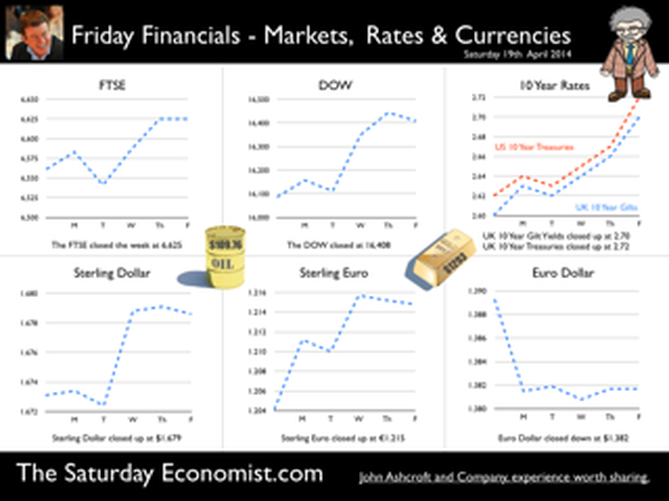

Janet Yellen was speaking at the Economic Club of New York this week. Three big questions continue to dominate policy formulation at the Federal Reserve. Unemployment, inflation and factors which may push the recovery off track. Actually, that’s more than three but … According to the Fed forecasts, US unemployment is set to fall to around 5.5% by the end of 2016 and inflation will hover just below 2%. “The economy would be approaching maximum employment and price stability for the first time in nearly a decade”. That's NICE! And what of interest rates? “Economic conditions, may for some time warrant keeping short term interest rates below levels the Committee views as likely to prove normal in the longer run”. The markets reacted well. The Dow moved up and the dollar moved down. Sterling moved to $1.679. In March, the Fed chair had given a clear indication that rates would start to rise in the first quarter of 2015. Less than a month later, there was no such clarity. Rates will be on hold until the recovery is well established. As long as it takes. Unemployment rate, the measure of momentum that really matters, to the doves at the Fed. Exogenous Shocks Nowhere in the speech did the “Capsid Bug” feature. According to a report in The Times today, black pod disease and capsid bug infestations are ravaging cocoa crops in West Africa. This shock to supply plus the surging demand from Chinese Chocaholics is causing a cocoa pop. Cocoa beans have jumped in price from $2,680 per tonne in January to over $3,000 per tonne in March. There could be a 115,000 tonne shortfall in supply this year. By next Easter, we may well be eating smaller eggs which cost much more. So much for the threat of world deflation! Does this matter? Well yes. The collapse of the Peruvian anchovy crop in 1972/3 was claimed by many to herald the onset of the hyper inflationary episode of the seventies. OK, the Russian grain famine, the onset of OPEC and the quadrupling of oil prices assisted considerably. But the message is, exogenous shocks from commodity prices can have a greater impact on domestic inflation. Much greater than the Phillips curve paradigm, much beloved by the FOMC, provides. This is clearly demonstrated in the UK economics data released this week. Inflation is falling, employment is rising. World prices mitigated by the appreciation of Sterling are marking the price changes. UK Inflation Inflation CPI basis slowed to 1.6% in March from 1.7% in the prior month. Goods inflation fell to 1.0% and service sector inflation fell to 2.3% (2.4%). Oil related transport costs were dominant in the slow down. Manufacturing output prices increased by just 0.5% as input costs actually fell by 6.5%. The fall in crude oil prices, imported metals, parts and equipment largely explained the fall. Sterling appreciation assisted the process. Sterling averaged $1.66 in March this year compared to $1.51 last year. A 10% appreciation assisting the “deflationary process” significantly. [Oil prices Brent crude basis averaged $108 approximately in both months]. So what of employment? Unemployment figures - Jobcentres will be closing by the end of 2016 Unemployment fell to 6.9% in the three months to February to a level of 2.24 million. This is below the level originally outlined in the Bank of England Forward Guidance in August last year. 7.0% the level at which the Bank would begin to consider an increase in base rates. The claimant count fell by 30,000 to a level of 1.142 million. Over the last three months, the count has fallen by 100,000 and almost 400,000 over the last twelve months. If current rates persist, the labour market will fall to pre recession levels towards the end of the year. By the end of 2016, No one will be left on the list. So this is what they mean by full employment! Jobcentres will have to close! The implications for earnings are evident. Already in February, whole economy earnings increased by 1.9% and wages in manufacturing and construction increased by 3%. We expect a significant acceleration in earnings throughout the year as the labour market tightens considerably. As for base rates, Yellen is signalling the US rates will be kept on hold well into 2015. The Bank of England may well have no such luxury. The MPC will be reluctant to raise rates ahead of the Fed. If this were to happen, despite the inherent structural weakness on trade and the current account, sterling will continue to rise significantly. $1.73 the next target? So what happened to sterling this week? The pound closed at $1.679 from $1.673 and at 1.215 from 1.204 against the Euro. The dollar closed at 1.382 from 1.3389 against the euro and at 102.42 against the Yen. Oil Price Brent Crude closed at $109.76 from $107.70. The average price in April last year was $101.2. The energy kicker to falling prices may well be over. Markets, the Dow closed up at 16,408 from 16,086and the FTSE also closed up at 6,625 from 6,561. UK Ten year gilt yields closed at 2.70 (2.60) and US Treasury yields closed at 2.72 from 2.62. Gold moved lower to $1,293 from $1,318. The pattern is bullish for equities.. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed