports have fallen by 4.6%. World trade growth has been subdued in the first six months of the year yet UK domestic demand increased by 3%. Sterling appreciation against the dollar has lead to a translation impact on the trade balance rather than an elasticity effect. Construction and housing ... The latest adjustment for construction data confirms the recovery continues driven by a huge increase in new housing. Total output increased by 5.3% in June, up by 4.8% in Q2 2014 compared to Q2 last year. The total value of new work in the month increased by 5.8% with the volume of new housing increasing by 18% compared to June last year. House Prices ... The increase in housing supply is doing little to assuage the demand for house moves and house prices. Halifax and Nationwide reported prices up by 10% in July. Our transaction model is simple. Activity is a function of house prices and the real cost of borrowing. With mortgages fixed at 4%, the double digit capital appreciation is irresistible to the basic mechanics of a free market. The real cost of borrowing is negative 6%. Demand for housing will continue to out strip supply, despite the regulatory adjustments to the mortgage market. So what happened to sterling this week? Sterling closed down against the dollar at $1.6774 from $1.682 and unchanged against the Euro at 1.252. The Euro was largely unchanged against the dollar at 1.341. Oil Price Brent Crude closed up slightly at $105.02 from 104.84. The average price in August last year was $111.28. Markets, closed mixed. The Dow closed up 61 points at 16,554 from 16,493 and the FTSE closed down 112 points at 6,567 from 6,679. UK Ten year gilt yields were down at 2.46 from 2.557and US Treasury yields closed at 2.42 from 2.49. Gold was up at $1,305 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Governor of the Bank of England, was before the Treasury Select Committee this week. The members of the committee were disturbed. The MPC and the Governor in particular were behaving like an unreliable boyfriend, one day hot, one day cold, leaving "people" not really knowing where they stand! Is that entirely fair? We look to Shakespeare for advice on the "Quality of Guidance following the leader in The Times today. The quality of guidance is not strained, It droppeth as the gentle rain from heaven. Upon the market place beneath. It is thrice blest. It blesseth him that giveth and him that provides an update some months later. Tis mighty and moves markets, Yeah even the lofty dollar trembles at the sound. It becomes the governor of the Bank of England, yeah even better than the crown. His script doth amply demonstrate the force of monetary policy and power. The attribute to awe and majesty, wherein doth sit the mystery of spare capacity and yield. Guidance is a sceptred sway, first this way and that. Dethroned in the hearts of Kings long past, it is an attribute to deity itself. For monetary power doth then show likest best, when reality seasons theory and pragmatic policy rules the nest. Anon.  The Manchester Index™ confirms the UK recovery is on track with growth continuing around 3% into the second quarter of the year. The index fell slightly to 33.6 from 35.1, still much higher than pre recession levels. The preliminary results from the GM Chamber of Commerce QES data were available this week. The survey suggests strong growth in manufacturing continues, with slightly more moderate growth in the service sector. The results are in line with our forecasts for the full year - available in the June Economic Outlook. The full results and presentation on the influential Chamber of Commerce QES survey for Q2 will be available on the 4th July. Don’t miss that! Public Sector Finances off track … The strong performance in the economy is slightly at odds with the Public Sector Finances for May, released this week. The UK economy is expanding by just over 3% in the first half of the year. We would expect an improvement in borrowing given the strength of the recovery. Two months into the year and borrowing is off track compared to last year and to plan. In the first two months of the year, total borrowing was up at £24.2 billion compared to £23.2 billion prior year. Strong VAT revenues contributed to a 9% growth in total receipts but expenditure increased by almost 6%, despite a fall in interest payments. Last year’s borrowing figure has been revised to £107.0 billion for the financial year. Good news for the Chancellor but revenues will have to improve and expenditure will have to be contained, if this year’s OBR forecast is to be met. Strong Retail sales in May … Strong retail sales are contributing to the VAT receipts. In May retail sales volumes were up 3.9% compared to last year. This is down on April’s staggering 6.5% growth but we still expect growth of 4.6% in the current quarter and 4.3% for the year as a whole. Internet sales were up by 15%, now accounting for 11.4% of all activity. The online disruption continues. Sales values were up by just 3.2%, contributing to deflation and retail concerns in the High Street. Inflation slows in May … And so it was with the inflation figures. Inflation CPI basis slowed to 1.5% in May, down from 1.8% in April. Service sector inflation was 2.2% and goods inflation held at 0.9%. Falls in transport service costs, notably air fares, provided the largest contribution to the decrease in the rate. Other large downward effects came from food, drinks and clothing. The fall came as something of a surprise, we still expect inflation to track near target (2%) for the year as a whole. Producer Prices no pressure on inflation … No pressure on inflation is evident in the producer price information, released this week. Output prices in May increased by just 0.5% as input costs fell by 5%. Import prices of fuel, oil, food, metals, chemicals, parts, equipment and materials the real story. It is a story of weak international growth in GDP and trade, with slow growth in commodity prices, assisted by the strength of sterling, closing the week above the critical $1.70 level. Monetary Policy and Minutes of the MPC ... So why is Sterling so strong? Statements from Governor Carney that rates may rise “sooner than markets expect" are contrasting with the “Business as Usual” stance from the Federal Reserve. The Fed reduced the forecast GDP 2014 outlook for the US economy to just 2.2% from 3% earlier. Tapering is set to continue but guidelines suggest interest rates will not rise until the second quarter of next year. In the UK, we expect rates to rise in the final quarter of the year. Inflation and earnings suggest that strong growth of itself will not precipitate the rise. The Sterling genie is removing the $1.70 stopper. Who speaks for Sterling? We asked in March last year as the pound headed to the $1.50 level. Sterling look set to test $1.74 in the months ahead unless rate fears are calmed. So what happened to sterling this week? The pound closed up against the dollar pushing through resistance at the $1.70 level. Sterling closed up at $1.7010 from $1.696, steady against the Euro at 1.252 (1.253). The Euro strengthened against the dollar at 1.358 from 1.353. Oil Price Brent Crude closed up at $114.70 from $113.07 on Middle East concerns. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed up. The Dow closed down at 16,945 from 16,776 and the FTSE was also up at 6,825 from 6,790. UK Ten year gilt yields held at 2.77 and US Treasury yields closed at 2.63 from 2.77 on interest rate trends. Gold moved higher on geo political fears at $1,314 from $1,274. That’s all for this week. Visit the revamped web site. Download our Quarterly Forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. About the Manchester Index™ … The Greater Manchester economy correlates highly with trends in the national economy. The Manchester Index® is an early indicator of trends in both the Manchester and the UK economy. The index is derived from the GM Quarterly Economics Survey which forms part of the British Chambers of Commerce National Survey. Greater Manchester is the largest contributor to this important business survey. We poll 5000 businesses every quarter. As the principal national business survey and the first to be published in each quarter, the results are closely monitored by HM Treasury and the Bank of England Monetary Committee. The GM survey data has a high correlation with the national data. In other key indicators, the unemployment claimant count for example, has a high correlation (over 99%) with the national data set. Our business investment tracker utilises data from capacity and investment intentions to forecast investment in the UK economy. We lag capacity by four quarters and investment intentions by two quarters to model spending.  The MPC left rates on hold this week. We will have to wait a few weeks to find out if the vote was unanimous. For the moment the consensus view is likely to have held. But for how long will this be the case? Forward Guidance is already becoming confused by statements from Martin Weale and Charlie Bean. By the Autumn, the Bank may adopt Dr Doolittle’s pushmi.pullyu animal as a mascot. So thin - the margin of spare capacity - for consensus. The timing of rates is likely to become more polarised amongst MPC members. Who will make the first move? The “Wad is on Weale” to be the first to break ranks. UK data suggest rates may rise sooner … The UK data continues to suggest rates may have to rise sooner than forward guidance implies. Car sales in of May were up by almost 8% in the month and by 12% in the year to date. According to Nationwide, house prices increased by 11% in the twelve months to May. The Halifax House Price data suggested house prices increased by almost 9% over the same period. According to Stephen Noakes, Halifax Mortgages Director : “Housing demand is very strong and continues to be supported by a strengthening economic recovery. Consumer confidence is being boosted by a rapidly improving labour market and low interest rates”. Christine Lagarde and the IMF squad were in the UK this week. The IMF has warned that house prices pose the greatest threat to the UK recovery. It called on the Bank of England to enact policy measures "early and gradually" to avoid a housing bubble. The Fund's annual health check, suggested the UK economy has "rebounded strongly” confirming growth would "remain strong this year at 2.9%”. The IMF also suggested growth is becoming “more balanced” but … Trade deficit deteriorates … There was no evidence of rebalancing in the trade figures for April. The trade deficit in goods increased to £2.5 billion in the month as the deficit (trade in goods) increased to almost £10 billion. OK, someone forget to include all the oil data in the month, which may have under stated exports by £700 million but this is a minor detail. We expect the deficit (trade in goods) to be between £112 billion and £115 billion offset by a £50 billion service sector surplus this year. No rebalancing on the trade agenda, as we have long explained. Markit/CIPS UK PMI® Survey Data The Markit/CIPS UK PMI® survey data was also released this week. “The UK manufacturing upsurge continued”. The Manufacturing PMI index was 57.0 in May, down slightly from 57.3 in April. The survey noted strong growth in output and new orders. There was also a sharp rise in construction output. House building remained the strongest performing area of activity. The headline index was signaling growth for the thirteenth successive month at 60.0, compared to 60.8 prior month. The headline service sector index continued in positive territory at 58.6 compared to 58.7 last month. Service sector employment growth increased at the fastest rate in 17 years. Interest rate outlook … The strong growth in consumer spending, retail sales, car sales and the housing market continues. The outlook for output remains strong in construction, manufacturing and the service sector. We expect investment activity to increase this year. The unemployment rate will continue to fall, placing greater pressure on wage settlements, leading to an increase in earnings into the second half of the year. The trade deficit will continue to deteriorate albeit at a rate which is offset by the strength of the service sector surplus. Sterling will probably hold at current levels for the rest of the year. Inflation, will remain around target, such is the weakness of international energy and commodity prices for the near future. With such a strong outlook for the domestic economy, rates should probably be on the rise by the Autumn of this year. However the MPC will be reluctant to move ahead of the Fed and the ECB. USA and Europe ... In the USA, Friday’s strong jobs report confirmed the economy is improving following the slight setback in the first quarter. Non farm payroll increased by over 200,000 as the unemployment rate held at 6.3%. For the year as a whole, the Fed may downgrade the growth forecast to around 2.7% from 3% currently. For the moment, forward guidance suggests US rates may begin to rise in the second quarter of 2015 but the outlook may be shortened, if the job trends continue. In Europe, the ECB is heading in another direction. The growth forecast within the Eurozone is just 1% this year but officials are concerned about the prospect of deflation. The latest HICP figure confirmed prices increased by just 0.5% compared to 0.7% prior month. The ECB decided to lower the interest rate on the main refinancing operations of the Eurosystem by 10 basis points to 0.15% and the rate on the marginal lending facility by 35 basis points to 0.40%. The rate on the deposit facility was lowered by 10 basis points to -0.10%. To support bank lending to households and business, excluding loans for house purchase, the ECB will be conducting a series of targeted longer-term refinancing operations (TLTROs) valued at €400 billion over a four year period. The scheme follows the success of the UK Funding for Lending Scheme. So what of forward guidance … Domestic considerations suggest UK rates should be on the rise towards the end of the year. For the moment, forward guidance in the UK and the USA suggests rates will be held until the second quarter of 2015. This may change, if the trends in job growth continue here and in the USA. In Europe, forward guidance is more concerned with the prospects of deflation and a “lost decade”. An increase in rates is not on the “horizon” nor even in the appendix. So what happened to sterling this week? The pound closed up against the dollar at $1.679 from $1.675 and unchanged against the Euro at 1.231 (1.230). The dollar closed broadly unchanged at 1.364 from 1.362 against the euro and at 102.53 (101.80) against the Yen. Oil Price Brent Crude closed down at $108.48 from $109.35. The average price in June last year was $102.92. It is summer after all. Markets, the Dow closed up at 16,899 from 16,682 and the FTSE moved up to 6,858 from 6,852. UK Ten year gilt yields closed at 2.64 (2.56) and US Treasury yields closed at 2.55 from 2.46. Gold held at $1,250 from $1,251. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  It was one of those heavy weeks for economics releases. Inflation, retail sales, government borrowing plus the eagerly awaited second estimate of GDP. Add in ONS house price information and a heady cocktail of excited headlines was to be expected from the financial pages. Inflation data as expected … It began quietly enough with the inflation data. No surprises, CPI inflation edged up to 1.8% in April from 1.6% in the prior month. The large rise in service sector inflation to 2.8% from 2.3% was offset by a small decline in goods inflation, falling to 0.9% from 1.0%. The uptick was marginally reflected in producer prices, increasing to 0.6% from 0.5%. The more volatile input costs, fell at a slower rate -5.5%, from -6.3% prior month. Energy and oil prices, were again significant in the reduced input costs. Imported metals, chemicals, parts and equipment fell significantly assisted by the 10% appreciation of sterling against the dollar. For the year as a whole, we think inflation will hover close to the target for the best part of the year. The risk remains to the upside in the final quarter. A rise in international prices, and domestic demand, boosted by compression in the labour market is likely to push prices higher. No risk of deflation on the UK horizon, a real risk to the upside is developing. House Prices .. UK house prices increased, according to the ONS data, by 8% in the twelve months to March. “The house market may derail the recovery", the headline. “Carney believes that house prices are the biggest risk to the economy” the great caution. No matter, that house prices increased by over 9% in the prior month or that house prices outside London are increasing by just 4% on average. In the North West prices increased by just over 3%, in Scotland prices hardly increased at all. In London, house prices increased by 17%. Foreign cash buyers at the top end of the market may be confusing the overall trend. However, significant volume and price escalation in the mid tier market is also impacting on price averages. Governor Carney has made it clear interest rates will not rise to combat rising house prices. The remit to action lies with the Financial Policy Committee. Already, action has already been taken to modify the Funding for Lending Scheme away from mortgage lending. Discussions between the Bank and Treasury will continue to consider modifications to the “Help to Buy Scheme”. Implementation of the Mortgage Market Review will also curb lending into 2014. There is a structural problem in the housing market. Mark Carney, Governor of Threadneedle Street, points out that Canada has half the population of the UK but builds twice as many houses. No wonder there is a supply issue. But is the Bank of England prepared to help out? Not really. The Little Old Lady will not turn a sod, grab a hod nor build a single house this year. “We are not in the business of building houses” the Governor’s mantra. The Bank of England will not build a single house in this cycle but neither will it allow the housing market to derail the recovery, provoking a premature move in base rates. Retail Sales … Retail sales figures, on the other hand, suggest rates may have to rise much sooner than expected. Retail sales volumes increased by 6.8% in April compared to prior year. It was May 2004 when retail sales volumes increased at a similar rate. Base rates were 4.75% at the time rising to over 5% within eighteen months. Retail sales values increased by just over 6%. Online sales increased by 13%, accounting for 11% of total action. Consumer confidence is back to the pre recession levels, car sales are up by 8% this year and retail sales are soaring. From a UK perspective, rates should be on the move by the Autumn of this year. The MPC will be reluctant to move ahead of the Fed and the ECB. The international context suggests the rate rise may be delayed until the second quarter of 2015. Thereafter, for those who would argue the forward horizon has 2.5% cap, the retail sales figures and base rate history should provide a warning of surprises to come. GDP Second Estimate … No surprises in the second estimate of GDP release for Q1. No revisions. The UK economy grew by 3.1% boosted by an 8% surge in investment activity. Manufacturing and Construction increased by over 3% and 5% respectively. The economy is rebalancing … well a little bit! Our May Quarterly Economics Update on behalf of GM Chamber of Commerce is released next week. The outlook for the year remains broadly unchanged. We expect the UK economy to grow by around 3% this year and 2.8% in the following year. The surge in retail activity has been a surprise, as is the continued strength in employment. The outlook remains much the same. Growth up, inflation rising slightly, employment increasing and borrowing, despite the blip in April, set to fall. Just the trade figures will continue to disappoint as we have long pointed out. So what happened to sterling? The pound closed broadly unchanged against the dollar at $1.682 from $1.683 and up against the Euro at 1.234 (1.227). The dollar closed at 1.363 from 1.370 against the euro and at 101.97 (101.54) against the Yen. Oil Price Brent Crude closed up at $110.52 from $109.91. The average price in May last year was $102.3. Markets, the Dow closed up at 16,593 from 16,447 but the FTSE adjusted to 6,815 from 6,855. The markets are set to move, the push before the summer rush perhaps. UK Ten year gilt yields closed at 2.63 (2.56 and US Treasury yields closed at 2.52 from 2.51. Gold was unchanged at $1,293 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  UK … This week, the Bank of England’s Monetary Policy Committee voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of QE assets at £375 billion. No real surprise, UK rates are expected to remain on hold until the second quarter of 2015. For the moment, UK policy is relatively clear cut. USA … Over in the USA, matters became a little more diffuse. Tapering is expected to continue, concluding the asset purchase programme in September or October this year. But then what happens next? In March, Janet Yellen head of the Fed, gave a clear indication US rates would begin to rise within six months of the end of tapering. Markets reacted badly and the FOMC was minded to recant. This week, testifying before the Joint Economic Committee of the U.S. Congress, Chairman Kevin Brady pushed pushed Yellen for more clarity on when the FOMC would raise interest rates. The Fed chair would not be drawn on this occasion. “There is no mechanical formula for when that would occur” - the somewhat mechanical and evasive response. Oh yes, a month is a long time in the formulation of monetary policy. Europe … In Europe, Mario Draghi, President of the ECB, faced the opposite dilemma. With modest growth forecast for Euroland this year, inflation below target at less than 1% and a Euro strengthening against the dollar ($1.375), the Italian banker is under pressure to alleviate European monetary conditions still further. Playing for time, Draghi stated policy makers at the bank were comfortable with action in early June. Action awaits the “staff projections” for growth and inflation next month, before considering the next step. Draghi must hope forecasts are revised upwards. Having promised to “do what it takes” to stimulate growth, the President is clearly at a loss, as to what can be done next. A reduction in base rates to the zero floor would have little economic impact. Experimentation with negative rates is a high risk strategy. The move would thrill academic economists but cause trauma in the markets. This is no time for experimentation with central bank novelties. QE is muted as a possibility but with German and French long rates at 1.45% and 1.9%, there seems little cause to push rates lower. Ten year bond rates in Spain and Italy are this week trading within 25 basis points of UK gilts. MPC Dilemma … So here in a way is the dilemma for the MPC. The UK economy is growing at 3% a year, unemployment is falling at such a rate, we may have to close the job centres in 2017. Inflation is below target but as Mario Draghi pointed out this week, it is the weakness in international commodity prices, oil, energy and food, the real determinants of low inflation. Low inflationary pressure exacerbated or assisted by the rise in the Euro (and Sterling) against the Dollar. The UK is caught in the Dollar Euro vortex, with basic economics pushing monetary policy in opposing directions apparently. The MPC cannot move ahead of the Fed or much in advance of Europe for that matter without pushing Sterling still higher. Deflation the illusion - OECD World Forecasts This month the OECD forecast a recovery in world growth this year to 3.4% in 2014 and almost 4% in 2015. The Euro area is set to grow by 1.2% and 1.7% over the period. Euro inflation is set to rise above 1.2% next year. Commodity prices (base metals) are demonstrating a price basing action, Oil Brent Crude basis is trading ahead of last year. The international price profile can change quickly and dramatically. The threat of deflation - an illusion - which may quickly dissipate. A strong ECB president should do nothing. The US must accept rates will rise within six months of the end of tapering. This would leave the MPC free to begin the inevitable rate rise in the second quarter of next year. Want to here more, don’t miss the quarterly economics presentation on Wednesday at DWF next week. The multi media roadshow rolls on! So what happened to sterling this week? The pound closed unchanged against the dollar at $1.685 from $1.687 and up against the Euro at 1.224 (1.217). The dollar closed at 1.375 from 1.377 against the euro and at 101.18 (102.23) against the Yen. Oil Price Brent Crude closed at $108.16 from $108.50. The average price in May last year was $102.3. Markets, the Dow closed unchanged at 16,544 from 16,542 and the FTSE also closed up at 6,821 from 6,814. The markets are set to the move, the push before the rush. UK Ten year gilt yields closed at 2.68 (2.72) and US Treasury yields closed at 2.62 from 2.72. Gold moved down $1,287 from $1,296. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  UK march of the makers … Good news for the march of the makers this week, - manufacturing output increased by 3.3% in January compared to disappointing growth of just 1.9% in the final quarter of 2013. Still some way to go to restore the sector to positive growth. Output remains some 9% below the peak registered in the first quarter of 2008. Output of Investment and capital goods increased by 3.8%, continuing the strong trend since the setback in 2008. We expect manufacturing output to increase by 2.9% for the year as whole and around 2.7% in the following year. Consumer goods output remained weak with further declines in the month. For some sectors of manufacturing, the march of the makers is more like a retreat from Moscow, than a move across the Rhineland. The makers will fail to make a real contribution to the rebalancing agenda. So what of net trade … The trade figures for January were released this week. After the December aberration, a month in which the ONS appears to have lost some £2 billion of imports, the total trade balance returned to normality. A deficit of £2.6 billion compared to £0.7 billion last month. There was a trade shortfall of £9.8 billion on goods, partly offset by an estimated surplus of £7.2 billion on services. For the year as a whole, we expect the trade deficit in goods to increase to £114 billion, offset by a trade in service surplus of £85 billion. The overall trade in goods and services shortfall will be £29 billion. At less than 2% of GDP, the deficit will not pose a threat to the outlook for sterling, assuming investment capital flows recover. The trade deficit will fail to make a real contribution to the rebalancing agenda. And what of Construction … Good news in construction. Output increased by 5.4% in January compared to the same month last year. New work increased by almost 6% in the month, as repair and maintenance budgets also increased by 4.5%. For the year as a whole we expect construction growth of around 6%, with strong growth in housing and commercial property expansion fuelling growth. Prospects for the year … The OECD suggests the UK economy will grow by over 3% in the first half of the year, in line with the strong expectations from the Bank of England “Nowcasting” model, news of which was also released this week. The NIESR GDP tracker for February suggests growth may have slowed to 2.6% in February after strong growth of 3.2% in the prior month. For the year as a whole most forecasters are moving to a 2.7% growth figure. Seems reasonable for now. The recovery appears secure and sustainable. Growth up, unemployment down, inflation down and borrowing heading in the right direction. Just the trade figures will continue to disappoint as we have long pointed out. Charlie Bean on the North East Scene … Charlie Bean was in the North East this week, delivering a speech to the Chamber of Commerce. Further reassurance the MPC will be doing its utmost to ensure that recovery is not nipped in the bud. “When the time does come for us to start raising Bank Rate, we should celebrate that as a welcome sign that the economy is finally well on the road back to normality”. Excellent. Much of the rest of the speech was devoted to investment, productivity and net trade. As the deputy governor points out, the United Kingdom has run a persistent trade deficit of the order of 2-3% of GDP since the beginning of the century. So much for “rebalancing”. On investment, productivity, depreciation and “on shoring”, the speech demonstrates the lack of fundamental understanding of the real economy amongst policy makers at a senior level. We had hoped for better from the new regime. Charlie represents the old guard due to retire in June this year. Of The Treasury Select Committee … The Governor and members of the MPC were in front of the Treasury Select Committee this week. The protocol still eludes the new man. Governor Carney actually winked at Chairman Tyrie at one stage. It is difficult to imagine Governor King, managing a nod let alone a wink. It appears the meetings of the MPC are minuted and recorded. Then for good measure the tapes are destroyed. Lack of good recording equipment formed part of the explanation by the old guard. The solution to invest in better equipment seemed a little too obvious for the Chairman and the new Governor. Expect a rethink! Wink Wink. So what happened to sterling? The pound closed at $1.662 from $1.672 and at 1.196 from 1.205 from against the Euro. The dollar closed at 1.390 from 1.387 against the euro and 101.31 from 103.3 against the Yen. Oil Price Brent Crude closed at $108.34 from $108.86. The average price in March last year was $108. Markets, moved down concerned about China and the Ukraine - The Dow closed at 16,107 from 16,458 and the FTSE closed at 6,527 from 6,712. UK Ten year gilt yields closed at 2.67 from 2.81and US Treasury yields closed at 2.65 from 2.80. Gold loves a crisis, closing up at $1,378 from $1,338. That’s all for this week. No Sunday Times and Croissants tomorrow. All records of the tennis results will be recorded then destroyed. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  UK rates on hold … No surprise this week - the MPC voted to keep rates on hold and maintain the size of the asset purchase programme at £375 billion. It will be some months yet before rates begin to rise. Our current assumption is that rates will begin to rise in the second quarter of 2015. 40% of respondents in the latest Bank of England/GfK Inflation survey expect rates to rise over the next twelve months. No worries for the future apparently. Once on the rise, over 70% expect rates to be less than 3% in five years time. So much for the madness of crowds. Clearly the general public have a much better grasp of the latest simulations of the “equilibrium real interest rate associated with a neutral monetary policy over the medium term” than is generally assumed. They must have been listening to the speech by David Miles last month. Asked about the current rate of inflation, the median answer was 3.5% down from 4.4% in November. Excellent. So much for the madness and the wisdom of crowds. US Payroll data up … In the USA, better than expected payroll data guarantees the Federal Reserve will continue to taper, with a further reduction this month to $55 billion. Employers added 175,000 more jobs in February. Movement in US futures suggest the markets attach a "higher probability to a US rate rise in the middle of 2015". Fed officials have said they are “comfortable with market expectations of future rate rises”. We think US rate rises could be on the agenda by the end of 2014 or early 2015. The implications for UK rate rises should be evident. Our mantra - watch the USA and add six months - may be a little more compressed in this cycle. UK survey data … This week the February Markit/CIPS UK PMI® surveys were released. The strong upswing in the UK manufacturing sector continued in February. Output and new business continued to rise at above-trend rates. The leading index at 56.9 was up from a revised reading of 56.6 in January. In construction, the pace of expansion continued to rise sharply. The leading index scored 62.6 in February, down from a 77-month high of 64.6 in January. Still a very strong performance. In the service sector, output continues to expand strongly in the month. The headline Business Activity Index recorded 58.2 during February, little changed on January’s 58.3 and indicative of a sharp rise in activity on a monthly basis. Overall, output in construction, manufacturing and services suggest the economy continues to recover across the board at a very strong rate. The latest NIESR GDP tracker suggest growth increased by 3.5% in January. The Bank of England expects growth of over 3.5% in the first quarter. For the year as a whole, the consensus forecast is for growth of 2.7% this year. We await the details of the latest GM Chamber of Commerce survey before raising our estimates of growth this year. The GDP(O) model is signalling growth of 3% for the year as a whole. The survey data is a little more tempered, I suspect. In the UK and the USA, growth is accelerating and the job market is “tightening”. The pay round will become more difficult by the end of the year. Earnings are set to increase significantly as critical unemployment levels are breached by early 2015. Household incomes are set to improve and the recovery in spending will continue. There will be no “rebalancing”, whatever that really means. Growth up, unemployment down, inflation down and borrowing heading in the right direction. Just the trade figures will continue to disappoint. If growth hits 3% this year, disappointment could turn to shock and alarm. Then all forward rate bets will be off. So what happened to sterling? The pound closed at $1.672 from $1.675 and at 1.205 from 1.213 against the Euro. The dollar closed at 1.387 from 1.381 against the euro and 103.3 from 101.7 against the Yen. Oil Price Brent Crude closed at $108.86 from $109.02. The average price in February last year was almost $116 falling to $108 in March. Markets, moved slightly - The Dow closed at 16,458 from 16,367 and the FTSE slipped closing at 6,712 from 6,809. UK Ten year gilt yields closed at 2.81 from 2.72 and US Treasury yields closed at 2.80 from 2.67. Gold lovers worship alone with a close at $1,338. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  We will not take risks with this recovery … The Bank of England will not take risks with this recovery, according to the latest statements from Mark Carney, Governor of the Bank of England. Base rates will remain on hold for some time yet. When they begin to rise, the increase will be slow and gradual. It will be many years before fair value base rates of 4.5% will be on the agenda, according to the guidelines issued this week. Markets anticipate the first rate rise may appear in the second quarter of 2015. Thereafter a rise to 2% may be possible but not until the end of 2016 or the beginning of the following year 2017. “The level of interest rates necessary to sustain low unemployment and price stability will be materially lower than before the crisis,” the more cryptic quote. The recovery has gained momentum. Output is growing at the fastest rate since 2007, jobs are being created at the quickest pace since records began and the inflation rate is back at 2%. “The recovery has been underpinned by a revival in confidence, a reduction in uncertainty, and an easing in credit conditions”. Yes, Forward Guidance has been a success! The Bank of England expect the economy to grow by 3.8% this year and 3.3% next year assuming interest rates are held at 0.5% through 2014 and into 2015. Assuming rates follow the path outlined in current market profiles, growth will be a more modest 3.4% this year falling to 2.7% next. A recovery neither balanced or sustainable … No wonder the Bank consider the recovery is neither balanced nor sustainable. The recovery is dependent upon household spending, with a sluggish investment performance to date and a structural trade deficit, exacerbated by weak growth in Europe. Growth of 3.4% is significantly above trend rate and above most forecasts for the year. Consensus forecasts predict growth of just 2.7% in 2014 falling to around 2.5% next. The bank is very bullish on a recovery in earnings, consumer spending and investment. We shall see who is right in due course. For the moment, the Bank looks hot! So what of Forward Guidance … Forward guidance may have been a success but the single point reference to the unemployment rate has been beset with problems. The 7% guideline for unemployment will be breached in the first quarter this year. Hence the single point guideline is on the way out. It was too easy to understand. The Governor will not be allowed to make the same mistake again. The Bank collective has had its way. “To allow others to monitor how the economy is evolving relative to our projections, today we are publishing forecasts of 18 more economic indicators.” Excellent. Yes, now we will have eighteen guidelines to better understand policy. The output gap is back, as is the meandering NAIRU. Eighteen reasons why it will prove more difficult to pin the Governor in difficult interviews on Newsnight in the future. It was never clear why 7% was the correct number to choose anyway. The Americans bagged the 6.5% level first but the Governor admitted the long term NAIRU was more like 5% anyway. It was just a number but at least we could “see it” so to speak. Not so the “Output Gap”. What is the size of the output gap? What colour are the eyes of a Yeti? an equally productive debate. In a service sector economy with limited supply constraints, does it really matter anyway? Forward Guidance is a great step forward. Simplicity, part of the success, made the process just too transparent for some. Forward Guidance USA … Over in the USA, Janet Yellen, as the new Chair of the Fed provided assurances there would be policy continuance following the Bernanke regime. Accommodative monetary policy, with progressive tapering remains on the agenda. The US is expected to grow by almost 3% this year with inflation below 2%. Unemployment will fall below 6.5% through the year. So what of forward guidance, - markets believe a rise in base rates may be possible towards the end of this year or early next. So what happened to sterling? The pound closed up at $1.6730 from $1.6407 and 1.2220 from 1.2030 against the Euro. The dollar closed at 1.3690 from 1.3635 against the euro and 101.82 from 102.31 against the Yen. Oil Price Brent Crude closed at $108.56 from $109.57 The average price in February last year was almost $116. Markets, moved up - The Dow closed at 16,105 from 15,794 and the FTSE closed at 6,663 from 6,571. UK Ten year gilt yields closed at 2.80 from 2.71 and US Treasury yields closed at 2.74 from 2.69. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed