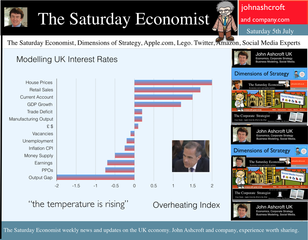

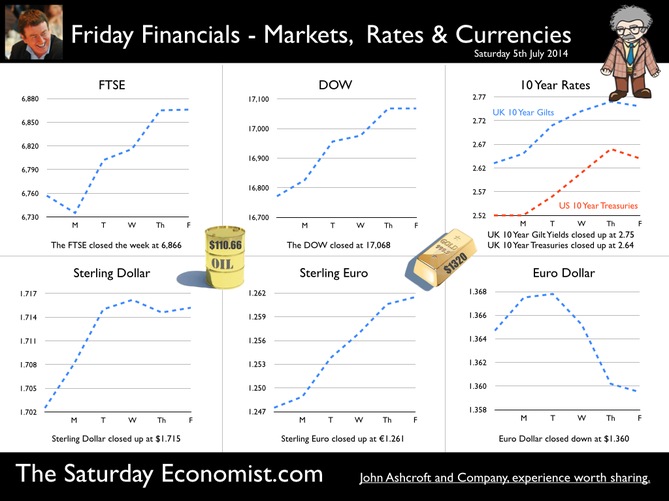

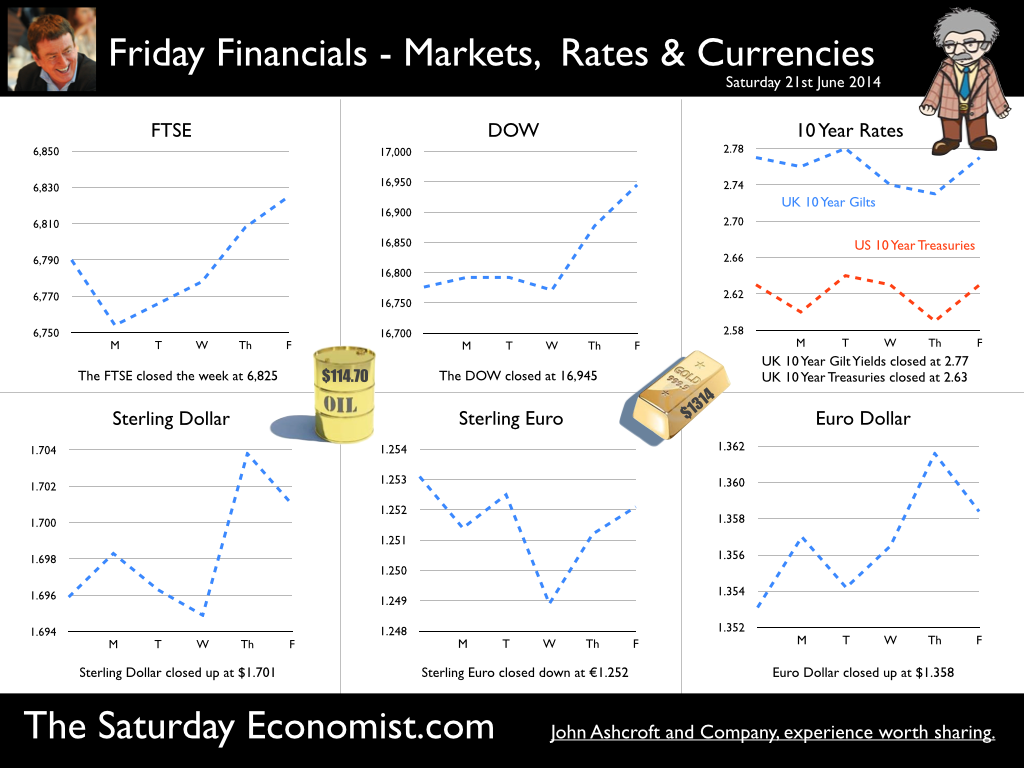

I made a trip to Liverpool this week. It was the Battle of the Economists, part of the International Festival of Business programme. Eight top economists were “in the ring” swapping punches. I “refereed” the morning event and hosted the Question Time session. It was a great event in the IFB calendar with lots of interesting perspectives on the world and UK economy. No blood spilled, nor egos bruised the outcome! To close the session, I asked the panel for views on when UK interest rates would begin to rise. Some argued for an immediate rate rise, most expected rates to rise in February next year and a few expected rates to rise in the November this year. As we said last week, “It is true there have been a lot of conflicting signals about when rates will rise! Following Mark Carney’s Mansion House speech, the odds in favour of a rate rise before the end of the year increased but then lengthened slightly, on the low inflation figures for May and the strength of sterling ”. “Don’t watch my lips - watch the data!” the new forward guidance from the Governor. This week, the data continued to suggest the rate rise would be sooner rather than later. House prices up almost 12% … House prices increased by almost 12% in the year to June according to Nationwide. In London prices increased by 26%. The price of a typical property in London, reached the £400,000 level with prices 30% above the 2007 highs. Should we be concerned? Of course but the rate of increase in house prices of itself, will not lead to an increase in interest rates necessarily. Sir Jon Cunliffe, Deputy Governor for Financial Stability at the Bank of England was in Liverpool this week. “The main risk we see arising from the housing market is the risk that house prices continue to grow strongly and faster than earnings. The concern is the increase in prices leads to higher and more concentrated household indebtedness.” The Bank is not worried about the rise in house prices per se. The FPC (Financial Policy Committee) is concerned about the risk to the banking sector from high household indebtedness exposed to the inevitable rate rise and potential collapse in asset prices. The introduction of measures on interest rate multiples and leverage, the confines of policy intervention for the moment. Car Sales up 10.6% year to date … The strength of the housing market demonstrates the strength of consumer confidence and spending. The economy is growing at 3% this year, retail sales were up by almost 4.5% in the first five months of the year, car sales were up by 6% in June and by 11% in the first six months. We are forecasting registrations will be over 2.4 million in 2014, higher than the pre recession levels recorded in 2007, placing additional pressure on the balance of payments in the process. Yet rates remain pegged at 0.5%! Does this continue to make sense? PMI Markit Purchasing Managers’ Index® Survey Data The influential PMI Markit surveys continue to demonstrate strong growth in the economy into June. In manufacturing, strong growth of output, new orders and jobs completed a robust second quarter. In construction, output growth continued at a four-month high and job creation continued at a record pace. In the service sector, the Business Activity Index, recorded 57.7 in June. The survey produced a record increase in employment with reports of higher wages pushing up operating costs. The Manchester Index™- nowcasting the UK economy The Manchester Index™, developed from the GM Chamber of Commerce Quarterly Economic Survey, slowed slightly from 35.1 in the first quarter to 33.6 in the second quarter, still well above pre recession levels. The data within the survey, confirms our projections for growth in the UK economy this year of 3%, moderating slightly to 2.8% in 2015. So when will rates rise ? The Saturday Economist Overheating Index revealed ... At the GM Chamber of Commerce Quarterly Economics Survey yesterday, we revealed the “overheating Index”. This is a summary of fourteen key indicators which form the basis of any decision to increase rates by the Monetary Policy Committee (MPC). The strength of consumer spending, reflected in house prices, retail sales and car sales would argue in favour of a rate rise earlier rather than later, as would the growth in the UK economy at 3% above trend rate. On the other hand, inflation, reflected in retail prices and manufacturing prices remain subdued. Despite the strength of the jobs market, earnings remain below trend levels. The decision, on when to increase rates, remains finely balanced for MPC members at this time. Our overheating index is broadly neutral but tipped slightly in favour of a rate rise now. By the final quarter of the year, assuming earnings and inflation rally from current levels, the decision will be much more clear cut. Based on data from the Overheating Index, we expect rates to rise before the end of the year. Clearly markets think so too ... So what happened to sterling this week? Sterling closed up again against the dollar at $1.715 from $1.702 and up against the Euro to 1.261 from (1.247). The Euro moved down against the dollar at 1.360 from 1.365. Oil Price Brent Crude closed down at $110.66 from $111.35. The average price in June last year was $102.92. Markets, US closed up on the strong jobs data. The Dow closed above the 17,000 level at 17,068 from 16,771 and the FTSE was also up at 6,866 from 6,757, the move above 7,000, too much for the moment. UK Ten year gilt yields were up at 2.75 from 2.63 and US Treasury yields closed at 2.64 from 2.63. Gold was up slightly at $1,320 from $1,316. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. The Manchester Index™ The influential Manchester Index™, is developed from the GM Chamber of Commerce Quarterly Economic Survey. It is a big survey which is comprehensive, authoritative and timely. Now we also have the Manchester Index™. The Manchester Index™ is an early indicator of trends in both the Manchester and the UK economy. Using the Manchester Index we are in a great position to “nowcast” the UK economy and get a pretty good steer on employment and investment in the process.

0 Comments

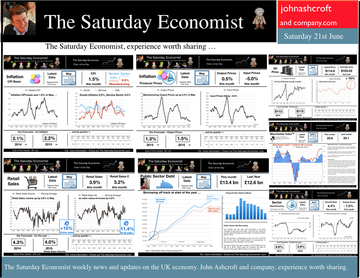

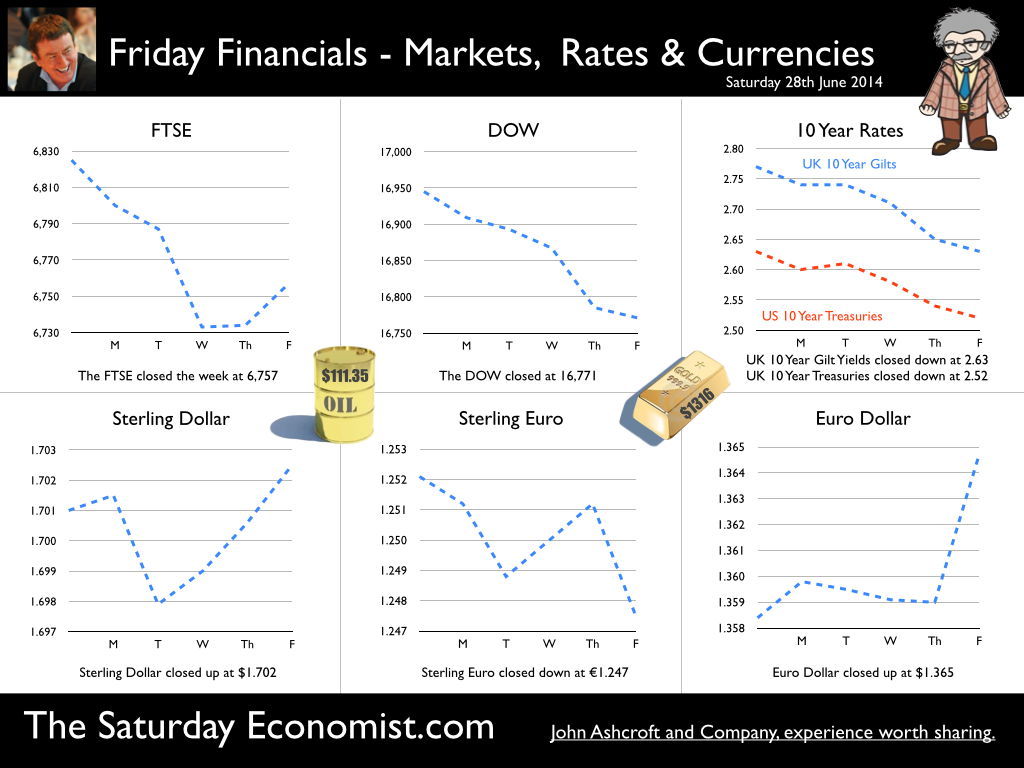

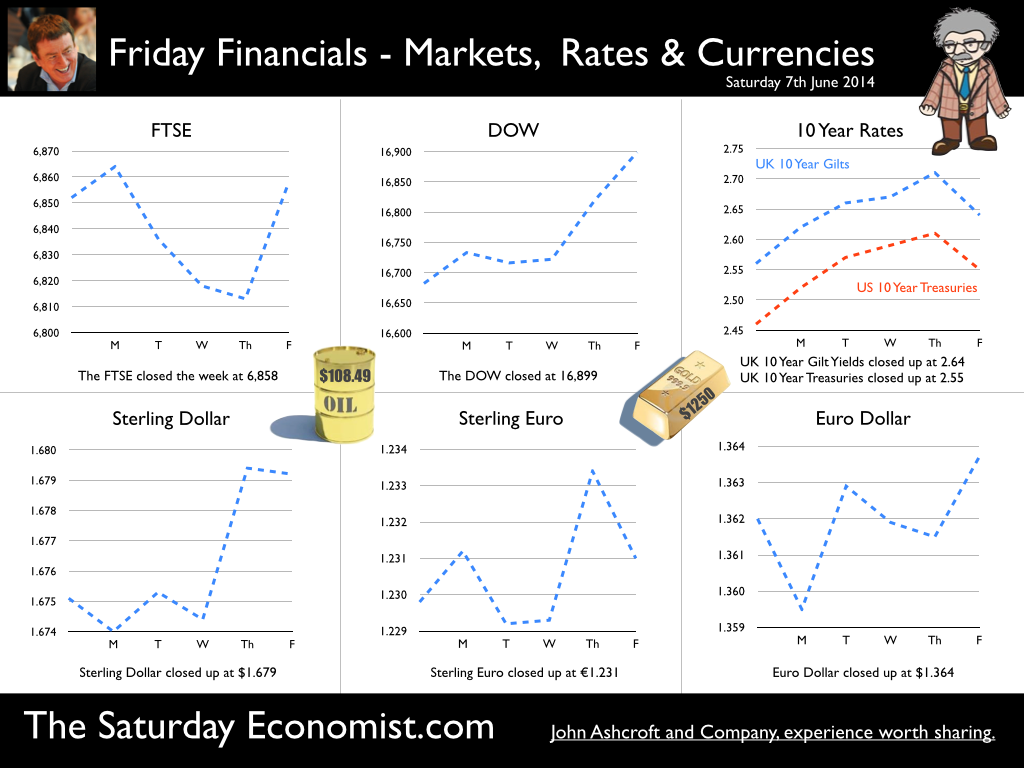

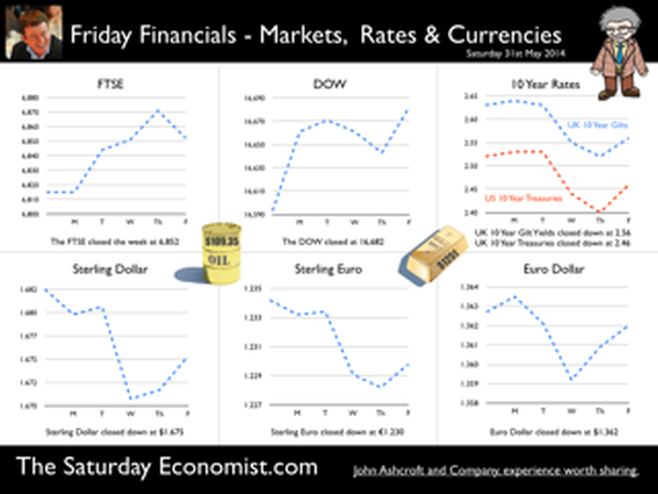

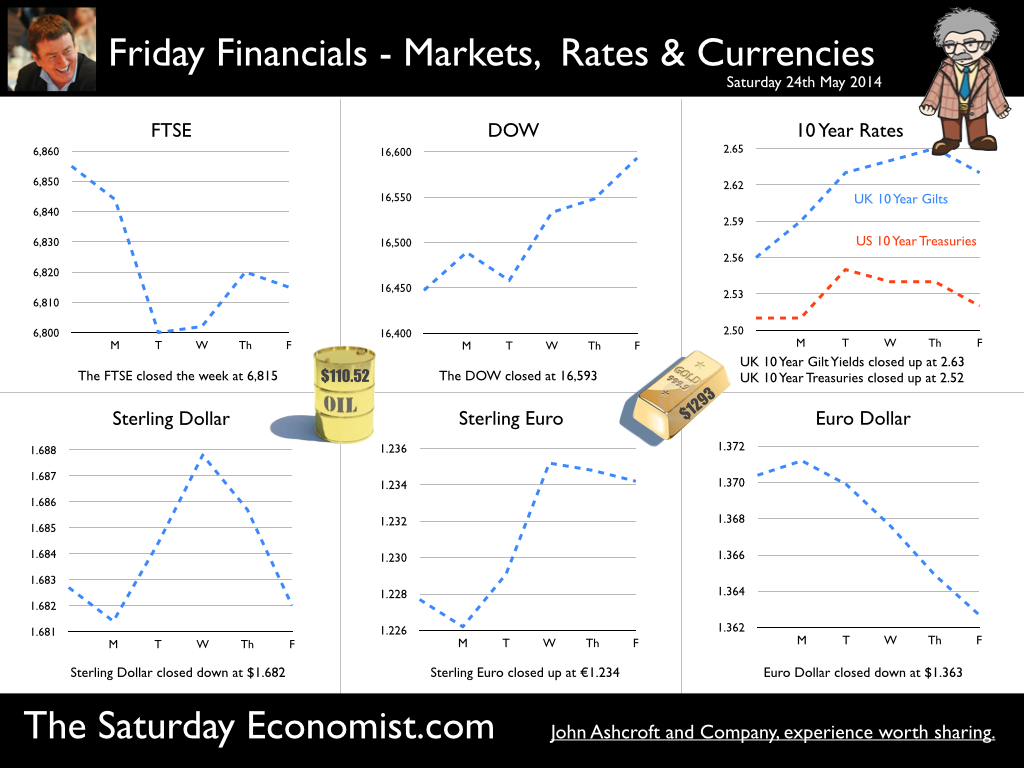

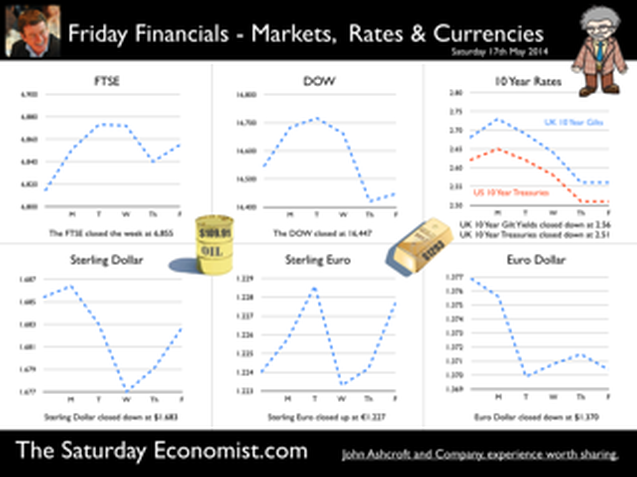

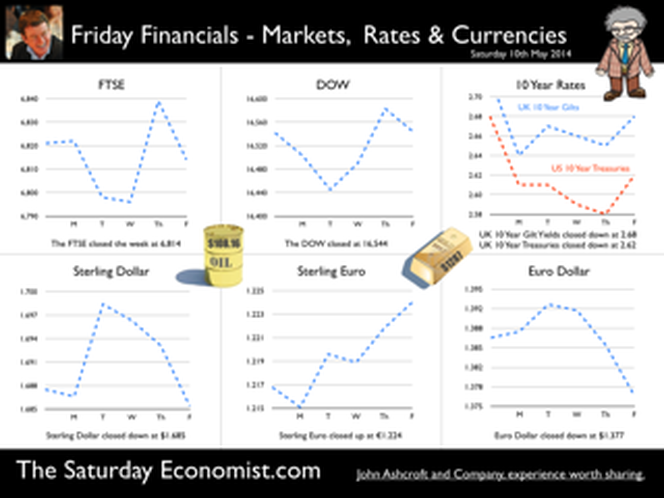

1 Investment is increasing but the economy is not re balancing … In the first quarter of 2014, investment increased by almost 10% compared to the first quarter prior year. The rally in investment is welcome but investment remains some way off the highs of 2007. By the end of 2015, investment will account for just over 15% of GDP compared to 61% for household consumption. The economy is not re balancing Download - Modelling UK Investment 2 Investment isn’t always about productive capacity … In 2007, the largest share of investment was property related. Over 70% of investment is explained by dwellings and commercial real estate investment. Machinery and equipment, areas of investment we tend to associate with “productive capacity”, account for just 20% of total investment spending. 3 There has been no significant loss to productive capacity … Our capital stock model suggests productive capacity within the economy will return to normal by the end of 2014. We identify productive capacity as investment in plant and machinery with a four year capital stock model. There has been no significant loss to productive capacity and output potential 4 Low interest rates of themselves do not stimulate investment … The cost of capital is a relatively low element in the return on investment model. Recovery is the key to unlocking the growth in investment. 5 Investment will assist not lead the recovery … We are forecasting an increase in investment of 7.4% in 2014 and 6.5% in 2015. Our forecasts for UK growth overall are 3% in 2014 and 2.8% in 2015. The investment share of GDP is set to increase as a result. This represents recovery rather than re balancing of the economy. Investment will assist, not lead, the recovery. Download our full report on Modelling UK Investment together with latest forecasts ...  The Governor was in front of the Treasury Select Committee this week. Pat McFadden raised a laugh about forward Guidance - “The bank is behaving like an unreliable boyfriend, one day hot, one day cold, - people on the other side of the message not really knowing where they stand”. But is that really fair? It is true there have been a lot of conflicting signals about when rates will rise! Following Mark Carney’s Mansion House speech, the odds in favour of a rate rise before the end of the year increased but then lengthened slightly, on the strength of sterling and the low inflation figures for May. The Governor is advising markets, “forward guidance is state contingent”. As the state of the economy changes, the timing of future rate increases will also change. No need to wait for the Quarterly Inflation Report to mark the move. The situation is fluid and dynamic. As the data changes, so will future rate rise probabilities. “Don’t watch my lips - watch the data!” the new guidance. Revisions to GDP data … And so it was, the UK data changed, slightly, this week with the revisions to growth in the first quarter. The ONS revised down growth in Q1 from 3.1% to 3%! This is hardly likely to impact on monetary policy in any way shape or form. The adjustments reflect minor statistical adjustments rather than major structural moves. Our forecast of growth for 3% in 2014 is unaffected by the change. Investment grabbed the headlines, increasing by almost 10% in the quarter. The year on year comparison was against a particularly weak quarter last year. We expect investment growth of over 7% for the year as a whole, using research data derived from the Manchester Index™. [GM Chamber of Commerce research data - capacity and investment intentions]. In the USA, the revisions to GDP growth in the first quarter were much more significant. The headlines confirm growth fell by 2.9% quarter on quarter. Yet, the underlying growth year on year was up by 1.5%. The FOMC expect US growth of 2.2% this year rising to over 3% next. So what of Medium Term Rates … In the UK, the governor would have markets believe rates will rise slowly and thereafter are unlikely to rise above 2.5% in the medium term. In the USA, the Fed present no such illusion. Medium term rates, according to members of the FOMC, are expected to rise to 4% plus and some members expect this to occur by 2016. For now, US Bond traders believe the FOMC is too optimistic about the economy. Interest rates will remain low well into this decade. But if it does happen “over there”, is the UK - US spread manageable? Hardly likely. The medium term path of UK base rates is set to return to the 4.0% plus norm in due course, narrowing the divide. As for the timing - well that is another "guidance" issue altogether! So what happened to sterling ... The pound closed up against the dollar closing above the highly significant $1.70 level. Sterling closed at $1.702 from $1.70, slipping against the Euro to 1.247 (1.252). The Euro moved up against the dollar at 1.365 from 1.358. Oil Price Brent Crude closed down at $111.35 from $114.70 as Middle East concerns cleared slightly. The average price in June last year was $102.92. Markets, closed down. The Dow closed down at 16,771 from 16,945 and the FTSE was also down at 6,757 from 6,825. UK Ten year gilt yields were down at 2.63 from 2.77 and US Treasury yields closed unchanged at 2.63. Gold was steady at $1,316 from $1,314. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Manchester Index™ confirms the UK recovery is on track with growth continuing around 3% into the second quarter of the year. The index fell slightly to 33.6 from 35.1, still much higher than pre recession levels. The preliminary results from the GM Chamber of Commerce QES data were available this week. The survey suggests strong growth in manufacturing continues, with slightly more moderate growth in the service sector. The results are in line with our forecasts for the full year - available in the June Economic Outlook. The full results and presentation on the influential Chamber of Commerce QES survey for Q2 will be available on the 4th July. Don’t miss that! Public Sector Finances off track … The strong performance in the economy is slightly at odds with the Public Sector Finances for May, released this week. The UK economy is expanding by just over 3% in the first half of the year. We would expect an improvement in borrowing given the strength of the recovery. Two months into the year and borrowing is off track compared to last year and to plan. In the first two months of the year, total borrowing was up at £24.2 billion compared to £23.2 billion prior year. Strong VAT revenues contributed to a 9% growth in total receipts but expenditure increased by almost 6%, despite a fall in interest payments. Last year’s borrowing figure has been revised to £107.0 billion for the financial year. Good news for the Chancellor but revenues will have to improve and expenditure will have to be contained, if this year’s OBR forecast is to be met. Strong Retail sales in May … Strong retail sales are contributing to the VAT receipts. In May retail sales volumes were up 3.9% compared to last year. This is down on April’s staggering 6.5% growth but we still expect growth of 4.6% in the current quarter and 4.3% for the year as a whole. Internet sales were up by 15%, now accounting for 11.4% of all activity. The online disruption continues. Sales values were up by just 3.2%, contributing to deflation and retail concerns in the High Street. Inflation slows in May … And so it was with the inflation figures. Inflation CPI basis slowed to 1.5% in May, down from 1.8% in April. Service sector inflation was 2.2% and goods inflation held at 0.9%. Falls in transport service costs, notably air fares, provided the largest contribution to the decrease in the rate. Other large downward effects came from food, drinks and clothing. The fall came as something of a surprise, we still expect inflation to track near target (2%) for the year as a whole. Producer Prices no pressure on inflation … No pressure on inflation is evident in the producer price information, released this week. Output prices in May increased by just 0.5% as input costs fell by 5%. Import prices of fuel, oil, food, metals, chemicals, parts, equipment and materials the real story. It is a story of weak international growth in GDP and trade, with slow growth in commodity prices, assisted by the strength of sterling, closing the week above the critical $1.70 level. Monetary Policy and Minutes of the MPC ... So why is Sterling so strong? Statements from Governor Carney that rates may rise “sooner than markets expect" are contrasting with the “Business as Usual” stance from the Federal Reserve. The Fed reduced the forecast GDP 2014 outlook for the US economy to just 2.2% from 3% earlier. Tapering is set to continue but guidelines suggest interest rates will not rise until the second quarter of next year. In the UK, we expect rates to rise in the final quarter of the year. Inflation and earnings suggest that strong growth of itself will not precipitate the rise. The Sterling genie is removing the $1.70 stopper. Who speaks for Sterling? We asked in March last year as the pound headed to the $1.50 level. Sterling look set to test $1.74 in the months ahead unless rate fears are calmed. So what happened to sterling this week? The pound closed up against the dollar pushing through resistance at the $1.70 level. Sterling closed up at $1.7010 from $1.696, steady against the Euro at 1.252 (1.253). The Euro strengthened against the dollar at 1.358 from 1.353. Oil Price Brent Crude closed up at $114.70 from $113.07 on Middle East concerns. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed up. The Dow closed down at 16,945 from 16,776 and the FTSE was also up at 6,825 from 6,790. UK Ten year gilt yields held at 2.77 and US Treasury yields closed at 2.63 from 2.77 on interest rate trends. Gold moved higher on geo political fears at $1,314 from $1,274. That’s all for this week. Visit the revamped web site. Download our Quarterly Forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. About the Manchester Index™ … The Greater Manchester economy correlates highly with trends in the national economy. The Manchester Index® is an early indicator of trends in both the Manchester and the UK economy. The index is derived from the GM Quarterly Economics Survey which forms part of the British Chambers of Commerce National Survey. Greater Manchester is the largest contributor to this important business survey. We poll 5000 businesses every quarter. As the principal national business survey and the first to be published in each quarter, the results are closely monitored by HM Treasury and the Bank of England Monetary Committee. The GM survey data has a high correlation with the national data. In other key indicators, the unemployment claimant count for example, has a high correlation (over 99%) with the national data set. Our business investment tracker utilises data from capacity and investment intentions to forecast investment in the UK economy. We lag capacity by four quarters and investment intentions by two quarters to model spending.  The first rate hike - it could happen sooner than markets expect … speaking at the Mansion House this week, Mark Carney gave a clear indication UK rates could be hiked this year. “It could happen sooner than markets expect”, the exact wording. A bit tough on the markets, they had placed great confidence in forward guidance. So much for the “unemployment trigger” or the “eighteen indicators” - “watch my lips”, the Governor’s new condition precedent. Last week we suggested - UK rates would have to rise sooner than forward guidance implied. We didn’t have long to wait. The Governor made the move. The markets now believe rates may rise in the final quarter of this year. October would be a fair bet. UK data continues to suggest rates should rise in the Autumn … Construction output increased by a revised 6.7% in the first quarter of the year and by 4.7% in April. We are forecasting growth of almost 6% this year and 5% in 2015. Our forecast for GDP growth is upgraded slightly to 3% from 2.9% this year, as a result of the revisions to the construction data. [Our forecast is unchanged for 2015 - 2.8%]. Manufacturing output increased by 4.4% in April following growth of 3.6% in the first quarter. A strong performance in capital goods output was supported by growth in consumer durables. The march of the makers is picking up the pace but output remains just over 7% below the peak level of 2008. We continue to forecast a recovery with growth of 4% this year. Jobs Data - another strong performance revealed this week. The claimant count fell by 27,000 to 1,086 thousand in May. The reduction over the last three months was 86,000. The average claimant count from 2005 to the middle of 2008 was 880,000. If current trends persist, the pre recession levels will be achieved by the end of the year and job centres will be closing by the end of 2017! The number of vacancies increased to 637,000. This is higher than the average pre recession levels of 634,000. The UV ratio fell to 1.7 from a peak of 3.8 in 2009. The average 2005 - 2008 was 1.4. 33 million are in work [DYDC], an increase of over one million over the last twelve months. Our estimate of spare capacity is 0.6%, compared to the estimates of 1% - 1.5% within the Bank of England. The margin is wafer thin. The “gap” will be exhausted by the final quarter of the year. The labour market is tightening. Rates should be set to rise towards the end of the year. So what happened to sterling this week? The pound closed up against the dollar following the comments from the Governor, encountering resistance at the $1.70 level. Sterling closed up at $1.696 from $1.679, up against the Euro at 1.253 (1.231). The Euro softened against the dollar at 1.353 from 1.364. Oil Price Brent Crude closed up at $113.07 from $108.48. The situation in Iraq and the Middle East pushed prices higher. The average price in June last year was $102.92. The inflation impact cannot be ignored if the a-seasonal pattern persists. Markets, closed down on fears of the rate hike in the UK and in the USA. The Dow closed down at 16,776 from 16,899 and the FTSE was also down 6,790 from 6,858. UK Ten year gilt yields rallied at 2.77 (2.63) and US Treasury yields closed at 2.77 from 2.55 on interest rate trends. Gold moved higher on geo political fears at $1,274 from $1,250. That’s all for this week. Visit the revamped web site. Download our quarterly forecast. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The MPC left rates on hold this week. We will have to wait a few weeks to find out if the vote was unanimous. For the moment the consensus view is likely to have held. But for how long will this be the case? Forward Guidance is already becoming confused by statements from Martin Weale and Charlie Bean. By the Autumn, the Bank may adopt Dr Doolittle’s pushmi.pullyu animal as a mascot. So thin - the margin of spare capacity - for consensus. The timing of rates is likely to become more polarised amongst MPC members. Who will make the first move? The “Wad is on Weale” to be the first to break ranks. UK data suggest rates may rise sooner … The UK data continues to suggest rates may have to rise sooner than forward guidance implies. Car sales in of May were up by almost 8% in the month and by 12% in the year to date. According to Nationwide, house prices increased by 11% in the twelve months to May. The Halifax House Price data suggested house prices increased by almost 9% over the same period. According to Stephen Noakes, Halifax Mortgages Director : “Housing demand is very strong and continues to be supported by a strengthening economic recovery. Consumer confidence is being boosted by a rapidly improving labour market and low interest rates”. Christine Lagarde and the IMF squad were in the UK this week. The IMF has warned that house prices pose the greatest threat to the UK recovery. It called on the Bank of England to enact policy measures "early and gradually" to avoid a housing bubble. The Fund's annual health check, suggested the UK economy has "rebounded strongly” confirming growth would "remain strong this year at 2.9%”. The IMF also suggested growth is becoming “more balanced” but … Trade deficit deteriorates … There was no evidence of rebalancing in the trade figures for April. The trade deficit in goods increased to £2.5 billion in the month as the deficit (trade in goods) increased to almost £10 billion. OK, someone forget to include all the oil data in the month, which may have under stated exports by £700 million but this is a minor detail. We expect the deficit (trade in goods) to be between £112 billion and £115 billion offset by a £50 billion service sector surplus this year. No rebalancing on the trade agenda, as we have long explained. Markit/CIPS UK PMI® Survey Data The Markit/CIPS UK PMI® survey data was also released this week. “The UK manufacturing upsurge continued”. The Manufacturing PMI index was 57.0 in May, down slightly from 57.3 in April. The survey noted strong growth in output and new orders. There was also a sharp rise in construction output. House building remained the strongest performing area of activity. The headline index was signaling growth for the thirteenth successive month at 60.0, compared to 60.8 prior month. The headline service sector index continued in positive territory at 58.6 compared to 58.7 last month. Service sector employment growth increased at the fastest rate in 17 years. Interest rate outlook … The strong growth in consumer spending, retail sales, car sales and the housing market continues. The outlook for output remains strong in construction, manufacturing and the service sector. We expect investment activity to increase this year. The unemployment rate will continue to fall, placing greater pressure on wage settlements, leading to an increase in earnings into the second half of the year. The trade deficit will continue to deteriorate albeit at a rate which is offset by the strength of the service sector surplus. Sterling will probably hold at current levels for the rest of the year. Inflation, will remain around target, such is the weakness of international energy and commodity prices for the near future. With such a strong outlook for the domestic economy, rates should probably be on the rise by the Autumn of this year. However the MPC will be reluctant to move ahead of the Fed and the ECB. USA and Europe ... In the USA, Friday’s strong jobs report confirmed the economy is improving following the slight setback in the first quarter. Non farm payroll increased by over 200,000 as the unemployment rate held at 6.3%. For the year as a whole, the Fed may downgrade the growth forecast to around 2.7% from 3% currently. For the moment, forward guidance suggests US rates may begin to rise in the second quarter of 2015 but the outlook may be shortened, if the job trends continue. In Europe, the ECB is heading in another direction. The growth forecast within the Eurozone is just 1% this year but officials are concerned about the prospect of deflation. The latest HICP figure confirmed prices increased by just 0.5% compared to 0.7% prior month. The ECB decided to lower the interest rate on the main refinancing operations of the Eurosystem by 10 basis points to 0.15% and the rate on the marginal lending facility by 35 basis points to 0.40%. The rate on the deposit facility was lowered by 10 basis points to -0.10%. To support bank lending to households and business, excluding loans for house purchase, the ECB will be conducting a series of targeted longer-term refinancing operations (TLTROs) valued at €400 billion over a four year period. The scheme follows the success of the UK Funding for Lending Scheme. So what of forward guidance … Domestic considerations suggest UK rates should be on the rise towards the end of the year. For the moment, forward guidance in the UK and the USA suggests rates will be held until the second quarter of 2015. This may change, if the trends in job growth continue here and in the USA. In Europe, forward guidance is more concerned with the prospects of deflation and a “lost decade”. An increase in rates is not on the “horizon” nor even in the appendix. So what happened to sterling this week? The pound closed up against the dollar at $1.679 from $1.675 and unchanged against the Euro at 1.231 (1.230). The dollar closed broadly unchanged at 1.364 from 1.362 against the euro and at 102.53 (101.80) against the Yen. Oil Price Brent Crude closed down at $108.48 from $109.35. The average price in June last year was $102.92. It is summer after all. Markets, the Dow closed up at 16,899 from 16,682 and the FTSE moved up to 6,858 from 6,852. UK Ten year gilt yields closed at 2.64 (2.56) and US Treasury yields closed at 2.55 from 2.46. Gold held at $1,250 from $1,251. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  It may have taken some time but households across Britain have finally come to terms the with strength of the recovery. According to GfK, the UK Consumer Confidence Barometer increased to levels last seen in the early part of 2005. Rejoice - we are having a recovery - would have been the Conservative mantra under Prime Minister Thatcher. Confidence in the economic situation of the country, increased to the highest level EVER, since records released in 2004. The propensity to spend is back to levels of 2006, even though the financial situation of households index is still below pre recession numbers. No surprise, perhaps, but with interest rates at such low levels, there is no real uptick in the intentions to save - for the moment at least. Interest Rates set to rise … Maybe households are waiting for the rates to rise. According to Markit®, nearly one in four households expect a rate rise within the next six months … almost half expect rates to rise within the next twelve months. Chris Williamson, Chief Economist at Markit® said, “the recent upbeat news-flow on the economy, strong economic growth in the first quarter, record employment growth and surging house prices, means an increasing number of people think it inevitable that policymakers will be forced into an earlier rate hike than previously envisaged.” Quite right! In fact almost ten per cent, think rates are set to rise within the next three months! So much for forward guidance from the Bank of England. Charlie Bean and Baby Steps … Charlie Bean, the outgoing (as in departing) deputy governor of the Bank of England has suggested “The argument for gradual rises suggests rates should start to go up sooner. The rise could start with “baby steps to avoid making mistakes”. “There’s a case for moving gradually because we won’t be quite certain about the impact of tightening the Bank rate, given everything that has happened to the economy.” The sentiment was also echoed by MPC member Martin Weale, this week. "We can wait a bit longer. How long that 'bit longer' will be I'm not sure.” Ah yes, the merits of forward guidance and a clear steer on monetary policy. Governor Carney will have to whip the MPC troops into line if we are to avoid complete confusion on the direction of rates. The Bank would still have us believe rates will rise in the second quarter of next year. UK rates should rise in the Autumn … In our Greater Manchester Chamber of Commerce Economic Quarterly Outlook, to be released next week, we begin to caution, UK rates should be on the rise in the Autumn, if the present trends in household spending, retail sales and the housing market continue. From an international perspective, the MPC will be reluctant to act ahead of the Fed and the ECB. In the first quarter, US GDP recorded growth of just 2% year on year, postponing, perhaps, the inevitable rate rise. In Europe, fears of deflation may force the ECB to act, to ease, rather than tighten, monetary conditions still further in the June meeting. Japan ends fears of deflation … In Japan, fears of deflation have been assuaged by Abenomics. The solution to fears of falling prices - increase the rate of sales tax and push up prices! Japanese inflation increased by over 3% in April, half of which is explained by the hike in taxes! Fears may later emerge about the slow down in growth, such is the Ground Hog day experience of the lost decade but for the moment, rejoice - the deflationary spiral has been broken in the East! Good News for growth in the UK … Good news for growth in the UK continued this week according to today’s Financial Times. Drugs and prostitution will add £10 billion to the UK economy. Yes, the news that prostitution and drugs will be included in the calculation of the National Accounts from September onwards, adding a new dimension to the “Service Sector” offer. The change will add almost £10 billion to the National Accounts. Hookers will contribute £5.3 billion to “output” (GDP(O)) and drug addicts will add £4.4 billion to the calculation of expenditure (GDP(E). According to ONS research, in 2009, 60,879 prostitutes serviced 25 clients per week at an average spend of £67.19. Don’t you just love economics! If only "tricks" paying 19p could be persuaded to spend more … that would be a recovery! So what happened to sterling this week? The pound closed down against the dollar at $1.675 from $1.682 and down against the Euro at 1.230 (1.234). The dollar closed broadly unchanged at 1.362 from 1.363 against the euro and at 101.80 (101.97) against the Yen. Oil Price Brent Crude closed down at $109.35 from $110.52. The average price in May last year was $102.30. Markets, the Dow closed up at 16,682 from 16,593 and the FTSE moved up to 6,852 from 6,815. The markets are set to move higher. UK Ten year gilt yields closed at 2.56 (2.63) and US Treasury yields closed at 2.46 from 2.52. Gold moved down to $1,251 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  It was one of those heavy weeks for economics releases. Inflation, retail sales, government borrowing plus the eagerly awaited second estimate of GDP. Add in ONS house price information and a heady cocktail of excited headlines was to be expected from the financial pages. Inflation data as expected … It began quietly enough with the inflation data. No surprises, CPI inflation edged up to 1.8% in April from 1.6% in the prior month. The large rise in service sector inflation to 2.8% from 2.3% was offset by a small decline in goods inflation, falling to 0.9% from 1.0%. The uptick was marginally reflected in producer prices, increasing to 0.6% from 0.5%. The more volatile input costs, fell at a slower rate -5.5%, from -6.3% prior month. Energy and oil prices, were again significant in the reduced input costs. Imported metals, chemicals, parts and equipment fell significantly assisted by the 10% appreciation of sterling against the dollar. For the year as a whole, we think inflation will hover close to the target for the best part of the year. The risk remains to the upside in the final quarter. A rise in international prices, and domestic demand, boosted by compression in the labour market is likely to push prices higher. No risk of deflation on the UK horizon, a real risk to the upside is developing. House Prices .. UK house prices increased, according to the ONS data, by 8% in the twelve months to March. “The house market may derail the recovery", the headline. “Carney believes that house prices are the biggest risk to the economy” the great caution. No matter, that house prices increased by over 9% in the prior month or that house prices outside London are increasing by just 4% on average. In the North West prices increased by just over 3%, in Scotland prices hardly increased at all. In London, house prices increased by 17%. Foreign cash buyers at the top end of the market may be confusing the overall trend. However, significant volume and price escalation in the mid tier market is also impacting on price averages. Governor Carney has made it clear interest rates will not rise to combat rising house prices. The remit to action lies with the Financial Policy Committee. Already, action has already been taken to modify the Funding for Lending Scheme away from mortgage lending. Discussions between the Bank and Treasury will continue to consider modifications to the “Help to Buy Scheme”. Implementation of the Mortgage Market Review will also curb lending into 2014. There is a structural problem in the housing market. Mark Carney, Governor of Threadneedle Street, points out that Canada has half the population of the UK but builds twice as many houses. No wonder there is a supply issue. But is the Bank of England prepared to help out? Not really. The Little Old Lady will not turn a sod, grab a hod nor build a single house this year. “We are not in the business of building houses” the Governor’s mantra. The Bank of England will not build a single house in this cycle but neither will it allow the housing market to derail the recovery, provoking a premature move in base rates. Retail Sales … Retail sales figures, on the other hand, suggest rates may have to rise much sooner than expected. Retail sales volumes increased by 6.8% in April compared to prior year. It was May 2004 when retail sales volumes increased at a similar rate. Base rates were 4.75% at the time rising to over 5% within eighteen months. Retail sales values increased by just over 6%. Online sales increased by 13%, accounting for 11% of total action. Consumer confidence is back to the pre recession levels, car sales are up by 8% this year and retail sales are soaring. From a UK perspective, rates should be on the move by the Autumn of this year. The MPC will be reluctant to move ahead of the Fed and the ECB. The international context suggests the rate rise may be delayed until the second quarter of 2015. Thereafter, for those who would argue the forward horizon has 2.5% cap, the retail sales figures and base rate history should provide a warning of surprises to come. GDP Second Estimate … No surprises in the second estimate of GDP release for Q1. No revisions. The UK economy grew by 3.1% boosted by an 8% surge in investment activity. Manufacturing and Construction increased by over 3% and 5% respectively. The economy is rebalancing … well a little bit! Our May Quarterly Economics Update on behalf of GM Chamber of Commerce is released next week. The outlook for the year remains broadly unchanged. We expect the UK economy to grow by around 3% this year and 2.8% in the following year. The surge in retail activity has been a surprise, as is the continued strength in employment. The outlook remains much the same. Growth up, inflation rising slightly, employment increasing and borrowing, despite the blip in April, set to fall. Just the trade figures will continue to disappoint as we have long pointed out. So what happened to sterling? The pound closed broadly unchanged against the dollar at $1.682 from $1.683 and up against the Euro at 1.234 (1.227). The dollar closed at 1.363 from 1.370 against the euro and at 101.97 (101.54) against the Yen. Oil Price Brent Crude closed up at $110.52 from $109.91. The average price in May last year was $102.3. Markets, the Dow closed up at 16,593 from 16,447 but the FTSE adjusted to 6,815 from 6,855. The markets are set to move, the push before the summer rush perhaps. UK Ten year gilt yields closed at 2.63 (2.56 and US Treasury yields closed at 2.52 from 2.51. Gold was unchanged at $1,293 from $1,293. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  The Bank of England Inflation Report - May - So when will rates rise? Q2 2015 still the best bet. The final whistle not for some time yet! The Bank of England Inflation Report was released this week. It was all so predictable. The Governor’s opening remarks explained, “The overall outlook for GDP growth and inflation in this report is little changed from February. The UK economy continues to perform strongly. Having increased by more than 3% in the past year, output is now close to regaining the pre-crisis level. 700,000 more people are in work than a year ago and inflation is below, but close to, the 2% target. And so it proved. The strong labour market performance continued into April. The claimant count rate fell by 25,000, to a rate of 3.3%. The wider LFS data (to March) also reflected the improvement with a fall in the overall rate to 6.8%. On current trends the job centres really will be closing in 2017! The MPC expectations are for growth to increase by 3.2% in the second quarter and by 3.4% for the year as a whole, with continued expansion in household spending. Spending will be supported by an increase in real wages as inflation remains close to target and earnings increase moderately, with a gradual improvement in productivity. The MPC obsession with spare capacity continues. “While there is a range of views on the Committee, the best collective judgement is the margin of spare capacity is around 1% to 1.5% of GDP.” Charlie Bean is not entirely convinced about the “fuzzy concept” of spare capacity. “There is a real danger of spurious precision and the pretence of knowledge in this area” said the Deputy Governor. Quite so. That and many others perhaps! Does spare capacity impact on inflation prospects? Not so much. International inflationary pressures are key to current price trends and for the moment remain subdued. “The global picture is consistent with muted external inflationary pressures which, coupled with sterling’s appreciation, will moderate CPI inflation in the near term” said the Governor. Inflation has fallen sharply since the Autumn and the outlook for inflation in the medium term remains benign. A benign inflation outlook which will avoid undue pressure, in the short term, to increase rates, despite the strong growth figures and the buoyant housing market. So what of rates? The strength of the recovery has moved the economy “closer to the point at which interest rates will have to rise”, the official statement. So when will rates rise? In February, the MPC were happy to attach some credence to the market view that rates would begin to rise in the second quarter of next year. If anything the view in May is slightly more “dovish” or certainly more obtuse. “Our guidance is giving businesses and households confidence that we won’t take risks with price stability, financial stability, or the incipient expansion. It will promote the recovery in business investment, productivity and real wages, that a sustained expansion demands.” Rates are still unlikely to move until the second quarter of next year, the implication. As we explained last week, the MPC will be reluctant to move ahead of the Fed and the ECB. Forward guidance then lapsed into sporting analogy as the governor explained : “Securing the recovery is like making it through the qualifying rounds of the World Cup. That is an achievement but not the ultimate goal. The real tournament is just beginning and the prize is a strong, sustained and balanced expansion.” Yes the the Governor is laying out his team formation for the tournament ahead . “A flat back four with growth, inflation, unemployment and borrowing all heading in the right direction. Two strikers up front, household spending, with support to come from business investment. Some confusion in mid field from the housing market but no mention of exports and rebalancing. So expect the odd own goal from the trade performance, errant on the wing, as we move into the final stages of the competition. The Governor, for now, is not “taking away the punchbowl as the match gets going”. Far from it, you may continue to consume alcohol on the terraces, well into the final stages. Base rates are not expected to rise anytime soon. Q2 next year still the best bet. The final whistle will not be blown for some time yet.” So what happened to sterling this week? The pound closed broadly unchanged against the dollar at $1.683 from $1.685 and up against the Euro at 1.227 (1.224). The dollar closed at 1.370 from 1.375 against the euro and at 101.54 (101.18) against the Yen. Oil Price Brent Crude closed up at $109.91 from $108.16. The average price in May last year was $102.3. Markets, the Dow closed down at 16,447 from 16,544 but the FTSE closed up at 6,855 from 6,821. The markets are set to move, the push before the summer rush. UK Ten year gilt yields closed at 2.56 (2.68) and US Treasury yields closed at 2.51 from 2.62. Gold moved up slightly $1,293 from $1,287. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.  UK … This week, the Bank of England’s Monetary Policy Committee voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of QE assets at £375 billion. No real surprise, UK rates are expected to remain on hold until the second quarter of 2015. For the moment, UK policy is relatively clear cut. USA … Over in the USA, matters became a little more diffuse. Tapering is expected to continue, concluding the asset purchase programme in September or October this year. But then what happens next? In March, Janet Yellen head of the Fed, gave a clear indication US rates would begin to rise within six months of the end of tapering. Markets reacted badly and the FOMC was minded to recant. This week, testifying before the Joint Economic Committee of the U.S. Congress, Chairman Kevin Brady pushed pushed Yellen for more clarity on when the FOMC would raise interest rates. The Fed chair would not be drawn on this occasion. “There is no mechanical formula for when that would occur” - the somewhat mechanical and evasive response. Oh yes, a month is a long time in the formulation of monetary policy. Europe … In Europe, Mario Draghi, President of the ECB, faced the opposite dilemma. With modest growth forecast for Euroland this year, inflation below target at less than 1% and a Euro strengthening against the dollar ($1.375), the Italian banker is under pressure to alleviate European monetary conditions still further. Playing for time, Draghi stated policy makers at the bank were comfortable with action in early June. Action awaits the “staff projections” for growth and inflation next month, before considering the next step. Draghi must hope forecasts are revised upwards. Having promised to “do what it takes” to stimulate growth, the President is clearly at a loss, as to what can be done next. A reduction in base rates to the zero floor would have little economic impact. Experimentation with negative rates is a high risk strategy. The move would thrill academic economists but cause trauma in the markets. This is no time for experimentation with central bank novelties. QE is muted as a possibility but with German and French long rates at 1.45% and 1.9%, there seems little cause to push rates lower. Ten year bond rates in Spain and Italy are this week trading within 25 basis points of UK gilts. MPC Dilemma … So here in a way is the dilemma for the MPC. The UK economy is growing at 3% a year, unemployment is falling at such a rate, we may have to close the job centres in 2017. Inflation is below target but as Mario Draghi pointed out this week, it is the weakness in international commodity prices, oil, energy and food, the real determinants of low inflation. Low inflationary pressure exacerbated or assisted by the rise in the Euro (and Sterling) against the Dollar. The UK is caught in the Dollar Euro vortex, with basic economics pushing monetary policy in opposing directions apparently. The MPC cannot move ahead of the Fed or much in advance of Europe for that matter without pushing Sterling still higher. Deflation the illusion - OECD World Forecasts This month the OECD forecast a recovery in world growth this year to 3.4% in 2014 and almost 4% in 2015. The Euro area is set to grow by 1.2% and 1.7% over the period. Euro inflation is set to rise above 1.2% next year. Commodity prices (base metals) are demonstrating a price basing action, Oil Brent Crude basis is trading ahead of last year. The international price profile can change quickly and dramatically. The threat of deflation - an illusion - which may quickly dissipate. A strong ECB president should do nothing. The US must accept rates will rise within six months of the end of tapering. This would leave the MPC free to begin the inevitable rate rise in the second quarter of next year. Want to here more, don’t miss the quarterly economics presentation on Wednesday at DWF next week. The multi media roadshow rolls on! So what happened to sterling this week? The pound closed unchanged against the dollar at $1.685 from $1.687 and up against the Euro at 1.224 (1.217). The dollar closed at 1.375 from 1.377 against the euro and at 101.18 (102.23) against the Yen. Oil Price Brent Crude closed at $108.16 from $108.50. The average price in May last year was $102.3. Markets, the Dow closed unchanged at 16,544 from 16,542 and the FTSE also closed up at 6,821 from 6,814. The markets are set to the move, the push before the rush. UK Ten year gilt yields closed at 2.68 (2.72) and US Treasury yields closed at 2.62 from 2.72. Gold moved down $1,287 from $1,296. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. It's just for fun, what's not to like! Dr John Ashcroft is The Saturday Economist. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed