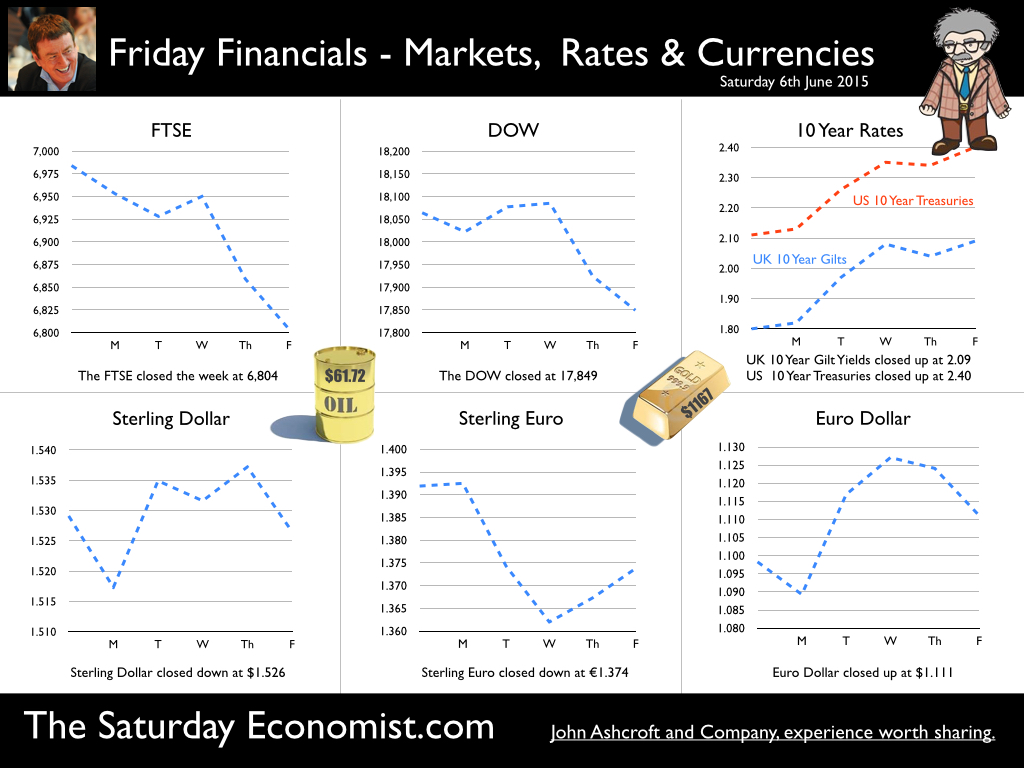

IMF in US review - synchronized swimmer calls for synchronized rate rise The US economy was on the IMF agenda last week. “The Fed should defer any increase in policy rates until the first half of 2016” the plea from Christine Lagarde. The U.S economy had lost momentum in the first quarter, derailed by bad weather, a cut back in oil investment and a stronger dollar, or so it was said. The IMF expects US inflation to return to 2% target in 2017. The jobs market is returning to pre-crisis norms. The IMF forecast for growth in the US was cut to 2.5% in 2015, strange, following growth of 2.7% in the first quarter. The U.S. dollar has risen 13 percent in real terms over the past 12 months. The move a product of cyclical growth divergences, different trajectories for monetary policies and a portfolio shift toward U.S. dollar assets. Greater exchange rate and bond volatility would be more likely be minimized if the rest of the west had time to catch up with US monetary policy movements. The Fed should fore go an early rate rise, the call. It didn’t really make sense. It was more a plea from an ex synchronized swimmer making a call for a more synchronized rate rise across the world, to avoid greater bond and forex volatility. It was never likely to be taken seriously. US jobs data deafens IMF call… So it proved with the Bureau of Labour Release on Friday. Total non farm payroll employment increased by 280,000 in May, the unemployment rate was essentially unchanged at 5.5 percent. The data for the previous two months was up rated. Earnings are increasing. The major jobs gains are in the leisure service sector (yielding low productivity). Sounds familiar? Treasury bonds fell sharply as the robust jobs report supported expectations the Federal Reserve would raise interest rates later this year. The prospect of higher US borrowing costs left equity markets lower on both sides of the Atlantic. Bond markets fell as US yields increased to 2.4%. The IMF call, will fall on deaf ears. The Fed will take the early flight from Planet ZIRP. September remains the market favourite for a Fed rate rise. So what happened in the UK this week? Bank holds rates … The Monetary Policy Committee at its meeting on 3 June voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of purchased assets at £375 billion. The Bank of England now on Twitter! It’s just an RT Retweet from last month. House Price data … The Nationwide and Halifax released the latest data for May rises this week. Halifax house prices increased by 8.6% in the month compared to 8.5% in April. Commenting, Martin Ellis, Halifax housing economist, said: “The imbalance between supply and demand is likely to continue to push up house prices over the coming months”. At Nationwide, house price rises slowed to 4.6% in May compared to 5.2% in April. Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “The May data resumes the gradual downward trend in evidence since the summer of 2014. Over the longer term we would expect house price growth to converge with earnings growth, which has typically been around 4% per annum. However, much will depend on supply side developments. The rate of building activity has remained well below that required to keep up with population growth.” So what can we make of it all? At the Saturday Economist, we expect the increase in prices to continue to slow towards the end of the year averaging just over 5% by the final quarter. Averaging 4% by the final quarter of 2016. In other news … Latest Markit/CIPS UK PMI® Survey Data … Manufacturing … output increased on solid domestic demand. The UK Manufacturing PMI increased to 52.0 in May. Consumer goods sector remains main growth sector as job creation slows further. Construction … There was a slight rebound in construction output growth in May, helped by post-election bounce in new orders. The headline seasonally adjusted Markit/CIPS UK Construction Purchasing Managers’ Index® (PMI®) registered 55.9 in May, up from 54.2 in April. Services … expansion slows, but remains strong. The Business Activity Index signalled growth of services output for the twenty-ninth successive month in May, posting 56.5. So manufacturing output increases, construction orders rebound and the service sector continues the path of strong growth. Election uncertainty out of the way, on we go! Brexit next! So what of rates? Janet Yellen made it clear last week, the Fed will look through the soft data in the first quarter US rates will rise before the end of the year. September still the favourite. The strong growth in the UK economy will continue. Once the Fed makes a move, the MPC will surely follow within a three to six months framework. So what happened to Sterling this week? Sterling moved down slightly against the Dollar to $1.526 from $1.529 and moved down against the Euro to €1.364 from €1.392. The Euro moved up against the Dollar to €1.111 from 1.098. Oil Price Brent Crude closed at $61.72 from $65.64 on news of OPEC decision to maintain output. The average price in June last year was $111.80. The deflationary push continues. Our forecasts of a $75 - $80 recovery by Q4 remains the base case. Markets, moved down. The Dow closed down at 17,849 from 18,064 and the FTSE closed down at 6,804 from 6,984. Gilts moved up. UK Ten year gilt yields moved to 2.09 from 1.80 US Treasury yields moved to 2.40 from 2.11. Gold moved up to $1,197 ($1,189). That’s all for this week. Don’t miss the Big Social Media Conference in July and the Great Manchester Economics Conference in October. It’s a great line up for all events! Download the June Economic Outlook for the UK and World Economy released last week! The Saturday Economist - now mailing to 50,000 businesses every month! John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed