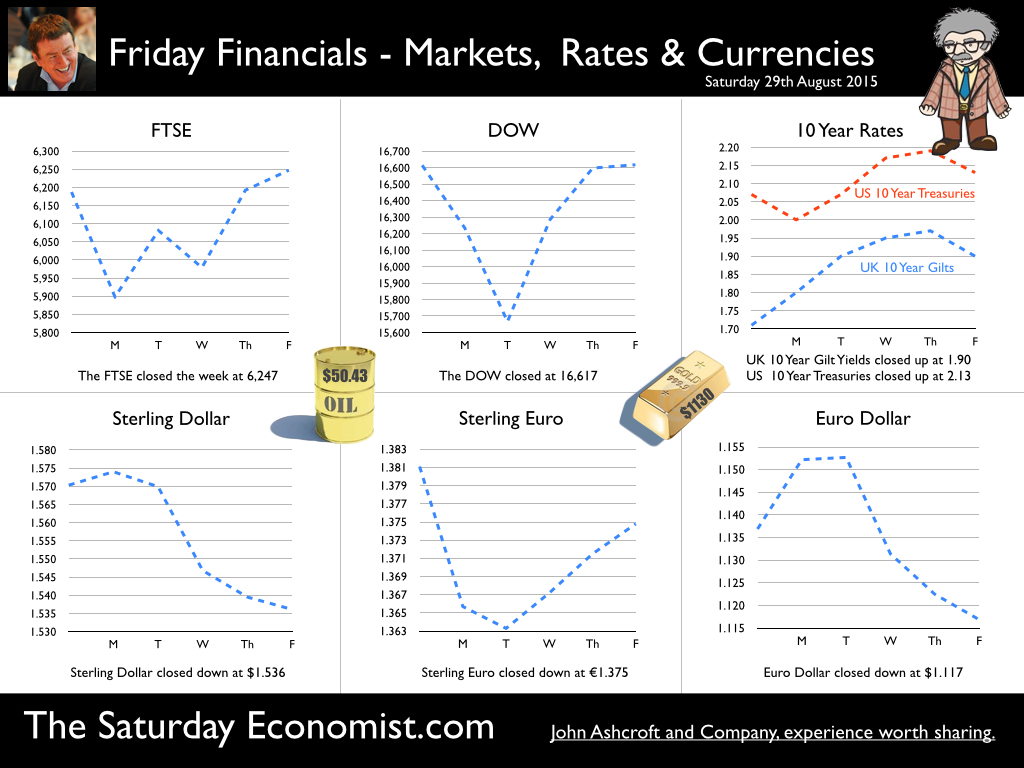

The Shanghai index fell further this week … 2,900 in the week before rallying to 3,232 at close. A recovery of sorts. Shanghai stocks are down from the 5,166 peak in the middle of June. A near 40% collapse from peak. The price drop leaves the index back in line with the 3,200 level at the start of the year. Does this signal real problems in the Chinese economy? Not really. The “Great Fall of China” is just another great example of the Speculative Bubble Map. A dramatic rise in price followed by an equally dramatic collapse. The professional traders, suck in the punters in a professional bull race followed by a bear short move. The innocent are caught unawares. Governments caught off guard. A command economy unable to command stock markets. Lessons rarely learned. It has happened before and it will happen again, ere too long. For Chinese investors, they only have to go back seven years to 2008 to have experienced the same thing on an even larger scale. Movements in markets of such dimension, do not reflect the underlying strength or weakness in the wider economy. So what of international markets …? In the US and UK shares shrugged off concerns with the FTSE and the Dow closing largely unchanged on the week. We would expect some recovery in levels over the final quarter as the underlying strength of the recovery in the US and UK continues. So what of growth? In the US the Bureau of Economic Analysis produced a revision to growth estimates in the US economy in the second quarter. US growth year on year increased by 2.7% largely driven by household spending up 3.1% and an investment surge up by almost 6%. For the year as a whole we expect US growth of 2.8% following growth of 2.4% last year. In the UK, the ONS released the second estimate of growth in the second quarter. Growth year on year was unchanged at 2.6% compared to 2.8% in the first quarter. We expect this to be revised up at some stage to deliver 2.8% for the year as a whole. Growth in the (private) service sector continues to drive output, up by 3.7%. Construction, up by 2.5% and manufacturing, up by 0.5% continue to disappoint. Data (especially construction data) will be subject to upward revision in due course. From a demand perspective, household spending (up 3.3%) and investment (up 4.9%) were the key drivers of domestic demand. Inventories fell, shipped abroad presumably. Exports increased by 8% and imports increased by just 6%. The trade deficit fell £9 billion compared to £11.2 billion last year. [Chained Value Basis]. Another trade miracle? Not really! A blip rather than a trend! So what of Rates? Market expectation have eased with regard to the Fed rate rise in September but mixed signals from the Fed emerged this week. William Dudley, the head of the New York branch of the Fed, said this week, it was “important not to overreact to short-term market developments”. “The argument for tightening monetary policy as early as September seemed “less compelling to me now than it was a few weeks ago” Stanley Fischer, the vice-chair of the Fed’s Board of Governors, made it clear a rate rise next month is still a possibility, despite volatility in the markets and uncertainty about China. So what will happen? We can't be sure. We will have to wait for the Fed meeting in just two weeks. It is time to leave Planet ZIRP. The engines on the runway are causing turbulence enough. US growth and strong labour markets will push for take off. Fasten your seat belts. The rate rise rumble will rattle markets over the next few months. Still worried about China? Don’t forget Linda Yeuh, ex Bloomberg, expert on China will feature at our Economics Conference in October. Author of China's Growth: The Making of an Economic Superpower, Linda will put concerns about growth into full context. It’s at the Radisson in Manchester on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in our fast paced “News Style” show. Imagine “Bloomberg meets Beyonce” that sort of thing! Book Now! So what happened to Sterling this week? Sterling moved down against the Dollar to $1.536 from $1.570 and moved down against the Euro to €1.375 from €1.381. The Euro moved down against the Dollar to €1.117 from 1.137. Oil Price Brent Crude closed at $50.43 from $45.19. The average price in August last year was $101.16. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. A forecast, clearly tested by latest US oil stocks data and OPEC inaction. Markets, held after some markdowns intra week! The Dow closed at 16,617 from 16,614. The FTSE closed up 6,247 from 6,187 up 60 points. Gilts - yields rallied. UK Ten year gilt yields increased to 1.90 from 1.71. US Treasury yields moved to 2.13 from 2.17. Gold moved down to $1,117 ($1,158). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed