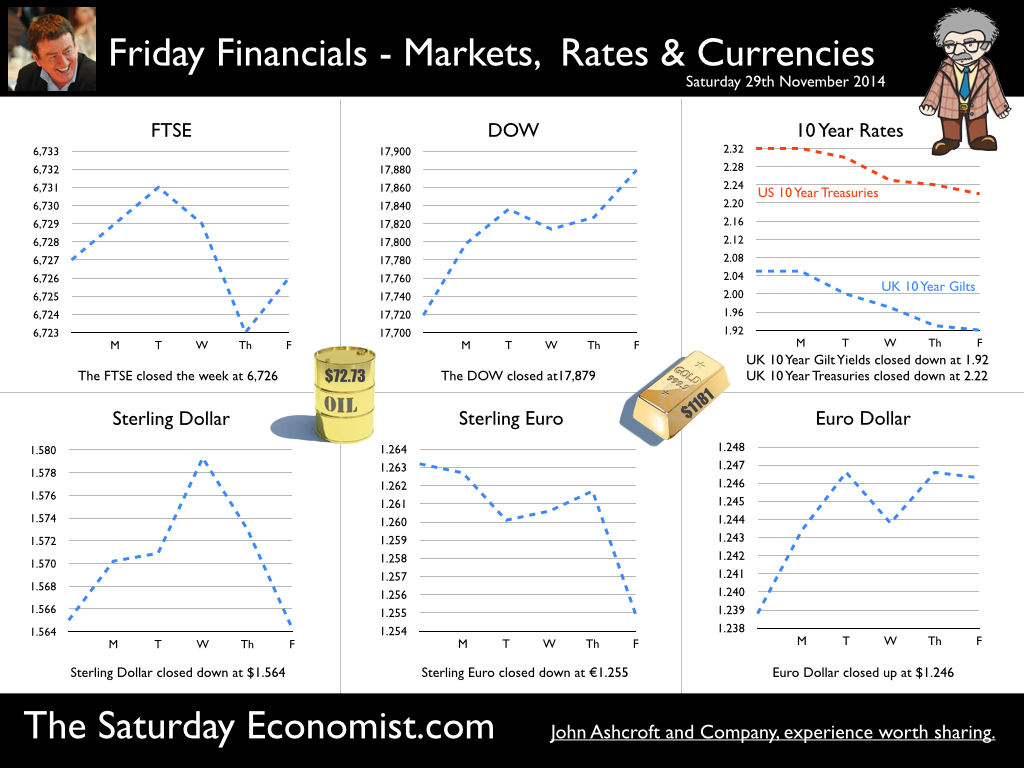

The UK economy grew by 3% in the third quarter ... The US economy grew by 2.4% in the same period. In India, growth slowed to 5.3% and in Europe … well it just doesn’t get any better for the moment. The battle against deflation continues over there. The second estimate of GDP for the third quarter was released by the ONS this week. For ONS watchers, it doesn’t get any more exciting. Domestic demand increased by 2.5% supported by a 2.4% growth in household spending. Government spending increased by 1%. Investment was up, increasing by just over 7%. Is the economy rebalancing? Not really … International Trade … Strange things are happening in the trade data. Exports fall by 1% compared to last year and imports fell by 2.4%. Weak world trade growth, up by just 2% in the quarter, is limiting the potential for UK exports. Problems in Europe are exacerbating the challenge …. but For imports, the pattern is rather strange. Domestic demand up by 2.5%, imports down by 2.4% - it doesn’t make sense. The trade deficit will increase significantly this year, if the UK continues to grow faster than major trading partners. We import to satisfy growth in the economy, despite the vagaries of Sterling. Slowly too, we are realising “we have to import to export”. A high proportion of exports are import dependent. It’s the Morton’s Fork of International Trade Theory. We cannot export without a significant growth in imports. Raw materials, components and semi manufactures. Just look at the car market. There is no simple “trade” solution to the twin deficit dilemma. On a better note … In nominal terms, the economy grew by over 5% which should argue for stronger tax receipts to assist the Treasury borrowing target before the end of the year. In output terms, the economy grew by over 3%! The service sector grew by 3.3%, with 4% growth in leisure, distribution and business services. Construction output was up 3% and manufacturing output increased by 3.4%. We see no reason why the economy should lose momentum into the final quarter and into next year for that matter. Our forecasts are unchanged. We still expect the economy to grow by 3% this year and around 2.8% in 2015. Don’t miss Our Quarterly Economics Update for December. It will be released following the Autumn statement from the Chancellor and the debt update from the OBR. Don’t miss either "The Great Manchester Economics Conference” in October next year. We have a great line up of specialists in Manchester for the day. It won't be dull - imagine Beyonce meets Newsnight! What’s Happening to Oil prices … Oil price Brent Crude traded briefly below $70 dollars per barrel on Friday, a reaction to “The Viennese Slice” - news from OPEC of no output cuts to improve short term oil prices. We mark the close at $72.73 this week. Is OPEC sending a message to US shale? Possibly. But the bears are out of the woods and naked. We think intra day sub $70 last week was a shake out! That’s our long shot of the week. We expect a winter rally anytime soon! So what happened to sterling this week? Sterling closed unchanged against the Dollar at $1.564 ($1.565) but moved down against the Euro to 1.255 from 1.263. The Euro closed up against the Dollar at €1.246 from (€1.239). Oil Price Brent Crude closed down at $72.73 from $79.61. The average price in November last year was $107.79. As we said last week, expect one last squeeze to flush out the timid, then settle in for the bull ride. The intra day sub $70 could well have marked the move. Markets, moved up. The Dow closed at 17,879 from 17,719 and the FTSE closed unchanged at 6,726 from 6,727. Our call is for 7,000 in the Christmas stocking! We shall see! Mining and Commodity majors feature in the UK market profile. UK Ten year gilt yields moved down to 1.92 from 2.05. US Treasury yields were down to 2.22 from 2.32. Gold moved down to $1,181 from $1,202. That’s all for this week. Plans are proceeding for the Great Manchester Economics Conference in October next year. It’s a great line up which will just get better. Subscribe to The Saturday Economist for updates and news of early bird ticket deals in due course. Interested in Social Media? Profiled on LinkedIn? You should be. LinkedIn claims one in three of the worlds professionals are on the platform. Check out our PhD in LinkedIn Guide. Now available on Amazon … 20% of the profits go to our nominated charities, Forever Manchester, WWF, Water Aid and Oxfam. Help the cause and Boost Your profile at the same time! Get Your PhD In LinkedIn for just £4.95 Click the Link! The Great Manchester Economics Conference - October 201 Plans are proceeding for the Great Manchester Economics Conference in October next year. It’s a great line up which will just get better. Subscribe to The Saturday Economist for updates and news of early bird ticket deals in due course. Interested in speaking, featuring or sponsoring, just drop me a line at [email protected]. Join the mailing list for The Saturday Economist or why not forward to a colleague or friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed