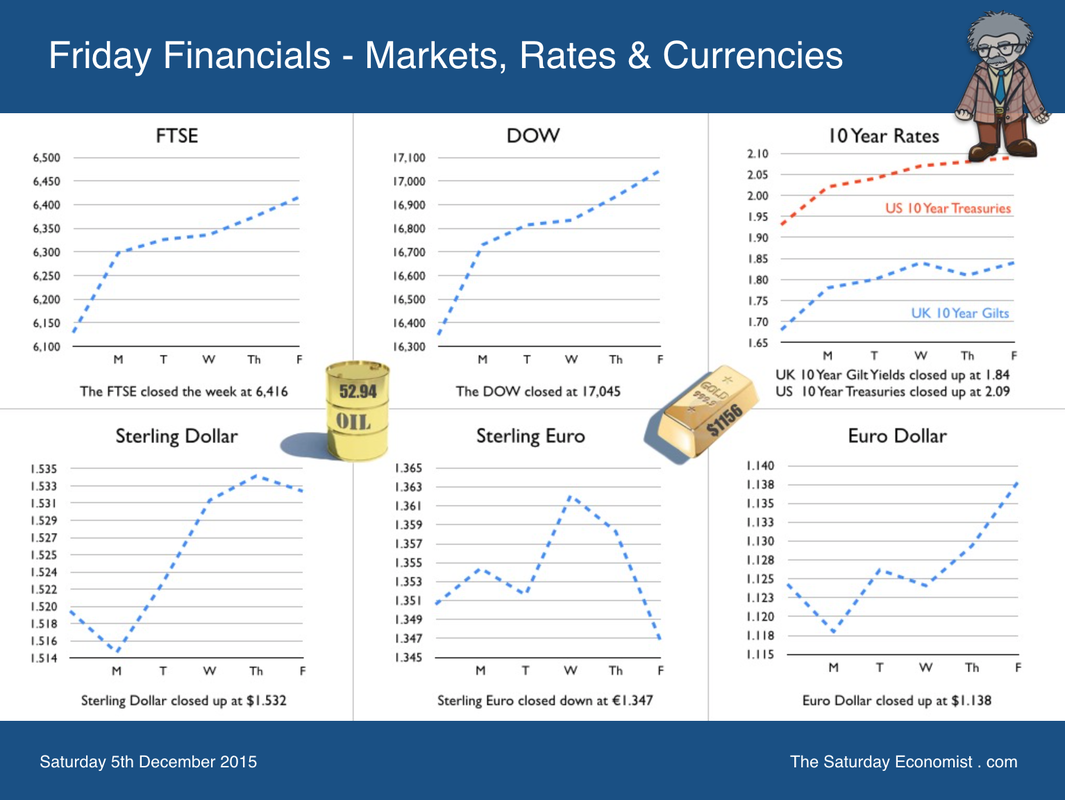

Super Mario … doing whatever to takes ... Strong jobs data suggests the Fed will hike rates at the December meeting later this month. Non Farm payroll employment increased by 211,000 in November and the US employment rate was steady at 5.0%. It seems clear Janet Yellen has staked a fair degree of credibility, on a gradual process of rate rises, beginning on the 16th December. In Europe, The ECB is heading in the other direction. “Super” Mario Draghi on Thursday, announced a commitment to extend the asset purchase programme into March 2017 and to drop the discount rate to -0.3%. The move is at odds with Uncle Sam’s monetary policy and contra to the advice of the Berlin Council of Wise Men. Last month, Berlin’s Council of Economic Experts - known as the country's five "wise men" said the ECB must consider tapering its bond-buying measures early “to avoid dangerous imbalances from building up in the bloc.” The warning was unheeded. Markets were disappointed by the paucity of the move in rates. The shorts had bet on a stronger discount and were forced to move quickly to close bear positions. The Euro closed up against the Dollar and Sterling, despite the ECB attempt to push the currency lower. Whatever it takes … In New York on Friday, Draghi reaffirmed the commitment to do whatever it takes to achieve the inflation target. “There cannot be any limit to how far we are willing to deploy our instruments to achieve our mandate” the quote. The central bank’s mandate is for inflation just below 2 per cent. A goal that has been missed substantially over the last two years, so what's the rush!. It’s a goal which will be pretty elusive with commodity prices on the floor and oil prices hovering around $40 per barrel. The move to weaken the Euro clearly backfired … the Euro rallied against both the Dollar and Sterling. Markets are coming to realise the Euro won’t go much lower on a technical and fundamental basis. The process of QE, as a policy option to boost growth and inflation has largely been discredited. Reliance on the spurious accuracy of dubious econometrics does not make for good monetary policy. Soon European policy makers will realise that NIRP on Planet ZIRP will just extend the misery of entrapment in this strange land. So what of locomotive theory … To pull the world out of recession in the mid seventies, the US led the way with fiscal expansion and the rest of the West was urged to hook up to the engine of growth. The oil price shock of the seventies had transferred wealth to the OPEC cartel, at the price of real effective demand in the oil importing countries. A co-ordinated policy response would prove more effective than policy heading in different directions. The oil price shock of the 2015 is reversing the process of wealth transfer. Oil importers gaining as oil exporters miss out. For the world economy, it is a zero sum game. The deflationary action of an oil price collapse is leading to a misalignment of monetary policy in a move to stimulate inflation. Domestic demand is not the problem in the West. “Inflation is always and everywhere an international phenomenon” brought about by the collapse in energy and commodity prices. Low rates and mis priced capital, leads to problems along the yield curve and over investment in asset classes including commodity extraction. Low rates are compounding, not resolving, the price problem. Flight formation, not locomotion theory, the solution. The US will lead the flight, the UK should be set for departure within months. The ECB should abandon NIRP before too much damage is done. It is time to leave Planet ZIRP, doing whatever it takes. So what of the UK … This week, PMI Markit data was released for November. Construction growth slowed in the month amid the slowest rise in housing activity for two years. Manufacturing expansion continued but at slower rates. Service sector growth continued to grow with new business increasing to a four month high. This month we update our UK Economic Outlook, our final update of 2015. We expect growth of 2.5% this year and 2.6% next. Manufacturing will disappoint. We expect construction growth of around 2.8% this year and 2.9% next. Private service sector growth will continue to lead the recovery with a strong performance in leisure, distribution and business services. Household spending in this the year of the LILIES will be 3.1% this year, slowing to 2.8% next. Business investment will increase by 3.9% this year rising to 5.6% next. The trade figures will continue to disappoint. The trade deficit will average 2.7% of GDP and will become a constraint to growth within our extended five year forecast framework [February 2016]. Employment and earnings will continue to rise, the government deficit will fall despite a significant rise in borrowing costs. This year and next may be as good as it gets. The LILIES will droop and fade as we enter 2017. You can download a copy of the Economic Outlook from the Saturday Economist web site here. So what happened to Sterling over the last two weeks? Sterling moved up against the Dollar at $1.511 from $1.503 and moved down against the Euro to €1.387 from €1.419 The Euro moved up against the Dollar at €1.088 from €1.059. Oil Price Brent Crude closed at $43.00 from $46.25. The average price in December last year was $62.24. Markets, steadied! The Dow closed at 17,847 from 17,806. The FTSE closed up at 6,238 from 6,393. Gilts - yields moved up. UK Ten year gilt yields were at 1.93 from 1.87, US Treasury yields moved to 2.27 from 2.23. Gold moved to $1,086 ($1,059). That's all for this week. Enjoy the rest of the week-end. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed