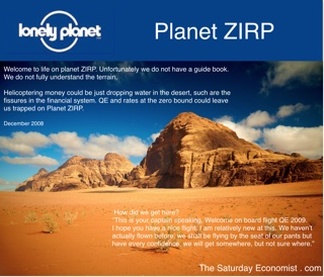

One day we will realise that low rates are part of the problem and not the solution. Planet ZIRP was always supposed to be a stopover not a permanent settlement. Low rates, and QE effectively mis price capital leading to a misallocation of resources. Misallocation of resources leads to asset price inflation in housing, commercial real estate bonds and gilts. Asset price inflation leads to yields and dividends collapsing, putting pressure on annuity yields, savers, pensioners, pension funds and insurance companies. Pension funds are forced to over invest in bond volumes to secure yield mass despite the risk of price collapse in the medium term. The lack of realistic yields and bond collapse can lead to capital flight. Overseas investors will reduce holdings of domestic gilts to offset the low yields and risk of bond price collapse in the medium term. Currently overseas holdings of UK gilts are down to 25% compared to a 30% plus average. Over the medium term, we expect bond yields (after Fisher) to reflect a hedge against inflation plus a real risk return. Hence we consider the normalised yield on ten year gilts to be between 4% to 4.5% if the plausible inflation target is 2%. There is a real risk of capital collapse as bond yields rise and capital prices fall as yields return to normalised values. The mis pricing of capital leads to unrealistic gilt yields (currently around 2%) which then leads to the mis pricing of risk in the search for yield. In 2012 Zambia was able to issue a dollar denominated government bond twenty times oversubscribed yielding 5.4%. Current Zambian 2 year yields are 22%. Low interest rates and the low cost of capital have led to an over investment in commodities and energy supplies. In turn over investment, despite strong demand conditions leads to over supply and pressure on prices. Low prices introduce a disinflationary spiral on planet ZIRP which reduces the pressure to increase rates, compounding the misallocation of resources and delaying the departure date. The Fed, is considering a rate rise in December, the MPC must surely follow in March or April next year. Draghi should avoid further talk of easing monetary policy and follow the counsel of the council of Wise Men. Warning from the Wise men of Europe … In Europe, Berlin's Council of Economic Experts - known as the country's five "wise men" - said the ECB must consider tapering its bond-buying measures early to avoid dangerous imbalances from building up in the bloc. The European Central Bank must end its unprecedented stimulus measures to prevent a new financial crisis from erupting in the eurozone. "Monetary policy is leading to a build-up of risks to financial stability which could pave the way for a new financial crisis,”. "Persistently low interest rates erode the earnings of banks and life insurance companies, and raise the appetite for taking risks. It is important to avoid delaying an exit from the low interest rate environment for too long.” Instead, they called for the ECB to announce "a timely end to monetary policy accommodation which could effectively prevent the further build-up of risks in the financial system.” Asset Price Inflation … In June 2013 Andy Haldane warned : “Let’s be clear, we have intentionally blown the biggest government bond bubble in history” speaking before the Treasury Select Committee. Andy Haldane was then the director of financial responsibility at the Bank of England. Not to worry, the markets will get the message in the end. High bond prices and absurdly low yields are a by product of life on Planet ZIRP. With short rates at or near the zero interest rate bound, undermining long term rates was considered to be the next great step. Who could possibly think that creating a financial climate with negative long term real rates, would encourage lending, in an uncertain business world. There is no “Lonely Planet” Guide to life on Planet ZIRP as we pointed out in December 2008. Commenting on a paper by Bernanke - we said then - “OK it’s official, the effects of QE remain quantitively quite uncertain. Welcome to Planet ZIRP. We don’t have a hand book or fully understand the terrain. We cannot be sure QE is going to work at all. The process of quantitative easing, the plan to helicopter money may work but as a fire fighting option, it may be like dropping water into a desert, such are the fissures in the financial system” We also said, “This is your captain speaking, Welcome on board flight QE 2009. I hope you have a nice flight, I am relatively new at this, haven’t actually flown before, we shall be flying by the seat of our pants but have every confidence, we will get somewhere, but not sure where, in the end.” QE was an experiment which is still five years late unproven. We warned then, Planet ZIRP, would be a desiccated sterile planet where a liquidity crisis is exacerbated and prolonged. Now, eight years on, the US markets are beginning to welcome the end of the Bernanke experiment and the departure from Planet ZIRP. Soon too UK and Euro markets will follow suit. We need to ensure an orderly exit, avoiding the mad rush should an asset collapse and sterling crisis precipitate a more rapid response. JKA

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed