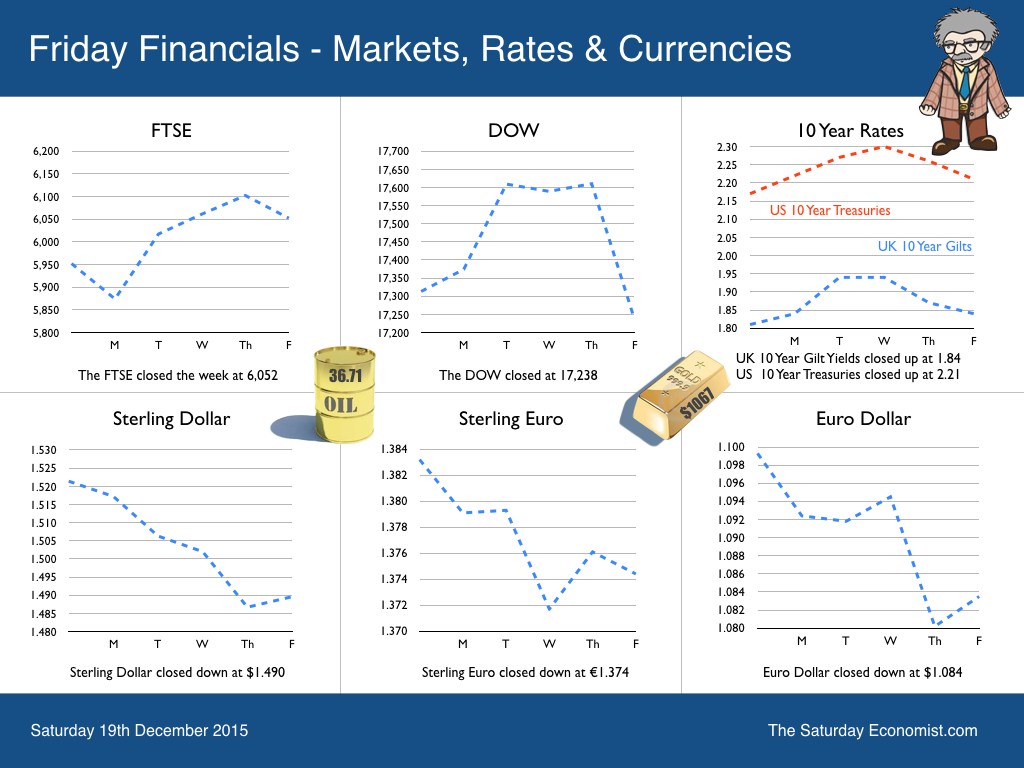

The Fed raised rates by 25 basis points this week. Markets now expect a further rate rise of similar dimension in March. The Fed blue dot chart suggest rates may rise to 1.25% by the end of 2016 with 2.25% in prospect for 2017. It is time to fasten seat belts, we are leaving Planet ZIRP. Well it’s an attempted take off at least. There can be no turning back, nor should there be. The US unemployment rate fell to 5% in November, with strong consumer spending, retail sales and automobile sales evident. US Inflation remains subdued as energy and commodity prices collapse. It all sounds very familiar from a UK perspective, so why should the MPC hold back? Janet Yellen stressed the importance of moving ahead of the curve. Better to raise rates slowly now, rather react with more dramatic increases later, as the recovery continues and inflation becomes endemic. What will happen to UK rates? What will happen to UK rates? Mark Carney hinted this week he may stay for an eight year term pushing tenure to 2020. Forward guidance of sorts? Some think it may take that long, for the Old Lady to effect a rate rise! We doubt that. This week data from the ONS suggests markets may not have long to wait. The retail sales boom continues - sales volumes increased by 5% in November - online sales increased by almost 11%. Car registrations increased by almost 4% in the month, with an increase of over 6% in prospect for the year as whole. Eight charts to explain why UK rates will rise and soon ... The unemployment fell to 5.2% in the three months to October as the claimant count rate fell to 2.3%. Vacancies increased, exceeding levels pre recession. In fact on a variety of indicators jobs data are ahead of levels at the beginning of 2008. Earnings data appeared to slow in October despite a 6% rise in construction pay. It is important to look through the one month data and accept the labour market is heating up with vacancies rising, recruitment difficulties increasing and pay levels moving higher. Inflation data remains subdued with the headline CPI level rising to 0.1%. Goods inflation fell by -1.9% as service sector inflation increased by 2.4%. Falls in transport and food costs are weighing on the rate of headline inflation. Manufacturing prices are held back by the weakness of oil and commodity prices. It’s all about oil … It really is all about oil at the moment. Oil, food and commodity prices. Inflation is always an everywhere an international phenomenon. Brent Crude fell to $36 per barrel this week, as OPEC indecision continues. Oil stocks are rising. The US is voting to allow exports of US black gold into world markets. The spread between Brent and WTI will narrow as a result. The battle for the markets of China and Asia becoming more critical to the OPEC cartel. To date the collapse in US production anticipated, has not yet materialised, despite a big fall in the oil rig count. It wouldn't take a big cut in OPEC production to change the price outlook. World demand for oil continues to grow as the recovery in the West continues and strong growth is maintained in China and India. If the world can agree on a strategy for Syria, it shouldn’t take much for OPEC to adapt to a new world order and reverse current output and price strategy for oil. Should that happen, prices would bounce back. Headline inflation would increase significantly. So what do we expect of UK rates … The MPC will follow the FED within six months with a change in ECB policy possible before the end of 2016. Conditions in the UK mirror those of the US. The Fed has made the bold move, it really is time for the Old Lady to pack her bags and prepare to leave Planet ZIRP. So what happened to Sterling over the last two weeks? Sterling moved down against the Dollar to $1.490 from $1.521 and moved down against the Euro to €1.374 from €1.383. The Euro moved down against the Dollar to €1.087 from €1.099. It's all about the Dollar this week Oil Price Brent Crude closed at $36.71 from $37.95. The average price in December last year was $62.24. The Goldman Sachs call to $20 no longer so ridiculous perhaps. Markets, closed above critical levels - The Dow closed at 17,238 from 17,313. The FTSE closed at 6,052 from 5,952 despite the weakness of mining stocks. Gilts - yields moved up. UK Ten year gilt yields were at 1.841 from 1.817. US Treasury yields moved to 2.21 from 2.17. The great rotation will continue into 2016. Gold moved down to $1,084 ($1,076), going nowhere slowly. That's all for this week. This will be the last Saturday Economist of 2016. We will be taking a break for a few weeks. Our What the Papers Say, Twitter morning review will continue during the break! Follow @jkaonline We wish you all a Merry Christmas and a Happy New Year. John © 2015 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed