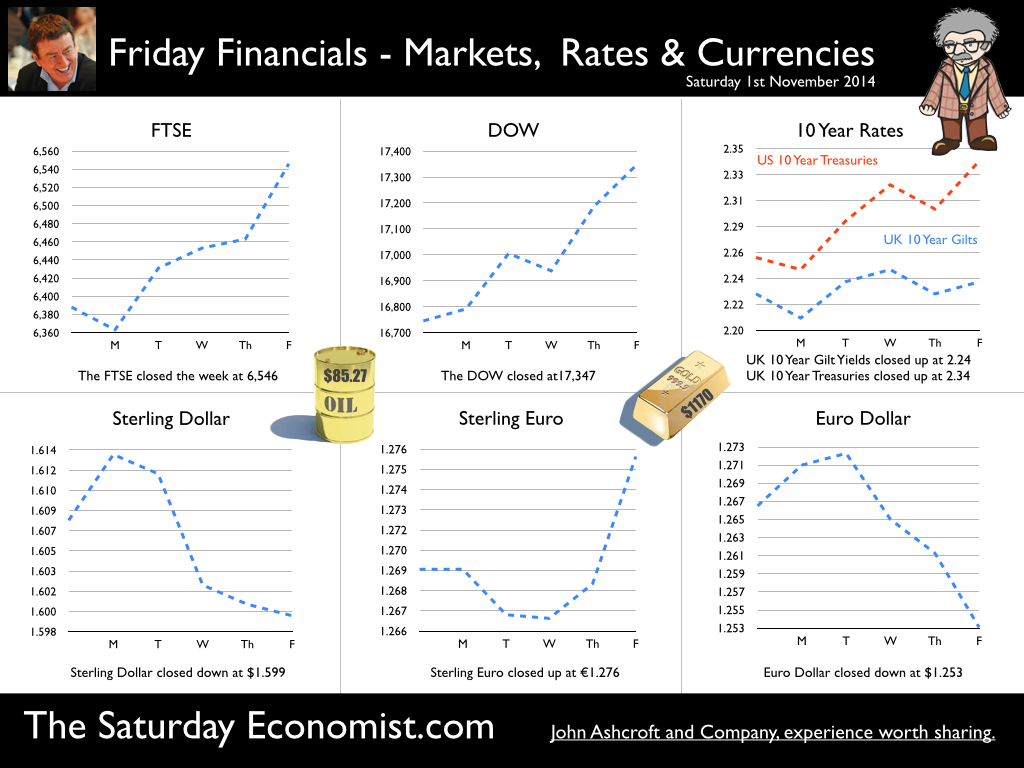

Forward Guidance … Remember forward guidance? With forward guidance, The Bank of England would try to guide expectations of the future path of monetary policy. Interest rates would be linked to certain economic indicators including employment, spare capacity or a broader spectrum of “Eighteen Indicators” as in Forward Guidance Mark II. Across the water, in the USA, forward guidance persists but is less “specific”. In the FOMC statement this week, Janet Yellen, declared “The Committee anticipates, based on its current assessment, that it will be appropriate to maintain the 0 to 1/4 percent target range (for the federal funds rate) for a considerable time following the end of its asset purchase program this month.” Yes, tapering is completed, QE is terminated but forward guidance, vague though it may be, continues. North of the Border, Mark Carney’s successor as the Governor of the Bank of Canada, Stephen Poloz, has made no secret that he’s done with providing “forward guidance”. “We’ll let markets do their job, which is to deal with the daily flow of new information and grind out new pricing, without specific interest rate guidance from the bank”. Ian McCafferty - is a Hawk ... In the UK, Forward Guidance seems to have given way to a sort of “Open Market Outcry”. In an article in The Sunday Times last week, McCafferty explained why “I am voting for higher rate rises now”. Essentially, although domestic price inflation and earnings data are subdued, the role of international prices is significant in setting domestic price levels. There is a risk domestic inflationary pressure is masked by international price trends. Slow world growth and low levels of world trade mean that commodity and world trade prices are low. This together with the relative strength of sterling is assisting in maintaining a low inflation outlook in the short term in the domestic economy. In the UK, earnings are also low, but the rapid growth in employment over the last twelve months and the dramatic fall in the claimant count, suggests the labour market may be tightening. There is evidence of skills shortages in the survey data and most economists believe that earnings are set to rise in the near term. Spare capacity is shrinking and the output gap is beginning to close. Above all Ian McCafferty believes, the short term outlook for inflation may remain benign but the full pass through effect of a rise in rates may take between eighteen months to two years to develop. The MPC must be forward looking. A slow rate rise now will avoid a more rapid rise later on. It is time to raise rates now. Minouche Shafik is a Dove … Minouche Shafik one of the newest members of the MPC, is a dove! believing there is “no significant evidence” of inflationary pressure in the economy. “If you look at what we would expect to see at this point in the recovery, the increases in wages that we have seen have not been significant,” Ms Shafik said in an interview with the Financial Times this week. Dismissing surveys pointing to future wage pressures for the moment, these are indicators that “haven’t manifested themselves” in real data. Wages and unit labour costs are important but “there is as yet no significant evidence of upward pressure on those prices” as yet. Ms Shafik believes the labour market could withstand significant further falls in unemployment before the pressure on earnings and wages begins to rise. “I think unemployment has not reached the place where we can say all the slack has gone in the labour market,” she said. So much for forward guidance. The messages are confused … The official guidelines from the Bank of England have turned into a bit of a free for all. The statement from Minouche is linked with formal “Dovish” speeches from other MPC members including Andy Haldane, Sir John Cunliffe and Ben Broadbent. The Medium Term Outlook - so what of rates? For the moment, the doves rule the Threadneedse Street coop. Concerns rates would rise before the end of the year are now completely abated. For most of this year, economists and markets believed rates would rise in February next year, before the UK election. Now, given developments in the UK, USA and particularly Europe, a rate rise pre election seems unlikely. In the USA, the Fed is unlikely to raise rates before June next year. US growth in Q3 was disappointing and some believe that increase may even be postponed until the Autumn of 2015. In Europe, an increase in rates appears to be off the agenda for two years at least. So what will happen to interest rates in the UK? We have always said the Bank of England will be reluctant to move ahead of the Fed and move base rates before an increase in the Fed Funds Rate. This would argue against any pre-election rate rise in February. Some analysts are beginning to think rates may not rise in the UK until the Autumn. For most June 2015 is becoming the month of choice. Don't rule out a pre election rise just yet ... What we do know, is that domestic demand remains strong, the job market is tightening rapidly. Earnings are set to rise as skill shortages are exacerbated. Service sector inflation remains above target despite the low levels of goods inflation and manufacturing prices. The balance of payments is deteriorating and the current account deficit could develop into a real problem for policy makers any time soon. The twin deficit dilemma, government borrowing and current account at 5% of GDP, will not be resolved by base rates at 0.5%. The Doves have control for the moment but the hawks are ready to pounce. For the moment we would sit with the doves. David Cameron may think it would be "lovely" for interest rates to remain at historic lows “forever” - but don't rule out a pre election rise just yet. So what happened to sterling this week? Sterling moved down against the dollar to $1.599 from $1.630 and also moved up against the Euro at 1.276 from 1.270. The Euro closed down against the dollar at 1.276 (1.283). Oil Price Brent Crude closed up at $85.27 from $86.26. The average price in November last year was $107.79. Markets, moved up. The Dow closed at 17,347 from 17,291 and the FTSE closed up at 6,546 from 6,387. What a difference a week makes! 7,000 FTSE for Christmas - back on! UK Ten year gilt yields move down to 2.24 and US Treasury yields closed at 2.34. Gold moved to $1,170 from $1,218. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed