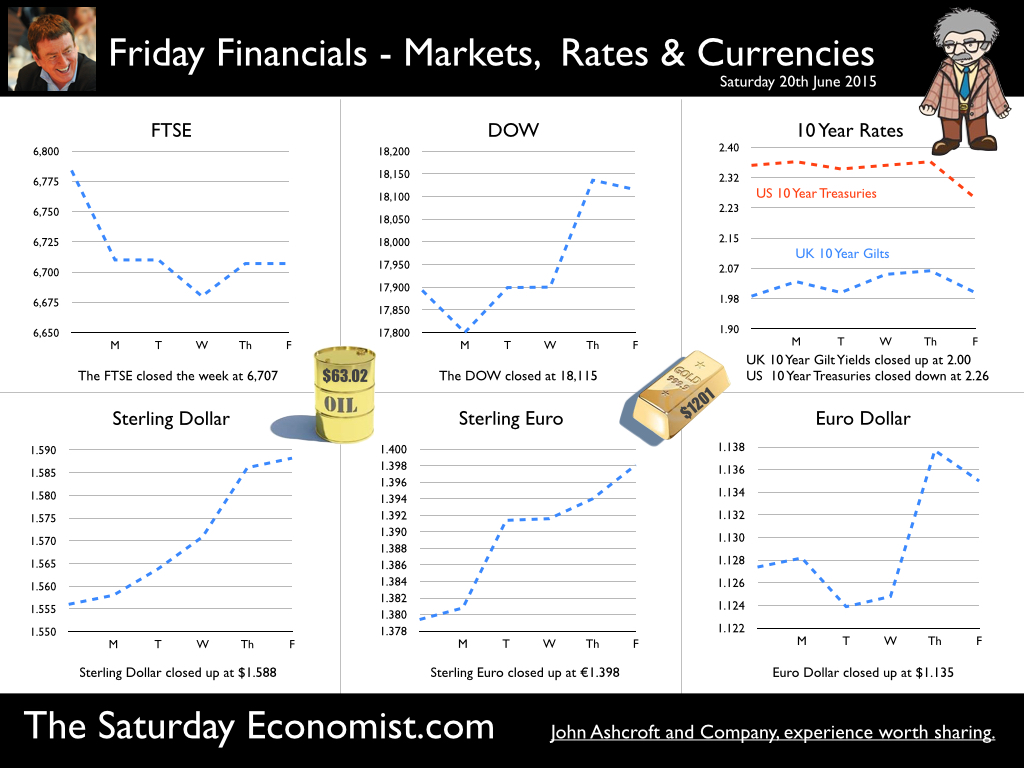

Year of the Lilies - Lilies don’t last long .. Breakfast TV this week with Steph McGovern talking about jobs and earnings. Asked about the feel good factor … this is the year of the LILIES, Low Inflation, Low Interest and Earnings Surge. For the consumer, the second half of 2015 may be the best period in this recovery cycle. “most of our people will never have it so good”. Real earnings are now over 2.5% adjusted for inflation. Between 2005 and 2007, real earnings averaged 2.5%. No wonder consumer confidence is high - unemployment is falling, wages are increasing, hence retail sales are booming. " Labour market overheating as earnings rise … It is time to realise the jobs market is signalling overheating in the economy, especially in a private service sector which is growing at 4%. The illusion of low inflation may disappear by the end of the year and into 2016. UK rates may have to rise sooner than the Bank of England would like to admit. Employment up by 424,000 in the year - self employment falls … There were 31.05 million people in work, 424,000 more than for a year earlier. The number of employees increased by 544,000. The number of self employed fell by almost 100,000. The thrill of entrepreneurship dwindles, as the lure of regular cash flow wins out! Private Service Sector jobs provide major gains … Private sector job gains were 483,000 as the public sector continues to shed jobs. Most of the job gains were in the service sector with accommodation, professional services and distribution, particular beneficiaries. Manufacturing employment increased by 76,000 (3%) compounding the UK productivity dilemma in the process. Unemployment rate 5.5% … There were 1.81 million unemployed people, 349,000 fewer than for a year earlier. The unemployment rates was 5.5%, down from 6.6% prior year. The number of people on the claimant count register fell by 16,000 in the month to 748,100 a rate of 2.3%. Over the year, 330,000 left the register, 50,000 over the last quarter. If the rate of job growth continues, Job centres will be closing in 2017. Vacancies increase … The number of vacancies in May increased to 734,000 compared to 652,000 a year earlier. Our UV ratio, the ratio of claimants to vacancies, fell to just 1.02. Earnings increase dramatically … Average earnings increased by 2.7% both including and excluding bonuses in the three months to May. Real earnings in the economy, adjusted for CPI inflation increased by over 2.6%. In the private sector, pay increased by 3.3%. Service sector pay increased by just under 3% with strong growth in business services (3%) and leisure (5%). (We define leisure as wholesale, retail, hotels, & restaurants). Manufacturing earnings moderated to 1.3% but construction earnings increased by over 5%. So what can we make of it all? … Employment is increasing, unemployment is falling. The labour market is tightening with recruitment difficulties increasing in the service sector and in construction. The latest earnings data confirms the strength of growth in the economy. We expect UK growth forecasts to be increased to almost 3% this year. On many measures the labour market has achieved levels beyond those experienced in 2007/8. Real earnings adjusted for inflation are at pre recession levels. The claimant count levels (sub 750k) are below the lows of 2008. At 2.3% the claimant count rate is below the 2008 low. Vacancies are higher than anything experienced in that year. The number of jobs in the economy has increased to 33.7 million from 32 million in 2008. The wider LFS data suggests the number of people unemployed in the economy fell to 1.8 million and a rate of 5.5%. In the two and a half years immediately prior to recession the unemployment rate averaged just 5.4%. So what of inflation … Inflation (CPI basis) rose by 0.1% in the year to May 2015, compared with a 0.1% fall last month. The largest upward pressure came from transport services, with the timing of Easter air fares, a likely factor in the movement. Service sector inflation increased to 2.3%. Goods deflation moderated slightly to -1.8%. Producer Prices … The output price index for manufactured goods fell by 1.6% in the year to May 2015. The overall price of materials and fuels bought by UK manufacturers fell 12.0% in the year to May 2015, down from a fall of 11.0% in the year to April 2015. Oil and food prices continue to dominate the low price outlook with imports of chemicals and metals assisting. So what does this mean for the rest of the year… We expect the low oil price impact to unwind by the end of the year, at a time of higher commodity prices world wide. In farming it is said the best cure for low prices is low prices and so it will prove with agriculture and food. Stronger growth, rising employment and recruitment difficulties will lead to wage increases compounding the inflation increases. We expect CPI inflation to increase to 1.2% by the end of the year and return to the 2% target (CPI basis) by the middle of 2016. So what of borrowing… on track to meet OBR target this year … The latest public sector finance figures were released by the ONS this week. Strong growth in income tax receipts reduced UK government borrowing in May to the lowest level in eight years. Public finances are benefiting from robust economic growth, stronger corporate profits, higher employment and a recovery in earnings Headline public borrowing fell to £10.1 billion in May from £12.4 billion a year earlier. For the first two months of the current financial year, public sector net borrowing was down by almost 25% compared to prior year. Income tax and national insurance receipts in May were the strongest for in four years. Total borrowing increased to £1.5 trillion (80% of GDP.) The Chancellor is exactly on track to meet the OBR target of £75.3 billion this year. With growth for the year set to be revised up, the out turn may be even better. Retail Sales Boom Continues … in the year of the Lilies! Retail sales in May 2015 increased by 4.6% compared with prior year. Food sales increased by 2.6%, textile, clothing and footwear stores increased by 4.2%, department store sales were up by 5.5% and household goods stores increased by over 12%. On line sales accounted for 12% of total values and increased by 7.4% on prior year. So what can we make of it all? For the consumer, the retail boom continues in the year of the Lilies. That’s Low Inflation, Low Interest Rates and an Earnings Surge. Last year sales volumes increased by 4.3% in the year. This year we expect a similar out turn for the year as a whole. For retailers, the thrill is muted. Higher levels of volume at lower revenue margins and internet sales reducing the take in store make life difficult for most retailers. So how long will it last? Lilies have an exotic look and a delicate nature but they are tender and must be treated with care. In the world of economics Lilies have a short life. The era of low inflation and low interest rates will draw to a close by the end of the year. Higher earnings will be offset by higher costs to come. Consumers may look back at the second half of 2015 and realise they never had it so good after all. So what of rates? Janet Yellen signaled this week, US rates are likely to rise at a gentle pace. The FOMC “Blue Dots” analysis suggest two modest US rate rises before the end of the year. The MPC minutes revealed “for two members the immediate policy decision remained finely balanced between voting to hold or raise rates.” The Fed will move, with September the favourite date. The MPC will follow, McCafferty and Weale are twitching. The UK rate move could be as early as November! So what happened to Sterling this week? Sterling moved up against the Dollar to $1.588 from $1.556 and moved up against the Euro to €1.398 from €1.379. The Euro moved up against the Dollar to €1.135 from 1.127. Oil Price Brent Crude closed at $63.02 from $64.15. The average price in June last year was $111.80. The deflationary push continues. Our forecasts of $65 dollars Q2 look good, a $75 - $80 recovery by Q4 remains the base case. Markets, were mixed. The Dow closed up at 18,115 from 17,893 and the FTSE closed down at 6,707 from 6,784. Bond Prices were also mixed. UK Ten year gilt yields moved to 2.00 from 1.99 US Treasury yields moved to 2.26 from 2.35. Gold moved up to $1,201 ($1,179). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed