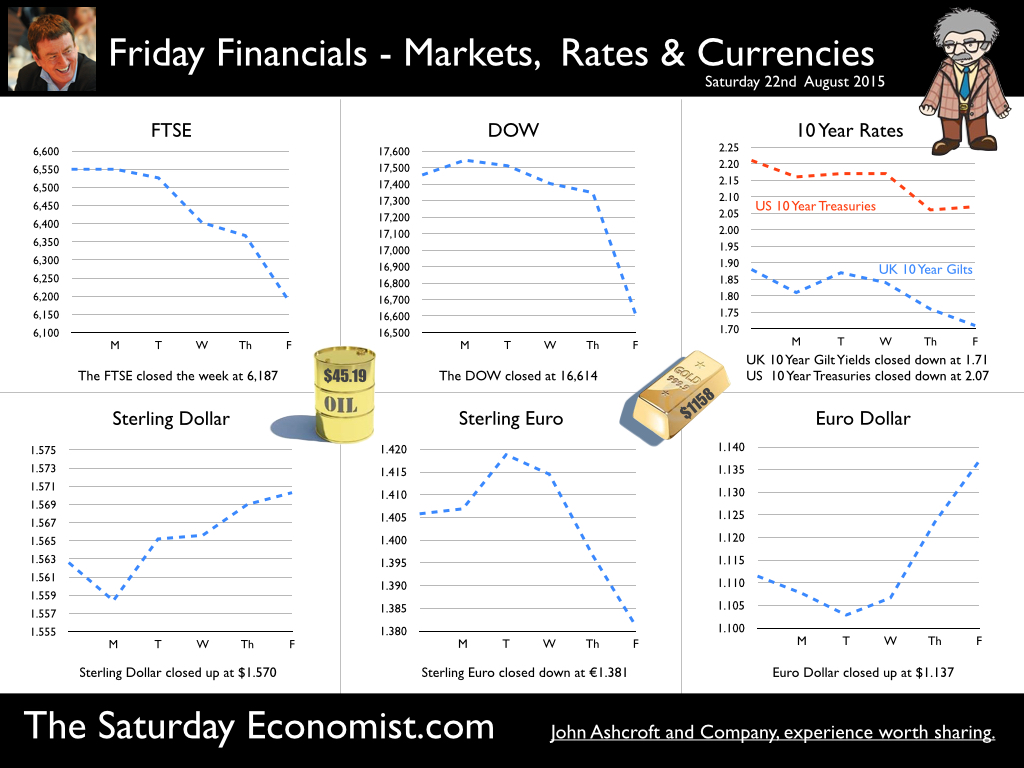

It should have been a great week for UK markets. Inflation edged higher, the retail sales boom continued and government borrowing fell over the first four months of the year. The good news on the UK recovery continued. So what happened? The FTSE fell by over 5%. Bond prices moved higher, gilt yields fell. Markets around the world slumped as fears about China and commodity prices continued. Last week the markets were trying to adjust to a currency devaluation for the Renminbi. This week, China’s Caixin Manufacturing PMI™ index fell to 47.1 in August from 47.8 in July. A 77 month low confirmed worst fears. Growth in China is slowing and may be below the official 7% estimate for GDO growth in 2015. China’s voracious appetite for primary commodities is slowing, putting pressure on metals and energy prices worldwide. In China, the Shanghai index fell by 11.5% last week, bringing the fall from the highs this year to over 30%. Churlish to point out out the index is still above the levels in February. Maybe the Chinese authorities know just how and when to prick a market bubble. Should we be so worried? Not really. World demand for energy and commodities continues to grow. The supply side is yet to adjust from over supply and surplus stocks in oil and copper specifically, energy and metals generally. Turmoil set to continue … We are leaving Planet ZIRP. Fasten your seat belts, there will be some turbulence on take off. With an anticipated rise in US rates and a strengthening of the dollar, the shock wave will extend to currencies and bond prices across the world. Despite fears to the contrary the “Sky is not falling down”. Chicken Licken and friends were devoured by the fox. In markets, chickens are devoured by bears. The shorts are out, in thin trading volumes in a holiday month. Prices are receding, just as the seas retreat from the beach before the Tsunami. It’s August, the commodity price outlook could look materially different by the end of the year. Inflation moved higher in July … UK inflation moved higher in July with the headline CPI increasing to 0.1% from 0.0% in June. Service sector inflation increased to 2.4%. Core inflation increased to 1.2%. Prices are moving higher. No need to worry about deflation, despite the strength of Sterling and the weakness in world commodity prices. The strength of domestic demand is gradually pushing prices higher. Retail Sales … In July retail sales volumes increased by 4.2%. The retail boom continues with a strong performance in housing related items particularly. For retailers, the news is mixed. Values increased by just 1%. Online sales increased by 13%, accounting for 12.6% of all sales. Multi Channel or die the mantra. For the consumer, growth in jobs and wages is improving confidence. This is the year of the LILIES after all. Real earnings adjusted for inflation are back to pre recession levels. With inflation and interest rates set to rise … this may be as good as it gets for households. Government Borrowing … The Chancellor recorded a surplus in July of £1.3 billion. Borrowing in the first four month of the financial year was just £24 billion, down by £7.4 billion from the same period last year. Income and corporation tax receipts were up by over 5%. VAT receipts were up by over 3%. Central government current receipts in July were 3.9% higher than in July 2014. Growth leads to higher revenues - True! Spending over the first four months of the year increased by just 0.1%. A great combination. For the year as a whole, the Government is on track to hit the OBR target of around £70 billion, down from £88 billion last year. With total debt of £1.5 trillion, it’s probably just as well. Worried about China? Linda Yueh, ex Bloomberg, expert on China will feature at our Economics Conference in October. Author of China's Growth: The Making of an Economic Superpower, Linda will put concerns about growth into full context. It’s at the Radisson in Manchester on the 2nd October. A great line up. Don’t miss this chance to see some of the great UK economists and commentators, together in our fast paced “News Style” show. Imagine “Bloomberg meets Beyonce” "Ian King Live" that sort of thing! Book Now - Click Here! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.570 from $1.5633 and moved down against the Euro to €1.381 from €1.406. The Euro moved up against the Dollar to €1.137 from €1.112. Oil Price Brent Crude closed at $45.19 from $49.07. The average price in August last year was $101.16. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our outlook forecast. A forecast clearly tested by latest US stocks data. Markets, moved lower! The Dow closed at 16,614 from 17,455, down 5% in the week. The FTSE closed at 6,187 from 6,550 down 5.5%. Gilts - yields slumped. UK Ten year gilt yields fell to 1.71 from 1.88. US Treasury yields moved to 2.07 from 2.21. Gold moved up to $1,158 ($1,1193). That’s all for this week. Don’t miss the Great Manchester Economics Conference in October. Check out the web site - Sign up and Save. The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed