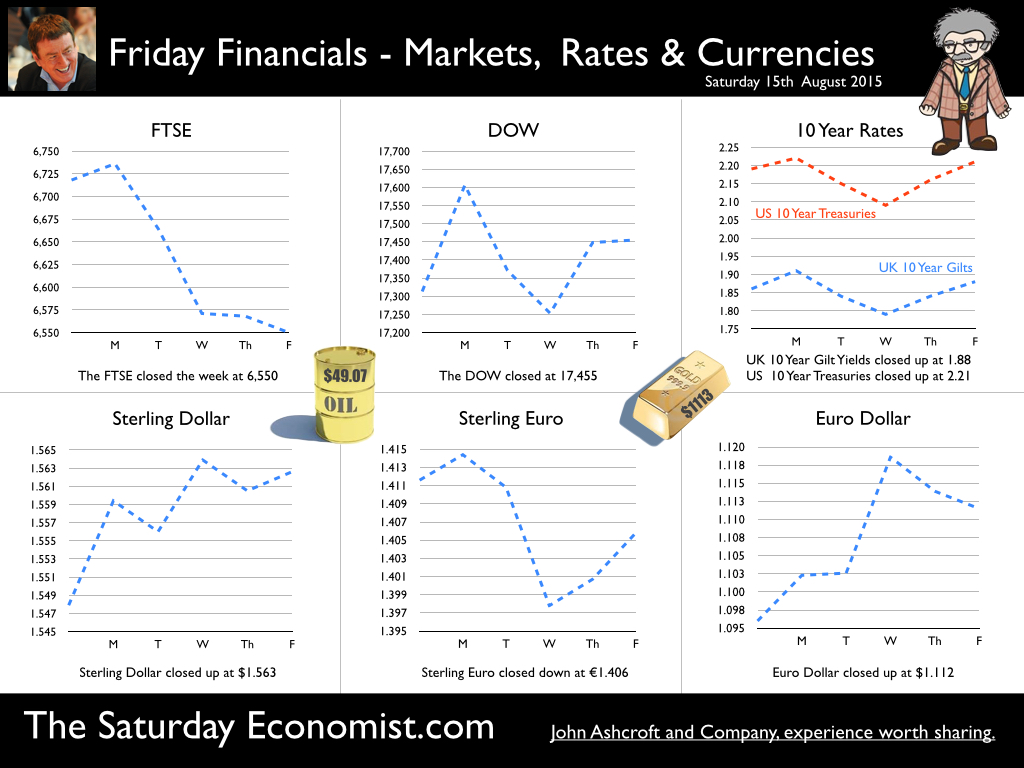

European growth continued at a steady pace into Q2 … European growth continued at a steady pace into the second quarter according to the latest flash estimates from Eurostat. Euro area growth increased by 1.2% compared to 1.0% in the first quarter, year on year. We expect growth of around 1.3% this year with little impact from the QE stimulus. Clearly, the PIGS are leaving the trough with growth in Portugal, Italy, Greece and Spain up by 1.5%, 0.5%, 1.4% and 3.1%. German growth of 1.6% was significant amongst the big four with France up by just 1.0%. No data as yet for Ireland in Q2. Celebrations continue following the heady growth of 6% in the first quarter. With the Greek crisis resolved in the current round, the Euro area is set for growth to continue into 2016, assuming no deterioration in Ukraine and Eastern Europe more generally. In the USA … U.S. industrial output moved into higher gear in July on the strength of auto production up by just over 10%. Manufacturing output increased by 1.5% year on year with strong demand for cars and consumer goods particularly. Since 2000, US manufacturing growth has averaged 1.7% [excluding the 14% fall in 2009]. The data will provide a further teaser for the Fed. Evidence of growth but hardly a threat to inflation. Will this lead to a later decision on a rate rise? Perhaps. For the moment, the money is on a rate rise next month - but the decision is data dependent after all! UK Jobs … The latest data on jobs and employment was released this week. The claimant count fell to 792.4 thousand down by 5,000 on prior month and by 220,000 prior year. The unemployment rate was 2.3%. Vacancies increased to 735.000 delivering a UV ratio of 1.08. Total earnings increased by 2.4% in the three months to June. Private sector services earnings increased by 2.8%, construction earnings increased by 3.5% and leisure sector earnings increased by 3.8%. The number of people in work increased by 350,000 over the past year with all of the growth explained by full time employees. The rate of job creation may be slowing but the levels are above the highs pre recession, placing pressure on recruitment and earnings. With inflation at zero overall in June, real earnings are boosting confidence and retail sales. This is the year of the LILIES with low inflation, low interest rates and an earnings surge. Real earnings (adjusted for inflation) are back to pre recession levels. We may look back and realise this may be as good as it gets for the consumer in this recovery cycle. So what about the Renminbi … Lots of excitement about the Chinese devaluation this week. A competitive structural adjustment in a deteriorating economy? Not really. The eye on the prize is acceptance into the IMF SDR basket of currencies. No need to rush in pegged to an overvalued dollar. The IMF accept the Yuan is fair value at current levels. The Chinese authorities have made it clear further devaluation is not required or desired. So what happened to Sterling this week? Sterling moved up against the Dollar to $1.563 from $1.5483 and moved down against the Euro to €1.406 from €1.412. The Euro moved up against the Dollar to €1.112 from 1.096. Oil Price Brent Crude closed at $49.07 from $48.80. The average price in August last year was $101.16. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, rallied. The Dow closed up at 17,455 from 17,313 but the FTSE closed down at 6,550 from 6,718. Gilts - yields moved higher. UK Ten year gilt yields rallied to 1.88 from 1.86. US Treasury yields moved to 2.21 from 2.19. Gold moved up to $1,113 ($1,093). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Agenda is now on the web site. The August deal is now open. Check out the web site Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed