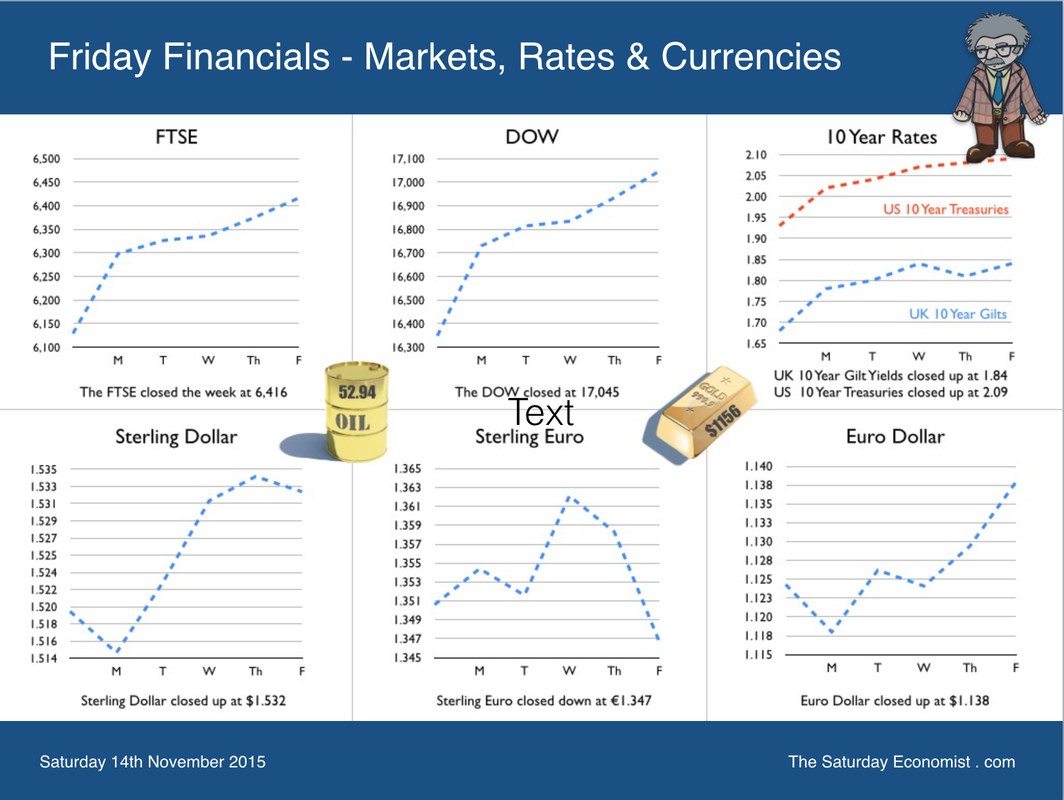

As the futurist at a dinosaur convention might explain, the good news - in the medium term, you will have have nothing to worry about, the bad news - not so good. Andy Haldane Chief Economist at the Bank of England was at the Trades Union Congress this week dismissing concerns about UK productivity in the years ahead. The good news, in the future we won’t have to worry about productivity. The bad news, fifteen million human jobs could be replaced by robots. That must have been a shock to the TUC with almost 6 million members and not so good for the UK economy with 34 million people currently in work. Accountants will be most at risk, [androids don’t file tax returns] but hairdressers, nannies and care workers will be spared. Economists will also avoid the cull, which is good news for some including the Chief Economist of the Bank of England … “When it comes to forecasting the economy, I can’t believe an Andy robot will be giving this lecture to the TUC a decade from now" he said ... Andy Haldane has already talked of the demise of capitalism and the end of money earlier this year. The termination of the TUC and the destruction of public sector finances presumably - the latest prognostication. In 2014 he was described by Times Magazine as the world’s 100 most influential people … ah yes, fear for the world if they send in the clones … Job Stats Latest … The latest employment data for October were released this week. More people are in work, unemployment rate down to 5.3%, the claimant count rate down to 2.1%. Vacancies are steady and earnings are increasing. The employment rate (the proportion of people aged in work) was 73.7%, the highest since comparable records began in 1971. On almost every employment measure key indicators are back to pre recession levels. The domestic pressure to increase base rates is becoming more evident. For households, this continues to be the year of the LILIES. Low Inflation, Low Interest rates with an Earnings Surge. Overall earnings in the three months to September were 3%. Earnings in the leisure sector were up by 4.4% and in construction earnings increased by 6%. Perhaps the high level of earnings explains the slow down in construction … you just can’t find a bricklayer or builder when you need them. Construction … According to the latest ONS data, output in the construction industry decreased by 1.6% in September 2015 compared with September prior year. For the quarter as a whole, output fell by just 0.1% compared to 2014. New work was up by 3% but repairs and maintenance fall by 5% apparently. [1A.Q volume seasonal adjusted index]. The construction data may yet be subject to revision, as has been the case over the last few years. Based on the latest data our forecast for GDP as a whole would fall to 2.5% this year and 2.7% next. The Bank of England are projecting 2.7% this year having adopted a “see through” basis on the latest data, accepting upward revisions are likely. We shall see … OECD on world trade … The OECD produced downward revisions to world trade and to world GDP this week. World growth is expected to slow to 2.9% this year and world trade to slow to just 2%, the gloomy outlook outlined by Angel Gurría, Secretary-General. The OECD is just too gloomy on trade. For example, imports into China are expected to fall by 15% this year, value basis. The OECD may well be missing the point. Chinese import volumes of oil and copper are up by almost 10% this year as the economy remains resilient and strategic reserve stocks are rising. The collapse in prices means the China trade surplus is set to almost double this year as the value of exports is maintained compared to last year and import values fall. Latest Euroland data … The latest data on Europe confirms the economy grew by 1.6% in the Eurozone and 1.9% amongst the wider EU 28. A modest but steady increase with a strong performance from Spain up by 3.4%. Despite Mario Draghi concerns, QE should be off the agenda given the growth data and the warning from the German Council of Wise Men against further extension of QE and the call for the next move in rates to be up. It is time for the West to provide a co-ordinated response to life on Plant ZIRP. Rates are set to rise in the US. The UK and Europe should follow to provide symmetrical response. The locomotive theory of fiscal stimulus and growth in the West also works for monetary policy. Soon we will realise, low rates are now the problem. Mis priced capital leads to misallocation of resources. Bond prices are inflated, forward yields offer negative returns. Over investment in risky assets ensues, including energy and commodity supplies particularly. In this scenario international deflationary pressures from commodity and energy prices are exacerbated by a prolonged stay on Planet ZIRP. So what happened to Sterling this week? Sterling moved up against the Dollar to $1.521 from $1.506 and moved up against the Euro to €1.418 from €1.403 The Euro moved down against the Dollar at €1.073 from€1.074. Oil Price Brent Crude closed at $43.84 from $47.35. The average price in November last year was $79.44. World stock levels and gloomy EIA outlook weighed down on prices. Markets, crashed! The Dow closed at 17,322 from 17814. The FTSE closed down at 6,118 from 6,353. Gilts - yields moved down. UK Ten year gilt yields were at 1.99 from 2.03. US Treasury yields moved to 2.29 from 2.33. Gold moved to $1,081 ($1,088). That's all for this week. Enjoy the rest of the week-end. Off to play tennis and hope for a win! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed