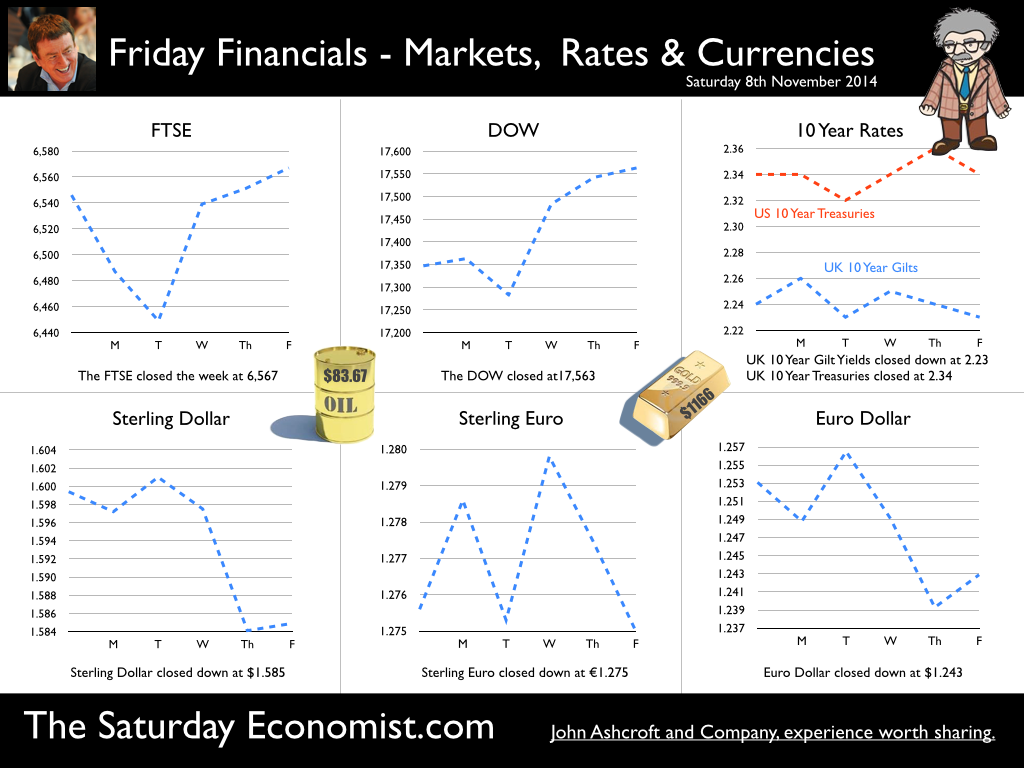

Forward Guidance … après ZIRP le déluge … Speaking in Paris this week at a symposium organised by the Banque de France, Mark Carney, Governor of the Bank of England warned markets to expect a bumpy ride when central banks begin to raise rates. Jumpy markets will not prevent central bankers from undertaking the important task of rate stabilization. Low levels of volatility are not here to stay. Fed Chairman Janet Yellen, also in Paris, echoed the message, saying "rate rises, when they materialize, could lead to heightened financial volatility”. New York Fed President William Dudley went further to say, “the resultant market turbulence could create significant challenges for those emerging market economies that have been the beneficiaries of large capital inflows in recent years”. Yes it’s “Après ZIRP le déluge” the message to markets, with Mark Carney cast in the role of Louis XV and Janet Yellen as Madame Pompadour. The message on low volatility will come as some surprise to oil slicks. Market traders love volatility, investors less so. The tumbrels are oiled and the edges sharpened, rates are set to rise in 2015. US Labour Markets … In the US strength in the labour market continued with 214,000 added to the payroll in October. The unemployment rate fell to 5.8%, closing the “spare capacity" gap still further. Job growth has now been underway since October 2010 as the US expansion continues. The recovery too late to save the Democrat hold on Congress, the Obama lament. UK Manufacturing … In the UK manufacturing output increased by 2.9% in September according to the latest data from the Office for National Statistics. Growth for the quarter was just over 3%, slightly below the first estimate suggest in the preliminary GDP release. Capital goods output increased by 3.7% in the month, and a remarkable 11% growth was recorded in consumer durables output. It is possible the strength of the housing market is boosting output in the household durables sector. Energy and utilities continue to be drag on growth and overall manufacturing output remains some 4.5% below the peak recorded in January 2008. Nevertheless, manufacturing is demonstrating a significant recovery this year, supported by strong growth in motor, marine and aerospace output. Despite fears of a slowing economy, the latest data confirms the recovery is on track as suggested in the Manchester Index™ derived from the influential Greater Manchester Chamber of Commerce QES survey. UK Car Market … New car registrations jumped 14.2% in October to 179,714 units. 2,137,910 cars have been registered in the year-to-date. The October performance exceeded expectations. We expect total sales to be just under 2.5 million in 2014, up by 8% on prior year. Mike Hawes, SMMT Chief Executive, said, “With economic confidence still rising, customers continue to benefit from attractive financial packages on exciting new models”. UK Trade … The strength of the car market is just one reason the trade deficit continues to deteriorate as we have long explained. According to first estimates from the ONS released this week, the UK’s deficit on trade in goods and services was £2.8 billion in September 2014, compared with £1.8 billion prior month. This reflects a deficit of £9.8 billion on goods, partly offset by an estimated surplus of £7.0 billion on services. In the third quarter of the year, the deficit (trade in goods) increased to £29 billion compared to £28 billion in the prior quarter. Germany remains the the UK's largest trading partner but in Q3 the UK recorded its largest ever deficit as exports fell and imports increased. Although we may worry about growth in Europe, the UK surplus with the USA reached the lowest level in almost eight years but there notable improvements to the deficits with China and Hong Kong. Do the latest figures change our outlook? Not really. For the year as a whole we expect the deficit (trade in goods) to increase to around £113 billion compared to £110 billion last year offset by an £82 billion (trade in services) surplus. The residual deficit (goods and services) will be around £31 billion, slightly down on prior year and at less than 2% of GDP, no threat to growth. So what happened to sterling this week? Sterling moved down against the dollar to $1.585 from $1.599 and also moved down slightly against the Euro at 1.275 from 1.276. The Euro closed down against the dollar at 1.243 (1.276). Oil Price Brent Crude closed down at $83.67 from $85.27. The average price in November last year was $107.79. Markets, moved up. The Dow closed at 17,563 from 17,347 and the FTSE closed up (just) at 6,567 from 6,546. UK Ten year gilt yields steadied at 2.23 and US Treasury yields were unchanged at 2.34. Gold moved to $1,166 from $1,170. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed