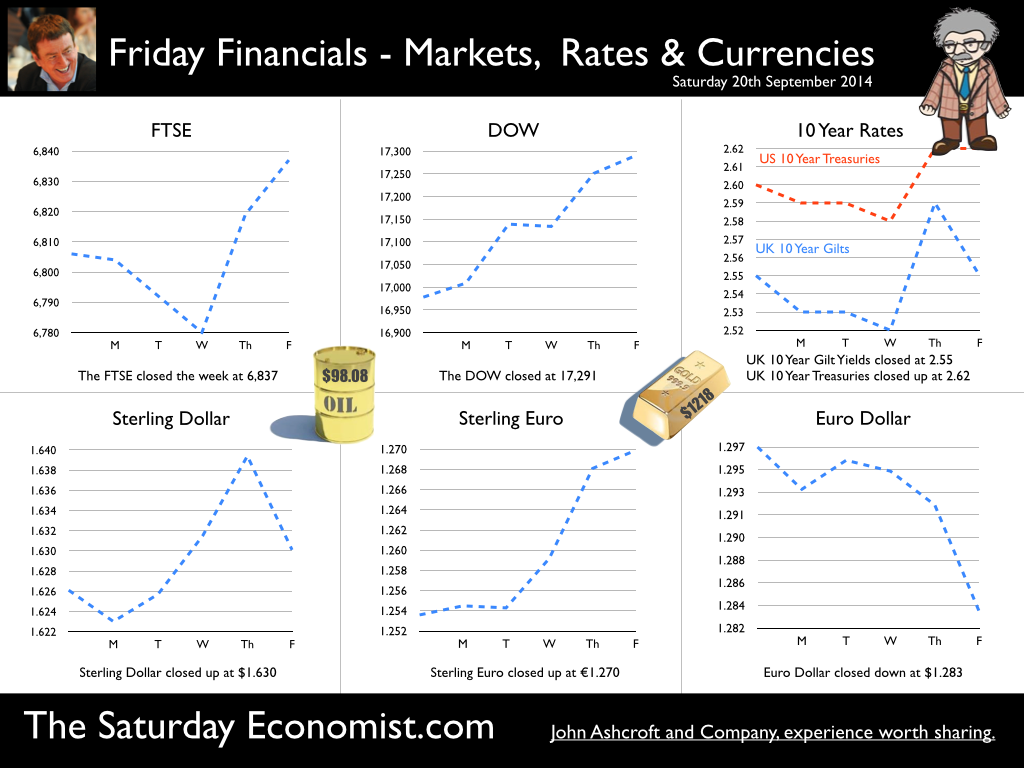

The UK economy grew by 3% in the third quarter as the strong growth experienced in the first half of the year continued. The results are in line with our latest forecasts and estimates produced by the Manchester Index™, the now-casting model from the GM Chamber of Commerce Quarterly Economic Survey. Service sector growth underpins the recovery in the economy with overall growth up by 3.3%. Business Services increased by 4.3% and leisure activity was also strong up by (3.8%). Distribution activity came in ahead of our latest forecasts with strong growth of 3.7%. So what of manufacturing and construction? Manufacturing growth was 3.4% and construction activity increased by a more modest 3%. An all round strong performance for the economy held back by the secular down trends in agriculture and extractives. Our forecasts for the year are unchanged. We expect growth of 3.1% for the year slowing to 2.8% in 2015. You can check out the full Quarterly Economics Outlook for the complete forecasts. Public Sector Borrowing Off Track … We think the UK economy grew by just over 5% (nominal) in the first half of the financial year. Revenues should track nominal growth. Hence, we would expect an improvement in borrowing given the strength of the recovery and some semblance of austerity. Six months into the year and borrowing remains off track compared to last year and to plan. In the first six months, total borrowing was £46.2 billion compared to £42.3 billion in 2013. In September, the latest month available, borrowing was £11.8 billion compared to £10.3 billion in the prior year. Last year’s figure has been revised down to £98 billion for the year as a whole. Good news but revenues will have to improve if this year’s OBR expectations are to be met. Spending is not really the problem. The squeeze on local government continues as departmental spending increased by a modest 1.6%. The paradox of thrift in recovery, continues as debt payments were up by 2.6% and social security payments increased by 3%. The real problem for the Chancellor is revenue … Central government receipts were down compared to last year, despite a strong rise in VAT (up 3.9%) and stamp duty (up 25%). Corporation tax revenues were healthy, up by over 5% but income tax revenues increased by just 0.1%. This is a real problem in an economy growing at over 5% in nominal terms, expanding jobs in the process. The low growth in earnings largely to blame perhaps but the paradox is at odds with basic economics. Compounding the embarrassment for Treasury, is the fall in interest and dividend receipts from the QE “Money for nothing, gilts for free” programme. Interest and dividends fell by £7.3 billion to just £9.1 billion as payments from the Bank to Treasury fell in the current financial year. Public sector net debt excluding financial interventions (PSND ex) was £1.45 trillion in September 2014, £100.7 billion or 7.5% higher than at the end of September 2013. That’s approximately 80% of GDP, still heading in the wrong direction. So what can we make of it all? The government is set to miss the OBR target for the current year, with borrowing overshooting the £100 billion mark in the year unless some dexterous accounting takes place. A serious embarrassment in the immediate run up to the election in either case. No Retail Boom … as the online squeeze continues … Retail sales volumes increased by just 2.7% in September as values increased by just 1.3%. Online sales were up by over 10% accounting for 11% of all activity continuing the squeeze on the conventional retail model. You can’t run a retail business without commenting on the weather. Warm weather in September appeared to hit clothing and footwear sales according to the ONS. “Too hot, too cold, too wet, too dry”, the retail mantra continues, perhaps the met office and not the ONS should handle the retail data. Average store prices in the month fell by 1.4% but with a large assist from petrol prices down by over 5%. Online food sales increased by over 13% year on year, compounding the footprint challenge for Tesco and other large store formats. Now accounting for 4% of all food sales, the problems set by online and multi channel will only increase in the food sector. After a strong start to the year with sales up 4% in the first six months, the third quarter retail has been disappointing. We have downgraded our forecasts for the rest of the year and into 2015 to just over 3%. Check out the Chart of the Day series … So what happened to sterling this week? Sterling moved up against the dollar at $1.630 from $1.609 and also moved up against the Euro at 1.270 from 1.260. The Euro closed up against the dollar at 1.283 (1.278). Oil Price Brent Crude closed up at $98.08 from $86.26. The average price in October last year was $109.08. The EIA forecast for Q4 average is $103 as we pointed out last week. Markets, moved up. The Dow closed at 17,291 from 16,352 and the FTSE closed up at 6,837 from 6,292. What a difference a week makes! 7000 FTSE for Christmas - back on! UK Ten year gilt yields move up to 2.55 from 2.15 and US Treasury yields closed at 2.62 from 2.18. Gold moved to $1,218 from $1,232. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed