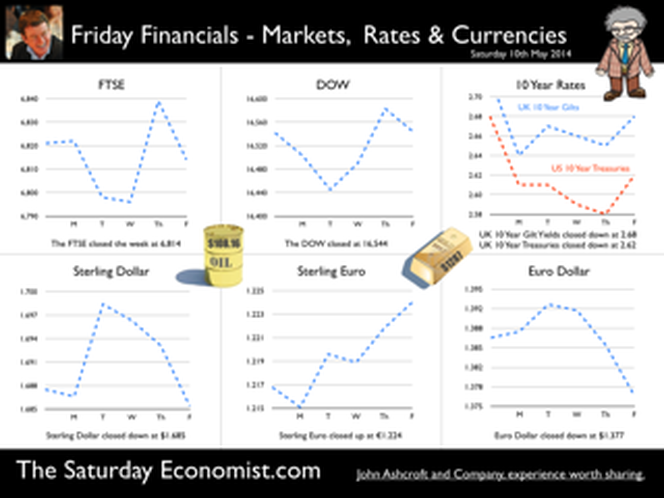

UK … This week, the Bank of England’s Monetary Policy Committee voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of QE assets at £375 billion. No real surprise, UK rates are expected to remain on hold until the second quarter of 2015. For the moment, UK policy is relatively clear cut. USA … Over in the USA, matters became a little more diffuse. Tapering is expected to continue, concluding the asset purchase programme in September or October this year. But then what happens next? In March, Janet Yellen head of the Fed, gave a clear indication US rates would begin to rise within six months of the end of tapering. Markets reacted badly and the FOMC was minded to recant. This week, testifying before the Joint Economic Committee of the U.S. Congress, Chairman Kevin Brady pushed pushed Yellen for more clarity on when the FOMC would raise interest rates. The Fed chair would not be drawn on this occasion. “There is no mechanical formula for when that would occur” - the somewhat mechanical and evasive response. Oh yes, a month is a long time in the formulation of monetary policy. Europe … In Europe, Mario Draghi, President of the ECB, faced the opposite dilemma. With modest growth forecast for Euroland this year, inflation below target at less than 1% and a Euro strengthening against the dollar ($1.375), the Italian banker is under pressure to alleviate European monetary conditions still further. Playing for time, Draghi stated policy makers at the bank were comfortable with action in early June. Action awaits the “staff projections” for growth and inflation next month, before considering the next step. Draghi must hope forecasts are revised upwards. Having promised to “do what it takes” to stimulate growth, the President is clearly at a loss, as to what can be done next. A reduction in base rates to the zero floor would have little economic impact. Experimentation with negative rates is a high risk strategy. The move would thrill academic economists but cause trauma in the markets. This is no time for experimentation with central bank novelties. QE is muted as a possibility but with German and French long rates at 1.45% and 1.9%, there seems little cause to push rates lower. Ten year bond rates in Spain and Italy are this week trading within 25 basis points of UK gilts. MPC Dilemma … So here in a way is the dilemma for the MPC. The UK economy is growing at 3% a year, unemployment is falling at such a rate, we may have to close the job centres in 2017. Inflation is below target but as Mario Draghi pointed out this week, it is the weakness in international commodity prices, oil, energy and food, the real determinants of low inflation. Low inflationary pressure exacerbated or assisted by the rise in the Euro (and Sterling) against the Dollar. The UK is caught in the Dollar Euro vortex, with basic economics pushing monetary policy in opposing directions apparently. The MPC cannot move ahead of the Fed or much in advance of Europe for that matter without pushing Sterling still higher. Deflation the illusion - OECD World Forecasts This month the OECD forecast a recovery in world growth this year to 3.4% in 2014 and almost 4% in 2015. The Euro area is set to grow by 1.2% and 1.7% over the period. Euro inflation is set to rise above 1.2% next year. Commodity prices (base metals) are demonstrating a price basing action, Oil Brent Crude basis is trading ahead of last year. The international price profile can change quickly and dramatically. The threat of deflation - an illusion - which may quickly dissipate. A strong ECB president should do nothing. The US must accept rates will rise within six months of the end of tapering. This would leave the MPC free to begin the inevitable rate rise in the second quarter of next year. Want to here more, don’t miss the quarterly economics presentation on Wednesday at DWF next week. The multi media roadshow rolls on! So what happened to sterling this week? The pound closed unchanged against the dollar at $1.685 from $1.687 and up against the Euro at 1.224 (1.217). The dollar closed at 1.375 from 1.377 against the euro and at 101.18 (102.23) against the Yen. Oil Price Brent Crude closed at $108.16 from $108.50. The average price in May last year was $102.3. Markets, the Dow closed unchanged at 16,544 from 16,542 and the FTSE also closed up at 6,821 from 6,814. The markets are set to the move, the push before the rush. UK Ten year gilt yields closed at 2.68 (2.72) and US Treasury yields closed at 2.62 from 2.72. Gold moved down $1,287 from $1,296. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed