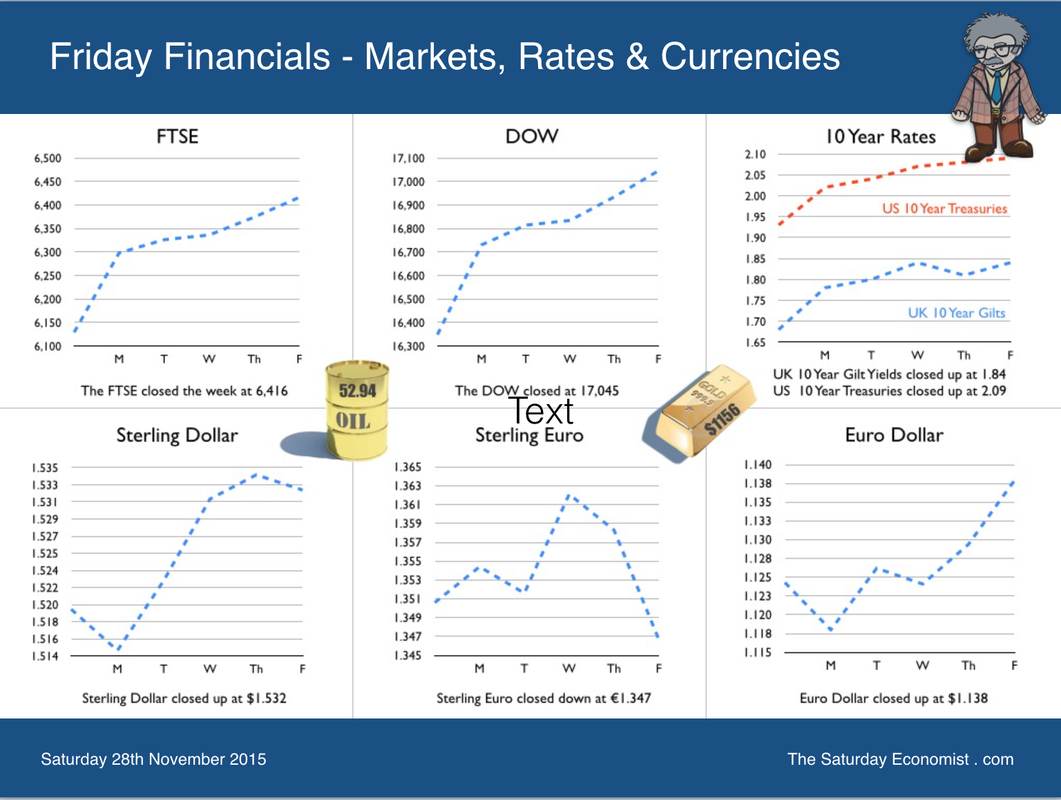

The Autumn statement promised to be a difficult time for the Chancellor. Latest borrowing figures for October, suggested an overshoot of £11 billion in the current year, against the July target. The ONS had reclassified housing association debt into the Government figures adding £4 billion to the borrowing total year on year. The abolition of tax credits, at a gain of £4.5 billion, was under pressure politically. The decision to cut police spending appeared impractical in view of the Paris terrorist attacks. On the face of it, the chances of securing the £10 billion surplus by 2019/20 appeared remote. By the end of the day on Wednesday, the Chancellor had produced not just one rabbit but a veritable warren of rabbits from within the pages of the Spending Review and Autumn statement. This is how he did it … The OBR Revisions … Osborne was assisted by a series of revisions to the revenue forecasts from the Office of Budget Responsibility. The OBR produced an estimated £27 billion of additional revenues over the forecast period to ease embarrassment. Not bad … Higher receipts from income taxes, corporation tax and VAT were unveiled– some of which result from modelling changes to the NICs and VAT deductions forecasts. Spending on debt interest was also lower in all years, reflecting a further fall in market interest rates plus the decision by the Bank of England to maintain the stock of gilts over the lifetime of the forecast. Not only would the Bank repurchase gilts on expiry but the dividend coupons would be returned to the Treasury under the QE ‘money for nothing, gilts for free” scheme. Hence some 25% of the gilts in issue would be coupon free. For the public finances, the measures ensured that public sector net debt continued to fall in every year of the forecast as a share of GDP. The budget reaches a surplus of £10.1 billion in 2019-20. The Chancellor was able to meet the legislated fiscal targets … in line with the estimates in the July statement. The adjustments to tax credits .. “I’ve had representations that these changes to tax credits should be phased in. I’ve listened to the concerns. I hear and understand them. And because I’ve been able to announce today an improvement in the public finances, the simplest thing to do is not to phase these changes in, but to avoid them altogether.” Reversing tax credit cuts produced a £5.0 billion increase in welfare spending over the period. In the first year, the effect was a loss of £3.5 billion and not the £4.5 billion as first estimated. Over the medium term the loss is mitigated by the implications of the Universal Credit adjustments phasing in from 2017 onwards. The Chancellor will have his welfare cut before the end of the decade, so best to avoid trouble in the house in the short term. New Revenue Options … New taxes from the apprenticeship levy (£11.6 billion), higher council tax (£6.2 billion) and higher stamp duty on second homes and buy to let (£3.8 billion) assisted the achievement of the tax reduction plans. The additional payroll tax for larger firms has largely gone unchallenged. It is not quite clear as yet how the apprenticeship levy will produce a full net income gain to the exchequer. The magic of the changes in spending and income mean, net borrowing in 2015/16 becomes £73.5 billion, falling to £49.9 billion in 2015/17, £24.8 billion in 2017/18, £4.6 billion on the following year, producing a surplus of £10 billion in 2019/20. All this including the additional housing association burden. So what of the economy … Growth helps, the OBR assume an average growth rate of 2.4% over the forecast horizon, with moderate assumptions on employment, trade and inflation. Is the projection realistic? It looks like it! The OBR states “On our central forecast, we judge that the Government has a greater than 50 per cent chance of meeting the fiscal mandate and supplementary target. “We expect the budget to be in surplus by 0.5 per cent of GDP £10.1 billion in 2019-20 and public sector net debt to fall by 0.6 per cent of GDP in 2015-16 and by bigger margins in subsequent years.” Projected total debt £1.7 trillion falls to 74% of GDP by 2019/20, still a massive burden on the economy attracting interest charges of £34.6 billion in this financial year rising to almost £50 billion by 2019/20. Fully interested the annual interest burden would be £75 billion assuming gilt yields move back to pre recession norms and the Bank of England withdraws from the gilt market! So is this the end of Austerity ? Paul Johnson of the IFS sums up the Spending Review … “There is no question that the cuts will be less severe than implied in July but this spending review is still one of the tightest in post war history. Total managed expenditure is due to fall from 40.9% of national income in 2014-15 to 36.5% in 2019-20. A swathe of departments will see real terms cuts. This is not the end of austerity" ... but growth will help ease the burden of the Master of the House. So what happened to Sterling over the last two weeks? Sterling fell slightly against the Dollar at $1.503 from $1.520 and moved down against the Euro to €1.419 from €1.427 The Euro moved down against the Dollar at €1.059 from€1.065. Oil Price Brent Crude closed at $46.25 from $45.10. The average price in December last year was $62.24. Markets, steadied! The Dow closed at 17,8068 from 17,818. The FTSE closed up at 6,393 from 6,334. Gilts - yields moved down. UK Ten year gilt yields were at 1.83 from 1.87. US Treasury yields moved to 2.23 from 2.24. Gold moved to $1,059 ($1,065), going nowhere slowly. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed