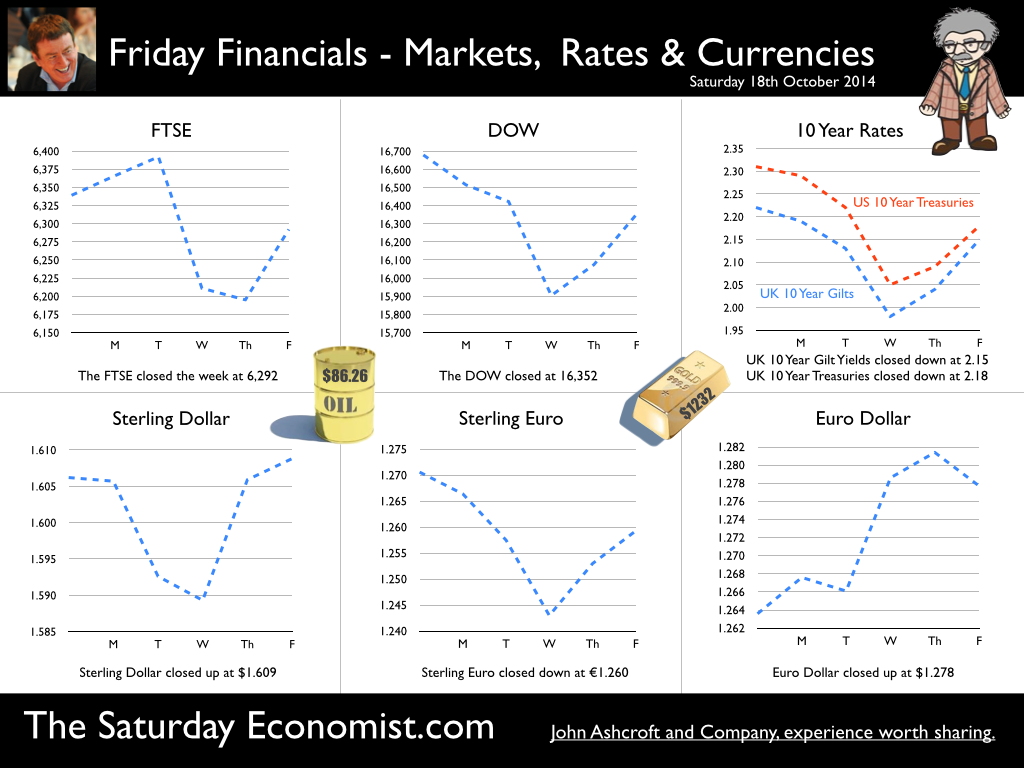

Planet ZIRP … It is a strange world on Planet ZIRP. Inflation is falling, employment is increasing, earnings remain low and the UK is set to grow by just over 3% this year. Interest rates are fixed at 50 basis points but Andrew Haldane, Chief Economist at the Bank of England, is “gloomier”. Interest rates could remain lower for longer, certainly longer than expected a few months ago. There is now real speculation, base rates will not rise until after the UK election and possible as late as Q4 2015. According to a speech in Kenilworth this week, worries include “the mark-down in global growth, heightened geo-political and financial risks and weak pipeline inflationary pressures from wages and commodity prices (including oil). In some ways the comments follow on from Fed statements in the US. A rate rise in the US is not expected until June 2015, with some speculation this could be postponed until the end of the year. We have always said, the MPC will be reluctant to move ahead the Fed. In some ways a dove was expected sing in Threadneedle Street any time soon. As it was the Chief Economist was nominated and Kenilworth was located. Why not! Oil Prices … Oil prices played the part this week testing $83 per barrel Brent Crude basis, before closing at $86.26. What is really going on? The EIA had not made any significant change to the short term demand outlook for oil in the October monthly review. If anything price conditions hardened slightly with Q4 prices expected to revert to $103 for the quarter and into 2015. Traders over reacted as the Saudis held nerve. The demand and supply fundamentals are unchanged. Markets felt the squeeze with the Dow relinquishing nine months gains in just a few weeks, before closing at 16,352. The FTSE closed at 6,292. Yes I know, we all thought 7,000 was a done deal all through the year but more patience is required! UK Inflation … The week had started well enough in the UK. Inflation CPI basis slowed to just 1.2% in September from 1.5% prior month. Goods inflation slowed to just 0.2% but service sector inflation was much higher at 2.0%. No real fears of deflation for the UK just yet. Manufacturing prices explain the inflation story in part, reflecting weak world prices. Manufacturing output prices were just 0.4% in September and the more volatile input costs were negative -7.4%. Crude oil and fuel were the big downward drivers. Food prices both manufactured and home produced were down by an average 10%. Don’t get too carried away with the retail price wars headlines. Inflation (or lack of it) is always and everywhere an international phenomenon at present. Food is no exception. UK Employment … The UK employment data confirmed we will be closing jobs centres by the end of 2017. The claimant count fell in September to 952,000, a rate of 2.8%. 400,000 have left the register over the past twelve months and the pace shows no signs of slowing. Within two years there will be no one looking to work! We may need more immigration not less! The wider LFS count fell below 2 million in August and a rate of just 6%. Vacancies increased and our U:V ratio fell to 1.41. That’s actually lower than the first quarter of 2007. The labour market is tightening, which makes the earnings data even more confusing. Earnings in August were up by just 0.8% in the month but manufacturing and construction earnings increased by almost 2% (3 month average). Earnings are compressed on Planet ZIRP but the pressure int he job market will force a return to norm at some stage. Problems in Germany .. Fears for Euroland and the German economy were prevalent this week. Euro inflation slowed to 0.3% in September and surprisingly weak output data in Germany in August caused great concern. Forecasts for growth in the largest Euro economy were officially downgraded. Berlin now expects growth of just 1.2% this year and the same in 2015, Slowing export growth the problem. Who would have thought that trade wars would hinder business! Quarterly Economics Review Q3 Our quarterly economic review for Q3 was released last week. We expect UK growth of 3.1% this year slowing to 2.8% next. The outlook for employment remains strong with the continuation of a subdued inflation outlook. We are more optimistic about investment. The trade figures will continue to disappoint and the current account deficit is cause for concern. So what happened to sterling this week? Sterling held against the dollar at $1.609 from $1.606 and down slightly against the Euro at 1.260 from 1.264. The Euro closed up against the dollar at 1.278 (1.264). Oil Price Brent Crude closed down at $86.26 from $90.23. The average price in October last year was $109.08 Markets, moved down. The Dow closed at 16,352 from 16,679 and the FTSE closed down at 6,292 from 6,339. UK Ten year gilt yields move down to 2.15 from 2.31 and US Treasury yields closed at 2.18 from 2.31. Gold moved to $1,232 from $1,221. That’s all for this week. Join the mailing list for The Saturday Economist or forward to a friend. John © 2014 The Saturday Economist by John Ashcroft and Company : Economics, Corporate Strategy and Social Media ... Experience worth sharing. The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The receipt of this email should not be construed as the giving of investment advice.

0 Comments

Leave a Reply. |

The Saturday EconomistAuthorJohn Ashcroft publishes the Saturday Economist. Join the mailing list for updates on the UK and World Economy. Archives

July 2024

Categories

All

|

| The Saturday Economist |

The material is based upon information which we consider to be reliable but we do not represent that it is accurate or complete and it should not be relied upon as such. We accept no liability for errors, or omissions of opinion or fact. In particular, no reliance should be placed on the comments on trends in financial markets. The presentation should not be construed as the giving of investment advice.

|

The Saturday Economist, weekly updates on the UK economy.

Sign Up Now! Stay Up To Date! | Privacy Policy | Terms and Conditions | |

RSS Feed

RSS Feed