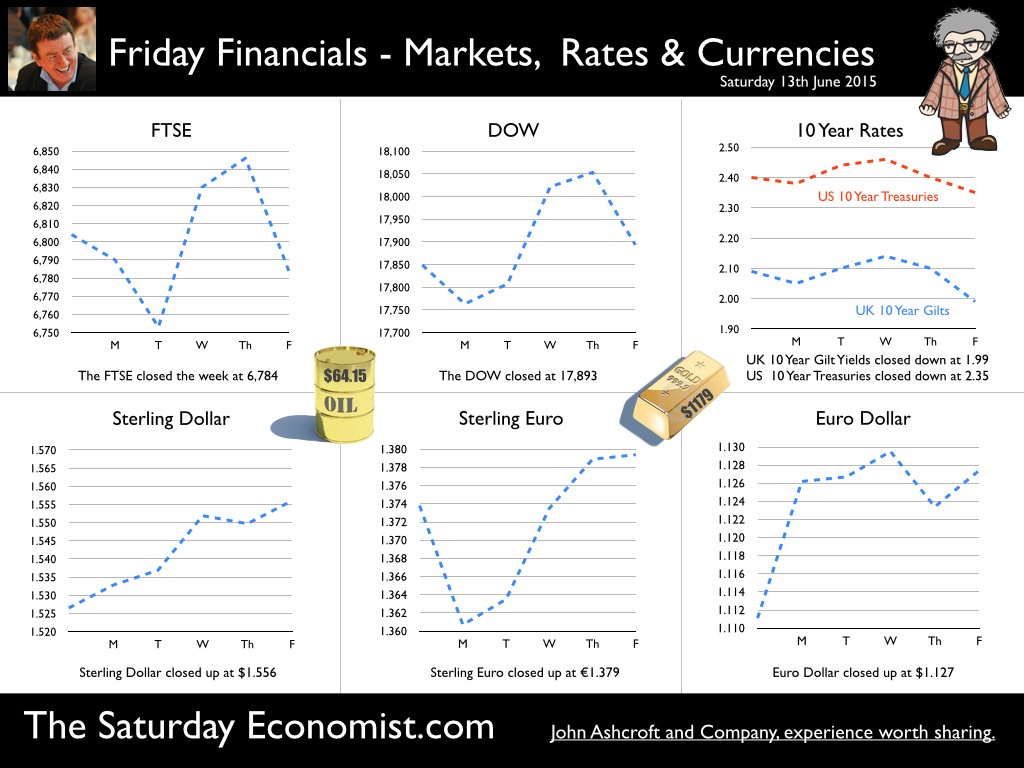

[The latest revision to construction data was released this week. Construction output increased by 4.4% in the first quarter of the year compared to a previous estimate of a slight fall year on year. I guess it’s an easy enough mistake to make. Bipolar disorder persists in the ONS with a SADD [Seasonally Adjusted Deficiency Disorder] contaminating the data. Construction growth increased by 9.5% in 2014 compared to 7.5% in prior publications. The changes in Q1 were largely to be expected. The previous numbers didn’t make sense. For some - the data revisions boost growth prospects. Our forecast for 2.8% GDP growth in 2015 remains the base case, with construction growth revised up slightly to 4.5% for the year as a whole. So what of Manufacturing … In business so to with entertainment and economics - if all the plates spinning well, it’s either the end of the act or an illusion. So it proved with the production data this week. Output in the mining and quarrying sector increased by 6.2% in April. Oil and gas extraction increased by almost 10%. There the excitement ends. Total production increased by 1.2% as manufacturing increased by just 0.2% Transport and chemicals were the highlight sectors up by 6% and 7% respectively. “Gloom around the loom” continued with textiles output down by 6% in the month and 8% in the first quarter. For the year as a whole manufacturing output is likely to increase by just over 2% compared to 3% in 2014. Ah yes the march of the makers - now moving at a funereal pace. So what of trade … The trade figures revealed a boost to exports in April. The UK deficit on trade in goods and services was estimated to have been £1.2 billion in April, compared with £3.1 billion in March. This reflects a deficit of £8.6 billion on goods, partially offset by an estimated surplus of £7.4 billion on services. Oil imports fell as chemical exports received a boost to trade. Exports to the US increased as imports from China and the EU fell. Should we get to excited about the April data? Not really! One months figures are volatile and subject to revision. When presented with information supporting an existing belief, the natural reaction is to accept new information without question. We call this "Confirmation Bias”. So too with trade data - the re balancing myth presents. [March last year looked even better.] The trend is our friend. We expect the trade in goods deficit to be £125 billion this year offset by a £90 billion trade in services surplus. Confirmation Bias? Yep - at least no one mentioned the J curve! So what of rates? Ian McCafferty [MPC] in an interview with Reuters this week, warned - the time for the Bank of England to start raising interest rates is getting closer. (Ian McCafferty voted for a rate rise late last year, suspending his call following the oil price collapse.) As the oil price effect unwinds and growth in the UK and world economy continues to pick up pace, the hawks will once again flap their wings in the MPC aviary. Capital markets are flapping on the prospects of the US rate rise. Emerging market funds have experienced strong outflows as investors realign dollar portfolios. Almost $10 billion left EM funds last week, 70% out of China according to the FT. The Russian Rouble dropped almost 10% against the dollar last month. Bond rates are rising as fixed income securities come under pressure. Robert Stheeman, the CEO of the DMO Debt Management Office warned Britain is at risk of government bond auction failure, the first since 2009. Increased financial market volatility to blame. Stheeman told Reuters in March that reduced liquidity and uncertainty about the outlook for U.S. monetary policy could lead to bigger price swings for British government bonds this year. US rates are expected to rise before the end of the year. September the favourite. The strong growth in the UK economy will continue. Once the Fed makes a move, the MPC will have to follow within a three to six months framework. McCafferty and Martin Weale will lead the call. Bond prices will fall as yields rise. So what happened to Sterling this week? Sterling moved up against the Dollar to $1.556 from $1.526 and moved up against the Euro to €1.379 from €1.364. The Euro moved up against the Dollar to €1.127 from 1.111. Oil Price Brent Crude closed at $64.15 from $61.72. The average price in June last year was $111.80. The deflationary push continues. Our forecasts of $65 dollars Q2 look good, a $75 - $80 recovery by Q4 remains the base case. Markets, moved nervously. The Dow closed up at 17,893 from 17,849 and the FTSE closed down at 6,784 from 6,804. Gilts moved down. UK Ten year gilt yields moved to 1.99 from 2.09 US Treasury yields moved to 2.35 from 2.40. Gold moved up to $1,179 ($1,197). That’s all for this week. Don’t miss The Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed