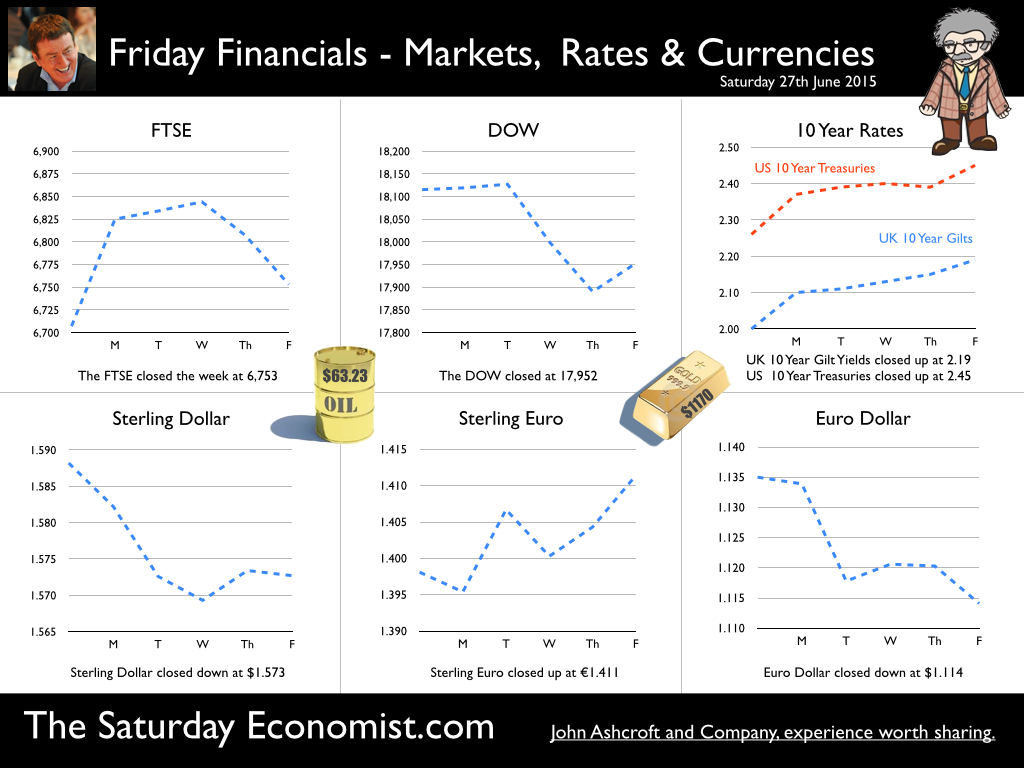

Greek negotiations - more a meeting of mimes … than a meeting of minds. It was a pretty good week for updates on the world economy. The US economy grew at a rate of 2.9% year on year in the first quarter. The Spanish economy grew at a healthy rate of 2.6%. The European economy is recovering. The PIGS are leaving the trough. The world economy will grow by 2.7% this year and over 3% next. World trade will increase by 3% this year and over 4% next. In the UK, we declared 2015 the year of the LILIES. With low inflation, low interest rates and an earnings surge, boosting the effects of more jobs and lower unemployment. This is the year “most of our people have never had it so good” said Harold MacMillan in 1957. “You will see a state of prosperity such as we have never had in my lifetime - nor indeed in the history of this country” he went on to say. Well at least since the great recession of 2008, we would add. But interest rates won’t stay low forever and inflation is set to rise by the end of the year … So when will rates rise? … In the US, September remains the favourite for the first rate rise with a further rate rise quite possible before the end of the year. MPC member Martin Weale suggested UK rates may have to rise earlier than expected, possibly as early as August. That seems all too hawkish. We expect a UK rate rise within three to six months of the first Fed move. The MPC won’t move ahead of the FED. So what’s going on in Greece … The European economy is in the early stages of recovery. This is really no time to leave the Greeks behind. Negotiations are becoming more a meeting of mimes than a meeting of minds. In ancient Greece, mimes were a simple farcical drama, including mimicry, dependent upon ludicrous actions and gestures for effect. So it continues to the present day with the Greek debt negotiations. The late call for a referendum by Prime Minister Alexis Tsipras is a measure of frustration in negotiations with the troika. The intransigent IMF is fond of draconian measures bordering on mediaeval economics. Punishment parallels with Captain Bligh. “The beatings will continue until morale improves:” the mantra. “I'm not advising cruelty or brutality with no purpose. My point is that cruelty with purpose is not cruelty - it's efficiency. A man will never disobey once he's watched his mate's backbone laid bare. He'll see the flesh jump, hear the whistle of the whip for the rest of his life.” So too it is hoped the anti austerity “Podemus” party in Spain will observe the flagellation of the radical-left Syriza party in Greece and take the whip in good measure. It really is time to end the farce, settle the issues and move on. We cannot leave the Greeks behind. Negotiations are stumbling over VAT hikes and pension cuts. The IMF rejected a Government proposal to increase corporation tax on the basis this would damage the economy. Yet pushed for higher VAT and Pension cuts. What nonsense. Strange to ignore the fact that pension cuts would damage, health , welfare and domestic demand. VAT hikes would put a sales tax on the tourist industry, especially the eradication of the 30% discount in the Greek Islands of Rhodes and Santorini. In negotiations with Governments, the numbers don’t always add up at onset. Do not question too closely the proposals of UK governments to reduce the deficit and eliminate debt over the lifetime of parliament. Nor should we forget the brilliant “magic asterisk” of the David Stockman era as budget director in the Reagan administration. “Cuts as yet to be identified” the small print on the magic asterisk included in the budget spreadsheets. Total Greek debt is just 3% of Eurozone GDP. It's an easy roll to move forward. Time for a few magic asterisks in the Greek Spreadsheets to move matters forward. There is no alternative … A Greek default with a return to the Drachma would lead depreciation of currency, onerous foreign debt obligations and high domestic inflation, Political instability with a threat to tourism a further risk. Higher import costs would mean the trade deficit would deteriorate with little or no improvement in tradeable goods exports. Banking instability would be exacerbated with capital controls imposed and bank withdrawals curtailed. It would take up to six months for an orderly currency transfer at best. Undecided who would pay for the printing presses to produce the new notes and what would happen to all those Euros stuffed into Greek mattresses already. And what of contagion? The geo political, currency and economic risks would be too much for a Eurozone for which Greek debt represents just 3% of GDP. Let us not forget too soon, the lessons of Lehman. Leave the IMF lobotomists out of the room, toss away the whip, a flick of the wrist and a few “Magic asterisks” would bring an end to the Drachma Drama. So what happened to Sterling this week? Sterling moved down against the Dollar to $1.573 from $1.588 but moved up against the Euro to €1.411 from €1.398. The Euro moved down against the Dollar to €1.114 from 1.135. Oil Price Brent Crude closed at $63.232 from $63.02. The average price in June last year was $111.80. The deflationary push continues. A $75 - $80 recovery by Q4 remains the base case in our forecast outlook. Markets, were troubled. The Dow closed down at 17,952 from 18115 but the FTSE closed up slightly at 6,753 from 6,707. Bonds moved lower as yields increased. UK Ten year gilt yields moved to 2.19 from 2.00 US Treasury yields moved to 2.45 from 2.26. Gold moved up to $1,1701 ($1,201). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed