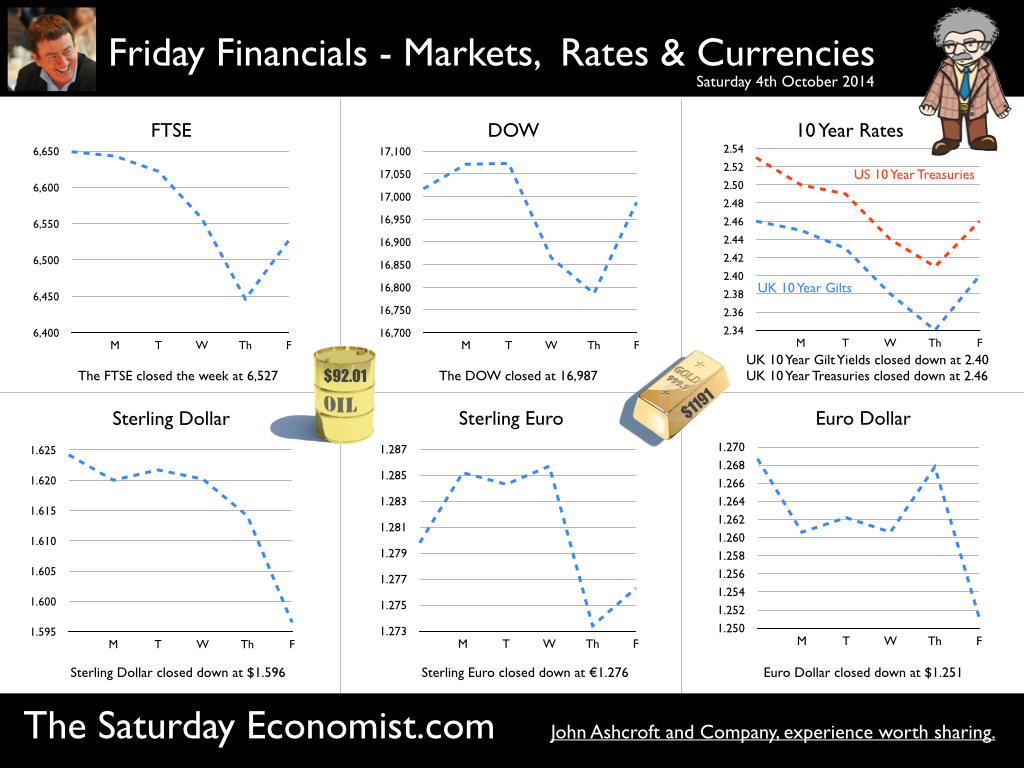

In the US this week, more evidence of the strong recovery emerged with the news of 248,000 jobs created in September. The unemployment rate fell to 5.9%, moving closer to the Fed long run target range 5.2% - 5.5%. 2014 will be the strongest year for US job growth since the late 1990s, raising the spectre of an early Fed funds rate rise in the first quarter of 2015. The Dow and Dollar soared on the news, the Dow testing the 17,000 level and the Dollar moving to €1.25 against the Euro. In Europe the dismal news continued. France is finished according to Andy Street the Managing Director of John Lewis. “Sclerotic, hopeless and downbeat, anyone with investments in France should get out now”. “La France c’est foutu” the reassuring comment from Manuel Valls the incoming French prime minister. According to the ECB “Survey data available to September confirm the weakening in the euro area’s growth momentum”. Growth forecasts in the French economy have been revised down for the year to just 0.5% compared to 0.9% for Euroland as a whole. Fears of deflation persist with the latest HICP data for September recorded at just 0.3%. [According to the Eurostat flash estimate, euro area annual HICP inflation was 0.3% in September 2014, after 0.4% in August.] In the UK … The much awaited revision to the GDP data for Q2 generated few surprises. Growth in the second quarter was 3.2% following growth of 2.9% in Q1. Our forecasts for the year are unchanged. The economy remains on track for growth of just over 3% this year slowing to 2.8% next. Particularly marked was the surge in investment spending. Following revisions to the methodology, investment spending increased by 10% in the first half of the year. The new data set included drug dealing and prostitution for the first time. The UK is spending more on drugs and prostitution than on fresh fish and tools for the garden shed! Just a few of the many facts revealed in out Chart of the Day release. The latest PMI Markit survey data provided evidence of growth moderation in Q3. The manufacturing index hit a 17 month low as the index fell to 51.6 from 52.2 in September. Still in growth but at a lower rate. In construction, the index moved higher to 64.2 in September, the sharpest expansion in output for eight months. In the services sector, strong growth continues, despite a drop in the index from 60.5 to 58.7. Overall we expect growth in the third quarter to slow to around 3.0% based on our short run forecasting model and the latest reading from the Manchester Index.™ Warning Flags … the twin deficit dilemma ... We now post two warning flags about the UK economy. In the first half of 2014, the current account deficit averaged 5% of GDP. We have long forecast a trade in goods deficit offset in part by a trade in services surplus. The overall “trade” deficit at around 2% of GDP reflects a structural problem for the UK, exacerbated by a higher rate of growth in domestic demand relative to world trade growth. Of itself the dimensions of deficit do not pose a threat to recovery. The external deficit … The larger current account deficit is quite another matter. Since 2013, the UK has experienced a significant collapse in overseas investment income. The reasons for which are not entirely clear as yet. The situation may reverse in due course, if European growth rallies and or sterling depreciates for example but we cannot be sure. The overall deficit on current account at 5% of GDP has been hit on previous occasions in the UK. In 1974 and in 1989. Interest rates were closer to 15% than 0.5% as rates were hiked to curb domestic demand and inflation and to offer some support to capital flows. The internal deficit … Latest government borrowing figures reveal the government is borrowing more this financial year than last. Concerning, given growth of 3% plus. The basic problem is receipts rather than spending. VAT and stamp duty revenues are up but income tax and corporation tax receipts are lagging. Last year’s receipts in the first six months of the year were flattered by the “money for nothing, gilts for free” benefits of QE. APF dividend revenues were £12 billion in the first five months of the year falling to £4 billion in the current year. The Chancellor is not reaping a “growth dividend” as the economy expands. The twin deficit dilemma … As a result, government borrowing in the current financial year will be around £95 billion. The internal deficit (PSNBR) is over 5% of GDP, the external deficit (Current Account) is of a similar dimension. The imbalance is manifest. We have been here before, but the MPC has not. Weaker sterling and higher UK base rates have always been the result … So what happened to sterling this week? Sterling slipped against the dollar to $1.696 from $1.624 and down against the Euro at 1.276 from 1.280. The Euro closed against the dollar at 1.251 (1.269). Oil Price Brent Crude closed down at $92.01 from $96.83. The average price in October last year was $109.08 Markets, moved down. The Dow closed at 16,987 from 17,017 and the FTSE closed down at 6,527 from 6,649. UK Ten year gilt yields move up to 2.40 from 2.46 and US Treasury yields closed at 2.46 from 2.53. Gold moved sideways at $1,191 from $1,221. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company. Economics, Strategy and Social Media ... Experience worth sharing. Disclaimer The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice. If you do not wish to receive any further Saturday Economist updates, please unsubscribe using the buttons below or drop me an email at [email protected]. If you enjoy the content, why not forward to a colleague or friend. Or they can sign up here

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed