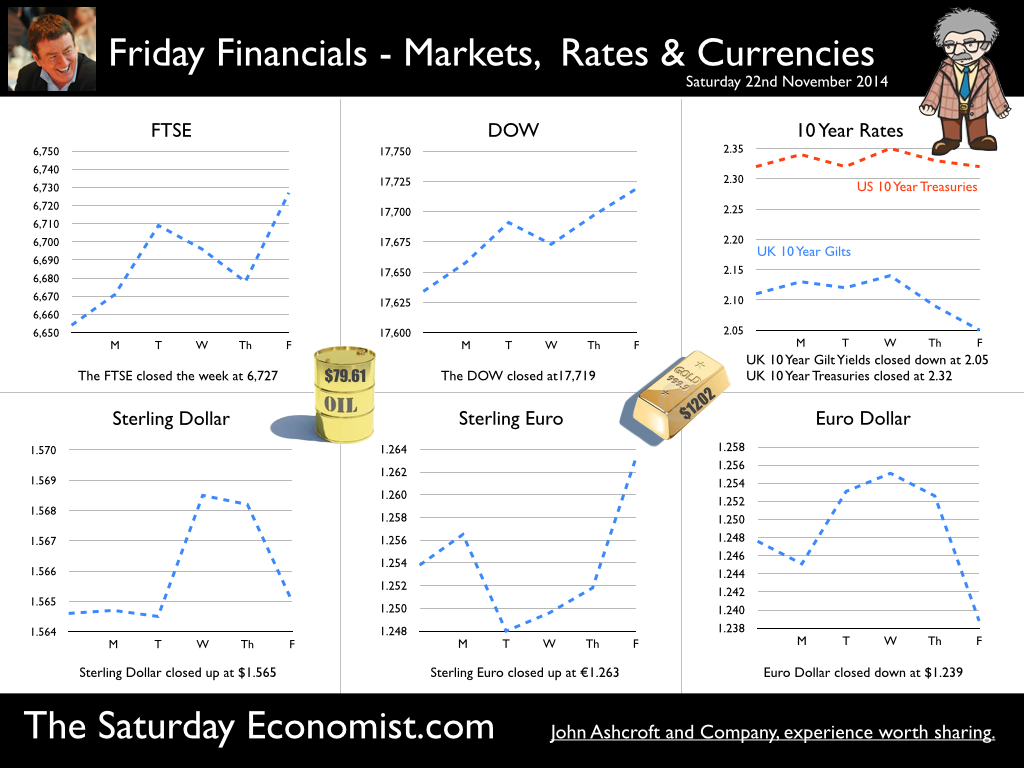

Government borrowing is off track but could yet get better. Borrowing for 2013/14 has been revised down yet again to £97.5 billion. This will be a tough target to beat. Our forecasts for the year are largely unchanged. For the year as a whole we now expect borrowing to be around £98 billion. Full revisions will be prepared following the Autumn Statement and the revised forecasts from the Office for Budget Responsibility due in the next few weeks. In the month of October borrowing was £7.7 billion in October slightly down on the 7.9 billion in the equivalent period. In the financial year to date borrowing was £64.1 billion, an increase of £3.7 billion compared with the same period in 2013/14. Revenues remain a challenge for the Chancellor. VAT receipts, stamp duty and corporation tax revenues are strong. The big weakness is income tax. Despite the strong rise in employment, the tax take remains weak. Low earnings and a big rise in self employment partly to blame. Total debt fell slightly to £1.449 trillion just under 80% of GDP. Borrowing is off Track but could yet get better. Lots of scope for revisions and updates before the end of March 2015. Retail Sales October …. Retail sales volumes increased by 4.3% year on year in October, the fastest growth rate since April this year. Values increased by just 2.8%. The sectors with the strongest growth this month were non-store retailing up 11.5% over the past year and household goods stores up by 10.8% increase. Department stores also continued to post positive results with growth in volumes of 8.2% over the past year. The strength of the housing market and in the increase in housing market transactions is impacting positively on retail activity. The total value of retail sales values increased by 2.8% in the month. On line sales increased by 7.5% in the month accounting for just over 11% of all retail activity. Our forecasts for the year are largely unchanged. For the year as a whole we now expect retail sales to increase by 3.5% in 2014 slowing slightly to 3.3% in the following year. The strong start to the “Golden Quarter” for retail may yet lead to an upward revision for the current year. Consumer Price Inflation : October … Inflation CPI basis increased to 1.3% in October from 1.2% prior month. Service sector inflation edged higher from 2.4% to 2.5% and goods inflation increased from just 0.2% to 0.3%. Heavy smokers and drinkers with kids in private school continue to suffer, as education costs increased by 10%, followed by alcohol and tobacco costs up by 5%. Utility bills continue to rise, up by 3.2% and restaurants and hotel costs increased by 2.5%. Transport costs remain subdued and food prices fell in the twelve month comparison. Producer Prices : October … Producer output prices increased by just 0.5% in October unchanged from the September level. Input costs fell by 8.4% in the month driven by a 22% drop in crude oil costs. Food costs down by 10% and imports of chemicals and materials down 4% assisted the cost reduction process. Where next for prices? The consensus is for inflation to remain below the 2% target for the foreseeable future. Oil prices trading at $80 Brent Crude basis will assist together with the relative weakness of world trade and commodity prices. Inflation is always and everywhere an international phenomenon, at least for the moment, until wages start to rise that is. So what happened to sterling this week? Sterling was largely unchanged against the dollar at $1.565 from $1.567 but moved up against the Euro to 1.263 from 1.251. The Euro closed down against the dollar at 1.239 (1.252). Oil Price Brent Crude closed unchanged at London close at $79.61 from $79.41. The average price in November last year was $107.79. Late news on Chinese rate cuts pushed oil above the $80 dollar mark. Expect one last squeeze to flush out the timid, then settle in for the bull ride. Markets, moved up. The Dow closed at 17,719 from 17,635 and the FTSE closed up at 6,727 from 6,654. Our call is now for 7,000 in the Christmas stocking! UK Ten year gilt yields moved down to 2.05 from 2.11 on dovish minutes from the MPC meeting. US Treasury yields were unchanged at 2.32. Gold moved to $1,202 from $1,187. That’s all for this week. Plans are proceeding for the Great Manchester Economics Conference in October next year. It’s a great line up which will just get better. Subscribe to The Saturday Economist for updates and news of early bird ticket deals in due course. Join the mailing list for The Saturday Economist or why not forward to a colleague or friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. The Great Manchester Economics Conference brought to you by The Saturday Economist, in association with pro-manchester and Greater Manchester Chamber of Commerce. It's a great line up of speakers with more BIG names due. Sign up to The Saturday Economist for news and updates of this great event. Want to join the line up or want to sponsor? Drop me an email ... the prof is really excited ...

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed