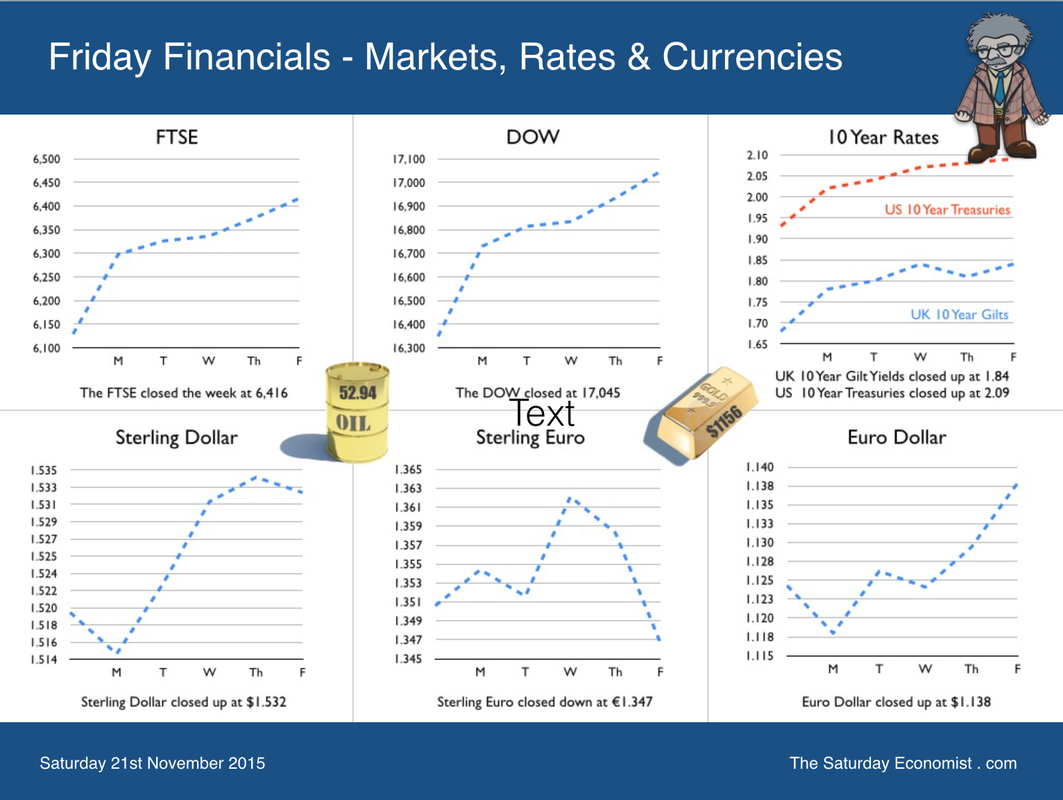

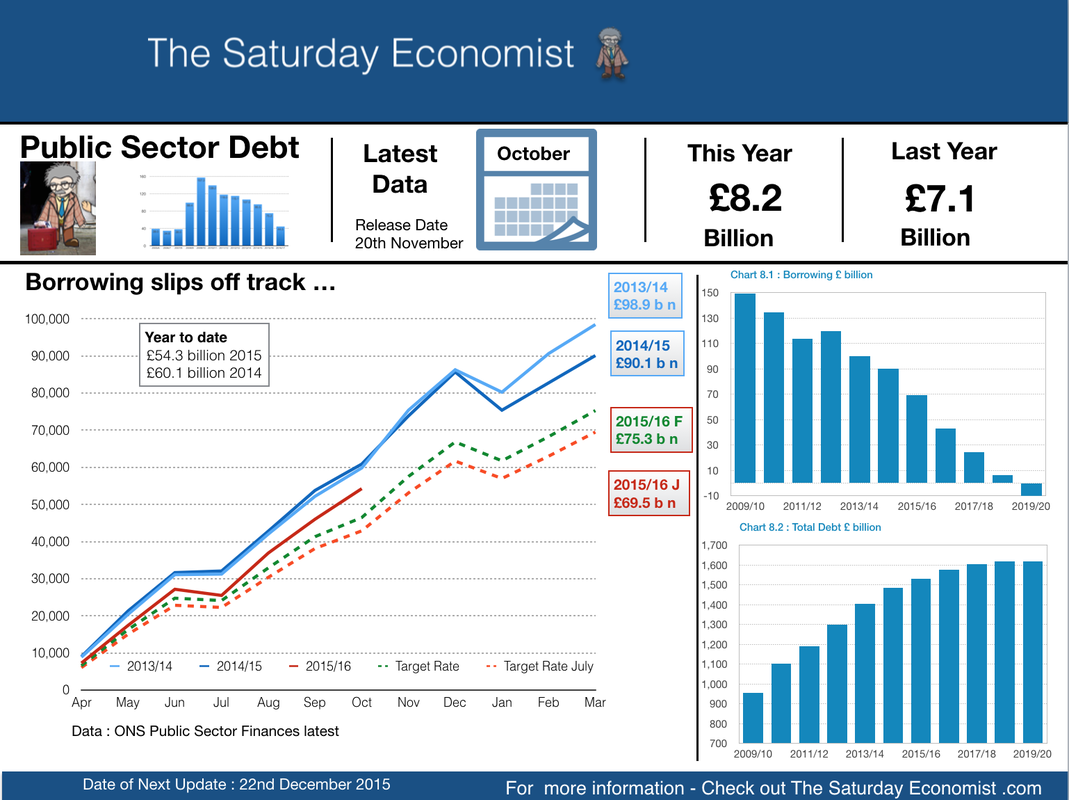

BBC Breakfast - I am the Spin Doctor … Tuesday this week - BBC breakfast with Stephanie McGovern, talking about inflation. I am the spin doctor. Yep the stool was rotating in the middle of the show emitting a loud creaking noise in the process. We were talking about inflation, deflation and the Year of the Lilies, in surround sound. If you missed the clip, it was at 6:50am after all, here’s the Youtube link, highly amusing! Inflation latest … The latest inflation figures for October were released this week. The headline CPI number was -0.1%, a mild deflation. As always we stress the difference between goods inflation, down -2.1% and service sector inflation up by +2.2%. Food and Transport costs are pushing the index lower. Leisure costs, restaurants and hotels push the index higher. The general expectation is for prices to begin to rise through 2016 as the impact of lower oil, food and commodity prices unwind and service sector wage pressures increase. The Bank of England expects prices to rise to around 1% by the end of 2016 returning to the 2% target within two years. A fair forecast assuming no dramatic change in oil and commodity prices ensues. Producer prices … Manufacturing output prices fell by -1.3% in October a much slower rate than the -1.8% prior month. Oil costs dominate the price outlook with petroleum costs down by over 17% in the month. Input costs fell by 12.1% compared to -13.4% in September. Crude oil prices, together with imported metals and chemicals dominate the downward effect on prices. So what’s the outlook? As we eruditely explained to national viewers on Tuesday … in farming it is said the best cure for low prices … is low prices. So too with energy and commodities. Oil closed at $45 dollars per barrel this week but prices are set to rally. In the US, the squeeze on US shale has seen a series of bankruptcies, 250,000 job losses and a collapse in the oil rig count. So far output has been resilient but for how long? In any case, at around $50 dollars per barrel, the deflationary impact of oil will subside from December onwards. A reversal in OPEC policy could see a bounce back in prices with inflationary implications evident. In commodity prices, Lonmin, Glencore, Antofagasta and others are adjusting the over supply condition. There is no fundamental demand shortage. Even in China, oil and copper imports are up almost 10% year to date. Over supply, a function of the low cost of capital on Planet ZIRP has created a deflationary spiral from which we must escape soon. Retail sales … Retail sales volumes were up by almost 4% in October but revenues increased by just 0.5% as store prices fell by 3.3%. A big problem for retail, more work in store at reduced margins with greater pressure from the internet. Online sales were up by 11.2% in October now accounting for 12.8% of all retail sales. Bad news for retailers, but great news for households, in this the year of the LILIES. Household goods sales were up by 5.5%, clothing and footwear sales were up by 2.4%. Government Borrowing … The government borrowing figures released on Friday were at first glance a disappointment for the Chancellor. Borrowing in the month was up by £1 billion compared to last year. For the year to date the total borrowing was down by just £6 billion, a total of £54 billion compared to £60 billion prior year. The Chancellor will overshoot the OBR target by over £10 billion if the trend is maintained. Revenues in the month were up by just 2% compared to 3% year to date. Spending increased by 3% in October compared to less than 1% year to date. Strange that. The Chancellor wouldn’t want to finalise the spending round and Autumn statement with an overly optimistic fiscal position year to date. “Grim month will limit Osborne’s giveaways” says Phil Aldrick in The Times today. Exactly … grim month, great timing. We still expect the Chancellor to hit the borrowing target in the current year with a better performance in the second half. We await the OBR update next week for a more comprehensive review. So what of Rates … The Fed gave a clear signal in the minutes of the October FOMC meeting rates may well rise in December by around 25 basis points. Ben Broadbent in a speech to Reuters this week, explained observers should not place great reliance of the market indicators of the future path of interest rates. UK Rates may rise sooner than expected. Sterling rallied against the Euro as Mario Draghi continued to suggest a further monetary easing in Euroland was possible in December. If the Fed moves in December, the MPC will surely follow in March or April next year. Draghi would be well advised to drag his feet, then follow the rest of the West in the escape from Planet ZIRP. So what happened to Sterling over the last two weeks? Sterling was largely unchanged against the Dollar at $1.520 from $1.521 and moved up against the Euro to €1.427 from €1.418 The Euro moved down against the Dollar at €1.065 from €1.073. Oil Price Brent Crude closed at $45.10 from $43.84. The average price in November last year was $79.44. World stock levels and gloomy EIA outlook weighed down on prices last week. News of US shut downs buoyed prices this week. Markets, bounced back! The Dow closed at 17,818 from 17,322. The FTSE closed up at 6,334 from 6,118. Gilts - yields moved down. UK Ten year gilt yields were at 1.87 from 1.99. US Treasury yields moved to 2.24 from 2.29. Incomprehensible. Gold moved to $1,065 ($1,081), going nowhere slowly. That's all for this week. Enjoy the rest of the week-end. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed