|

Digging up the runway on Planet ZIRP … why negative rates are not the solution ...

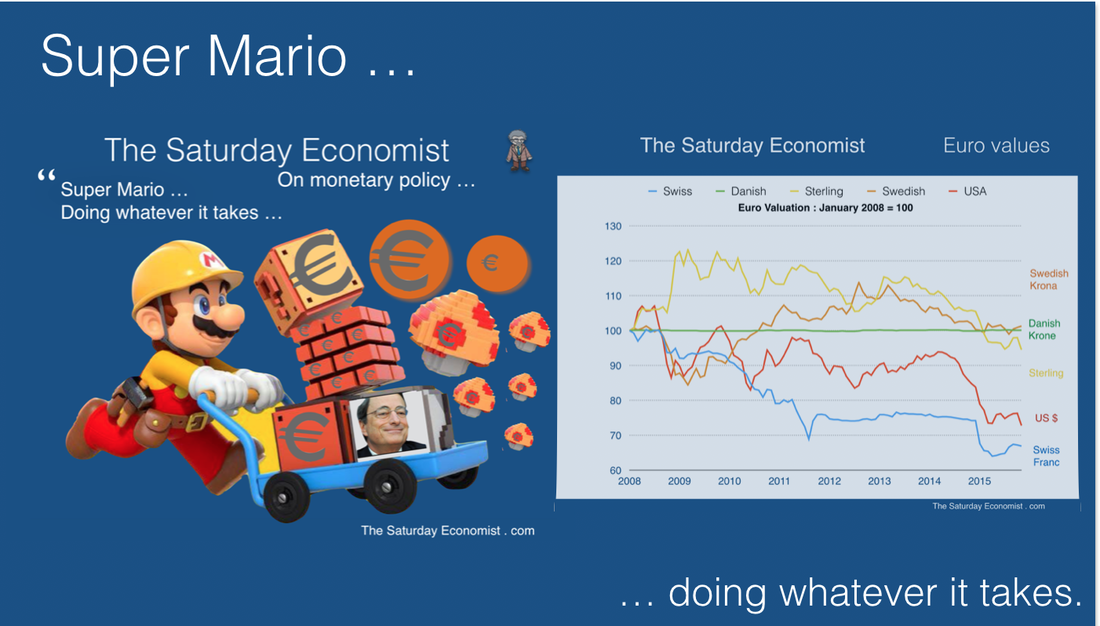

Interest rates at the lower bound and beyond, mis price capital, distort the yield curve, lead to a misallocation of resources, penalise savers, pressure returns within pension funds and generate asset bubbles in gilts bonds and property prices. Super Mario Draghi is doing whatever it takes to save Euroland. Last week the European Central Bank lowered the deposit rate to minus 0.3% from minus 0.2%. Three eurozone neighbours, Denmark, Sweden and Switzerland have pushed their interest rates deeper into negative territory in response to ECB rate cuts. The Swiss National Bank has a deposit rate of minus 0.75%, Denmark’s National Bank interest rate on certificates of deposit is -0.75 per cent and in Sweden the deposit rate is -1.1%. Europe is digging in on Planet ZIRP, going beyond the zero bound and exploring the catacombs of NIRP with a negative interest policy. It is a dangerous and misguided development. So what is the objective … There are two principal objectives relating relating to growth and inflation. The ECB believes lower rates will stimulate household spending, encourage business investment and engineer a weakness in the Euro currency to increase export competitiveness. A weaker Euro will stimulate inflation as the cost of imports of raw materials, food, energy, manufactures and semi manufactures increase. Mario Draghi believes Euroland will have a better chance of meeting the near 2% inflation target with negative interest rates. Well that’s the theory anyway. It is a theory and an experiment. A dangerous experiment in which central banks impose a levy on financial institutions to hold their money and banks will charge customers for money in deposit accounts and checking accounts. Homeowners with floating rate agreements may end up with negative-interest mortgages. Instead of paying the bank principal plus interest each month, households will pay principal, minus interest. If negative interest rates become entrenched, individuals would withdraw money from the bank and hoard cash. Banks would have a lower lending capacity. To avoid households hoarding cash, central bankers could consider a bank note cancellation policy. State lotteries will randomly select on a weekly basis, a series of bank note numbers which would be withdrawn from use with immediate effect. Imagine trying to pay in Euros for your weekly shop or a trip to the Bierkeller, only to discover the notes you want to pay with were out of date. Retailers would be required to check for counterfeit currency and currency currency! Consumers would be reluctant to accept any notes whatsoever, without confirmation the notes offered were within date. So what’s the problem … it’s madness of course … Interest rates at the lower bound and beyond, mis price capital, distort the yield curve, lead to a misallocation of resources, penalise savers, pressure returns within pension funds and generate asset bubbles in gilts bonds and property prices. Subzero rates in Denmark and Sweden have helped fuel a surge in house prices. The average price of a Danish apartment climbed 8% in the first half of 2015. The cost of Swedish apartments is 16% higher than a year ago according to the Wall Street Journal article this week. Andy Haldane Chief Economist at the Bank of England, suggested in 2013, the combination of interest rates at the lower bound and QE had created the biggest bond price bubble in history. As for currency depreciation … the ECB’s negative deposit rate has helped bring down the value of the euro but will that really help the trade balance? Exports increase as a function or world trade and relative prices. The demand conditions are dominant with a much weaker price effect. As the weakness in world trade volumes persist, there will be little or no growth in the volume of exports from Euroland, no matter what happens to the value of the currency in the short term. Euroland already enjoys a trade surplus with the rest of the world. Further currency wars would have a negative effect of international capital flows. Beggar thy neighbour depreciation is bad enough but experimenting with negative rates to effect the change could well be disastrous. As for inflation, inflation is always and every where an international phenomenon at the present time. Energy prices have collapsed as a result of over investment, oversupply and OPEC intransigence to cut output. Low cost of capital has led to an over investment in oil exploration and mining. The resultant over capacity has lead to a collapse in prices. Tinkering with exchange rates will be of limited value if oil prices collapse to $20 per barrel in 2016 as some pessimistic pundits predict. As for household spending and business investment, in theory, negative rates impact on consumers or businesses by encouraging borrowing and spending. For businesses and investment, the cost of capital is merely one of the factors in a payback calculation. The anticipated returns to capital over the life time of the investment are dominant. If forward conditions are correct businesses will invest. Negative rates will just add to fears about sustainability over the medium term. As for consumers, they are already benefiting from the year of the Lilies with a recovery in employment, earnings, low inflation and strong growth in real earnings. Lower rates will merely impact further to the detriment of savers. Time to co-ordinate international monetary policy … The US is set to increase base rates later this month. The UK is likely to follow within six months. This is not the time for Euroland to be moving in the opposite direction. In the seventies we talked of a coordinated response to recession in the West. The US would lead recovery with an expansive fiscal policy to which the rest of the west could hook up. We called it the "locomotive theory" of recovery. Now is the time for a co-ordinated monetary policy response. Planet ZIRP was supposed to be an emergency stop over, never a long term settlement. This is not the time to dig up the runway, experimenting with negative rates. It really is time to leave Planet ZIRP together in full flight formation. Mario Draghi should do whatever it takes … and rethink negative rates action.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed