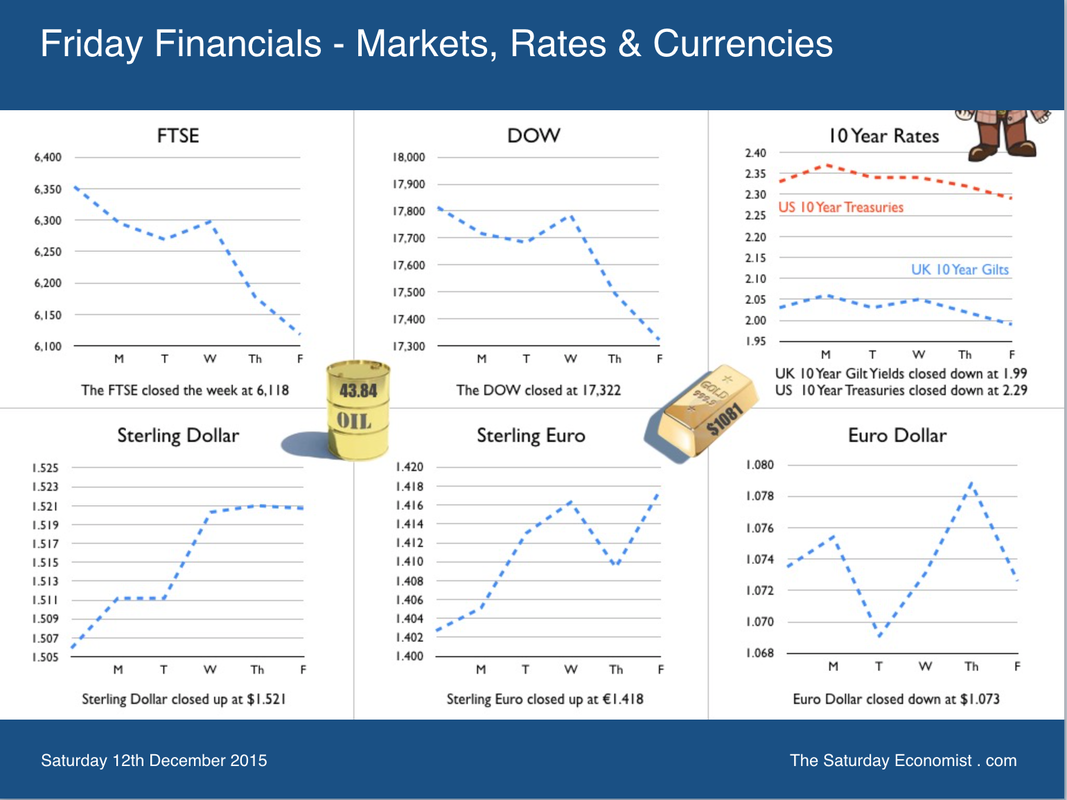

News of US retail sales in November will provide the platform for the Fed to increase rates next week. A strong performance in cars, home products and leisure activities offset weakness in food and gasoline spending. Retail sales increased by just 1.4% year on year, not a big move but enough for Janet Yellen to lead the flight from Planet ZIRP. The UK will be wise to follow within six months. This week the MPC voted to keep rates on hold and tp maintain the stock of asset purchases at £375 billion. The committee voted 8 : 1, Ian McCafferty the hawk, calling for a 25 basis points increase. Planet ZIRP was supposed to be an emergency stopover not a permanent settlement. Last week Super Mario pushed rates further into negative territory placing greater pressure on the Swiss, Swedes and Danes to follow into the NIRP dug out. In Canada, Governor Stephen Poloz suggested negative rates were a policy option for Canada, as the country grapples with low inflation and sluggish growth rates. How easy do untried, untested, policy options fall into central bank parlance? Digging up the runway on Planet ZIRP … Interest rates at the lower bound and beyond, mis price capital, distort the yield curve, lead to a misallocation of resources, penalise savers, pressure returns within pension funds and generate asset bubbles in gilts, bonds and property prices. Low cost of capital can lead to over investment in oil and commodity prices, with resultant lower prices exacerbating the deflationary environment. Negative rates will impair not improve the banking system. With negative rates, deposits are withdrawn to avoid punitive charges and the bank asset base and lending capacity shrinks as a result. Time to make the move ... Chinese whispers … In China fears about growth are over blown. Retail sales increased by 11.2% in November, the fastest pace this year. Industrial output increased by 6.2% in the month, boosted by production of cars and non ferrous metals specifically. Consumption accounted for 60% of GDP in the first half of the year as the rebalancing agenda develops on plan. Exports fell by 6.8% in November as imports also declined in value terms. Fears about growth are exaggerated, as volume imports of oil and metals, especially copper, continue to increase. China is stock piling at low prices, whilst producers allow prices to enter free fall. The apparent fall in trade values, a result of the weakness of world prices not underlying volumes. Back in the UK … Chancellor Osborne received a pat on the back from the IMF this week. Christina Lagarde confirmed the UK has “repaired the damage” from the financial crisis, like “few other countries have been able to achieve”. “Fixing the roof whilst the sun shines” stated the confident chancellor, excellent. OK, we still have a few problems on the snagging list. The 4% borrowing deficit, surging house prices, the trade deficit and international capital flows heading in the wrong direction. Markets may fret about the fall in China’s international reserves to $3.4 trillion dollars. In November, UK reserves fell to around $36 billion that’s down from $70 billion last year. UK reserves are now lower than than Poland, Peru and the Philippines. Worrying. And it isn’t getting any better. This week, the ONS revealed the deficit trade in goods increased to £11.8 billion in October offset by a £4.1 billion services surplus. We expect the trade in goods deficit to increase to £125 billion this year and £130 billion next. The service sector surplus will increase but at a slower rate as the tourism deficit increases. Weak data on manufacturing and construction in October reveal the inability of the Chancellor to fulfil the rebalancing agenda. The trade and capital account deficit at more than 5% of GDP will be a real challenge to the maintenance of reserves and sterling credibility. The Chancellor may have to spend more time with the IMF in the months to come, discussing more than roof repairs. If Sterling credibility comes under pressure, the MPC may not have the luxury of a vote. Markets will decide on the direction and pace of the next rate moves. So what happened to Sterling over the last two weeks? Sterling moved up against the Dollar to $1.521 from $1.511 and moved down against the Euro to €1.383 from €1.387. The Euro moved up against the Dollar at €1.099 from€1.088. Oil Price Brent Crude closed at $37.95 from $43.00. The average price in December last year was $62.24. Markets, fell! The Dow closed at 17,313 from 17,847. The FTSE closed down at 5,952 from 6,238. Gilts - yields moved down. UK Ten year gilt yields were at 1.81 from 1.87. US Treasury yields moved to 2.17 from 2.27. Gold moved up to $1,076 ($1,059), going nowhere slowly. That's all for this week. Enjoy the rest of the week-end. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed