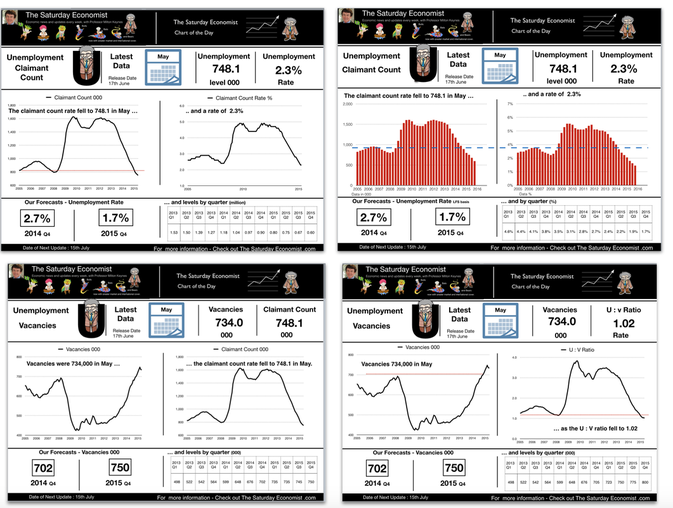

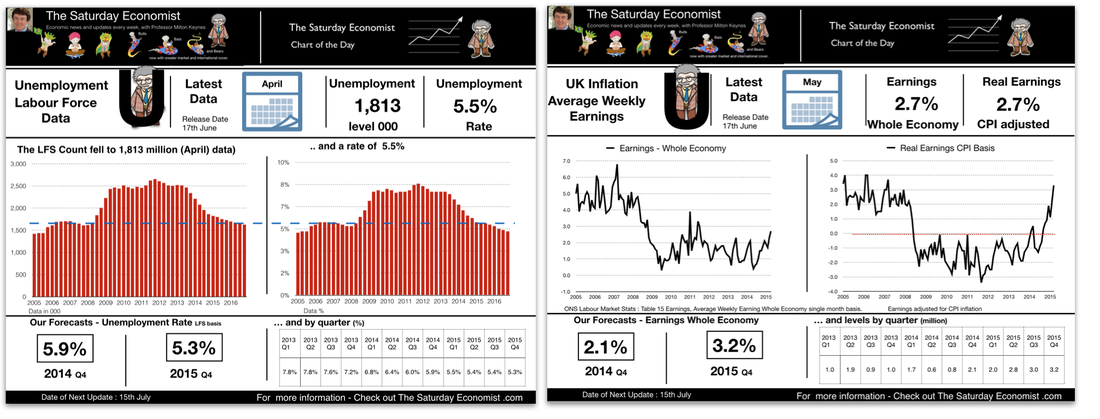

Labour market overheating as earnings rise .. “It is time to realise the jobs market is signalling overheating in the economy, especially in a private service sector which is growing at 4%. The illusion of low inflation may disappear by the end of the year and into 2016. UK rates may have to rise sooner than the Bank of England would like to admit.” Employment up by 424,000 in the year - self employment falls … There were 31.05 million people in work, 424,000 more than for a year earlier. The number of employees increased by 544,000. The number of self employed fell by almost 100,000. The thrill of entrepreneurship dwindles as the lure of regular cash flow wins out! Private Service Sector jobs provide major gains … Private sector job gains were 483,000 as the public sector continues to shed jobs. Most of the job gains were in the service sector with accommodation, professional services and distribution, particular beneficiaries. Manufacturing employment increased by 76,000 (3%) compounding the productivity dilemma in the process. (Manufacturing output increased by less than 2.5%.) Unemployment rate 5.5% … There were 1.81 million unemployed people, 349,000 fewer than for a year earlier. The unemployment rates was 5.5%, down from 6.6% prior year. Claimant count falls below 750,000 … The number of people on the claimant count register fell by 16,000 in the month to 748,100 a rate of 2.3%. Over the year, 330,000 left the register, 50,000 over the last quarter. Job centres will be closing in 2017, if the rate of job growth continues. Vacancies increase … The number of vacancies in May increased to 734,000 compared to 652,000 a year earlier. Our UV ratio, the ratio of claimants to vacancies, fell to just 1.02. Earnings increase dramatically … Average earnings increased by 2.7% both including and excluding bonuses in the three months to May. Real earnings in the economy, adjusted for CPI inflation increased by over 2.5%. In the private sector, pay increased by 3.3%. Public sector pay rises were subdued (0.3%). Service sector pay increased by just under 3% with strong growth in business services (3%) and leisure (5%). (We define leisure as wholesale, retail, hotels, & restaurants). Manufacturing earnings moderated to 1.3% but construction earnings increased by 5.3%. So what can we make of it all? … Employment is increasing, unemployment is falling. The labour market is tightening with recruitment difficulties increasing in the service sector and in construction. The latest earnings data confirms the strength of growth in the economy. We expect UK growth forecasts to be increased to almost 3% this year. On many measures the labour market has achieved measures beyond those experienced in 2007/8.. Real earnings adjusted for inflation are returning to pre recession levels. The claimant count levels (sub 750k) are below the highs of 2008. At 2.3% the claimant count rate is below the 2008 highs. Vacancies are higher than anything experienced in that year. The number of jobs in the economy has increased to 33.7 million from 32 million in 2008. The wider LFS data suggests the number of people unemployed in the economy fell to 1.8 million a rate of 5.5%. In the two and a half years immediately prior to recession the unemployment rate averaged just 5.4%. Summary It is time to realise the jobs market is signalling overheating in the economy, especially in a private service sector which is growing at 4%. The illusion of low inflation may disappear by the end of the year and into 2016. UK rates may have to rise sooner than the Bank of England would like to admit.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed