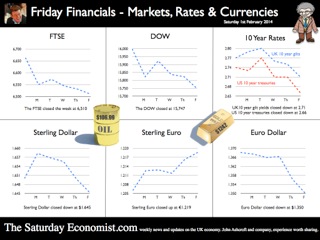

GDP growth up in the UK .. The ONS delivered the preliminary estimate of growth in the final quarter of the year this week. The UK economy grew by 2.8% year on year and 1.9% for the year as a whole. Who would believe this time last year markets were still fretting about a triple dip recession. The service sector, accounting for almost 80% of activity increased by 2.6%, construction increased by 4.5% and even the beleaguered manufacturing sector managed to push output up by 2.6%. Within the service sector, the leisure pound was once again to the fore, with strong growth in distribution, hotels and restaurants up by 4.5%. Business services increased by over 3%. We expect growth to be revised up to 2% for 2013 at some stage. For the moment we stick with our forecast of growth in 2014 and 2015 of 2.5% and 2.7% respectively. Our GDP(O) model is still performing well. The dataset has been updated and is available on the Publications page, along with our latest review of world trade. For economists, it doesn’t get more exciting. The release of the preliminary estimate is comparable to the release of a first draft of a Harry Potter chapter. What happened to the Weasleys, Gilderoy and Malfoy? Has Hagrid shaved off his beard as an end of year bet? Has Dumbledore lost weight. Has Voldemort renounced the devil and all his works? So what happened to Hermione and Harry? Can water supply and sewage really have grown by 8% in the final three months of the year? All is revealed to muggles and analysts alike by Joe Grice Chief Economist of the Office for National Statistics. In a high profile press conference, analagous to the lottery or some talent show, Joe reveals all... and the number is 1.9%. Excellent, thanks Joe. Data revisions are always interesting. But imagine if the next chapter of Rowling release revealed, the philosopher’s stone has been lost, the Chamber of Secrets has been opened to the public, the prisoner of Azkaban has been recaptured and the goblet of fire turns out to be a flaming glass of sambuca. It really can be so dramatic. After all the double dip disappeared. One day we may discover there was no recession in 2008 after all. Can’t wait for the next chapter in the GDP chronicles on the 26th February. So what happened to consumer spending and what of investment? Still stuck in the deathly hallows no doubt. US GDP also increased by 2.7% in the final quarter ... Over in the US, the Bureau of Economic Analysis announced growth of 2.7% in the final quarter and 1.9% for the year as a whole. The UK and the USA are neck an neck in the race to be the fastest growing economies in the Western World. Makes you wonder why the Fed were spending $85 million each month on treasuries and mortgage debt. No wonder the decision was made to taper further and reduce the spend to $65 billion with immediate effect. It is said that if a butterfly flaps its wings in Nicaragua, it can cause a hurricane in New York. I always found that difficult to be believe. But then who would have thought gay marriage could cause such flooding in Somerset according to UKIP. Even so, Bernanke flapping his tapering wings in Washington caused chaos in capital markets across the world. The tapering announcement led to falls in international stock markets, capital flight from developing economies and exchange rates rattling in India, Turkey and Argentina. Turkey hiked rates to over 10% to persuade the dollars to stick around. In Buenos Aires, they have long since departed. So what happened to sterling? Markets were disturbed by the decision on tapering, once again undermining stock market strength in the USA and destabilizing international capital flows across developing economies. Nevertheless, the CBOE Vix volatility index closed relatively unchanged over the week at 18.4. The pound closed at $1.6433 from $1.6481 against the dollar and 1.2184 from 1.2041 against the Euro. The dollar closing at 1.3487 from 1.3681 against the euro and 101.96 from 102.34 against the Yen. Oil Price Brent Crude closed at $106.40 from $107.88. The average price in January last year was almost $113, no real threat to inflation from crude oil prices Markets, moved down - The Dow closed at 15,698 from 15,879 and the FTSE closed at 6,5210 from 6,663. 7,000 on the FTSE no longer such a soft call for the near term. UK Ten year gilt yields closed at 2.72 from 2.78 and US Treasury yields closed at 2.65 from 2.72. Yields will test the 3% level as tapering accelerates into 2014 but for this week, once again, the flight to quality led the market. That’s all for this week. No Sunday Times and Croissants tomorrow or for the rest of this year for that matter. We are taking a break in this pre election year. Join the mailing list for The Saturday Economist or forward to a friend. The list is growing as is our research team. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed