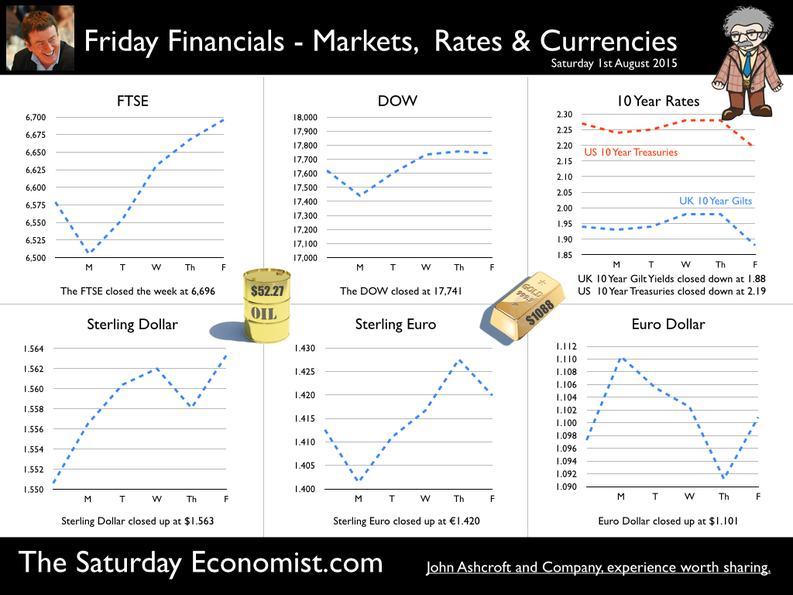

We feature in the UK Top Ten Economists this week … This week we featured at number six in the CityAM Top 100 economists in the UK & Ireland. A great privilege to be in the “most influential top ten list! Based largely on social media profiles, Jonathan Portes, Diane Coyle, Andrew Sentance, Chris Williamson, Kate Barker, Bridget Rosewell and Mark Gregory are also listed. These great names will also feature in The Saturday Economist Economics Conference in October. It’s a great line up. Robert Chote (OBR) and Carl Emmerson (IFS) will also be with us, along with top journalists and commentators. You can check out the full CityAM list here and get details of the economics conference here. Buy your tickets soon, it promises to be a sell out at the Radisson in Manchester on the 2nd October. GDP Preliminary GDP Q2… This week the ONS released the preliminary estimate of GDP in the second quarter of the year. Growth year on year was up by 2.6% following growth of 2.9% in the first quarter and 3% last year. Service sector growth was up by 2.7% held back by a sluggish public sector performance, up by just 0.6%. Private sector services surged ahead at 3.6% lead by leisure sector growth (distribution, hotels and restaurants) of 4.5%. Napoleon may have claimed we are a nation of shopkeepers, (“Une nation de Carrefour et Conforama” [unverified]) but we are rapidly becoming a nation of party animals. The march of the makers rebuilding the workshop of the world in the quest for £1 trillion exports by 2020 long forgotten. Manufacturing output increased by just 0.5% and construction output increased by just 2.2%. The construction data is at odds with survey data and empirical observation. Our Manchester Index suggests growth will be revised up to 2.8% in the second revision of GDP, based on a revision to construction data. Our forecast of 2.8% - 2.9% growth for the year as a whole unaffected by the latest GDP estimate. US GDP Growth … In the US, the BEA (Bureau of Economic Analysis) released the second quarter estimate of US GDP. Growth was up by 2.3% compared to 2.9% in the first quarter and 2.4% last year. Personal consumption increased by just over 3% and gross private sector investment was up by 4.5%. Weak government spending (0.3%) and a surge in imports (4.9%) impacted on the overall growth figure. Will this change the Fed view on rates? Into August and the view is the Fed will make the move before the end of the year. September may be a little premature. The FOMC statement this week was as enigmatic and phlegmatic as usual … “The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.” So when will rates rise …? The FOMC looks set to move on rates over the next few months and we expect the UK to follow before the end of the year or early next. Oil prices and commodity prices continue to push world price levels lower. Interesting that Antofagasta has just taken a $billion dollar bet on copper prices, despite the six year price low. According to The Times, The FTSE 100 miner is set to outbid BHP Billiton for a 50% stake in the Chilean Zaldivar mine. Perhaps they know something we don’t but then Barrack Gold are the sellers! That’s the beauty of the market. Buyers and sellers, bulls and bears. We are bulls and expect a significant change in oil and copper prices into the final quarter of the year. Don’t get too carried away by the strength of Sterling either. UK growth will come at the expense of the trade imbalance despite the fortunes of Sterling. A number of analysts are now beginning to reference the current account deficit in their analysis. At 6% of GDP, we have been here before in 1974 and 1979. It did not end well. For the moment households will continue to enjoy the year of the LILIES with low inflation, interest rates and the earnings surge. Sooner or later the balance of payments will once again become a constraint to growth but not just yet! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.563 from $1.551 and moved up against the Euro to €1.420 from €1.413. The Euro moved up against the Dollar to €1.101 from 1.097. Oil Price Brent Crude closed at $52.27 from $54.41. The average price in August last year was $101.16. The deflationary push continues but is set to unwind. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. Markets, rallied. The Dow closed up at 17,741 from 17,620 and the FTSE closed up at 6,696 from 6,579. Gilts - yields softened. UK Ten year gilt yields fell to 1.88 from1.94. US Treasury yields moved to 2.19 from 2.27. Gold moved up to $1,088 ($1,079). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. The Agenda is now on the web site. The Early Bird deal has now closed. You can still save over £50. Check out the web site Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed