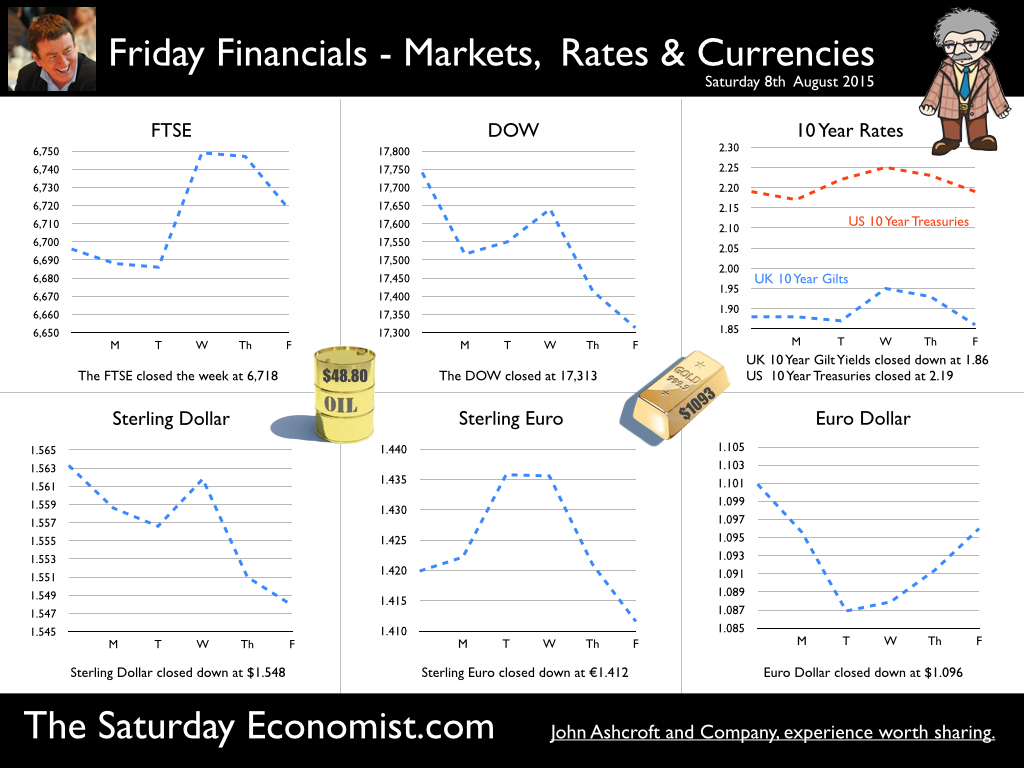

Super Thursday and the Inflation Report … It was Super Thursday this week. The Bank of England released the decision on interest rates and the minutes of the meeting at the same time. A new approach to communications at the Bank of England … an end to the drip feed of information around monetary policy decisions. Decisions and minutes of the meeting together at the same time! Excellent! No longer would commentators have to speculate on the line up of hawks and doves over the next few weeks. The minutes revealed just one hawk on the MPC this month. Ian McCafferty alone believed risks to the medium-term inflation outlook justified an immediate increase in Bank Rate. McCafferty voted for a 25 point increase. It didn’t happen. David Miles retires from the MPC after six years service, never having seen an increase in base rates at all. A job well done? So what can we learn about the future direction of interest rates … In the madness of King George, Dr. Pepys, analyses the King's stools and urine believing that body wastes may contain some clue to the Royal malady. So too economists analyse the comments and statements on the Governor’s output, to garner some clue about when base rates are set to rise. The speech in Lincoln, the MPC minutes, the Inflation Report, opening remarks and Q&A. So when will rates rise? It isn’t clear yet but the timing is getting closer. In his Lincoln speech, the Governor warned the decision as to when to increase rates will likely “come into sharper relief around the turn of this year”. In the opening remarks for the Inflation Report the Governor said “the likely timing of the first Bank Rate increase is drawing closer. However, the exact timing of the first move cannot be predicted in advance; it will be the product of economic developments and prospects. In short, it will be data dependent …” And what of the data ? So what of the data? It’s confusing. The slowdown in Russia, Brazil and China. The weakness of world trade volumes. The strength of Sterling, the collapse of oil, energy and commodity prices. The continued low inflation levels, the rise in wages, the strength of consumer confidence and spending, the slow down in the jobs market, the somnolent productivity trends. In the US the GDP figures for Q2 were disappointing but the July jobs data continues to point to stronger growth. The Fed may still move in September, clearing the path for the MPC to follow within four to six months. A decision which is data dependent is a decision confused by signals from a UK economy clearly on the turn. The Bank has revised the forecast for UK growth this year to 2.8% with an inflation outlook of 1.5% in 2016 based on a $57 oil price. Base rates set to average 1% in 2016. Yes the timing of the first Bank Rate increase is getting closer! Meanwhile … In the minutes, the MPC agreed to buy a further £17 billion of gilts. “The Committee agreed to re-invest the £16.9 billion of cash flows associated with the redemption of the September 2015 gilt held by the Asset Purchase Facility.” The DMO has a lot of gilts to sell this year - £120 billion to be precise. The Old lady is splashing the cash to assist the funding process. So what of manufacturing … Manufacturing output increased by just 0.5% in June and by just 0.6% in the second quarter. Strong growth in consumer durables was offset by a fall in non durable output and a weak performance in capital goods. The data is consistent with the preliminary estimate of GDP in the second quarter. The march of the makers slows to a crawl ... so much for re balancing. And what of trade … The UK’s deficit on trade in goods and services was estimated to have been £1.6 billion in June 2015, compared with £0.9 billion in May. This reflects a deficit of £9.2 billion on goods, partially offset by an estimated surplus of £7.6 billion on services. Patrick Hosking writing in The Times today talks of the “false dawn” in the re balancing agenda based on the June data! Alas it was ever thus. Strong growth in the UK will lead to an increasing deficit - trade in goods. Domestic demand growth is import dependent. As for exports, policy makers fail to take into account the heavy dependence on imports to achieve an export target. Exports are import dependent, for raw materials, components, parts and semi manufactured goods. International manufacturing syndication within the car, marine and aerospace industries - a clear demonstration of the problem. Wings, wheels and water may be the champions of export growth but they suck in an awful lot of foreign product in the process. Higher export growth in manufacturing? Be careful what you wish for! So what happened to Sterling this week? Sterling moved down against the Dollar to $1.5483 from $1.563 and moved down against the Euro to €1.412 from €1.420. The Euro moved down against the Dollar to €1.096 from 1.101. Oil Price Brent Crude closed at $48.80 from $52.27. The average price in August last year was $101.16. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, cooled. The Dow closed down at 17,313 from 17,741 but the FTSE closed up at 6,718 from 6,696. Gilts - yields softened. UK Ten year gilt yields fell to 1.86 from 1.88. US Treasury yields were unchanged at 2.19. Gold moved up to $1,093 ($1,088). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Agenda is now on the web site. The Early Bird deal now closed. You can still save money if you buy your tickets in August. Check out the web site Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed