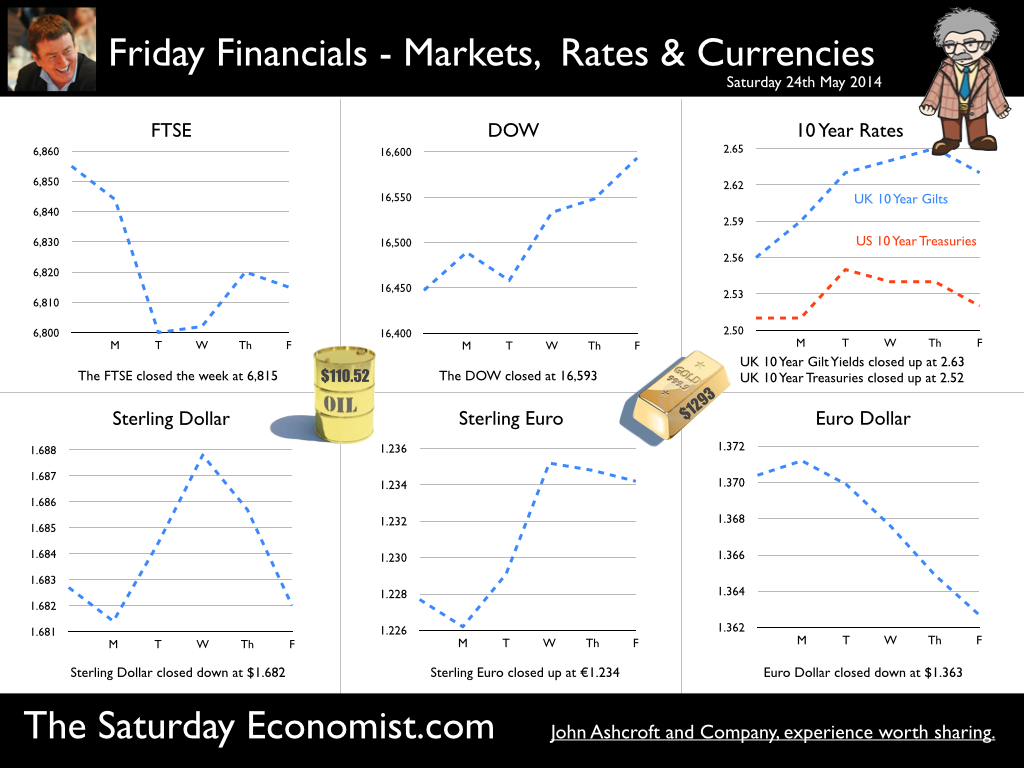

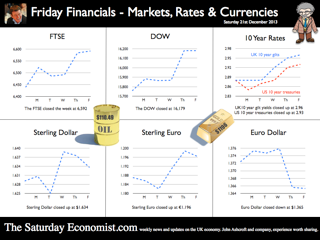

It was one of those heavy weeks for economics releases. Inflation, retail sales, government borrowing plus the eagerly awaited second estimate of GDP. Add in ONS house price information and a heady cocktail of excited headlines was to be expected from the financial pages. Inflation data as expected … It began quietly enough with the inflation data. No surprises, CPI inflation edged up to 1.8% in April from 1.6% in the prior month. The large rise in service sector inflation to 2.8% from 2.3% was offset by a small decline in goods inflation, falling to 0.9% from 1.0%. The uptick was marginally reflected in producer prices, increasing to 0.6% from 0.5%. The more volatile input costs, fell at a slower rate -5.5%, from -6.3% prior month. Energy and oil prices, were again significant in the reduced input costs. Imported metals, chemicals, parts and equipment fell significantly assisted by the 10% appreciation of sterling against the dollar. For the year as a whole, we think inflation will hover close to the target for the best part of the year. The risk remains to the upside in the final quarter. A rise in international prices, and domestic demand, boosted by compression in the labour market is likely to push prices higher. No risk of deflation on the UK horizon, a real risk to the upside is developing. House Prices .. UK house prices increased, according to the ONS data, by 8% in the twelve months to March. “The house market may derail the recovery", the headline. “Carney believes that house prices are the biggest risk to the economy” the great caution. No matter, that house prices increased by over 9% in the prior month or that house prices outside London are increasing by just 4% on average. In the North West prices increased by just over 3%, in Scotland prices hardly increased at all. In London, house prices increased by 17%. Foreign cash buyers at the top end of the market may be confusing the overall trend. However, significant volume and price escalation in the mid tier market is also impacting on price averages. Governor Carney has made it clear interest rates will not rise to combat rising house prices. The remit to action lies with the Financial Policy Committee. Already, action has already been taken to modify the Funding for Lending Scheme away from mortgage lending. Discussions between the Bank and Treasury will continue to consider modifications to the “Help to Buy Scheme”. Implementation of the Mortgage Market Review will also curb lending into 2014. There is a structural problem in the housing market. Mark Carney, Governor of Threadneedle Street, points out that Canada has half the population of the UK but builds twice as many houses. No wonder there is a supply issue. But is the Bank of England prepared to help out? Not really. The Little Old Lady will not turn a sod, grab a hod nor build a single house this year. “We are not in the business of building houses” the Governor’s mantra. The Bank of England will not build a single house in this cycle but neither will it allow the housing market to derail the recovery, provoking a premature move in base rates. Retail Sales … Retail sales figures, on the other hand, suggest rates may have to rise much sooner than expected. Retail sales volumes increased by 6.8% in April compared to prior year. It was May 2004 when retail sales volumes increased at a similar rate. Base rates were 4.75% at the time rising to over 5% within eighteen months. Retail sales values increased by just over 6%. Online sales increased by 13%, accounting for 11% of total action. Consumer confidence is back to the pre recession levels, car sales are up by 8% this year and retail sales are soaring. From a UK perspective, rates should be on the move by the Autumn of this year. The MPC will be reluctant to move ahead of the Fed and the ECB. The international context suggests the rate rise may be delayed until the second quarter of 2015. Thereafter, for those who would argue the forward horizon has 2.5% cap, the retail sales figures and base rate history should provide a warning of surprises to come. GDP Second Estimate … No surprises in the second estimate of GDP release for Q1. No revisions. The UK economy grew by 3.1% boosted by an 8% surge in investment activity. Manufacturing and Construction increased by over 3% and 5% respectively. The economy is rebalancing … well a little bit! Our May Quarterly Economics Update on behalf of GM Chamber of Commerce is released next week. The outlook for the year remains broadly unchanged. We expect the UK economy to grow by around 3% this year and 2.8% in the following year. The surge in retail activity has been a surprise, as is the continued strength in employment. The outlook remains much the same. Growth up, inflation rising slightly, employment increasing and borrowing, despite the blip in April, set to fall. Just the trade figures will continue to disappoint as we have long pointed out. So what happened to sterling? The pound closed broadly unchanged against the dollar at $1.682 from $1.683 and up against the Euro at 1.234 (1.227). The dollar closed at 1.363 from 1.370 against the euro and at 101.97 (101.54) against the Yen. Oil Price Brent Crude closed up at $110.52 from $109.91. The average price in May last year was $102.3. Markets, the Dow closed up at 16,593 from 16,447 but the FTSE adjusted to 6,815 from 6,855. The markets are set to move, the push before the summer rush perhaps. UK Ten year gilt yields closed at 2.63 (2.56 and US Treasury yields closed at 2.52 from 2.51. Gold was unchanged at $1,293 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

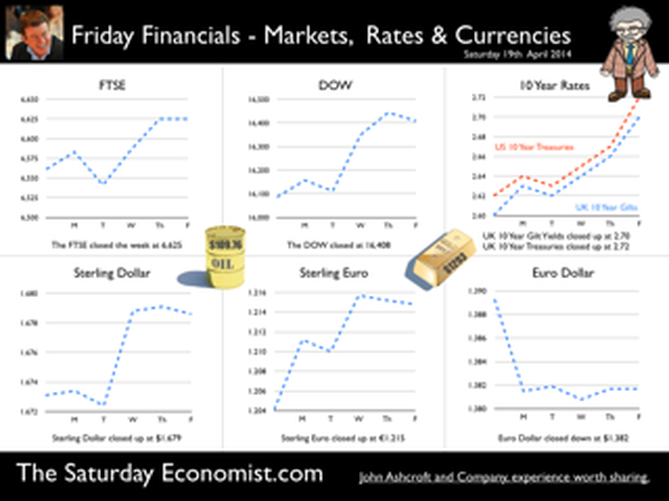

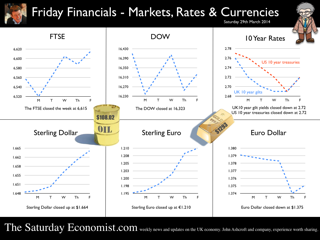

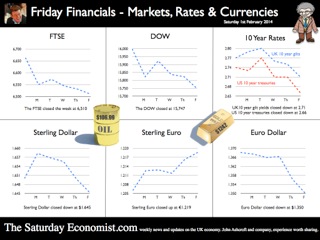

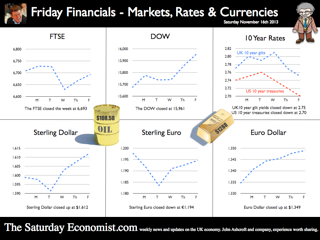

Janet Yellen was speaking at the Economic Club of New York this week. Three big questions continue to dominate policy formulation at the Federal Reserve. Unemployment, inflation and factors which may push the recovery off track. Actually, that’s more than three but … According to the Fed forecasts, US unemployment is set to fall to around 5.5% by the end of 2016 and inflation will hover just below 2%. “The economy would be approaching maximum employment and price stability for the first time in nearly a decade”. That's NICE! And what of interest rates? “Economic conditions, may for some time warrant keeping short term interest rates below levels the Committee views as likely to prove normal in the longer run”. The markets reacted well. The Dow moved up and the dollar moved down. Sterling moved to $1.679. In March, the Fed chair had given a clear indication that rates would start to rise in the first quarter of 2015. Less than a month later, there was no such clarity. Rates will be on hold until the recovery is well established. As long as it takes. Unemployment rate, the measure of momentum that really matters, to the doves at the Fed. Exogenous Shocks Nowhere in the speech did the “Capsid Bug” feature. According to a report in The Times today, black pod disease and capsid bug infestations are ravaging cocoa crops in West Africa. This shock to supply plus the surging demand from Chinese Chocaholics is causing a cocoa pop. Cocoa beans have jumped in price from $2,680 per tonne in January to over $3,000 per tonne in March. There could be a 115,000 tonne shortfall in supply this year. By next Easter, we may well be eating smaller eggs which cost much more. So much for the threat of world deflation! Does this matter? Well yes. The collapse of the Peruvian anchovy crop in 1972/3 was claimed by many to herald the onset of the hyper inflationary episode of the seventies. OK, the Russian grain famine, the onset of OPEC and the quadrupling of oil prices assisted considerably. But the message is, exogenous shocks from commodity prices can have a greater impact on domestic inflation. Much greater than the Phillips curve paradigm, much beloved by the FOMC, provides. This is clearly demonstrated in the UK economics data released this week. Inflation is falling, employment is rising. World prices mitigated by the appreciation of Sterling are marking the price changes. UK Inflation Inflation CPI basis slowed to 1.6% in March from 1.7% in the prior month. Goods inflation fell to 1.0% and service sector inflation fell to 2.3% (2.4%). Oil related transport costs were dominant in the slow down. Manufacturing output prices increased by just 0.5% as input costs actually fell by 6.5%. The fall in crude oil prices, imported metals, parts and equipment largely explained the fall. Sterling appreciation assisted the process. Sterling averaged $1.66 in March this year compared to $1.51 last year. A 10% appreciation assisting the “deflationary process” significantly. [Oil prices Brent crude basis averaged $108 approximately in both months]. So what of employment? Unemployment figures - Jobcentres will be closing by the end of 2016 Unemployment fell to 6.9% in the three months to February to a level of 2.24 million. This is below the level originally outlined in the Bank of England Forward Guidance in August last year. 7.0% the level at which the Bank would begin to consider an increase in base rates. The claimant count fell by 30,000 to a level of 1.142 million. Over the last three months, the count has fallen by 100,000 and almost 400,000 over the last twelve months. If current rates persist, the labour market will fall to pre recession levels towards the end of the year. By the end of 2016, No one will be left on the list. So this is what they mean by full employment! Jobcentres will have to close! The implications for earnings are evident. Already in February, whole economy earnings increased by 1.9% and wages in manufacturing and construction increased by 3%. We expect a significant acceleration in earnings throughout the year as the labour market tightens considerably. As for base rates, Yellen is signalling the US rates will be kept on hold well into 2015. The Bank of England may well have no such luxury. The MPC will be reluctant to raise rates ahead of the Fed. If this were to happen, despite the inherent structural weakness on trade and the current account, sterling will continue to rise significantly. $1.73 the next target? So what happened to sterling this week? The pound closed at $1.679 from $1.673 and at 1.215 from 1.204 against the Euro. The dollar closed at 1.382 from 1.3389 against the euro and at 102.42 against the Yen. Oil Price Brent Crude closed at $109.76 from $107.70. The average price in April last year was $101.2. The energy kicker to falling prices may well be over. Markets, the Dow closed up at 16,408 from 16,086and the FTSE also closed up at 6,625 from 6,561. UK Ten year gilt yields closed at 2.70 (2.60) and US Treasury yields closed at 2.72 from 2.62. Gold moved lower to $1,293 from $1,318. The pattern is bullish for equities.. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Inflation, deflation and retail sales … Inflation CPI basis fell to 1.7% in February from 1.9% at the start of the year. Good news for households as net earnings improve. Good news for the Bank of England as inflation hits the lowest level for almost five years. Interest rates are more likely to stay on hold into 2015. We never thought otherwise. Should we be worried about deflation? Not really. The fall was marked by a reduction in goods inflation. Service sector inflation, accounting for half the index, was unchanged at 2.4%. The other half, “goods stuff” slowed to 1.2% from 1.4%. Despite higher growth, lower unemployment and expansive monetary policy, inflation is drifting lower but it isn’t all one way. Fish and sewage prices increased by 6%, tobacco prices by 7%, utilities, gas and electricity up by over 6% and insurance costs up by 5%. If you plan to send a post card from your hospital bed to the kids in private school about a book you have just read. Don’t do it! Hospital services, postal services and book costs were up 6%. Education costs increased by over 10%. Stay healthy, watch TV and Skype the better solution. Strong growth in the UK suggests prices should be rising. So why the drop? The fall in inflation, particularly goods inflation is assisted by trends in world trade and prices, assisted by the appreciation of sterling. Manufacturing Prices … Sterling has appreciated by 10% over the year. World prices, oil and basic materials are relatively flat. In February, manufacturing input costs fell by 5.7% overall. Crude oil prices fell by 11% and imported metals and materials fell by 15% and 5% respectively. Imports of parts and equipment assisted the fall, down by 7%. Manufacturing output prices slowed to 0.5% from 0.9%. This will improve the retail inflation outlook over the short term. We haven't seen input costs fall like this since September 2009 as the UK and the world grappled with recession. So can it really last? World growth is increasing, world trade is growing, we still await the full recovery in Europe but it will come. Oil prices are becalmed, as the market tries to understand the implications of fracking in the USA. Commodity prices, particularly metals, copper, lead, zinc and iron ore are experiencing a market work out which reflects stock adjustment rather than supply and demand derterminants.. Sooner or later, commodity prices will turn, perhaps in the second half of the year. Fears of deflation are over played, as are the suggestions the inflation genie is back in the bottle in the UK. Retail Sales … UK domestic demand conditions are improving demonstrated by the strength of retail sales in the UK. Retail sales in February increased by 3.7%. Sales growth over the last three months has averaged 4.3%. Values in February increased by just 3.8%. On line sales increased by 12% in value accounting for almost 11% of all retail sales. Food sales increased by 14% with a 4% penetration. Clothing and footwear sales were up by 15% with an 11% share. National Accounts Data The latest revisions to UK gross domestic product (GDP) were released on Friday. GDP is estimated to have increased by 1.7% in 2013 revised down 0.1percentage points from the previously estimated 1.8% increase. Does this affect out outlook for the year? Not really. We have just released the GM Chamber of Commerce Quarterly Economic Outlook, in which we think growth will be around 2.9% this year. The forecast upgrade is as a result of the latest survey data and the strength of the Manchester Index®, a powerful indicator of trends in the UK economy. The late revisions will lower or forecasts for construction a little. Check out the full forecast on the GM Chamber Economics Web site. Manchester News Good news for Lynder Myers with a restructuring effected by Jepson Holt, Assure Law, EY and Duff & Phelps. Paul Smith from Duff & Phelps summed it up “the primary objective to find a solvent and consensual solution to a complex problem”. Excellent. So what happened to sterling? The pound closed at $1.664 from $1.649 and at 1.21 from 1.1956 against the Euro. The dollar closed at 1.375 from 1.3790 against the euro and 102.82 from 102.27 against the Yen. Oil Price Brent Crude closed at $108.01 from $107.37. The average price in March last year was $108. Markets, the Dow closed down at 16,323 from 16,410 and the FTSE closed at 6,615 from 6,557. UK Ten year gilt yields closed at 2.72 from 2.76 and US Treasury yields closed at 2.72 from 2.77. Gold loves a crisis, the crisis is over as the metal moved lower to $1,293 from $1,358. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  GDP growth up in the UK .. The ONS delivered the preliminary estimate of growth in the final quarter of the year this week. The UK economy grew by 2.8% year on year and 1.9% for the year as a whole. Who would believe this time last year markets were still fretting about a triple dip recession. The service sector, accounting for almost 80% of activity increased by 2.6%, construction increased by 4.5% and even the beleaguered manufacturing sector managed to push output up by 2.6%. Within the service sector, the leisure pound was once again to the fore, with strong growth in distribution, hotels and restaurants up by 4.5%. Business services increased by over 3%. We expect growth to be revised up to 2% for 2013 at some stage. For the moment we stick with our forecast of growth in 2014 and 2015 of 2.5% and 2.7% respectively. Our GDP(O) model is still performing well. The dataset has been updated and is available on the Publications page, along with our latest review of world trade. For economists, it doesn’t get more exciting. The release of the preliminary estimate is comparable to the release of a first draft of a Harry Potter chapter. What happened to the Weasleys, Gilderoy and Malfoy? Has Hagrid shaved off his beard as an end of year bet? Has Dumbledore lost weight. Has Voldemort renounced the devil and all his works? So what happened to Hermione and Harry? Can water supply and sewage really have grown by 8% in the final three months of the year? All is revealed to muggles and analysts alike by Joe Grice Chief Economist of the Office for National Statistics. In a high profile press conference, analagous to the lottery or some talent show, Joe reveals all... and the number is 1.9%. Excellent, thanks Joe. Data revisions are always interesting. But imagine if the next chapter of Rowling release revealed, the philosopher’s stone has been lost, the Chamber of Secrets has been opened to the public, the prisoner of Azkaban has been recaptured and the goblet of fire turns out to be a flaming glass of sambuca. It really can be so dramatic. After all the double dip disappeared. One day we may discover there was no recession in 2008 after all. Can’t wait for the next chapter in the GDP chronicles on the 26th February. So what happened to consumer spending and what of investment? Still stuck in the deathly hallows no doubt. US GDP also increased by 2.7% in the final quarter ... Over in the US, the Bureau of Economic Analysis announced growth of 2.7% in the final quarter and 1.9% for the year as a whole. The UK and the USA are neck an neck in the race to be the fastest growing economies in the Western World. Makes you wonder why the Fed were spending $85 million each month on treasuries and mortgage debt. No wonder the decision was made to taper further and reduce the spend to $65 billion with immediate effect. It is said that if a butterfly flaps its wings in Nicaragua, it can cause a hurricane in New York. I always found that difficult to be believe. But then who would have thought gay marriage could cause such flooding in Somerset according to UKIP. Even so, Bernanke flapping his tapering wings in Washington caused chaos in capital markets across the world. The tapering announcement led to falls in international stock markets, capital flight from developing economies and exchange rates rattling in India, Turkey and Argentina. Turkey hiked rates to over 10% to persuade the dollars to stick around. In Buenos Aires, they have long since departed. So what happened to sterling? Markets were disturbed by the decision on tapering, once again undermining stock market strength in the USA and destabilizing international capital flows across developing economies. Nevertheless, the CBOE Vix volatility index closed relatively unchanged over the week at 18.4. The pound closed at $1.6433 from $1.6481 against the dollar and 1.2184 from 1.2041 against the Euro. The dollar closing at 1.3487 from 1.3681 against the euro and 101.96 from 102.34 against the Yen. Oil Price Brent Crude closed at $106.40 from $107.88. The average price in January last year was almost $113, no real threat to inflation from crude oil prices Markets, moved down - The Dow closed at 15,698 from 15,879 and the FTSE closed at 6,5210 from 6,663. 7,000 on the FTSE no longer such a soft call for the near term. UK Ten year gilt yields closed at 2.72 from 2.78 and US Treasury yields closed at 2.65 from 2.72. Yields will test the 3% level as tapering accelerates into 2014 but for this week, once again, the flight to quality led the market. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The good news for policy makers continued this week as inflation and unemployment continued to head in the right direction. The latest revisions to the National Accounts suggest the economy will grow by 2% this year. Inflation CPI ... falling Inflation CPI basis fell to 2.1% in November down from 2.2% in October. Manufacturing output prices increased by less than 1% in the month, unchanged from the prior period. Input costs for manufacturers actually fell by 1% as world commodity prices including metals and oil remained subdued. Overall the inflation outlook is benign with inflationary pressures diminishing. It will take some time for world demand to impact on price levels as long as the recovery in Europe remains protracted. We expect the international inflation outlook to look pretty soft over the next twelve months. Labour Costs ... set to rise On the other hand we expect a reversal in the trend in domestic labour costs by the end of next year. The claimant count fell by 37,000 in November to a level of 1.269 million, a rate of 3.8%. The overall number of claimants, over the past year, has fallen by 300,000 down from a rate of 4.6% in November 2012. 120,000 have found work over the past three months. At the current rate of jobs growth, the claimant count rate will fall to around 2.5%, within twelve to fifteen months. This is a pre recession rate, consistent with significant growth in rates of pay and remuneration. As it is, the rate of private sector earnings increased by almost 1.5% in October. The widely reported “whole economy rate” increased by just under 1% but the warning signs are there for policy makers - domestic inflationary pressures and labour costs will be back on the MPC agenda by the end of 2014. As unemployment falls ... The wider Labour Force Survey Data confirmed the unemployment level fell to 2.388 million in October and a rate of 7.4%. This is a fall of 120,000 over the past year as the overall number of people in employment increased by almost 500,000. The 7% hurdle rate outlined in Forward Guidance could be within reach within twelve months as the rate of economic growth accelerates into the final quarter of 2013 and into next. Interest rates are set to rise, probably after the 2015 election. Bank of England MPC Minutes ... The minutes of the Bank of England Monetary Policy Committee were released this week, explaining why base rates were not increased in the December meeting. The domestic recovery was robust with inflationary pressure diminishing it was said. The GDP figures had confirmed the rapid pick up in consumption growth. Strong contribution from stock building had been offset by a large drag from net trade. The overall divergence between domestic demand and net trade had been larger than expected. Any significant narrowing of the current account deficit in the near term seemed unlikely! Rebalancing ? Does this mean the MPC had got the message about the rebalancing agenda? Sadly not. The minutes went on to claim that a sustained recovery would require some rebalancing from domestic to external demand! Some hope, the UK is set for a classic consumption rally with domestic demand growth of significant proportions. Fears about the appreciation of sterling are misguided. Higher sterling will alleviate inflationary pressures and de facto improve margins and competitiveness of exports. For exporters, demand (not price) conditions are dominant. The sluggish recovery in Europe will be the real obstacle to export growth over the next twelve months. And what of Investment ... Better news for investment however. The minutes claimed that beyond the near term, it seemed likely that a pick up in business investment spending would be necessary, Business and Dwellings investment had been weaker than expected to date. Weaker than expected in the Bank of England model, perhaps. The good news is that, we expect a strong rally in investment spending in 2014 as capital expenditure projects are brought back to the board room on the back of stronger domestic demand. Just 20% of total investment is determined by plant and machinery and our models suggest the four year capital stock has fallen to £163 billion down from an average £183 billion in the three years prior to recession. That represents a fall of 12%. Our less aggressive ten year Capital Stock Model suggests the overall level of productive investment has fallen by just 2%. No threat to the output capacity of UK PLC. The shortfall will be addressed by additional investment over the next three years to restore capacity equilibrium. Investment in transport equipment is set to rally on the back of a a 10% increase in commercial vehicle sales this year. Intangibles “investment” is set to rise on the back of a healthier M & A and corporate finance market in 2014. Together transport equipment and intangible investments account for a further 20% of total investment. Why has investment been subdued ... ? Why has investment been subdued post recession? Well in general businesses will invest in response to rising demand not a fall in the cost of capital. More specifically, 60% of investment identified in the national accounts is linked to property, either dwellings or commercial real estate. No policy maker should be surprised by the lag in investment intentions in this sector. Significant price collapse has left almost half the banked commercial real estate under water on a conventional 65% LTV (loan to value) test. A significant recovery in prices is required to restore equilibrium in the commercial real estate sector. The recovery in property and real estate may be a little more protracted, than “other investment classes”. Nevertheless we expect strong investment growth in 2014 and 2015 with investment in “dwellings” staging a marked recovery. So what of the revisions to the National Accounts? The latest revisions to the National Accounts confirm the economy grew by 2% year on year in Q3. We now expect the economy to grow by 2% for the year as a whole and by 2.5% in 2014 rising to 2.7% in the following year. And what of tapering? The Fed announced the beginning of tapering with a reduction in the rate of asset purchases by $10 billion from January 2014. What is that all about? The Fed said, “The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.” Oh dear? The link between longer term rates and growth has never been fully explained as neither has the linkage between domestic asset price inflation and international deflationary pressures. Nevertheless, it is time to buckle up, we are leaving Planet ZIRP - This week, the US growth rate was revised up to 2% year on year in Q3, Fed rates will also be on the rise in 2015. What happened to sterling? The pound closed at £1.6351 from £1.6294. Against the Euro, Sterling closed at €1.1950 from €1.1856. The dollar moved up against the yen closing at ¥104. from ¥103.6 and closing at 1.3678 from 1.3740 against the Euro. Sterling is on a rally which has led to a break out above £1.60, but €1.20 still presents significant overhead resistance. Oil Price Brent Crude closed at $111.58 from $108.53. The average price in December last year was almost $110, so no real threat to inflation. Markets, US moved higher - The Dow closed at 16,275 from 15,755. The FTSE closed at 6,606 from 6,434. 7,000. UK Ten year gilt yields closed at 2.94 from 2.90 US Treasury yields closed at 2.89 from 2.87. Yields will test the 3% level as tapering accelerates. Gold closed at $1,207 from $1,239. That’s all for this week, and for this year. No Sunday Times and Croissants tomorrow or for the next few weeks. The professor and his team are away for a short break. Have a great Christmas of Holiday Break and have a Happy New Year. Join the mailing list for The Saturday Economist or forward to a friend John © 2013 The Saturday Economist, by John Ashcroft and Company, Dimensions of Strategy and The Apple Case Study. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  Economics news – you don’t have to be an optimist to see the glass is half full .. Yes it's the Inflation Report “You don’t have to be an optimist to see the glass is half full”, the opening remarks from Governor Carney’s Inflation Report presentation this week. The Governor went on to say, “the glass is half full and it will be filled”. A clear reference the recovery will be allowed to gain momentum before the Bank of England and the MPC will intervene “to take away the punch bowl” and begin the rise in base rates. The MPC are sticking with forward guidance. Rate rises will not even be considered until the level of unemployment hits 7% or even lower. [Subject to caveats on inflation expectations and market stability]. When will this be? In August the Bank assumed this would be in 2016 at the earliest. On Wednesday, the Governor admitted there was a 40% chance this could be by the end of 2014 with a 60% chance it would be by the end of 2015. Such has been the strength of the economics data over the last three months. Our own models assume the knock out unemployment rate will be hit by the third quarter of 2015. Thereafter rates may rise by around 50 basis points in short time. For the moment, the MPC are on a learning journey. The path of productivity, earnings, job creation and unemployment so unclear, we are all embarking on a “learning journey” suggested the governor. The £5m recently spent on the Bank of England model, of little value in the new world it would appear. Charlie Bean appeared most discomfited by the trip. Economics from Cambridge, a PhD from MIT and teaching at Stanford and LSE in the knowledge pack. One could be forgiven the reluctance to take the Mark Carney refresher course. But then why not? Having seriously failed to understand the impact of low rates on investment and depreciation on the trade balance, it is time to denounce the omniscient stance of the Oxbridge collective. Yes send them back to school. Martin Weale was indeed sent back to school this week. The MPC member was delivering a speech on the role of monetary policy and forward guidance to A-level students in London. “To cut a long story short, our job is to ensure that people buy coats when they need them”. Excellent. I am sure that cleared things up. Martin once worked in a shop apparently. Yes the black cloud gang disbanded, it’s back to school for all. Fill up your glasses, the punch bowl is on the table, the Carney Credit card is behind the bar. Inflation Good news for the Governor, inflation fell in October CPI to 2.2% from 2.7% in the prior month. Education hikes last year fell out of the index as we expected but the fall in transport costs pushed the index even lower. 2.4% CPI inflation was our call and still seems to be a reasonable target by the end of the year. Manufacturing prices suggest there is little cost pressure in the economy but retail energy prices are moving significantly higher. Retail Sales Retail sales figures in October were slightly disappointing, an increase of 1.8% in volume and 2.5% in value, slightly down on the averages in Q3. The demise of Barratts Shoes and Blockbuster a reminder, conditions remain tough on the high street as household real incomes remain under pressure. Internationally Janet Yellen, the new head at the Fed is still worried about the strength of the US recovery. Tapering may be postponed still later into the New Year. Growth in France and Japan in the third quarter a further warning the world recovery still requires accommodation. QE tapering US style is not the answer. Buying treasuries and Mortgage Backed Securities to support asset prices makes no sense. Blend a NASDAQ tracker fund into the purchase mix would follow the logic and demonstrate the folly. What happened to sterling? Sterling closed at £1.6113 from £1.6018. Against the Euro, Sterling closed at €1.1940 from €1.1982. The dollar moved up against the yen closing at ¥100.1 from ¥99.1 and closing at 1.3494 from 1.3368 against the Euro. Oil Price Brent Crude closed at $108.50 from $105.12. The average price in November last year was almost $110. We expect Brent Crude to average $110 in the month, with no material inflationary impact. Markets, pushed higher - The Dow closed at 15,962 up from 15,762. The FTSE closed at 6,693 from 6,708. UK Ten year gilt yields closed at 2.75 from 2.77 US Treasury yields closed at 2.70 from 2.75. Yields will test the 3% level over the coming months. Gold closed at $1,288 from $1,284. The bulls may have it may just have to wait for now. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow and watch out for news of our Friday Financials Feature with Monthly Markets updates coming soon. John Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist.  Economics news – news from Washington and Beijing ... Washington Good news from across the Pond, a Washington truce has been achieved. The US government has returned to work, Yosemite National Park is open, international creditors will be paid. The debt crisis is over. A twenty week truce has been secured. Markets rallied, the dollar slipped, Google shares breached the $1,000 level and the S&P 500 hit a new high. What more could we ask? Beijing In China, growth continued at 7.8% into the third quarter up from 7.5% in the second. For those fearing a hard landing, crash landing, soft landing, end of the world scenario, it is time to stop shorting the markets and buy in, the world is not coming to an end any time soon. London - Mortgages In the UK, mortgage lending increased by 32% in the third quarter compared to Q3 last year. FLS and Help to Buy are boosting the market. We expect house prices to rise by 5% this year and almost 8% next year before a normalized escalation returns. Prices are beginning to rise across the UK. Yes Prices will move across the UK, like a tidal wave across the flood plain. Check out The Saturday Economist Housing Market Review for more information. Inflation Tuesday, the ONS released the latest inflation figures for September. CPI inflation was unchanged at 2.7% as RPI moved down slightly to 3.2% from 3.3%. We expect a further fall in CPI inflation around 30 basis points next month, as education fees drop out of the data series. Thereafter prices will be pretty sticky around 2.5%. Energy costs are set to rise and service sector inflation at 3.4% up from 3.0% last month will create problems for policy makers. As we have long pointed out, service sector inflation has averaged 3.7% for the last twenty years. Manufacturing prices Manufacturing Prices, on the other hand, have averaged around 1% over the same period, boosted by falls in clothing and footwear specifically. The immediate outlook for manufacturing prices is pretty benign, Output prices increased by just 1.2% in September and input costs increased by 1.1%, down from 5% in July. Retail sales Retail sales were also released this week. Retail sales volumes were up by 2.2% in September and by 2.4% in the third quarter. Sales values increased by almost 4% in the three months boosted by on line sales and department store sales. Is the housing market stimulating footfall? Quite probably. We expect the volume of housing transactions to increase significantly this year, boosting sales of carpets, furniture durables and DIY goods in the process. Employment The employment figures were also released this week. The claimant count fell by over 40,000 in September to a rate of 4% compared to 4.2% last month. The wider FLS count fell in the three months to August, to 2.87 million, a rate of 7.7% from 7.8% last month. Lagging as it does, the broader unemployment rate could fall to around 7.5% by the end of the year. The Bank of England “knock out rate” under forward guidance at 7% could be in sight by the end of 2014. So what of base rates? Interesting Spencer Dale the Bank of England’s chief economist was on Twitter this week in a hashtag #AskBoE “open hour” adventure. The telling tweet - a rate rise in 2014 was unlikely. Just as unlikely as a rate rise in 2016 no doubt. The markets expect a move in 2015 but will it wait until after polling day? We will have to ask next time the bank is online, perhaps using Facetime or Skype? What would Governor King have made of it all! So what does this all mean? The economy is recovering and growing at a much faster rate into the final quarter. The first estimate of GDP in Q3 will be released next week. We expect growth year on year to be over 1.5% rising to trend rate in the final quarter of the year. Inflation is falling, employment is rising, even the debt figures due next week will look much better. Energy costs may provide a problem for households but “wear a jumper”, the ministerial advice could keep bills down and boost retail sales in the process. What happened to sterling? Sterling moved up against the dollar and against the Euro as the dollar slipped. The pound closed at £1.6174 from $1.5954. Against the Euro, Sterling closed at €1.1816 from €1.1772. The dollar moved down against the yen closing at ¥97.7 from ¥98.5 and closing at 1.3682 against the Euro. Oil Price Brent Crude closed at $109.94 from $111.28. The average price in October last year was almost $112. We expect oil to average less than $112 in the month, with no inflationary impact. Markets, pushed higher - The Dow closed at 15,399 up from 15,237. The FTSE closed at 6,623 from 6,487. The US debt deal is done. The rally is on. UK Ten year gilt yields closed at 2.72 from 2.74, US Treasury yields closed at 2.58 from 2.69. Gold closed at $1,313 from $1,270. The bulls have it, at least for the week. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or please forward to a colleague or friend. UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below. If you enjoy the content, why not forward to colleague or friend.  Economics news – inflation falls, no boom in the housing market, good news on borrowing, Chancellor Osborne is ticking the right boxes this week ... Inflation - Retail Prices The rate of inflation slowed to 2.7% in August compared to 2.8% in July. We expect a further significant fall next month and by the end of the year the inflation rate should be around 2.4%. Thereafter prices could be a little sticky. Service sector inflation was 3% in August and goods inflation was 2.4% in the latest monthly data. Inflation - Manufacturing Prices The good news on inflation was also manifest in the manufacturing sector. Output prices increased by just 1.6% compared to 2.1% in July. Input costs for manufacturers also fell back from 5% in July to 2.8%. Part of the reason for the slow down was oil and energy costs. The average price of oil in August was $111 dollars per barrel, slightly down on the same period last year. The rate of wages and earnings growth remains subdued, presenting a benign outlook for inflation over the short term. At close this week Brent Crude was trading at $109 dollars per barrel. The outlook for manufacturing inflation is pretty benign. House Prices - ONS data For those wary of a housing boom, the ONS also released the House Price Index in July. In the 12 months to July 2013 UK house prices increased by 3.3%, up from a 3.1% increase in the 12 months to June 2013. Signs of a national boom? Not really but certainly signs of a good recovery! Annual house price increases in England were driven by London (9.7%) and the South East (2.6%). Excluding London and the South East, UK house prices increased by just 0.8%. In the North West, prices actually fell by almost 1%. The RICS has made the call for a peg on prices around 5%. This to reflect a normalised earnings growth rate of 3% plus a supply side restraint adjustment to stimulate additional investment presumably. Would this work nationally? Obviously not. But some consideration to mortgage rationing on a regional basis especially in the South East may gain political if not market traction. Retail Sales August - A further indication, the recovery is on track with no signs of a runaway boom in prospect... Retail Sales in August were up by 2.1% in volume and 3.6% by value compared to August last year. Internet sales were up by 22% in the month accounting for 10% of all retail sales. Trading is better but not that much. With online trends and large store consolidation, life for most retailers is tough. Government Borrowing Further good news for the Chancellor, the level of borrowing fell in August. We expect further significant falls before the end of the financial year. In August 2013, public sector net borrowing excluding temporary effects of financial interventions (PSNB ex) was £13.2 billion. This was £1.3 billion lower than in August 2012 when it was £14.4 billion. The Chancellor is on track for a significant fall in borrowing this year. We expect the level of borrowing excluding interventions and transfers to fall to around £105 billion compared to a revised £115 billion last year. Car Manufacturing Car output increased by 16% in August bring the year to date output growth to 3%. More good news but the August headline should be kept in perspective. The year to date total is the better trend guide and let’s not forget commercial vehicle output is down in the year by 17%. Tapering USA Despite clear indications “Tapering” may begin in the Fall, the Fed decided to continue the process of QE, purchasing mortgage backed securities at a pace of $40 billion per month and longer term Treasury securities at the rate of $45 billion per month, this week. What does this mean for US and UK interest rates? Not much in the short term. Check out the Saturday Economist Special Post "No tapering, more tampering, leads to more questions than answers at the Fed". Assessing market reaction over the week, Bernanke fires a blank would have a more appropriate headline. What happened to sterling? Sterling responded to the news on tapering, moving up against the dollar but down against the Euro. The pound closed at $1.5994 from $1.5871 having tested the 1.60 level intra week. Against the Euro, Sterling closed down at €1.1824 from €1.1940. The dollar moved little against the yen closing at ¥99.3 from ¥99.4 Oil Price Brent Crude closed at $109 from $111. The average price in September last year was almost $113. We expect oil to average $110 in the current quarter, with no real inflationary impact. Markets, rallied - The Dow closed up at 15,451 from 15,376 . The FTSE closed up at 6,596 from 6,584. The Fed statement this month was a mis fire non event. We still think the FTSE will clear 7000 within ten weeks and the DOW will press 16,000. UK Ten year gilt yields closed at 2.92 from 2.94, US Treasury yields closed at 2.79 from 2.89. The fed statement this week pulled long rates down by just 12 basis points. Long rates are decoupling from shorts, returning to fair value. They are just a bit reluctant to leave, with pleas from the FOMC to “stick around”! Gold closed at $1,331 from $1,312. The bulls have it or do they? The news on tapering bought some upside gain but not much, we think gold will trade sideways for some time. That’s all for this week, don’t miss The Sunday Times and Croissants out tomorrow. Join the mailing list for The Saturday Economist or forward to a friend UK Economics news and analysis : no politics, no dogma, no polemics, just facts. John © 2013 The Saturday Economist. John Ashcroft and Company, Dimensions of Strategy . The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed