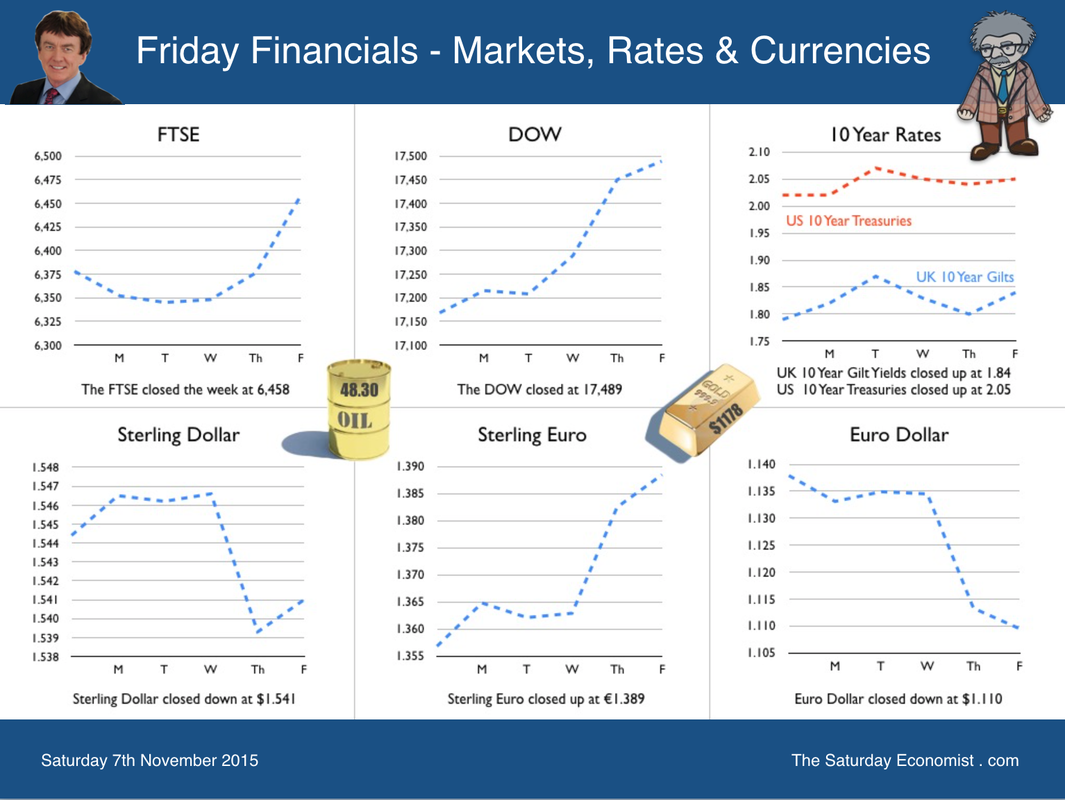

Remember, Remember the 5th of November, began the Governor in his opening remarks on Thursday. "What is memorable about today’s Inflation Report", he continued … well not much really. Assured in August, the interest rate rise would come into closer focus at the end of the year, by the end of the meeting analysts, were less clear about which year was in question. The indication - rates would be on hold until late into 2016 or early the following year. Bags packed, ready to leave, now we are told all flights are suspended until 2017 perhaps. We are trapped on Planet ZIRP with no chance of escape. The Inflation Report headlines familiar. Inflation close to zero. Another letter written to the Chancellor. The MPC has voted by a majority of 8-1 to maintain Bank Rate at 0.5%. Asset purchases will be maintained at £375 billion until inflation hits the 2% level ... More fundamentally, monetary policy must continue to balance two forces, domestic strength and foreign weakness, if we are to return inflation to target in a sustainable manner. Sterling fell on the news of a weaker rate outlook, [assisting inflationary acceleration in the process.] The weakness of growth in emerging markets and Chinese whispers caused a complete change in the Bank stance on interest rates apparently. In reality not much has changed. Chinese stocks rallied this week, marking a new bull market. Growth of 6.5% is set to become the new Mandated Mandarin target. Not much of a slow down in reality. Despite the poor UK growth outlook in Q3, The Bank of England is still expecting growth of 2.7% this year with inflation set to return to target over the medium term. Before the Governor’s end of term in office - perhaps. Late in the presentation the Governor explained, “There is no major central bank, the Bank of England included, that knows what it is going to do at its next meeting” - yep we were certainly getting that feeling. Bring back forward guidance the mantra and some semblance of oversight and see through in the process. US Jobs in October … No such quandary in the USA. Despite the poor GDP figure in Q3, (2% year on year) the Fed remains on track to hike rates in December. Chatter from the FOMC is turning to the rate and timing of the subsequent round of increases in 2016. The October employment data proved the strength of the US recovery continues. Total non farm payroll employment increased by 271,000 in October. The unemployment rate essentially unchanged at 5.0 percent. So what of the UK … Despite the dovish remarks during the Inflation Report presentation, the MPC will be obliged to follow the Fed with a rate rise in early 2106. We still expect a UK rate rise on March. Growth will be around 2.7% this year, with little slow down next year. The jobs market is tightening and earnings are increasing. Domestic demand will remain strong. The international outlook may change significantly for the better early in the New Year. UK Manufacturing September … The GDP figures in Q3 released last week were hampered by a poor performance in manufacturing and construction. We expect substantial revision to the construction data on the next ONS update but the manufacturing figures continue to disappoint. Data released this week confirms manufacturing output fell in September by 0.6% and by almost 1% in the quarter. A further disappointing performance from consumer durables and capital goods, continue recent trends. The PMI Markit data suggests a modest manufacturing rally in October. The average growth over the last fifty years has been less than 0.5%. We now expect zero growth this year following last year’s near 3% surge. Trade Data in September … The trade deficit narrowed in September following an implausible fall in imports in the month. The UK’s deficit on trade in goods and services was estimated to have been £1.4 billion in September 2015, a narrowing of £1.6 billion from August 2015. The narrowing is attributed to trade in goods, where the deficit fell from £10.8 billion in August 2015 to £9.4 billion in September 2015. The fall was attributed to a decrease in unspecified goods of £1.0 billion. It must have included the fall in Volkswagen vehicles. Last month, VW sales fell by 10% year on year as the emissions scandal clouds the new registrations outlook. For the year as a whole, we still expect a trade in goods deficit of £125 billion largely offset by a service sector surplus of £95 billion. The overall deficit (trade in goods and services) less than 2% of GDP will not provide a hindrance to growth. So what happened to Sterling over the last two weeks? Sterling moved down against the Dollar to $1.506 from $1.541 but moved up against the Euro to €1.403 from €1.389 The Euro moved down against the Dollar at €1.074 from €1.110. Oil Price Brent Crude closed at $47.35 from $48.30. The average price in November last year was $79.44. The deflationary push continues. Markets, up? The Dow closed at 17,814 from 17,489. The FTSE closed down at 6,353 from 6,458. Gilts - UK yields moved up. UK Ten year gilt yields were at 2.03 from 1.84. US Treasury yields moved to 2.33 from 2.05. Gold moved to $1,088 ($1,178). That's all for this week. Enjoy the rest of the week-end. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed